Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Measurable accomplishments like reducing claim processing time by 25% and improving client satisfaction scores by 30% reflect impactful achievements.

- Showcases career progression: Starting as an insurance specialist and advancing to claims representative shows steady career growth, with increased responsibilities like managing multimillion-dollar renewals and resolving complex claims efficiently.

- Illustrates problem-solving ability: Developing a claims expedited process that halved delays showcases innovative problem-solving skills and initiative.

More Claims Representative Resume Examples

Check out our claims representative resume examples to understand how to showcase your negotiation skills, customer service experience, and attention to detail. These insurance resume samples will help you create a resume that stands out in the insurance industry.

Entry-Level Claims Representative

Why this resume works

- Centers on academic background: Earning a master’s in business administration and a bachelor’s in finance reveals the applicant’s strong academic foundation, setting the stage for their early career successes.

- Puts skills at the forefront: By adopting a skills-based resume format, this applicant places essential skills front and center, spotlighting their capabilities effectively.

- Shows digital literacy: Implementing data analysis and risk assessment tools showcases digital literacy, highlighting computer skills necessary for modern work environments.

Mid-Level Claims Representative

Why this resume works

- Includes a mix of soft and hard skills: By mixing claims processing expertise with interpersonal skills, the applicant effectively manages complex tasks while maintaining strong customer relations.

- Points to measurable outcomes: Resolving 85% of claims within two weeks highlights the applicant’s efficiency in delivering timely, measurable outcomes that significantly impact organizational performance.

- Displays technical expertise: The applicant showcases technical prowess through certifications like Certified Claims Professional, ensuring mastery in specialized insurance processes essential for the role.

Experienced Claims Representative

Why this resume works

- Focuses on work history: Using a chronological resume format, the applicant details work history from claims analyst to representative, painting a clear picture of career progression and expertise.

- Showcases impressive accomplishments: The applicant’s accomplishments, including improving claims processing efficiency by 30%, show significant influence on business outcomes and highlight senior-level impact.

- Sections are well-organized: Bullet points paired with clear headers make navigating the resume straightforward, ensuring that each section is easy to scan.

Claims Representative Resume Template (Text Version)

Cut the complexity with the text below. For downloadable designs, check out our resume templates.

Jane Anderson

Detroit, MI 48201

(555)555-5555

Jane.Anderson@example.com

Professional Summary

Experienced claims representative skilled in claims processing with a strong background in customer service, known for improving efficiency and accuracy. Expertise in risk assessment and financial analysis, committed to resolving claims swiftly and effectively.

Work History

Claims Representative

Elite Insurance Group – Detroit, MI

January 2023 – July 2025

- Processed 100+ claims monthly with 98% accuracy

- Reduced claim processing time by 25% in 2024

- Resolved 90% of customer inquiries in first contact

Claims Adjuster

Pioneer Assurance Co. – Southgate, MI

January 2018 – December 2022

- Evaluated 150+ claims monthly, saving 0,000/year

- Enhanced client satisfaction scores by 30% in 2021

- Resolved complex claims within seven days

Insurance Specialist

Secure Future Insurance – Southgate, MI

January 2016 – December 2017

- Managed policy renewals exceeding million annually

- Improved policy retention rates by 15% in 2017

- Trained 10 new employees in policy procedures

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Skills

- Claims Processing

- Customer Service

- Risk Assessment

- Conflict Resolution

- Analytical Thinking

- Attention to Detail

- Time Management

- Financial Analysis

Certifications

- Certified Claims Professional (CCP) – National Claims Association

- Insurance License – Illinois Department of Insurance

Education

Master of Business Administration Finance

University of Chicago Chicago, Illinois

December 2015

Bachelor of Science Economics

Iowa State University Ames, Iowa

December 2012

Related Resume Guides

Advice for Writing Your Claims Representative Resume

Discover our tips on how to write a resume for a claims representative role and learn how to highlight your knack for detail, problem-solving skills, and customer service experience. Dive into strategies tailored just for you and unlock the secrets to crafting a standout resume in your field.

Highlight your most relevant skills

Listing relevant skills on your resume is important because it helps you stand out and shows employers why you’re a great fit for the claims representative role. A dedicated skills section makes it easy for hiring managers to quickly see what you bring to the table, especially if your abilities match the job description.

Be sure to include a balance of technical skills like knowledge of insurance policies or claim processing systems, along with soft skills such as communication, problem-solving, and attention to detail.

In addition to having a separate skills section, weaving key abilities into your work experience can make an even stronger impact. For example, mention how your negotiation skills helped resolve disputes efficiently or how your organizational abilities ensured the timely completion of claims. These examples show how you’ve used your strengths in real situations, making them more memorable and meaningful.

The goal is to highlight what makes you qualified while being specific about how those skills apply to the claims representative role. Focus on qualities that reflect both your ability to handle complex tasks and interact effectively with customers or colleagues. This approach helps keep your resume focused and tailored to the job you’re trying to land.

A resume format that highlights problem-solving skills, attention to detail, and customer service experience can help claims representatives stand out.

Showcase your accomplishments

When organizing your work experience as a claims representative, list your jobs in reverse chronological order. Start with the most recent role and work backward. Each entry should include your job title, employer name, location, and employment dates. This clear structure helps hiring managers quickly see your career progression.

Focus on turning job duties into measurable accomplishments to make your resume stand out. Instead of listing responsibilities like “processed claims” or “managed customer inquiries,” highlight achievements such as “reduced claim processing time by 20% through improved workflows” or “resolved 95% of customer issues on the first call.”

Use numbers, percentages, or other data to show the impact you had in previous roles. Quantifiable results demonstrate your ability to deliver value and make it easy for employers to understand what you bring to the table. Incorporate action-oriented words like “streamlined,” “maximized,” or “implemented” when describing achievements.

For example, you might say, “Implemented a new tracking system that reduced errors by 15%.” These descriptions show how your skills directly contributed to efficiency or cost savings in past roles. Hiring managers are drawn to resumes that showcase results because they provide evidence of performance and potential impact in their organization.

5 claims representative work history bullet points

- Processed and resolved over 200 insurance claims per month, achieving a 95% customer satisfaction rate.

- Streamlined the claims processing workflow, reducing average handling time by 20% and improving overall efficiency.

- Investigated and identified fraudulent claims, saving the company approximately $50,000 annually.

- Collaborated with policyholders to gather necessary documentation, ensuring a 98% accuracy rate in claim submissions.

- Trained new team members on system protocols and best practices, contributing to a 15% increase in team productivity.

Choose a straightforward resume template with clear sections and basic fonts, avoiding elaborate designs to ensure your experience and skills stand out.

Write a strong professional summary

A professional summary on a resume serves as an introduction for hiring managers, providing a snapshot of your skills and accomplishments. You can decide whether to use a summary or a resume objective based on your experience level and career goals.

A professional summary typically has three to four sentences showcasing experiences, skills, and achievements. It’s suited for applicants with significant work history in their field. The goal is to convey your professional identity and demonstrate the value you can bring to the company. This is ideal for someone like a seasoned claims representative with extensive industry knowledge and accomplishments.

On the other hand, a resume objective focuses more on career goals and aspirations. It suits entry-level workers, career changers, or those with employment gaps. While summaries emphasize “what I’ve accomplished,” objectives focus on “what I aim to contribute.”

Next, we’ll provide examples of both summaries and objectives tailored to various industries and levels of experience. See our library of resume examples for additional inspiration.

Claims representative resume summary examples

Entry-level

Recent graduate with a Bachelor of Arts in insurance and risk management, eager to start a career as a claims representative. Completed internship at a top insurance firm where foundational skills in claim processing and customer service were honed. Licensed in Property & Casualty Insurance with strong analytical capabilities and attention to detail.

Mid-career

Claims representative with over five years of experience in the insurance industry, specializing in auto and home claims. Proven track record of efficiently assessing damages, negotiating settlements, and maintaining compliance with state regulations. Known for exceptional client communication and ability to manage high-volume claim portfolios while ensuring customer satisfaction.

Experienced

Senior claims representative with deep expertise in complex commercial liability claims, having successfully led teams to optimize claim resolution processes. Certified in Advanced Claims Management and adept at employing strategic negotiation techniques to reduce payout costs by 20%. Recognized for leadership skills that drive team performance and foster collaborative cross-departmental relationships.

Claims representative resume objective examples

Entry-level

Detail-oriented entry-level claims representative with a background in customer service and strong analytical skills. Seeking to use problem-solving abilities and communication expertise in a claims department to efficiently process claims and deliver exceptional client support.

Recent graduate

Ambitious recent graduate with a degree in business administration, aiming to start a career as a claims representative. Eager to apply knowledge of insurance principles and data analysis to contribute effectively to claim assessments and optimize claim resolution processes.

Career changer

Dedicated professional transitioning from retail management into the role of claims representative, bringing transferable skills such as conflict resolution, attention to detail, and team collaboration. Excited to leverage these abilities in the insurance sector to ensure accurate claim evaluations and improve customer satisfaction.

Make your claims representative resume stand out by using our AI Resume Builder. Choose a template, add your details, and get a professional-looking resume quickly!

Match your resume to the job description

Tailoring resumes to job descriptions is key because it helps job seekers stand out to employers and pass through applicant tracking systems (ATS). These systems scan resumes for specific keywords and phrases from job postings. By customizing your resume to match the job description, you increase your chances of getting noticed by hiring managers, especially in competitive fields like claims representation.

An ATS-friendly resume uses keywords that align with your skills. Including these words can help ensure that your resume gets seen by people making hiring decisions. For a role like a claims representative, using relevant terms can highlight how well you fit the position.

To identify keywords from job postings, look for skills, qualifications, and duties mentioned often. Words like “claims processing,” “customer service,” or “insurance policies” might appear frequently. Use these exact phrases in your resume to show you’re a strong match for the job.

Incorporate these terms naturally into your resume content. For example, instead of writing “Handled customer inquiries,” you could write “Managed customer inquiries related to insurance claims.” This way, you’re using specific language from the job posting while describing your experience.

Making targeted resumes improves ATS compatibility and increases the likelihood of securing an interview. Tailored resumes show employers that you’ve taken the time to understand their needs and that you’re a good fit for their team.

Make sure your resume shines by using our ATS Resume Checker. It helps catch formatting problems, missing keywords, and structure issues before you send it to potential employers.

FAQ

Do I need to include a cover letter with my claims representative resume?

Including a cover letter with your claims representative resume is a smart move that can make you stand out to potential employers.

A cover letter lets you explain why you’re interested in the role and how your skills in conflict resolution, attention to detail, or policy analysis match the job’s needs.

For instance, if the company focuses on auto insurance claims or medical reimbursements, you can highlight specific experience you’ve had in those fields to show you’re a great fit.

If you’re unsure where to start, try using tools like our Cover Letter Generator that guide you through crafting a professional yet personalized cover letter.

Additionally, reviewing cover letter examples tailored for roles like claims representatives can help you better understand how to structure and refine your own.

How long should a claims representative’s resume be?

For a claims representative, your resume should ideally be a one-page resume. This length is perfect for showcasing key skills like customer service expertise, attention to detail, and experience in processing insurance claims efficiently.

If you have extensive experience or specialized certifications that are highly relevant, extending your resume to a two-page resume can be appropriate.

Explore our guide on how long a resume should be for tips on determining the ideal length for your career stage.

How do you write a claims representative resume with no experience?

When crafting a claims representative resume without experience, highlight your skills, education, and any relevant experiences that showcase your potential. For guidance on creating a resume with no experience, consider these helpful tips to get started:

- Emphasize relevant coursework: If you’ve completed courses related to insurance, risk management, or customer service during your studies, list them prominently. This will show your foundational knowledge of the field.

- Highlight transferable skills: Showcase skills such as communication, problem-solving, and attention to detail. These are important for a claims representative and can be gained from part-time jobs or volunteer work.

- Include internships or volunteer experiences: If you’ve had any internships or volunteered where you handled documents or worked in customer-facing roles, include those as they demonstrate valuable experience.

- Showcase technical skill: Mention familiarity with software programs commonly used in claims processing, if applicable. Being tech-savvy is often beneficial in this role.

By focusing on these areas, you’ll effectively convey your readiness for a claims representative position even without direct experience.

Rate this article

Claims Representative

Share this page

Additional Resources

Customer Service Representative Cover Letter Examples & Templates for 2026

Check out customer service representative cover letter examples to discover how to make a powerful first impression, emphasize your most relevant skills, and effectively wrap up your application to leave

Customer Care Representative Cover Letter Examples & Templates for 2026

Check out customer care representative cover letter examples to discover effective strategies for starting your letter with impact, emphasizing your relevant skills, and crafting a strong conclusion that leaves a

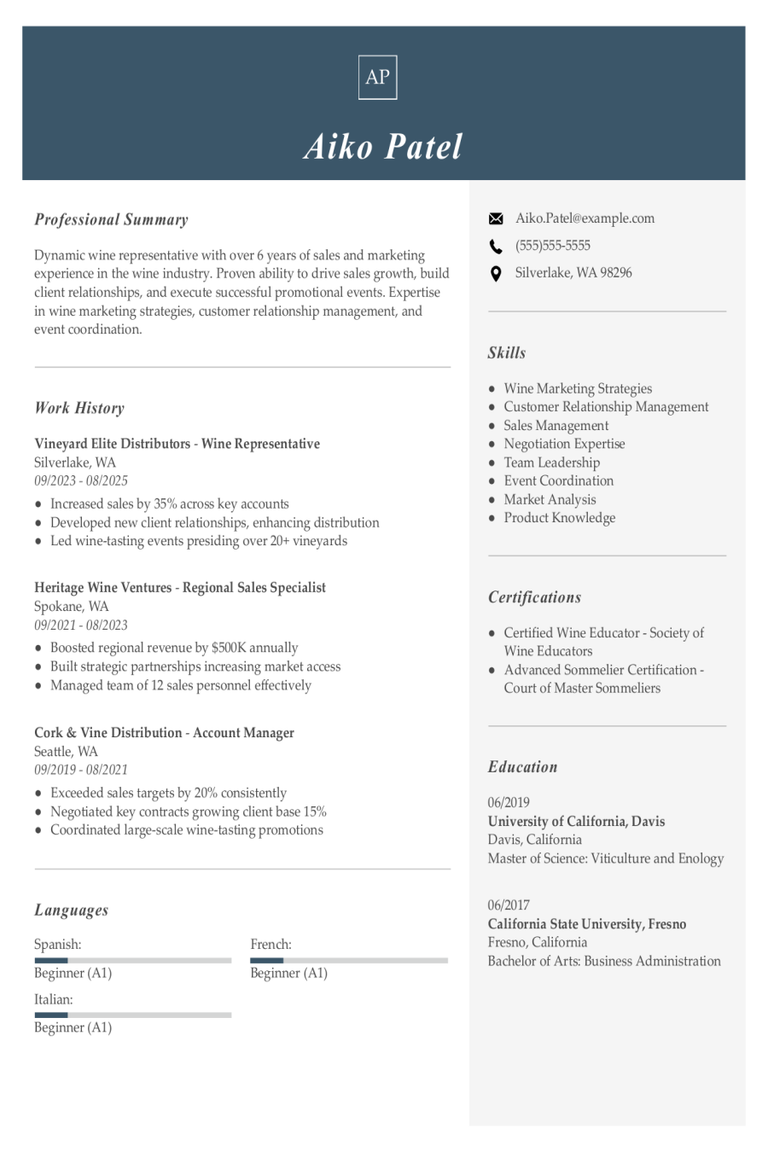

Wine Representative Resume Examples & Templates

Wine representative resume examples show how to spotlight your knowledge of different wines and build great customer relationships. Discover tips for showcasing your sales skills and highlighting your experience in

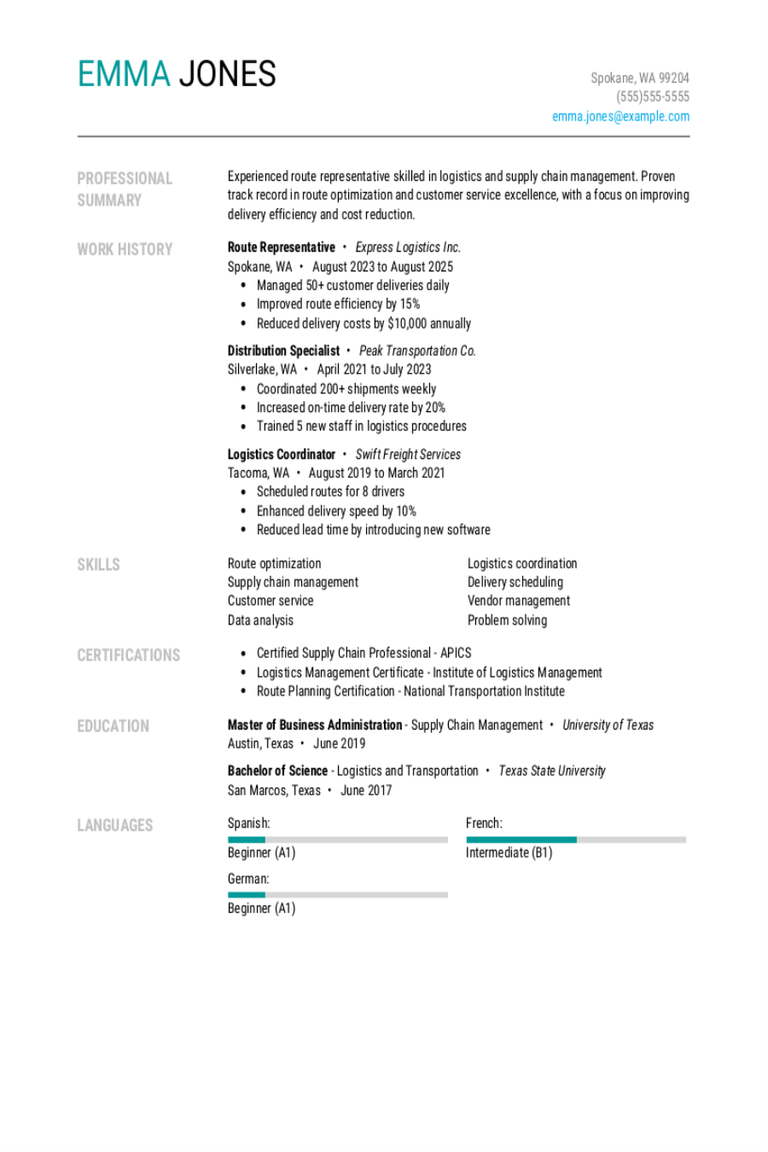

Route Representative Resume Examples & Templates

Discover route representative resume examples that show how to spotlight your delivery skills and on-the-road experience. Use our tips to help you showcase your reliability and ability to manage multiple

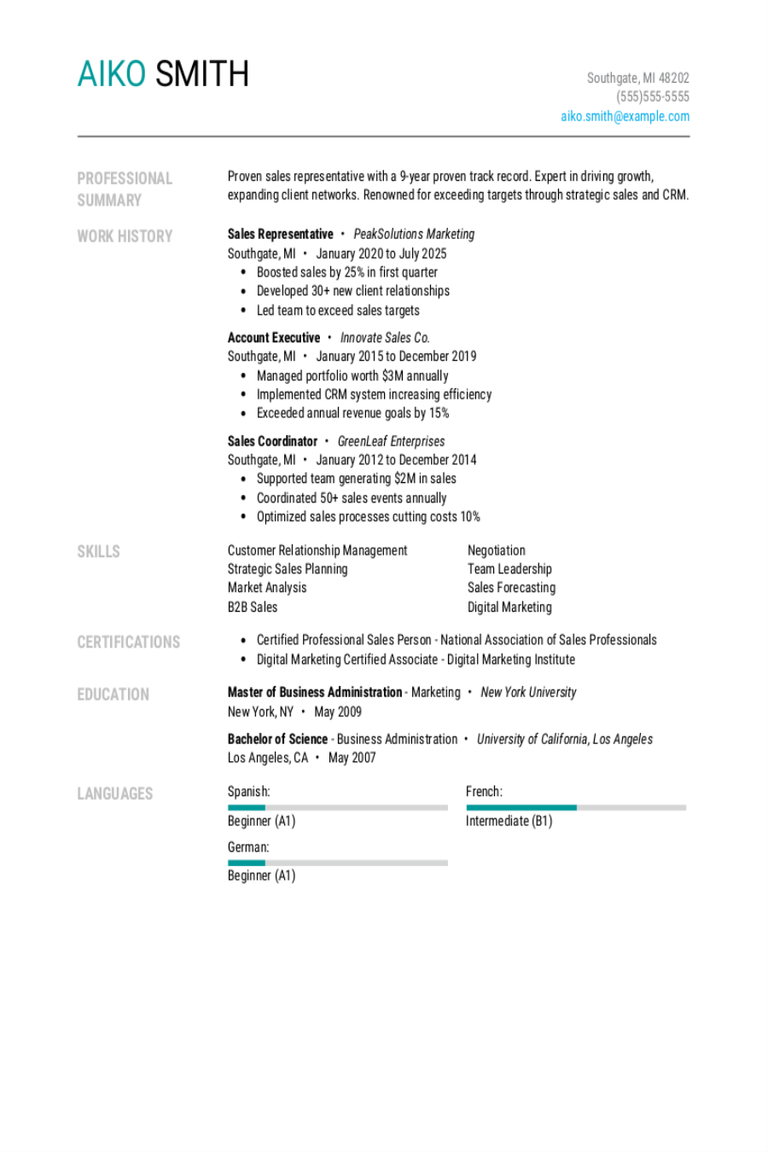

Sales Representative Resume Examples & Templates

Find sales representative resume examples that highlight how to showcase your communication skills and sales achievements. Get tips on organizing your experience to grab attention and stand out to hiring

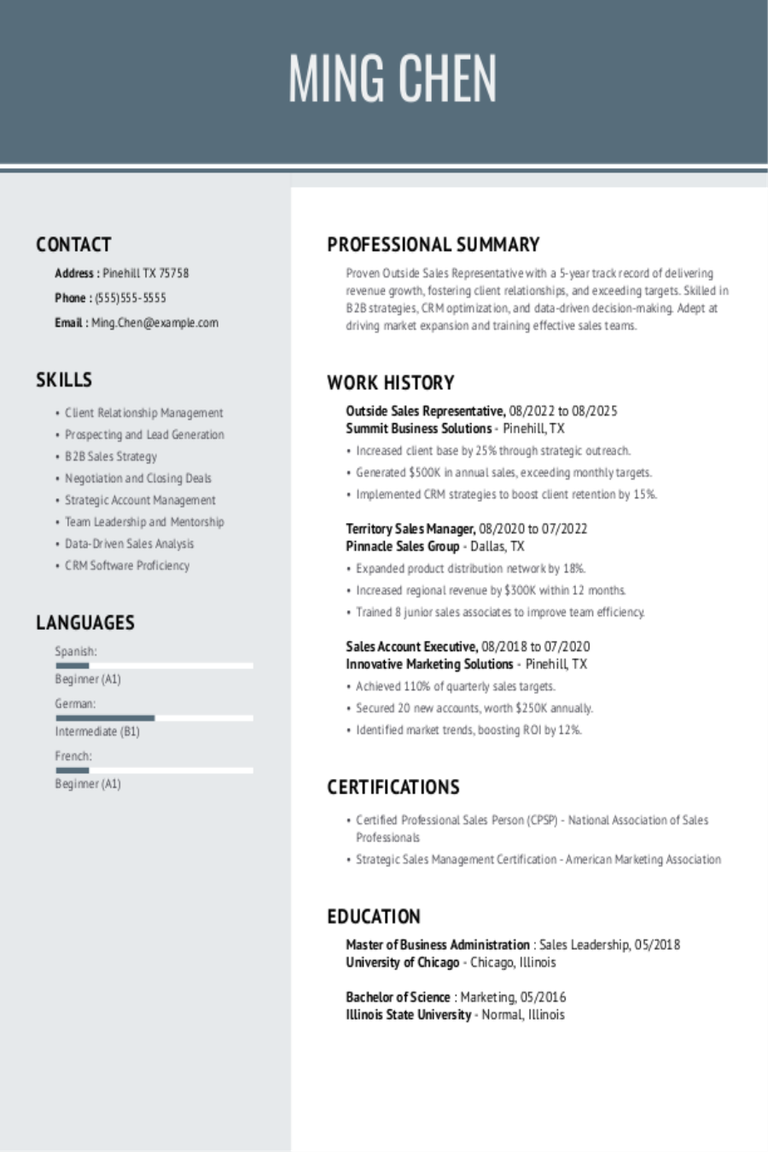

Outside Sales Representative Resume Examples & Templates

Discover outside sales representative resume examples that focus on building strong relationships and driving sales growth. Learn how to showcase your negotiation skills and highlight your experience in meeting targets