Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Measurable accomplishments like reducing fraud losses by 25% and identifying patterns saving $3M yearly highlight the applicant’s impact and value.

- Uses action-oriented language: Using action verbs like “reduced,” “analyzed,” and “collaborated” showcases decisive initiative and effectiveness.

- Illustrates problem-solving ability: Creating a fraud analytics model that boosted efficiency by 30% highlights their problem-solving skills, critical thinking, and initiative.

More Fraud Analyst Resume Examples

Our fraud analyst resume examples show how to emphasize your investigative skills, attention to detail, and ability to identify risks. Use these insurance resume samples to create a resume that highlights your expertise in fraud prevention.

Entry-Level Fraud Analyst

Why this resume works

- Effective use of keywords: By using role-specific keywords like “fraud detection” and “risk assessment” strategically, the applicant optimizes their application to pass through applicant tracking systems (ATS).

- Shows digital literacy: By showcasing skills such as data analysis and cybersecurity, the applicant evidences their computer skills and readiness to handle modern digital tools.

- Centers on academic background: Highlighting degrees from New York University and the University of Virginia effectively showcases strong academic foundations essential for early-career professionals in finance and economics.

Mid-Level Fraud Analyst

Why this resume works

- Points to measurable outcomes: By reducing fraud incidents by 22% and recovering $1M annually, the applicant showcases a results-driven mindset through impactful fraud prevention strategies.

- Demonstrates language abilities: Language skills in Spanish and French are pivotal for fostering cross-cultural communication, improving international work experiences.

- Displays technical expertise: Certifications like Certified Fraud Examiner and Financial Risk Manager highlight the applicant’s technical expertise, essential for specialized fraud investigation roles.

Experienced Fraud Analyst

Why this resume works

- Lists relevant certifications: Listing certifications like Certified Fraud Examiner reflects the applicant’s dedication to expertise and continuous learning.

- Showcases impressive accomplishments: By quantifying achievements such as recovering over $1M, the applicant’s accomplishments signal a capacity for significant business impact.

- Focuses on work history: Using a chronological resume format, the work history highlights extensive experience from financial investigator to fraud analyst, emphasizing career growth.

Fraud Analyst Resume Template (Text Version)

Aiko Rodriguez

San Francisco, CA 94103

(555)555-5555

Aiko.Rodriguez@example.com

Professional Summary

Dynamic fraud analyst with 9 years’ experience in risk assessment and fraud detection. Proven track record of reducing losses and enhancing efficiency through innovative strategies. Expert in compliance and investigation with strong analytical skills.

Work History

Fraud Analyst

Integrity Wealth Management – San Francisco, CA

July 2021 – July 2025

- Reduced fraud losses by 25% in 2022

- Analyzed 100+ suspicious activities weekly

- Collaborated with cross-function teams

Risk Investigator

Secure Banking Partners – Riverside, CA

July 2016 – June 2021

- Identified fraud patterns saving M yearly

- Streamlined reporting processes, improving efficiency

- Developed analytics tools to predict risks

Anti-Money Laundering Specialist

Trust Financial Services – Riverside, CA

July 2013 – June 2016

- Processed 200+ alerts monthly with 98% accuracy

- Implemented AML regulations, reducing risks

- Conducted training sessions for new recruits

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- Mandarin – Beginner (A1)

Skills

- Fraud Detection

- Risk Assessment

- Data Analysis

- Regulatory Compliance

- Investigation Techniques

- AML Knowledge

- Problem Solving

- Team Collaboration

Certifications

- Certified Fraud Examiner (CFE) – Association of Certified Fraud Examiners

- AML Certification – Global Compliance Institute

Education

Master of Science Financial Forensics

Stanford University Stanford, California

June 2013

Bachelor of Arts Economics

University of California, Berkeley Berkeley, California

June 2011

Related Resume Guides

Advice for Writing Your Fraud Analyst Resume

Dive into our tips on how to write a resume for a fraud analyst position and see how you can highlight your investigative skills, attention to detail, and ability to spot inconsistencies.

Highlight your most relevant skills

Listing relevant skills when applying for a job like a fraud analyst is very important. It helps show employers that you have what it takes to do the job well. Skills tell them about your abilities and how you can fit into their team.

By creating a dedicated skills section, you make it easy for hiring managers to see what you bring to the table. It’s good to balance between technical skills, like data analysis and understanding of fraud systems, and soft skills, such as communication and problem-solving.

To make your application stand out even more, try to weave these key skills into your work experience section. For example, when describing past jobs, mention how you used specific fraud analysis tools or worked with others to solve complex problems.

This approach not only shows that you have the right skills but also demonstrates how you’ve already put them into action in real situations. Doing this gives potential employers a clearer picture of your capabilities and makes your resume more impactful.

Select a resume format that highlights your skills in detecting fraud, developing strategies, and using data analysis tools.

Showcase your accomplishments

When organizing your work experience as a fraud analyst, list each job in reverse chronological order. Start with your most recent position and work backwards. For each entry, include your job title, the name of the employer, the location, and your employment dates. This helps hiring managers quickly see where you’ve worked and what you’ve done recently.

To make your resume stand out, focus on quantifying your accomplishments rather than just listing duties. Turn tasks into achievements by showing measurable results like percentages or cost savings. For example, instead of saying “reviewed transactions,” say “reduced fraudulent transactions by 30% through detailed analysis.” This shows clear evidence of your impact.

Use action words that highlight what you did and achieved in each role. Words like “analyzed,” “implemented,” or “optimized” are strong choices that convey your actions effectively.

Quantified accomplishments help hiring managers assess how well you performed and the skills you bring to their team. This approach paints a clearer picture of your capabilities as a fraud analyst, making it easier for employers to see why you’d be a great fit for their organization.

5 fraud analyst work history bullet points

- Analyzed transaction data to identify fraudulent activity, reducing false positives by 25% through improved detection algorithms.

- Collaborated with cross-functional teams to implement fraud prevention strategies, decreasing fraud incidents by 30% over a year.

- Conducted in-depth investigations of suspicious transactions, successfully recovering $500,000 in lost revenue.

- Developed and maintained comprehensive fraud risk assessment reports, improving response times to threats by 40%.

- Trained new team members on fraud analysis techniques and tools, contributing to a 20% increase in department efficiency.

Choose a straightforward resume template with clear headings and standard fonts to showcase your skills. Avoid intricate designs that might complicate readability.

Write a strong professional summary

A professional summary on a resume serves as an introduction for hiring managers, providing a snapshot of your skills and accomplishments. You can decide whether to use a summary or a resume objective based on your experience level and career goals.

A professional summary is typically three to four sentences long and highlights your experience, key skills, and notable achievements. It works best for experienced applicants who want to showcase their professional identity and the value they bring to the table. A strong summary can immediately grab attention by showing what you’ve accomplished in your career.

On the other hand, resume objectives outline your career goals and are ideal for entry-level applicants, career changers, or those with employment gaps. While summaries focus on “what I’ve accomplished,” objectives emphasize “what I aim to contribute.”

Now, let’s look at examples of both summaries and objectives crafted for various industries and levels of experience. See our library of resume examples for additional inspiration.

Fraud analyst resume summary examples

Entry-level

Recent graduate with a Bachelor’s degree in finance and a focus on fraud detection and prevention. Completed internships that provided hands-on experience with risk analysis and data monitoring tools. Certified in anti-money laundering (AML) compliance and skilled in using Excel for data analysis. Eager to apply analytical skills and support fraud investigation teams.

Mid-career

Fraud analyst with over six years of experience in financial institutions, specializing in transaction monitoring and fraud detection systems. Proven track record of identifying fraudulent activities, reducing false positives, and collaborating with law enforcement agencies. Holds certification as a Certified Fraud Examiner (CFE) and recognized for developing effective fraud prevention strategies.

Experienced

Senior fraud analyst with expertise in leading cross-functional teams and implementing advanced analytics to combat financial crime. Over 10 years of experience working with multinational banks to improve their fraud risk management frameworks. Spearheaded initiatives that led to a 30% reduction in fraud losses year-over-year. Passionate about mentoring junior analysts and driving innovation in the field.

Fraud analyst resume objective examples

Recent graduate

Detail-oriented recent graduate with a bachelor’s degree in finance seeking an entry-level fraud analyst position. Eager to apply analytical skills and knowledge of fraud detection techniques to support financial institutions in mitigating fraudulent activities and improving security measures.

Career changer

Dedicated customer service professional transitioning into the role of fraud analyst, offering strong problem-solving abilities and keen attention to detail. Aspires to leverage experience in handling financial transactions and customer interactions to identify and prevent fraudulent activities within the banking sector.

Entry-level applicant with training

Ambitious individual with formal training in data analysis and risk assessment, aiming for a fraud analyst position. Committed to using statistical tools and methodologies learned during coursework to assist organizations in identifying trends and patterns indicative of potential fraud risks.

Craft your fraud analyst resume with our Resume Builder to highlight your skills in detecting scams and suspicious activities. It’s easy to use and lets you tailor your resume to the job.

Match your resume to the job description

Tailoring your resume to the job description is key to standing out. Many companies use applicant tracking systems (ATS) to sort through resumes. These systems look for specific keywords and phrases from the job posting. If your resume doesn’t include these terms, it might not even be seen by a human recruiter. By matching your resume to the job description, you increase your chances of getting noticed.

An ATS-friendly resume includes keywords that match the job description and highlight your skills. This means using exact words or phrases that employers are looking for. When you do this, hiring managers are more likely to see your application because it shows you have what they need.

To find these important keywords, read the job posting closely. Look for skills, qualifications, and duties that come up often. For example, if you see “fraud detection,” “data analysis,” or “risk assessment” mentioned several times in a fraud analyst role, make sure to use these exact phrases in your resume.

Once you’ve identified the keywords, weave them naturally into your resume content. For instance, instead of writing “Investigated claims,” say “Conducted thorough fraud investigations on suspicious claims.” This mirrors the language in the job posting while highlighting your experience.

Using targeted resumes makes them more compatible with ATS systems and increases their effectiveness. It shows employers that you’ve taken the time to customize your resume and present yourself as a good fit for their team.

Don’t let little mistakes keep you from a job! Try our ATS Resume Checker to scan your resume for potential issues and receive on-the-spot feedback to improve your resume score.

FAQ

Do I need to include a cover letter with my fraud analyst resume?

Yes, including a cover letter with your fraud analyst resume can improve your application by showcasing your motivation and specific skills.

A cover letter lets you explain why you’re interested in the role and how your analytical abilities match the company’s goals.

For example, if the organization focuses on data-driven decision-making or uses unique fraud detection software, mention any related experience or enthusiasm for those areas.

You can use tools like our Cover Letter Generator to craft an effective cover letter that complements your resume with structured guidance and expert tips.

Also, reviewing various cover letter examples tailored to financial positions can inspire and help ensure your application is polished and targeted.

How long should a fraud analyst’s resume be?

For a fraud analyst, aim for a one-page resume to succinctly highlight your skills in risk assessment, data analysis, and expertise in detecting fraudulent activities.

If you have extensive experience or specialized certifications, a two-page resume can be justified. Just ensure every detail is relevant and shows your ability to safeguard financial assets effectively.

Focus on recent roles and achievements that directly relate to fraud detection and prevention. Tailor each section to the unique demands of the industry while keeping it clear and concise.

Explore our guide on how long a resume should be for examples and tips on determining the ideal length for your career stage.

How do you write a fraud analyst resume with no experience?

To craft a fraud analyst resume when you don’t have direct experience, focus on showcasing your skills, education, and any relevant experiences that demonstrate your potential in this area. Check out these tips for building a resume with no experience:

- Highlight relevant coursework: List courses from your degree that relate to fraud analysis, such as finance, data analysis, or criminal justice. Include any projects or case studies where you analyzed patterns or used analytical tools.

- Showcase transferable skills: Emphasize skills like attention to detail, critical thinking, problem-solving, and skills in Excel or SQL. These are important for identifying fraudulent activity.

- Include internships or volunteer work: If you’ve had an internship in a financial institution or volunteered for tasks involving data analysis or investigation, describe these experiences even if they were unpaid.

- Leverage certifications: If you’ve completed certifications like Certified Fraud Examiner (CFE) or any online courses related to fraud detection and prevention, include these to demonstrate your commitment and knowledge.

Check out resources on crafting resumes for specific roles without direct experience to gather more insights and examples tailored for aspiring fraud analysts.

Rate this article

Fraud Analyst

Share this page

Additional Resources

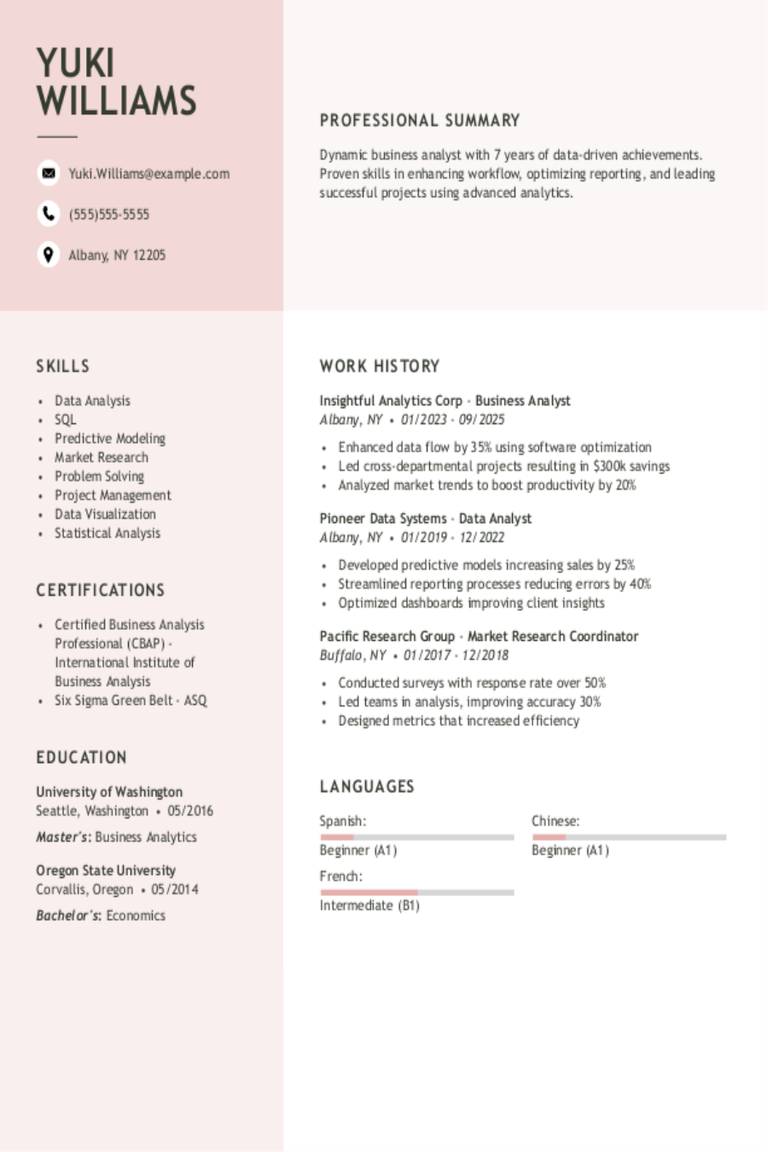

Business Analyst Resume Examples & Templates

Explore business analyst resume examples to see how to showcase your problem-solving, teamwork, and data skills. Browse tips to highlight your experience turning ideas into action and improving processes to

Quality Control Analyst Resume Examples & Templates

Discover how quality control analysts showcase their skills in monitoring products and ensuring standards are met. These resume examples will help you highlight your experience with testing processes and improving

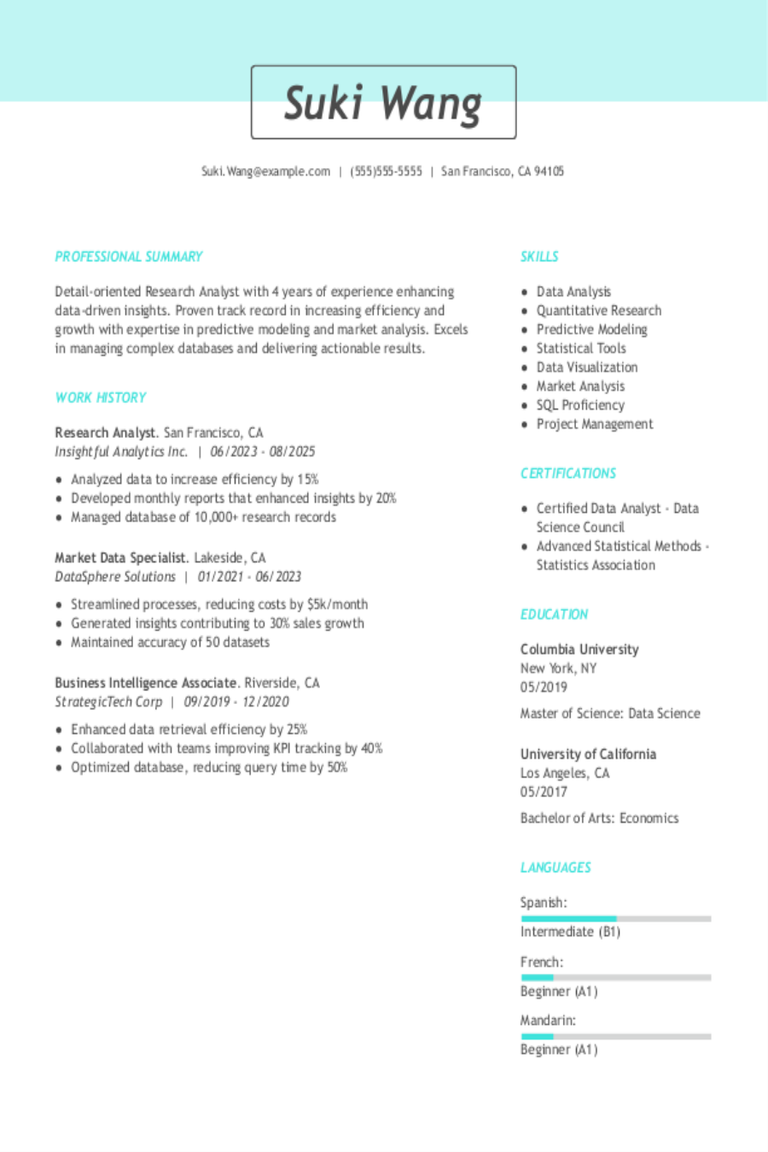

Research Analyst Resume Examples & Templates

Browse research analyst resume examples and learn how to spotlight your skills in data analysis, problem-solving, and research techniques.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies accomplishments: By

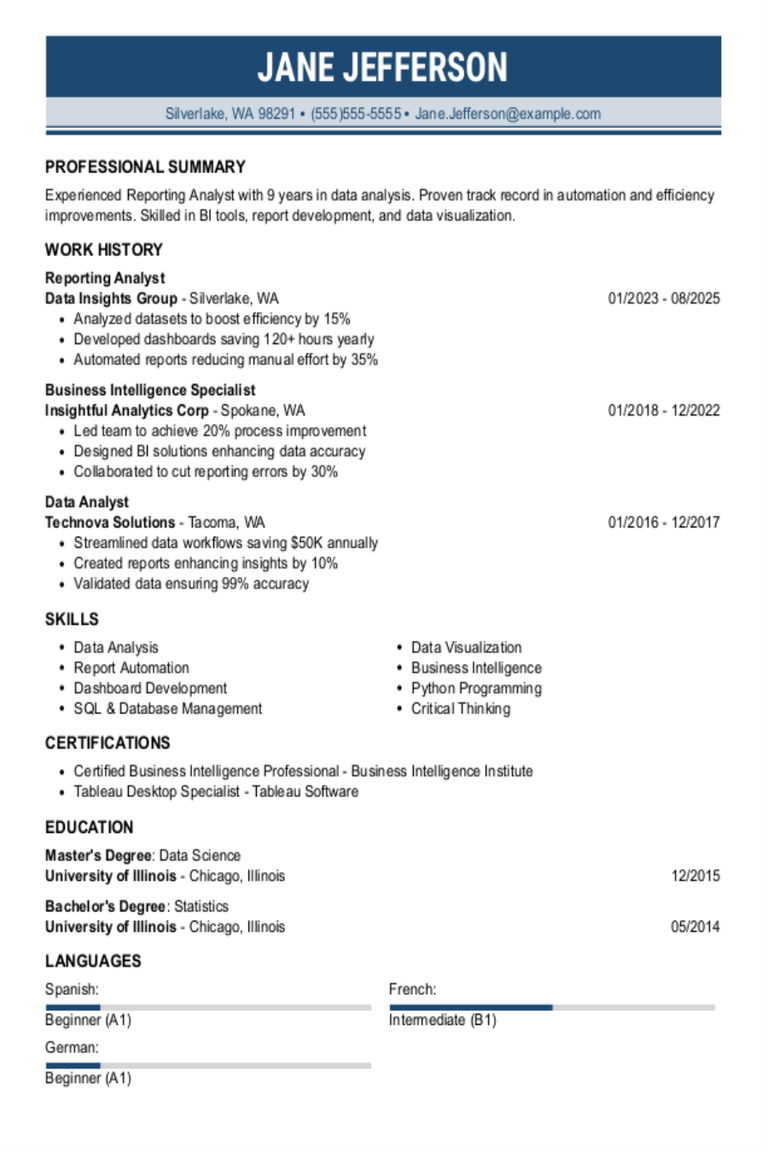

Reporting Analyst Resume Examples & Templates

Discover reporting analyst resume examples and learn to showcase your experience in creating reports and making insights stand out to potential employers.Build my resumeImport existing resumeCustomize this templateWhy this resume

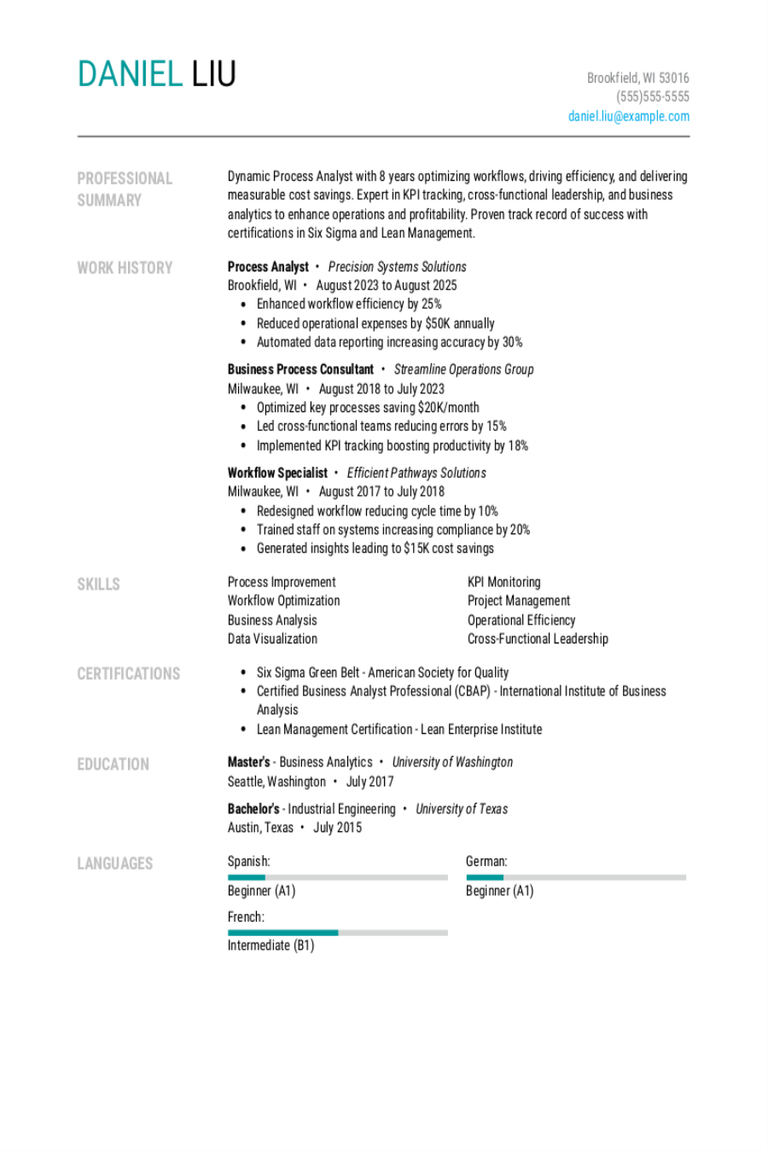

Process Analyst Resume Examples & Templates

Explore process analyst resume examples that show how to spotlight problem-solving and data analysis skills. These tips help you highlight your experience in improving workflows and boosting efficiency.Build my resumeImport

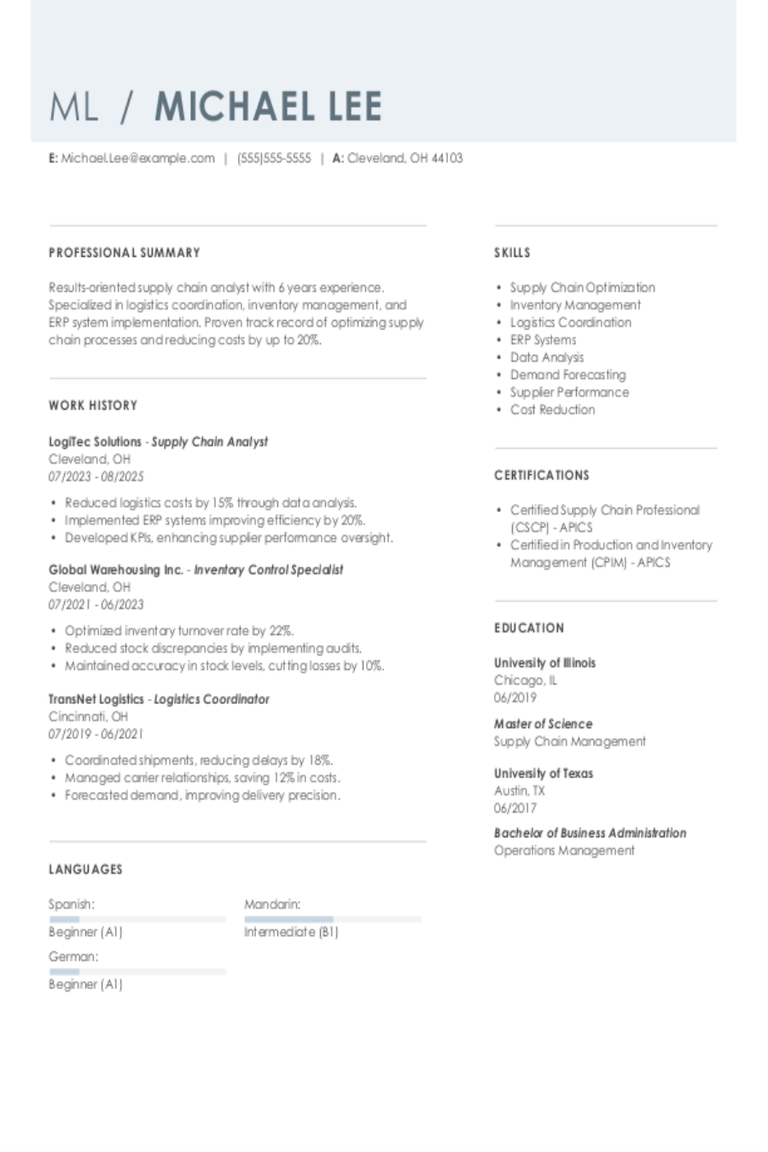

Supply Chain Analyst Resume Examples & Templates

Browse supply chain analyst resume examples to see how to highlight your logistics and planning skills. Learn how to showcase your experience in managing inventory, optimizing processes, and improving supply