Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Measurable accomplishments, like a 35% reduction in fraud loss and $250,000 annual savings, showcase the applicant’s significant financial impact.

- Illustrates problem-solving ability: Through innovative solutions such as developing a risk model that cut false positives by 40%, the applicant highlights problem-solving skills, critical thinking, and initiative.

- Uses action-oriented language: Using powerful action verbs like “identified” and “streamlined,” the applicant’s bullet points convey decisive initiative, illustrating effectiveness in every role.

More Fraud Investigator Resume Examples

See our fraud investigator resume examples to learn how to highlight your investigative skills, attention to detail, and experience in detecting fraudulent activities. These insurance resume samples will guide you in crafting a standout resume.

Entry-Level Fraud Investigator

Why this resume works

- Puts skills at the forefront: By using a skills-based resume format, the applicant’s expertise in fraud detection and risk assessment is spotlighted.

- Centers on academic background: The education section showcases degrees in criminal justice and statistics, emphasizing academic excellence important for early-career professionals aiming to stand out.

- Shows digital literacy: Mentioning technical skills like data analysis tools highlights the applicant’s computer skills and digital readiness, essential for modern workplaces.

Mid-Level Fraud Investigator

Why this resume works

- Points to measurable outcomes: By reducing fraud cases by 30% and identifying $500k in unauthorized transactions, the applicant showcases effective problem-solving with quantifiable outcomes.

- Demonstrates language abilities: Language skills in Spanish, French, and Mandarin improve cross-cultural communication, supporting international work.

- Displays technical expertise: Possessing certifications such as Certified Fraud Examiner and CPA License highlights the applicant’s technical expertise important for forensic accounting roles.

Experienced Fraud Investigator

Why this resume works

- Showcases impressive accomplishments: By designing fraud prevention strategies for multiple branches, the applicant showcases a tangible impact on organizational security and efficiency.

- Focuses on work history: The applicant uses a chronological resume to emphasize their extensive career experience, presenting a clear trajectory of professional growth and achievements.

- Emphasizes leadership skills: Managing a team to achieve annual fraud mitigation targets highlights the applicant’s effective leadership skills in guiding projects and driving impactful results.

Fraud Investigator Resume Template (Text Version)

Hank Green

Eastside, WA 98002

(555)555-5555

Hank.Green@example.com

Professional Summary

Experienced fraud investigator with expertise in risk management and data analysis. Demonstrated success in reducing fraud losses by over 35%, informed by strong financial auditing skills and regulatory compliance knowledge. Committed to effective fraud prevention and sustainable operational improvements.

Work History

Fraud Investigator

Integrity Financial Services – Eastside, WA

June 2022 – July 2025

- Identified fraud schemes, reducing loss by 35%

- Conducted audits saving 0,000 annually

- Trained 12 new hires on fraud detection

Risk Analyst

Guardian Credit Union – Seattle, WA

July 2018 – May 2022

- Streamlined processes reducing risk by 20%

- Analyzed data for fraud indicators monthly

- Collaborated on cross-department strategies

Compliance Officer

Trust Bank Corp – Spokane, WA

May 2016 – June 2018

- Implemented protocols reducing breaches by 50%

- Reviewed reports ensuring regulatory adherence

- Conducted team training improving skills 30%

Skills

- Fraud Prevention

- Risk Management

- Data Analysis

- Investigative Techniques

- Regulatory Compliance

- Financial Auditing

- Reporting & Documentation

- Critical Thinking

Education

Master’s Degree Criminal Justice

University of Illinois Champaign, Illinois

May 2016

Bachelor’s Degree Finance

Illinois State University Normal, Illinois

May 2014

Certifications

- Certified Fraud Examiner – Association of Certified Fraud Examiners

- Certified Risk Management Professional – Risk Management Institute

Languages

- Spanish – Beginner (A1)

- French – Beginner (A1)

- German – Beginner (A1)

Related Resume Guides

Advice for Writing Your Fraud Investigator Resume

Explore our tips on how to write a resume for a fraud investigator position and discover how to highlight your skills in uncovering deceit and safeguarding integrity.

Write a strong professional summary

A professional summary is a brief introduction at the top of your resume that shows hiring managers who you are and what you bring to the table. You can decide whether to use a summary or a resume objective based on your experience level and career goals.

A professional summary is usually three to four sentences long, highlighting your experience, key skills, and major achievements. This approach works best for experienced applicants, and the goal is to quickly showcase your professional identity and the value you offer.

On the other hand, resume objectives focus on career goals and are ideal for those just starting, changing careers, or with employment gaps. They express “what I aim to contribute” rather than “what I’ve accomplished.” Now let’s look at examples of both summaries and objectives tailored for various industries and experience levels. See our library of resume examples for additional inspiration.

Fraud investigator resume summary examples

Entry-level

Recent graduate with a Bachelor of Science in criminal justice and a concentration in fraud examination. Completed internships with local law enforcement agencies, gaining foundational skills in conducting investigations and analyzing financial records. Certified Fraud Examiner (CFE) and skilled in using data analysis tools to detect fraudulent activities. Eager to contribute to a team dedicated to preventing and investigating fraud.

Mid-career

Fraud investigator with 5+ years of experience in identifying, analyzing, and investigating fraudulent activities within the banking sector. Proven track record of successfully resolving complex cases involving credit card fraud, identity theft, and embezzlement. Certified Fraud Examiner (CFE) with adept knowledge of regulatory compliance and advanced skill in forensic accounting techniques.

Experienced

Seasoned fraud investigator with over 15 years of experience leading high-profile investigations across multiple industries, including finance, insurance, and retail. Expert in developing anti-fraud strategies, managing investigation teams, and using advanced data analytics to uncover sophisticated fraud schemes. Recognized for achieving significant reductions in financial losses through innovative detection methods and collaboration with legal authorities.

Fraud investigator resume objective examples

Entry-level

Detail-oriented and analytical recent criminal justice graduate seeking an entry-level fraud investigator position. Eager to apply foundational knowledge in law enforcement and investigative techniques to assist in identifying fraudulent activities and protecting organizational assets.

Career changer

Dedicated finance professional transitioning into fraud investigation, with a solid background in financial analysis and risk assessment. Looking to leverage analytical skills and experience in detecting discrepancies to contribute effectively to a proactive fraud prevention team.

Entry-level

Aspiring fraud investigator with a keen interest in cybersecurity and data analysis, eager to join a dynamic investigative team. Committed to developing expertise in identifying fraudulent patterns and supporting efforts that safeguard company integrity.

Highlight your fraud investigations by using our Resume Builder to create a clean, professional resume that stands out to employers.

Include relevant certifications and training

Certifications and training are important for a fraud investigator because they show you have the right skills to detect and prevent fraud. With proper credentials, you can stand out in the job market.

Having these certifications means you’ve learned about the latest tools and techniques used in fraud detection. It also shows employers that you’re committed to your job and staying updated on new trends. Here are a few examples of certifications for your resume:

- Certified Fraud Examiner (CFE)

- Certified Financial Crime Specialist (CFCS)

- Certified Anti-Money Laundering Specialist (CAMS)

- Criminal Justice Information Services (CJIS) Certification

- Association of Certified Fraud Examiners (ACFE) Training

Listing these certifications in a dedicated section can boost your resume’s impact. They prove you have the specialized knowledge needed for investigating fraud cases effectively. Including them alongside your education highlights your expertise and readiness for this role.

Example of a certifications section

Certified Fraud Examiner (CFE)

Issued by: Association of Certified Fraud Examiners (ACFE)

Issued 2023

Professional Certified Investigator (PCI)

Issued by: ASIS International

Expires 2025

Certified Financial Crime Specialist (CFCS)

Issued by: Association of Certified Financial Crime Specialists

Issued 2022

Anti-Money Laundering Certified Associate (AMLCA)

Issued by: Florida International University

Expires 2024

Choose a polished and well-organized resume template that effectively showcases your skills and qualifications to stand out to hiring managers in your field.

Showcase your work experience

Highlighting relevant work experience as a fraud investigator is key to catching the attention of hiring managers. Start by listing your most recent position first, followed by older roles in reverse chronological order. Include the job title, employer name, location, and employment dates for each role.

Use action-oriented language to describe your accomplishments and responsibilities, focusing on how you contributed to identifying fraudulent activities or improving investigative processes.

For example, instead of saying “responsible for fraud detection,” say “conducted in-depth investigations that uncovered $500K in fraudulent transactions.” In your descriptions, emphasize measurable results whenever possible.

Show how your efforts led to positive outcomes like reducing financial losses, improving compliance with regulations, or streamlining case review processes. Incorporate skills specific to a fraud investigator’s role, such as case management, analyzing suspicious activity reports (SARs), interviewing witnesses or subjects, collaborating with law enforcement agencies, and using forensic tools or software.

Keep each entry clear and concise while ensuring it reflects strong contributions to prior employers. Avoid generic phrases; instead, focus on achievements and problem-solving abilities that show you’re equipped for tackling complex fraud cases. Tailoring this section effectively demonstrates your expertise and makes you stand out for the role of fraud investigator.

5 fraud investigator work history bullet points

- Identified and resolved fraud cases, recovering $1.5 million in assets over 12 months.

- Developed a risk assessment tool that reduced fraudulent activities by 25% within the first quarter.

- Conducted comprehensive investigations, leading to a 40% increase in successful prosecution rates.

- Collaborated with law enforcement agencies to dismantle a major fraud ring, resulting in 20 arrests.

- Improved internal reporting systems, decreasing case resolution time by 15%.

Highlight your investigative skills by selecting a resume format that showcases experience in audits, compliance, and attention to detail.

Match your resume with the job description

Tailoring your resume to the job description is essential as it helps you stand out to employers and ensures your application passes through applicant tracking systems (ATS).

To succeed, an ATS-friendly resume uses keywords directly from the job description while showcasing your skills and experience. By including relevant terms strategically, you make it easier for both the system and hiring managers to see that you’re a strong match for the role.

To find important keywords, carefully review the job posting for repeated phrases in sections like responsibilities or requirements. For example, if applying as a fraud investigator, look for words such as “fraud detection,” “risk assessment,” or “case analysis.” Use exact matches where possible to align with what employers are seeking.

Incorporate these terms naturally into bullet points or descriptions. For instance, rewrite general statements like “investigate cases” into more precise ones, such as “conducted fraud investigations involving risk assessments and case analysis.”

Targeted resumes not only improve compatibility with ATS but also make you more appealing to hiring managers by clearly showing how you meet their needs. To further increase your chances of landing an interview, customize your resume according to each job application.

You can use our ATS Resume Checker to scan your resume for common issues and receive on-the-spot feedback to improve your resume score.

FAQ

Do I need to include a cover letter with my fraud investigator resume?

Yes, including a cover letter with your fraud investigator resume is a smart move. It gives you the chance to highlight your passion for investigating and preventing fraud, and to explain why you’re particularly interested in the company or role.

You can use your cover letter to detail specific cases you’ve worked on or techniques you’ve mastered that align with the job requirements. If the company specializes in certain types of fraud, like financial or cybercrime, mention any relevant experience you have in those areas.

For guidance, you could use tools like our Cover Letter Generator to craft a tailored letter based on your skills and achievements.

Also, reviewing cover letter examples can inspire and ensure yours effectively showcases what makes you a strong applicant for this role.

How long should a fraud investigator’s resume be?

For a fraud investigator, targeting a one-page resume is ideal if you have up to 10 years of experience. This keeps your qualifications concise, spotlighting key skills like investigative techniques and knowledge of fraud detection software.

If your career extends over a decade or involves significant specialized training and certifications, a two-page resume can work. Ensure every detail highlights your expertise in uncovering fraudulent activities.

Check out our guide on how long a resume should be for examples and tips on determining the best length for your career stage.

How do you write a fraud investigator resume with no experience?

If you’re crafting a resume with no experience as a fraud investigator, focus on showcasing your skills, education, and any related experiences that demonstrate your ability for the role. Here are some tips to create an impactful resume:

- Emphasize relevant coursework: If you’ve taken classes in criminal justice, finance, or data analysis, list them prominently. These demonstrate foundational knowledge applicable to fraud investigation.

- Showcase transferable skills: Highlight skills like attention to detail, analytical thinking, and problem-solving. If you’ve held roles requiring these abilities—such as customer service or data entry—mention specific achievements that illustrate these strengths.

- Include related volunteer work or projects: If you’ve volunteered for organizations where you analyzed data or assisted with compliance tasks, detail what you accomplished. This shows initiative and a proactive approach toward gaining relevant experience.

- List certifications and training: Mention any certifications, such as Certified Fraud Examiner (CFE), or online courses related to fraud detection and prevention.

Consider tailoring each section of your resume to reflect aspects of the fraud investigation field, even if they come from different contexts.

Rate this article

Fraud Investigator

Share this page

Additional Resources

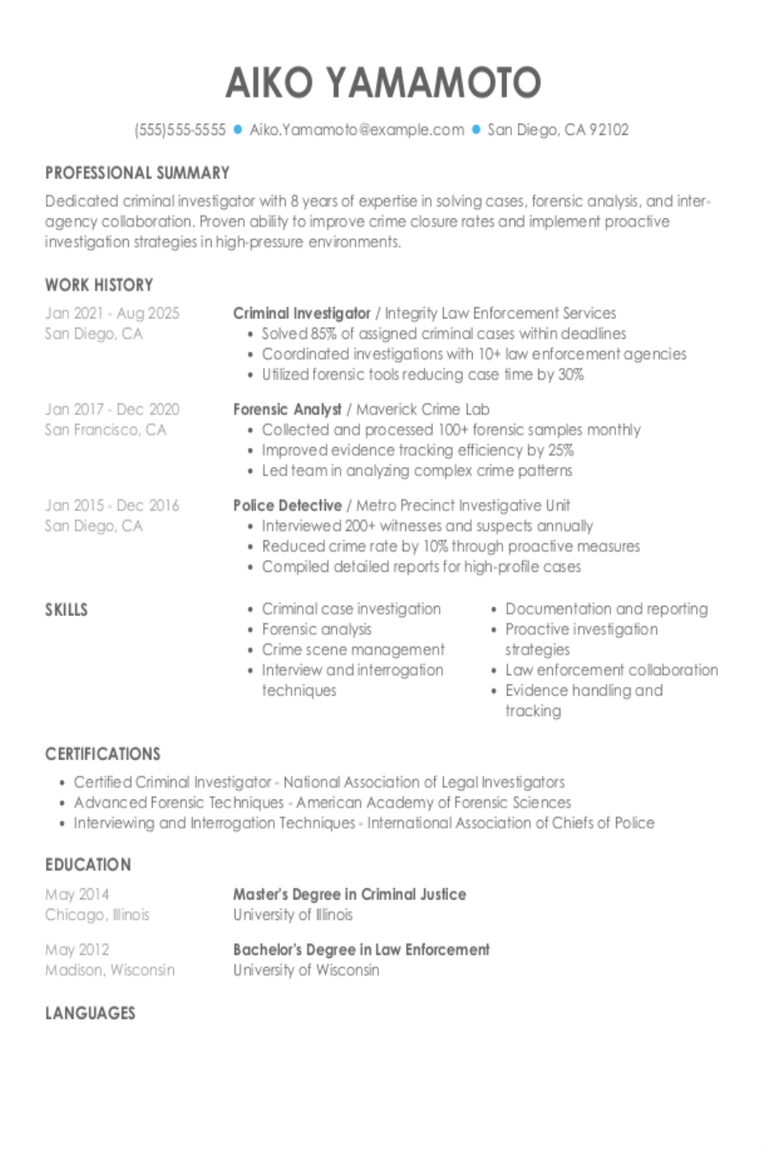

Criminal Investigator Resume Examples & Templates

Discover criminal investigator resume examples and tips to help you spotlight detective skills, analyze evidence, and solve cases.Build my resumeImport existing resumeCustomize this templateWhy this resume worksHighlights industry-specific skills: The applicant’s

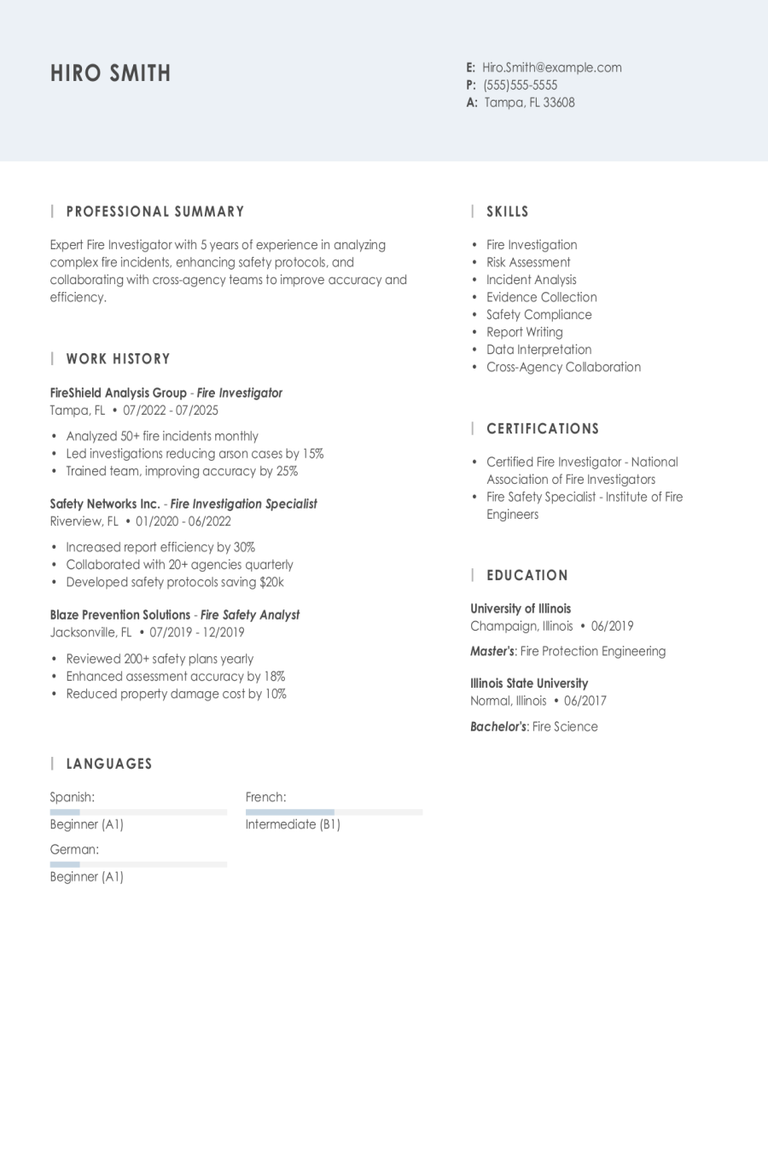

Fire Investigator Resume Examples & Templates

Discover fire investigator resume examples and tips on how to highlight your skills in analyzing fire scenes and determining causes.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

Fraud Analyst Resume Examples & Templates

Explore fraud analyst resume examples to see how to describe your knack for spotting suspicious activity and keeping money safe. These examples and tips will help you showcase your skills

The Illusion of Wage Growth: Where Paychecks Stretch the Farthest

U.S. wages have climbed at one of the fastest rates in modern history. Between 2020 and 2024, the average American worker’s pay rose from about $64,000 to $75,600, an 18%

100+ Resume Objective Statement Examples & Best Practices

In just a sentence or two, a resume objective statement tells hiring managers the role or career path you’re aiming for and the unique skills and value you bring to

150+ Skills for a Resume: Examples for Any Job

Crafting a standout resume starts with highlighting the skills and qualifications that demonstrate your fit for the role. But in a crowded job market, knowing which abilities will actually catch