Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: By including measurable accomplishments, like cutting risk exposure by 30% and saving $500K annually, the applicant reflects impact and value.

- Showcases career progression: Progressing from compliance manager to chief compliance officer shows a clear trajectory of increasing responsibility and leadership across roles in regulatory compliance and risk management.

- Illustrates problem-solving ability: Designing an alert system that reduced alerts by 40% exemplifies problem-solving skills and innovative thinking.

More Executive Resume Examples

Explore more executive resume examples to learn how to highlight your regulatory expertise, leadership skills, and successful compliance strategies. These samples will guide you in crafting a compelling resume for top executive roles.

Risk Manager

Why this resume works

- Effective use of keywords: Incorporating role-specific keywords like “risk assessment” and “financial risk management,” the applicant ensures their resume smoothly navigates through applicant tracking systems (ATS).

- Puts skills at the forefront: Featuring skills upfront, like data analysis and project management, mirrors a skills-based resume format, spotlighting the applicant’s core competencies effectively.

- Shows digital literacy: Use of advanced risk monitoring tools highlights the applicant’s digital readiness, aligning with essential computer skills for today’s tech-driven work environments.

Regulatory Affairs Specialist

Why this resume works

- Includes a mix of soft and hard skills: Balancing technical acumen with interpersonal skills, the applicant effectively coordinates cross-functional teams and manages compliance audits, showcasing a versatile skill set.

- Displays technical expertise: Certifications like ISO 13485 and expertise in FDA regulations reveal the applicant’s solid grasp of essential industry standards, important for maintaining high compliance levels.

- Demonstrates language abilities: Language skills in Spanish, Italian, and Mandarin highlight the applicant’s ability to facilitate effective communication in diverse healthcare settings.

Vice President of Compliance

Why this resume works

- Focuses on work history: The chronological resume format effectively organizes an extensive career history, showcasing clear progression from senior compliance manager to vice president of compliance.

- Lists relevant certifications: By including certifications like Certified Compliance Professional and Professional Risk Manager, the applicant reinforces their expertise in risk management and regulatory practices.

- Emphasizes leadership skills: Managing teams that reduced audit times by 20% reflects the applicant’s leadership skills and ability to inspire results-driven collaboration.

Chief Compliance Officer Resume Template (Text Version)

Aiko Miller

Chicago, IL 60616

(555)555-5555

Aiko.Miller@example.com

Professional Summary

Seasoned Chief Compliance Officer with proven success in risk assessment, regulatory compliance, and policy development, enhancing efficiencies by 30%.

Work History

Chief Compliance Officer

RegulaCorp Solutions – Chicago, IL

March 2022 – June 2025

- Led team to achieve 20% compliance rate increase

- Reduced risk exposure by 30% year-on-year

- Developed policies saving 0K annually

Director of Risk Management

Shield Trust Co. – Chicago, IL

June 2019 – February 2022

- Slashed incident response by 15%

- Implemented system improving efficiency by 25%

- Facilitated team training resulting in 35% upskill

Compliance Manager

Secure Holdings – Springfield, IL

January 2018 – May 2019

- Managed audits leading to 100% policy adherence

- Streamlined processes boosting productivity by 20%

- Conducted assessments minimizing risks by 50%

Languages

- Spanish – Beginner (A1)

- French – Beginner (A1)

- Mandarin – Beginner (A1)

Skills

- Regulatory Compliance

- Risk Assessment

- Policy Development

- Audit Management

- Strategic Planning

- Leadership

- Data Analysis

- Process Improvement

Certifications

- Certified Regulatory Compliance Manager – Institute of Certified Bankers

- Certified Risk Manager – National Alliance for Insurance Education & Research

Education

Master of Business Administration Business Administration

Columbia University New York, NY

May 2016

Bachelor of Science Finance

University of California Los Angeles, CA

June 2014

Related Resume Guides

Advice for Writing Your Chief Compliance Officer Resume

Explore our tips on how to write a resume for a chief compliance officer role and discover how to highlight your expertise in regulatory standards and risk management. Whether you’re seasoned in compliance or stepping up, learn how crafting a tailored resume can help you stand out and land that dream job.

Highlight your most relevant skills

Listing relevant skills on your resume helps employers see quickly if you’re the right fit for the role. Creating a dedicated skills section on your resume makes it easy for them to identify your strengths. This section should have a mix of technical skills, like understanding laws and regulations, and interpersonal skills, such as leadership and communication.

Balancing these skills shows you’re not only knowledgeable but also able to work well with others. You can also weave your key skills into your work experience section. This makes a greater impact because it shows how you’ve used these skills in real-world situations.

For example, if you’ve led a team to meet compliance goals, mention that along with your leadership skills. If you’ve developed policies that improved company standards, highlight your analytical abilities. By integrating these details, you paint a clearer picture of how effective you can be as a chief compliance officer in their organization.

Select a resume format that highlights leadership in compliance, risk management strategies, and policy creation.

Showcase your accomplishments

When organizing your work experience as a chief compliance officer, start with your most recent job and move backward. For each position, include your job title, the name of the employer, location, and dates you worked there. This helps recruiters easily follow your career path.

Instead of just listing duties, focus on achievements that show how you’ve made a difference in those roles. Quantifying accomplishments makes them more impactful; use numbers like percentages or time saved to show real results.

Turning duties into measurable achievements is key. For example, instead of saying “managed compliance team,” you could say “led compliance team to reduce audit errors by 30%.” This gives a clear picture of what you accomplished and how it benefited the company. Use action words like “implemented,” “improved,” or “streamlined” to describe your core duties and successes.

Quantified accomplishments allow hiring managers to quickly see the value you bring. They highlight your ability to create change and improve processes effectively. By using clear examples backed by numbers, you’re showcasing not just what you did but how well you did it. This makes your resume stand out in a competitive field like compliance management.

5 chief compliance officer work history bullet points

- Led the development and implementation of a compliance program, reducing regulatory violations by 40% over two years.

- Collaborated with cross-functional teams to address compliance gaps, achieving a 100% success rate in audits for three consecutive years.

- Implemented automated monitoring systems, cutting compliance reporting time by 50%.

- Trained over 200 employees annually on regulatory requirements, improving policy adherence scores by 25%.

- Conducted risk assessments across multiple departments, mitigating high-risk incidents by 30% within one fiscal year.

Choose a straightforward resume template featuring clear sections and readable fonts. Steer clear of elaborate designs or excessive colors for a cleaner look that highlights your experience and skills effectively.

Write a strong professional summary

A professional summary serves as a brief introduction at the top of your resume, helping hiring managers quickly grasp who you are and what you offer. When crafting your resume, you can opt for either a professional summary or an objective.

A professional summary typically spans three to four sentences and showcases your experience, skills, and achievements. It’s ideal for professionals with extensive experience. Its purpose is to highlight your professional identity and the value you bring to a company.

Conversely, a resume objective outlines your career goals. It’s ideal for entry-level individuals, those switching careers, or those with work history gaps. Consider it as “what I’ve accomplished” in a summary versus “what I aim to contribute” in an objective.

Now that we understand the distinction between summaries and objectives, let’s explore examples tailored to various industries and levels of experience. Explore our library of resume examples for additional inspiration.

Chief compliance officer resume summary examples

Entry-level

Recent juris doctor graduate with a focus on compliance and regulatory affairs. Completed internships in legal compliance departments, gaining foundational skills in policy analysis, risk assessment, and regulatory research. Certified in ethics and compliance through SCCE’s Basic Compliance & Ethics Academy, aspiring to support organizations in navigating complex legal landscapes.

Mid-career

Compliance officer with over seven years of experience in the financial services sector. Expertise in developing and implementing compliance programs, conducting audits, and ensuring adherence to SEC regulations. Successfully led initiatives that improved internal control processes, reducing non-compliance incidents by 30%. Strong analytical skills paired with a proactive approach to risk management.

Experienced

Seasoned chief compliance officer with more than 15 years of leadership experience across diverse industries including healthcare and finance. Proven track record of steering large-scale compliance frameworks that align with global standards while fostering an ethical corporate culture. Accomplished in driving strategic initiatives that resulted in a 40% enhancement of regulatory adherence scores across multiple business units.

Chief compliance officer resume objective examples

Entry-level

Detail-oriented professional with a recent background in compliance and risk management education seeking an entry-level chief compliance officer role. Excited to apply knowledge of regulatory frameworks and ethical best practices to support organizational integrity and policy adherence.

Career changer

Driven individual transitioning from a legal career into compliance leadership, aiming to leverage expertise in legal research, contract review, and regulatory analysis in an entry-level chief compliance officer position. Committed to fostering a culture of accountability and ensuring operational alignment with industry standards.

Recent graduate

Ambitious graduate with coursework in corporate governance, risk assessment, and compliance systems eager to contribute as an entry-level chief compliance officer. Ready to bring strong analytical skills and a proactive mindset to help organizations navigate complex regulatory environments.

Want to make your chief compliance officer resume stand out? Use our AI Resume Builder to easily organize your skills and experience for maximum impact.

Match your resume to the job description

Tailoring your resume to the job description helps you stand out and boosts your chances of passing through applicant tracking systems (ATS). ATS software scans resumes for specific keywords and phrases from job postings, filtering out those that don’t match. By aligning your resume with the job description, you can ensure that it is noticed by screening technology and hiring managers.

An ATS-friendly resume includes keywords and phrases from the job posting that align with your skills. Incorporating these terms makes it more likely for hiring managers to notice your application. The goal is to make sure your resume mirrors what employers are looking for without overloading it with unnecessary details.

Targeted resumes improve ATS compatibility by matching employer needs closely. To find keywords in a job posting, look for skills, qualifications, and duties mentioned multiple times. For instance, if you see “compliance management,” “risk assessment,” or “policy development” repeated, include these exact phrases in your resume. Using precise terms shows that you understand what’s important for the role.

Incorporate these terms naturally into your resume by adjusting your job descriptions. Instead of just listing responsibilities, say how you applied those skills. For instance, change “Ensure compliance with regulations” to “Effectively ensured compliance with regulations across multiple departments.” This approach makes your experience feel active and relevant.

Make sure your resume passes through applicant tracking systems! The ATS Resume Checker spots common problems and gives advice to make your resume better.

FAQ

Do I need to include a cover letter with my chief compliance officer resume?

Yes, adding a tailored cover letter to your chief compliance officer resume can boost your application and give you an edge over others. A cover letter allows you to show your leadership style, highlight key achievements in regulatory compliance, and explain how your expertise matches the organization’s needs.

For example, if the company operates in a highly regulated industry like finance or healthcare, you can emphasize experience managing specific compliance standards or navigating audits successfully. You can use it to share insights into your strategic approach to risk management or detail how you’ve created effective compliance programs that align with corporate goals.

Consider checking cover letter examples to ensure yours conveys professionalism and focuses on accomplishments relevant to this high-level role. You may also find it helpful to use our Cover Letter Generator for guidance and personalized content suggestions.

How long should a chief compliance officer’s resume be?

For a chief compliance officer, a two-page resume is generally appropriate. This allows you to detail your extensive experience in regulatory adherence, risk management, and leadership roles without overwhelming the reader.

Make sure every point you include demonstrates your expertise in compliance strategy, policy development, and team management. Highlighting major achievements and specific projects will showcase your ability to handle complex compliance issues effectively.

Explore our guide on how long a resume should be for examples and tips on determining the ideal length for your career stage, whether it’s a one-page resume or longer.

How do you write a chief compliance officer resume with no experience?

If you’re aiming for a chief compliance officer role but lack direct experience, emphasize relevant skills, education, and transferable work experiences that show your potential. Here are a few tips on how to write a resume with no experience:

- Emphasize your education: List your degrees, certifications, and any specialized training in compliance, law, or business management. Highlight courses or projects related to regulatory affairs or risk management.

- Showcase transferable skills: Highlight skills from previous roles that apply to compliance work, such as attention to detail, analytical thinking, leadership abilities, and knowledge of industry regulations.

- Include relevant experience: If you’ve held positions that involved regulatory compliance tasks or oversight responsibilities (even if not directly as a CCO), detail those experiences. This could include roles in legal departments, auditing, or quality assurance.

- Mention professional development: Include any workshops, seminars, or ongoing education related to compliance. Memberships in professional organizations like the Society of Corporate Compliance and Ethics (SCCE) are also valuable.

Tailoring your resume this way will help demonstrate your readiness for a chief compliance officer role despite having limited direct experience.

Rate this article

Chief Compliance Officer

Share this page

Additional Resources

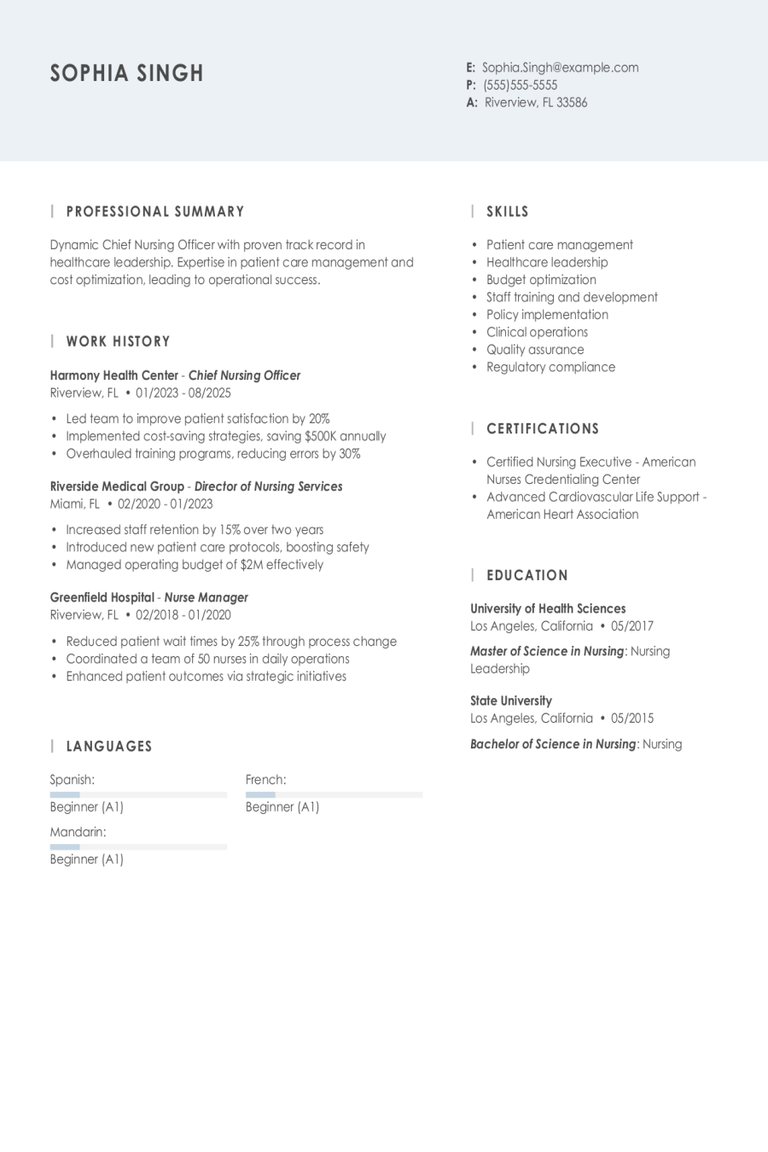

Chief Nursing Officer Resume Examples & Templates

Discover chief nursing officer resume examples that highlight leadership and healthcare management skills. Find tips to showcase your experience in guiding nursing teams and improving patient care.Build my resumeImport existing

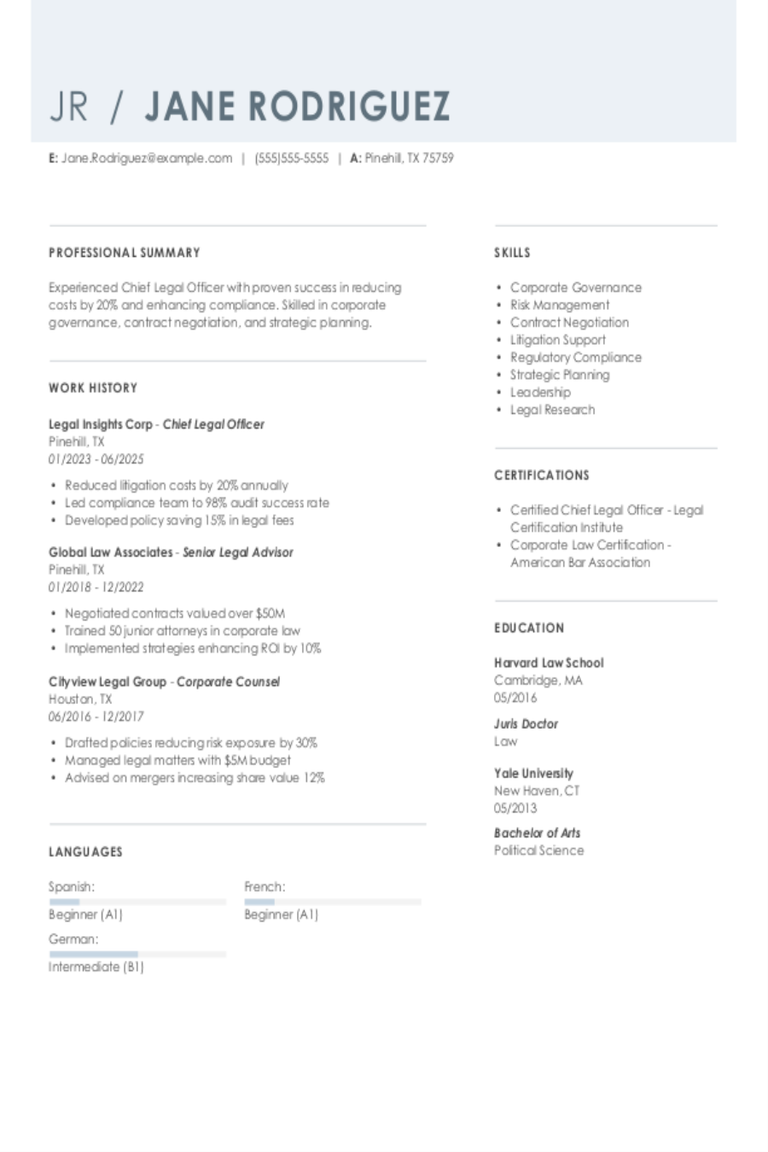

Chief Legal Officer Resume Examples & Templates

Explore chief legal officer resume examples and tips to learn how to showcase your ability to guide company decisions, manage legal risks, and ensure compliance.Build my resumeImport existing resumeCustomize

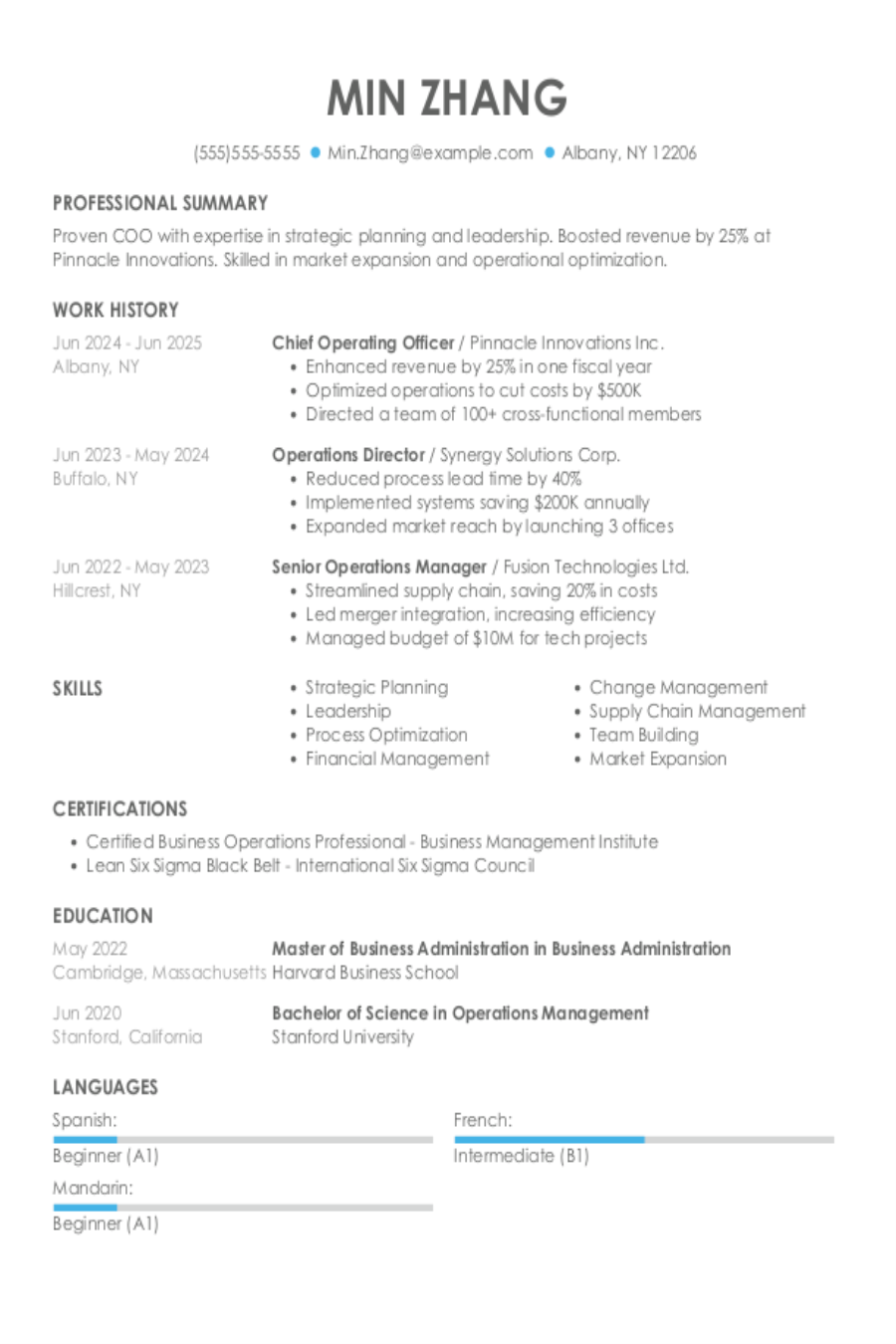

Chief Operating Officer Resume Examples & Templates

Explore chief operating officer resume examples that focus on leading operations and improving business efficiency. These tips will help you show your management skills and highlight your experience in driving

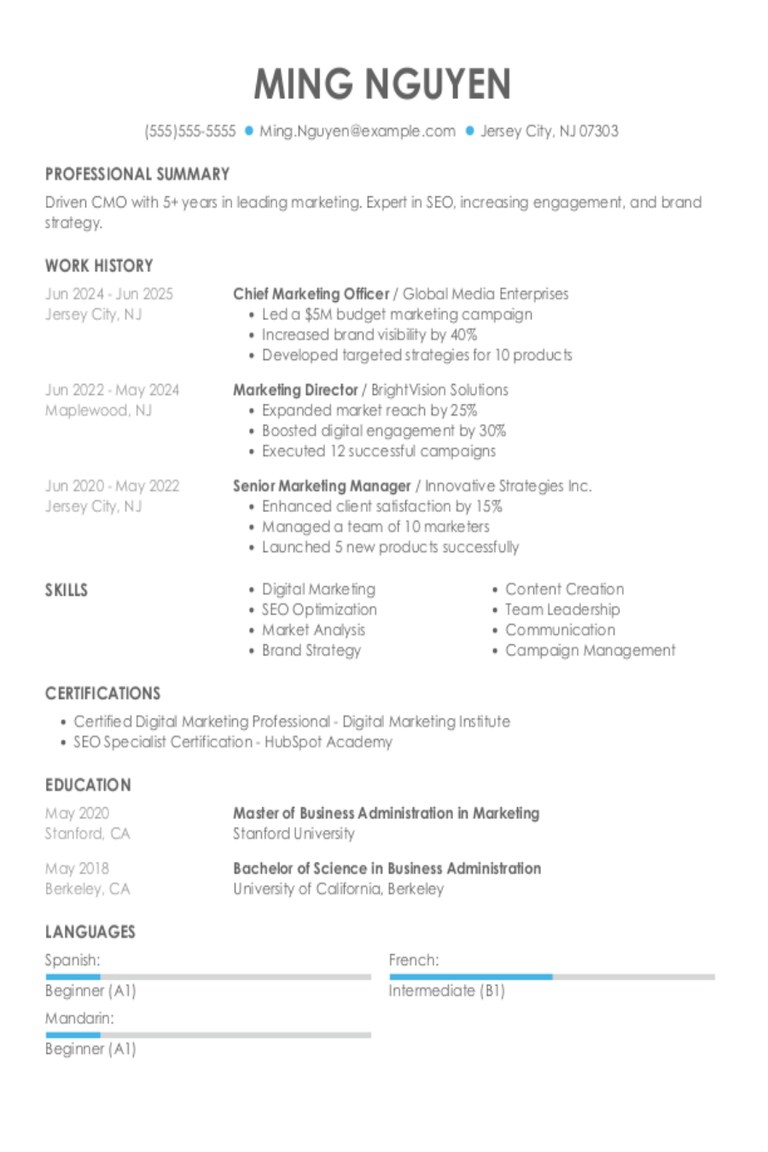

Chief Marketing Officer Resume Examples & Templates

Explore chief marketing officer resume examples and tips that show you how to highlight your leadership skills and experience with strategy, team management, and market analysis.Build my resumeImport existing resumeCustomize

The Great Compliance: Workers Back Down as Employers Regain Power in 2026

Just one year ago, half of American workers said they would quit rather than accept a forced return-to-office (RTO) mandate. Today, that era is over. A new MyPerfectResume survey of 1,000

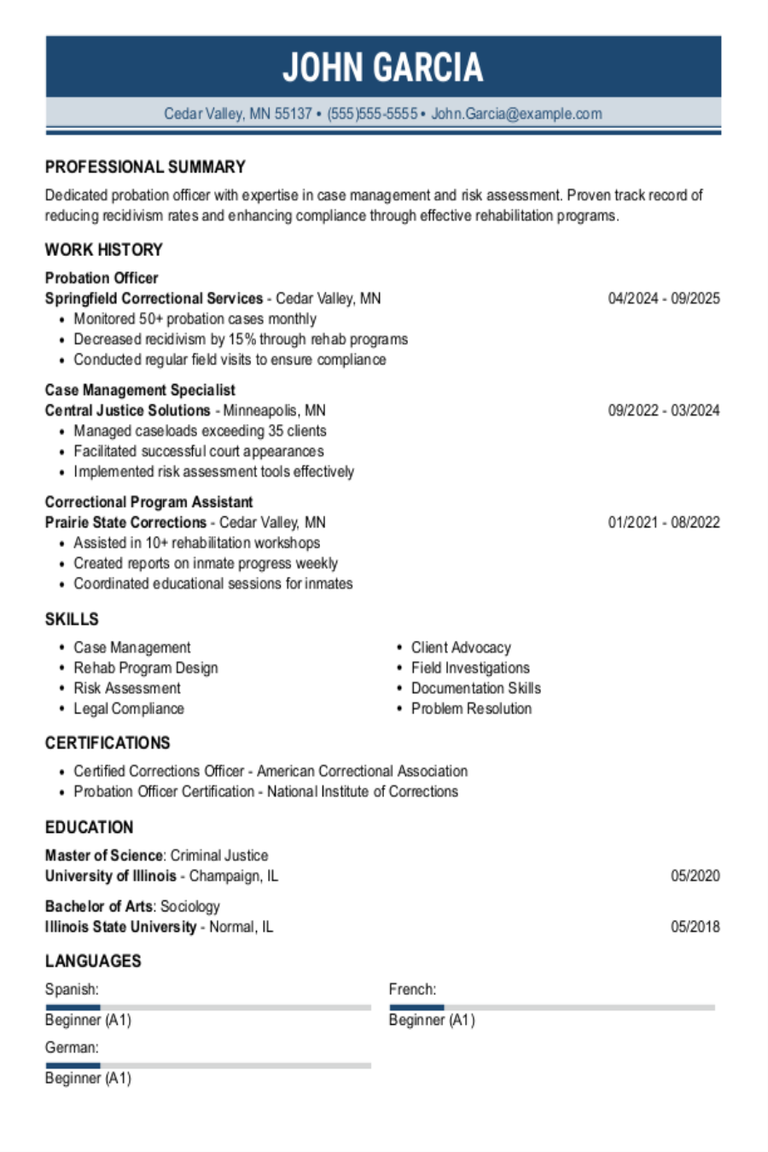

Probation Officer Resume Examples & Templates

Review probation officer resume examples and tips to discover how to showcase your strengths in communication, conflict resolution, and guiding individuals through challenging situations.Build my resumeImport existing resumeCustomize this templateWhy