Table of Contents

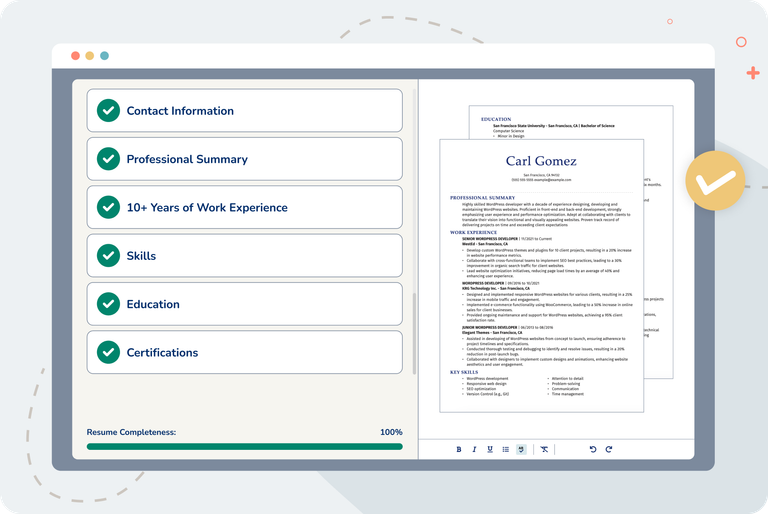

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Showcasing measurable accomplishments like managing portfolios over $50M and improving retention by 20% reveals the applicant’s impact.

- Uses action-oriented language: Using action verbs like “implemented” and “analyzed,” the applicant conveys initiative and effectiveness.

- Illustrates problem-solving ability: By reducing expenses by $500K and implementing financial software, the applicant demonstrates problem-solving skills and initiative.

More Banking Resume Examples

Check out our banking resume examples to understand how to showcase your financial acumen, customer service expertise, and analytical skills. These samples will help you craft a resume that attracts top employers in the banking sector.

Entry-Level Banking Resume

Why this resume works

- Effective use of keywords: Integrating keywords such as “customer service” and “cash handling” throughout exemplifies strategic planning to pass applicant tracking systems.

- Shows digital literacy: Demonstrating digital readiness, the applicant’s experience with processing transactions showcases essential computer skills for modern banking environments.

- Centers on academic background: Academic achievements like a master’s degree in finance emphasize a strong foundation, important for someone early in their career aiming to excel in financial roles.

Mid-Level Banking Resume

Why this resume works

- Points to measurable outcomes: Increasing client base by 30% and reducing delinquency rate by 15% showcase the applicant’s dedication to achieving measurable outcomes in their roles.

- Includes a mix of soft and hard skills: The applicant balances technical skills like loan underwriting with strong interpersonal skills evident in client relations and financial advising.

- Displays technical expertise: Certifications as a loan officer and chartered financial analyst emphasize the applicant’s technical expertise relevant to financial analysis and risk assessment.

Experienced Banking Resume

Why this resume works

- Showcases impressive accomplishments: By achieving branch profitability within the first year, the applicant’s standout accomplishments reflect senior-level performance and significant business impact.

- Lists relevant certifications: Relevant certifications, such as certified branch manager, showcase the applicant’s expertise and commitment to continuous learning.

- Focuses on work history: Emphasizing work history in a chronological resume format effectively highlights extensive career experience, as seen with roles from assistant manager to branch manager.

Explore Even More Banking Resumes

Banking Resume Template (Text Version)

Aiko Yamamoto

Detroit, MI 48202

(555)555-5555

Aiko.Yamamoto@example.com

Skills

- Financial Analysis

- Client Portfolio Management

- Investment Strategies

- Market Research

- Risk Management

- Financial Reporting

- Budgeting

- Data Analytics

Languages

- Spanish – Beginner (A1)

- French – Beginner (A1)

- German – Intermediate (B1)

Professional Summary

Seasoned banking professional with 9 years of experience in finance, portfolio management, and client satisfaction. Proven track record in improving financial operations and implementing effective strategies.

Work History

Banking

FinancePros Group – Detroit, MI

July 2021 – July 2025

- Managed client portfolios over $50M

- Improved customer retention by 20%

- Implemented new financial software

Financial Analyst

Global Finance Solutions – Detroit, MI

July 2017 – June 2021

- Analyzed investment opportunities $10M+

- Reduced operational expenses by $500K

- Prepared quarterly financial reports

Investment Advisor

WealthManagement Associates – Southgate, MI

July 2016 – June 2017

- Advised clients on $5M investment plans

- Increased portfolio performance by 15%

- Conducted market trend analyses

Certifications

- Certified Financial Analyst (CFA) – CFA Institute

- Certified Banking Specialist (CBS) – American Bankers Association

Education

Master of Business Administration Finance

Harvard University Cambridge, MA

June 2016

Bachelor of Science Economics

University of California, Berkeley Berkeley, CA

June 2014

Browse Resume Examples by Industry

- Aviation

- Billing And Collections

- Biology

- Boating

- Business Operations

- Casino

- Chemistry

- Child Care

- Civil Engineering

- Compliance

- Computer Hardware

- Computer Software

- Construction

- Copywriting

- Cosmetology

- Costco

- Culinary

- Customer Service

- Dance

- Data Systems Administration

- Deloitte

- Dentistry

- Driving

- Education

- Electrical

- Electrical Engineering

- Energy

- Engineering

- Entertainment

- Entrepreneur

- Entry Level

- Environmental

- Environmental Science

- Event Planning

- Executive

- Fashion

- Film

- Finance

- Fitness And Nutrition

- Food Service

- Freelancing

- General Laborer

- Goldman Sachs

- Government

- Graphic Design

- Healthcare Support

- Hospitality

- Human Resources

- HVAC

- Industrial Engineering

- Information Technology

- Insurance

- Interior Design

- Inventory Management

- Janitorial

- Landscaping

- Language Services

- Law

- Law Enforcement

- Library

- Logistics

- Maintenance

- Marketing

- McKinsey

- Mechanical Engineering

- Mechanics

- Media And Communication

- Medical

- Mental Health

- Meta

- Metal Work

- Military

- Mining

- Museum

- Music

- Netflix

- Non Profit

- Nursing

- Pharmaceutical

- Photography

- Physical Therapy

- Plumbing

- Politics

- Production

- Program Manager

- Project Manager

- Psychology

- Purchasing

- Quality Control

- Real Estate

- Religion

- Retail

- Safety And Security

- Sales

- Sciences

- Shipping

- Social Services

- Special Education

- Sports

- Statistics

- Student

- Teaching

- Team Lead

- Tesla

- Training And Development

- Transportation

- Travel

- Veterinary

- Walgreens

- Walmart

- Web Development

Advice for Writing Your Banking Resume

Dive into our advice section on how to write a resume for a banking position. Whether you’re aiming to break into the finance world or advance your banking career, we’ve got tailored tips to help you highlight your expertise and achievements.

Highlight your most relevant skills

When applying for a job in banking, listing relevant skills is key. It helps employers quickly see if you fit their needs. Your skills section should include both technical skills, like financial analysis or data management, and interpersonal skills, such as communication and teamwork. This balance shows that you’re not only good with numbers but also work well with people, which is important in banking.

Creating a dedicated skills section makes it easy for hiring managers to find what they’re looking for. But don’t stop there. You can make your resume even stronger by weaving these key skills into your work experience descriptions.

For example, instead of just listing that you worked at a bank, describe how you used your customer service skills to help clients or applied analytical thinking to solve problems. This way, employers see exactly how you’ve used your abilities in real situations. By focusing on the right mix of skills and showing how you’ve used them in past jobs, you’ll stand out more to potential employers in the banking field.

For banking, choose a resume format that highlights your financial expertise, certifications, and strong analytical skills.

Showcase your accomplishments

When crafting a resume for a banking position, it’s important to organize your work experience in reverse chronological order. Start with your most recent job and work backwards. For each role, include the job title, employer name, location, and employment dates. This layout helps employers easily track your career progression and see how your skills have developed over time.

To make your resume stand out, focus on quantifying accomplishments rather than just listing duties. Instead of saying “handled customer transactions,” turn it into an achievement by adding measurable results like “processed 100+ transactions daily with 99% accuracy.”

Use numbers to show percentages, time savings, cost reductions, or efficiency improvements. Action-oriented words like “increased,” “reduced,” or “improved” create a dynamic picture of your contributions.

Quantified accomplishments help hiring managers quickly assess the impact you’ve had in previous roles and the skills you bring to the table. By showcasing how you’ve made a difference in past banking jobs—whether through boosting sales by 20% or cutting processing times by half—you demonstrate your ability to deliver results. This approach makes it clear why you’re a great fit for the banking industry.

5 banking work history bullet points

- Managed a portfolio of 150+ high-net-worth clients, achieving a 20% growth in assets under management within one year.

- Implemented a new customer relationship management system that improved client satisfaction scores by 15%.

- Led a team of analysts in conducting risk assessment for loan applications, reducing default rates by 10%.

- Developed and executed financial strategies that increased branch revenue by $1.5 million annually.

- Streamlined account opening procedures, decreasing processing time by 30% and boosting customer onboarding.

Choose a simple resume template with clear sections and readable fonts. Avoid too many colors or fancy designs so employers can quickly find your skills and experience.

Write a strong professional summary

A professional summary on a resume serves as an introduction for hiring managers, providing a snapshot of your skills and accomplishments. You can decide whether to use a summary or a resume objective based on your experience level and career goals.

A professional summary is typically three to four sentences long and showcases your experience, skills, and achievements. It’s best for those with some experience in the field, as it highlights your professional identity and the value you bring to a job. In banking, this could mean emphasizing your track record in customer service or financial analysis.

On the other hand, a resume objective is more about stating career goals. It’s ideal for entry-level applicants, career changers, or those with employment gaps. Unlike summaries that focus on past accomplishments, objectives are about what you aim to contribute to the job.

Next, we’ll provide examples of both summaries and objectives tailored for various industries and levels of experience to help guide you in crafting your own. See our library of resume examples for additional inspiration.

Banking resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in Finance from Temple University and a minor in economics. Completed internships at ABC Bank, gaining foundational skills in customer service, transaction processing, and financial analysis. Certified in Bloomberg Market Concepts (BMC) and proficient in Microsoft Excel and financial modeling. Eager to contribute to a dynamic team and grow within the banking industry.

Mid-career

Results-driven banking professional with over seven years of experience in retail banking and customer relationship management. Demonstrated expertise in managing client portfolios, cross-selling financial products, and leading branch operations. Recognized for exceeding sales targets by 20% annually and receiving the Employee of the Year award at DEF Bank. Adept at using CRM software to improve customer engagement.

Experienced

Seasoned banking executive with more than 15 years of experience in corporate banking, risk management, and strategic planning. Proven track record of leading teams to achieve significant growth, reducing non-performing assets by 30%, and driving profitability through innovative financial solutions. Holds an MBA from UVW Business School and certifications in Chartered Financial Analyst (CFA) Level II. Committed to fostering strong client relationships and navigating complex regulatory environments.

Banking resume objective examples

Recent graduate

Detail-oriented recent finance graduate with a strong academic background seeking an entry-level banking position to use analytical skills and financial knowledge. Eager to contribute to a dynamic banking team while gaining hands-on experience in financial services and customer relations.

Career changer

Dedicated professional transitioning into the banking sector, bringing extensive experience in customer service and management. Aiming to leverage transferable skills to support banking operations, improve client satisfaction, and grow within a reputable financial institution.

Entry-level applicant

Ambitious individual with foundational knowledge in finance and economics seeking an entry-level role in banking. Committed to delivering excellent customer service, learning about bank products, and supporting daily operations while contributing positively to the bank’s success.

Want your banker resume to stand out? Use our AI Resume Builder to easily highlight your skills and make sure your resume looks professional.

Match your resume to the job description

Tailoring your resume to specific job descriptions is important because it helps you stand out to employers and pass through applicant tracking systems (ATS). These systems filter resumes by scanning for keywords and phrases from the job postings. If your resume matches the job description, it’s more likely to get noticed by hiring managers.

An ATS-friendly resume includes keywords that match the skills and experiences mentioned in the job listing. By aligning your resume with these terms, you boost your chances of getting seen by human eyes. This makes it easier for hiring managers to see how well-suited you are for the banking position.

To find keywords in a job posting, look for repeated skills, qualifications, and duties. For example, if a banking job mentions “customer service,” “financial analysis,” or “account management” often, make sure these words appear in your resume too.

Incorporate these terms naturally into your resume content. Instead of just listing duties, rephrase them using target keywords. For instance, change “Handled customer transactions” to “Managed customer transactions efficiently to improve service quality.”

Targeted resumes not only help with ATS but also show employers you’re serious about the role. By focusing on key details from each description and customizing your resume, you’ll create a strong impression and improve your chances of landing an interview in banking.

You can use our ATS Resume Checker to scan your resume for potential issues and receive on-the-spot feedback to improve your resume score.

FAQ

Do I need to include a cover letter with my banking resume?

Yes, including a cover letter with your banking resume can strengthen your application and show a genuine interest in the role.

A cover letter lets you highlight specific skills, such as financial analysis or customer relationship management, while explaining how they fit with the bank’s needs and goals.

For example, if the institution emphasizes community involvement or innovation in financial services, you can showcase relevant achievements that connect to those priorities.

You can use tools like our Cover Letter Generator to craft a tailored cover letter or write one manually by addressing key job requirements and sharing your unique value.

Checking out cover letter examples can also give you ideas for effectively structuring and presenting your qualifications clearly and compellingly.

How long should a banking resume be?

For a banking role, aim for a one-page resume to succinctly present your key skills like financial analysis, regulatory knowledge, and customer service. Highlight your most relevant experience and achievements in areas such as risk management or investment strategies.

If you have extensive experience or specialized certifications in banking, expanding to a two-page resume is acceptable. Just ensure that every detail is directly related to the job you’re applying for and adds value, focusing on recent roles and accomplishments.

For more detailed guidance, explore resources on how long a resume should be tailored to your career stage and industry.

How do you write a banking resume with no experience?

If you have no experience in banking, focus on highlighting your education, transferable skills, and relevant coursework or activities. Here are a few tips on writing a resume with no experience:

- Emphasize education: Start with your degree, including the institution name, graduation date, and any relevant courses like finance, economics, or business management.

- Showcase transferable skills: List skills such as customer service, communication, problem-solving, and attention to detail. These can come from part-time jobs or volunteer work.

- Include internships or volunteer work: If you’ve had any internships or volunteer roles that involved financial tasks or customer interaction, describe those experiences and the responsibilities you handled.

- Highlight software skill: Mention any familiarity with financial software or tools like Excel, QuickBooks, or other banking-related programs.

- Add a strong objective statement: Craft a brief statement at the top of your resume explaining your career goals in banking and why you’re passionate about entering this field.

By focusing on these areas, you’ll be able to create a compelling banking resume that highlights your potential and readiness for the role.

Rate this article

Banking

Share this page

Additional Resources

Banking Attorney Resume Examples & Templates

Explore banking attorney resume examples and learn how to showcase your negotiation power, understanding of banking regulations, and ability to handle complex cases while protecting clients’ interests.Build my resumeImport existing

Corporate Banking Resume Examples & Templates

Explore corporate banking resume examples and tips to learn how to highlight your finance skills and experience managing client relationships and handling complex financial transactions.Build my resumeImport existing resumeCustomize this

The Illusion of Wage Growth: Where Paychecks Stretch the Farthest

U.S. wages have climbed at one of the fastest rates in modern history. Between 2020 and 2024, the average American worker’s pay rose from about $64,000 to $75,600, an 18%

100+ Resume Objective Statement Examples & Best Practices

In just a sentence or two, a resume objective statement tells hiring managers the role or career path you’re aiming for and the unique skills and value you bring to

150+ Skills for a Resume: Examples for Any Job

Crafting a standout resume starts with highlighting the skills and qualifications that demonstrate your fit for the role. But in a crowded job market, knowing which abilities will actually catch

When to Use a Two Page Resume (With Examples & Formatting Tips)

If you’ve spent years building your skills, growing in your career, and racking up accomplishments, a one-page resume might not cut it. A two-page resume gives you space to present a