Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Measurable accomplishments, like a 15% increase in customer satisfaction, highlight the applicant’s tangible impact and value.

- Uses action-oriented language: Strong action verbs like “processed” and “resolved” convey active engagement and effectiveness in responsibilities, illustrating the applicant’s initiative through dynamic language.

- Illustrates problem-solving ability: Solving over 200 monthly inquiries efficiently reflects the applicant’s proactive problem-solving skills, showcasing their ability to tackle challenges creatively.

More Bank Teller Resume Examples

Browse more bank teller resume examples to discover how to highlight customer service skills, cash handling experience, and attention to detail. These banking resume samples will help you craft a resume that impresses employers in the banking industry.

Entry-Level Bank Teller

Why this resume works

- Effective use of keywords: By strategically incorporating role-relevant keywords like “cash handling” and “customer service,” the applicant ensures their resume stands out to hiring managers in their field.

- Centers on academic background: The education section emphasizes significant academic achievements such as a master’s degree in business administration, which is important for someone early in their career.

- Shows digital literacy: Including technical skills like data entry accuracy highlights the applicant’s computer skills and digital readiness, aligning well with modern workplace demands.

Mid-Level Bank Teller

Why this resume works

- Points to measurable outcomes: Through achievements like reducing customer wait time by 30% and improving satisfaction scores, the applicant clearly emphasizes their ability to drive impactful results in their roles.

- Demonstrates language abilities: Language skills in Spanish, French, and German support cross-cultural communication and improve workplace interactions.

- Includes a mix of soft and hard skills: Balancing technical skills like cash handling with strong interpersonal skills, such as team collaboration, showcases a well-rounded professional profile.

Experienced Bank Teller

Why this resume works

- Showcases impressive accomplishments: Implementing software that cut transaction times by 20% and training new employees showcase senior-level performance and significant impact on business efficiency.

- Focuses on work history: Using a chronological resume format, the applicant’s extensive career experience in banking is effectively highlighted through detailed job roles over the years.

- Lists relevant certifications: Listing certifications like Certified Bank Teller and Customer Service Excellence reinforces the applicant’s expertise and dedication to continuous learning.

Bank Teller Resume Template (Text Version)

Allison Cruz

Austin, TX 78703

(555)555-5555

Allison.Cruz@example.com

Skills

- Customer Service

- Cash Handling

- Detail-Oriented

- Interpersonal Skills

- Problem Solving

- Time Management

- Financial Transactions

- Team Leadership

Languages

- Spanish – Beginner (A1)

- French – Beginner (A1)

- German – Beginner (A1)

Professional Summary

Finance professional with proven banking expertise. Skilled in customer service and transaction management. Recognized for enhancing efficiency and satisfaction.

Work History

Bank Teller

Capital Savings Bank – Austin, TX

February 2024 – June 2025

- Processed 100+ daily transactions efficiently

- Increased customer satisfaction by 15%

- Managed ,000 daily cash flow

Customer Service Associate

Commerce Financial Services – Pinehill, TX

January 2023 – January 2024

- Resolved 200+ monthly inquiries promptly

- Boosted membership enrollment by 20%

- Assisted in balancing monthly accounts

Cashier Supervisor

Fairview Retail Solutions – Houston, TX

February 2021 – December 2022

- Supervised team of 5 cashiers effectively

- Reduced checkout time by 25%

- Handled ,000 in daily transactions

Certifications

- Certified Bank Teller – American Banking Association

- Customer Service Excellence – National Customer Service Association

Education

Master of Business Administration Finance

University of Chicago Chicago, Illinois

June 2020

Bachelor of Science Economics

Illinois State University Normal, Illinois

June 2018

Related Resume Guides

Advice for Writing Your Bank Teller Resume

Explore our advice on how to write a resume tailored for a bank teller position. Discover how to highlight your customer service skills, attention to detail, and cash handling experience effectively.

Highlight your most relevant skills

Listing relevant skills when applying for a job is important because it helps show you are a good fit for the role. Creating a dedicated skills section on your resume lets you highlight abilities like cash handling, customer service, and attention to detail.

It’s also important to include interpersonal skills like communication and problem-solving. This balance of technical and soft skills can make your resume stand out.

To make an even stronger impact, integrate key skills into your work experience section. For example, if you mention managing daily transactions in your job history, also note how your accuracy and efficiency helped reduce errors.

This approach not only showcases your abilities but also provides real-world examples of how you’ve used them effectively in past roles. By doing this, you present a well-rounded view of your qualifications as a bank teller.

When applying for a bank teller position, select a resume format that highlights your customer service experience, cash handling skills, and attention to detail prominently.

Showcase your accomplishments

When organizing your work experience as a bank teller, list your jobs in reverse chronological order. This means you start with your most recent job and work backwards. For each job entry, include your job title, the name of the employer, the location, and the dates you worked there. This helps employers quickly see where you’ve worked and what roles you’ve held over time.

To make your resume stand out, focus on quantifying your accomplishments rather than just listing responsibilities. Turning duties into achievements can be done by showcasing measurable results like percentages or improvements in efficiency.

For example, instead of saying “handled customer transactions,” you could say “processed an average of 100 transactions daily with 99% accuracy.” Using action words like “achieved,” “improved,” or “increased” helps to highlight these accomplishments.

Quantified achievements help hiring managers easily understand your impact and skills as a bank teller. They want to see how you contributed to the success of past workplaces. By focusing on numbers and specific outcomes, you paint a clear picture of what you can bring to their team.

5 bank teller work history bullet points

- Processed an average of 200+ daily transactions, achieving a 98% accuracy rate and improving customer satisfaction scores by 15%.

- Assisted with the onboarding of new customers, opening over 50 accounts per month, and contributing to a 10% increase in branch growth.

- Managed cash drawer with $20,000 daily balance, consistently balancing within a $2 variance at end-of-day audits.

- Promoted bank products to clients, resulting in a 25% increase in sales of savings accounts and credit cards.

- Resolved customer inquiries efficiently, reducing complaint resolution time by 40% through improved communication strategies.

Select a straightforward resume template for easy reading. Use clear headings with basic fonts and limit colors or elaborate designs to highlight your skills and experience.

Write a strong professional summary

A professional summary on a resume serves as an introduction to hiring managers, presenting a snapshot of your career. You can decide between using a professional summary or a resume objective for this purpose, depending on your experience level.

A professional summary is usually three to four sentences long and highlights your experience, skills, and achievements. It’s best suited for experienced applicants who want to showcase their professional identity and the value they bring.

On the other hand, resume objectives are statements of your career goals. They’re ideal for entry-level job seekers, those changing careers, or individuals with employment gaps. Unlike summaries that focus on past successes (“what I’ve accomplished”), objectives emphasize future contributions (“what I aim to contribute”).

Next, we’ll provide examples of both summaries and objectives tailored for various industries and experience levels to help you craft an effective introduction as a bank teller or any other role. Explore our library of resume examples for additional inspiration.

Bank teller resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in Finance from XYZ University and completed an internship at ABC Bank. Knowledgeable in basic banking operations, customer service, and cash handling. Skilled in Microsoft Office Suite and eager to apply academic knowledge to support daily branch activities and improve customer experiences.

Mid-career

Experienced bank teller with over five years in retail banking environments, focusing on delivering exceptional customer service and efficient transaction processing. Proven track record of balancing high volumes of cash transactions while ensuring compliance with bank policies. Recognized for resolving customer inquiries promptly and maintaining long-term client relationships.

Experienced

Seasoned bank teller with over 10 years of experience in managing large-scale transactions and leading teller teams in high-traffic branches. Expertise in fraud detection, financial product promotion, and training new staff members to uphold service standards. Demonstrated ability to drive branch sales initiatives and contribute to operational improvements through strategic planning.

Bank teller resume objective examples

Entry-level

Detail-oriented and ambitious recent finance graduate seeking an entry-level bank teller position to use strong mathematical skills and customer service experience. Eager to contribute to a team-focused environment while providing exceptional service to clients and assisting with daily banking operations.

Career changer

Customer service specialist with five years of experience transitioning into the banking sector as a bank teller. Looking to leverage excellent communication and problem-solving abilities in a financial setting to improve customer satisfaction and support branch goals.

Recent high school graduate

Energetic high school graduate aiming for a bank teller role to apply strong organizational skills and enthusiasm for learning about financial services. Committed to delivering friendly, efficient service and contributing positively to the branch’s success.

Create a standout resume fast! Our AI Resume Builder helps you highlight your skills as a bank teller and makes sure your resume looks professional.

Match your resume to the job description

Tailoring your resume to job descriptions is key to standing out. Employers often use applicant tracking systems (ATS) that scan resumes for specific keywords and phrases found in job postings. By customizing your resume, you increase your chances of getting noticed by the ATS and, ultimately, the employer.

An ATS-friendly resume uses keywords from the job description that match your skills. This can make it easier for hiring managers to see how well you fit the role. It’s about making sure your past experiences align with what the employer is looking for.

To find these keywords, carefully read the job posting. Look for skills or duties mentioned more than once, such as “customer service,” “cash handling,” or “team collaboration.” Using exact phrases from the job description shows you’re a good match for the position.

Incorporate these keywords naturally into your resume. For example, change “Handled money efficiently” to “Managed cash handling operations accurately.” This way, you’re still being truthful but also aligning with what employers are seeking.

The benefits of targeted resumes include passing through ATS filters and catching hiring managers’ attention more effectively. By using relevant terms, you improve your chances of landing an interview and moving closer to securing a bank teller position.

With our ATS Resume Checker, you can spot over 30 common resume issues in layout and wording. Quickly learn how to boost your resume score with helpful tips.

FAQ

Do I need to include a cover letter with my bank teller resume?

Yes, adding a cover letter to your bank teller resume can leave a strong impression on potential employers. A cover letter lets you show your enthusiasm for the bank and explain why you’re drawn to working there.

You can also spotlight key skills like customer service and cash handling that are essential for a bank teller role, making your application stand out.

If the bank is involved in community projects or offers financial products that interest you, mention how these match with your experience or goals.

Consider using resources like our Cover Letter Generator to craft a personalized cover letter, and check out cover letter examples online to help tailor yours effectively for the banking industry.

How long should a bank teller’s resume be?

A bank teller’s resume should ideally be a one-page resume. This length is perfect for emphasizing key skills like customer service, cash handling, and familiarity with banking software. Focus on showcasing experiences that demonstrate your ability to manage transactions accurately and support clients effectively.

If you have extensive experience or specialized certifications in the financial sector, a two-page resume might be suitable. Just ensure every detail is relevant, highlighting your efficiency in banking operations and recent roles that make you stand out.

For more guidance on resume lengths tailored to different career stages, explore our guide on how long a resume should be.

How do you write a bank teller resume with no experience?

To craft a resume with no experience for a bank teller position, emphasize the skills you’ve developed, your educational background, and any activities that show you’re ready for the job. Here are some tips to guide you:

- Emphasize transferable skills: Highlight skills like customer service, cash handling, attention to detail, and communication. These are important for a bank teller role and can be gained from retail jobs, volunteering, or school projects.

- Detail your education: Include any relevant coursework in finance, business, or mathematics that aligns with the bank teller position. Mention honors or awards if applicable.

- Include volunteer work or internships: If you’ve volunteered at events handling money or interned at financial institutions, list these experiences to show practical application of your skills.

- Showcase achievements: If you’ve been recognized for reliability or accuracy in past roles (even non-financial), mention these accomplishments as they reflect qualities important to being a bank teller.

Consider looking into additional resources on crafting resumes without experience for more examples and tailored advice.

Rate this article

Bank Teller

Share this page

Additional Resources

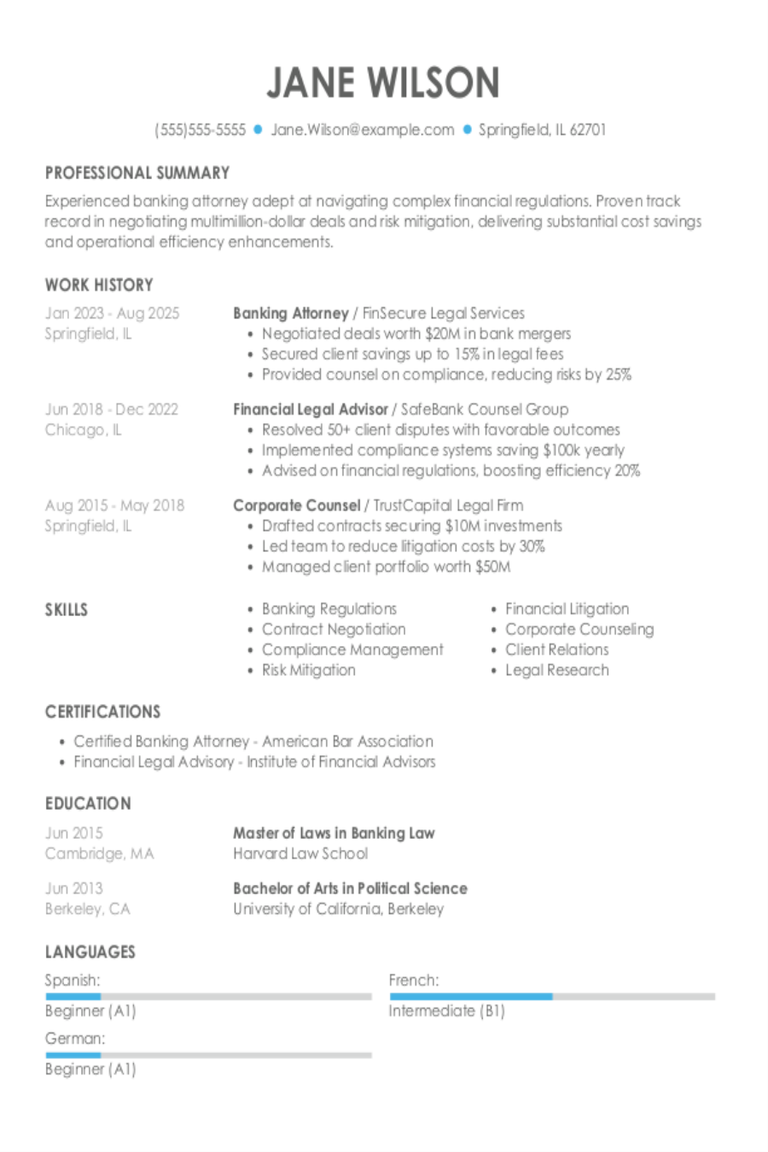

Banking Attorney Resume Examples & Templates

Explore banking attorney resume examples and learn how to showcase your negotiation power, understanding of banking regulations, and ability to handle complex cases while protecting clients’ interests.Build my resumeImport existing

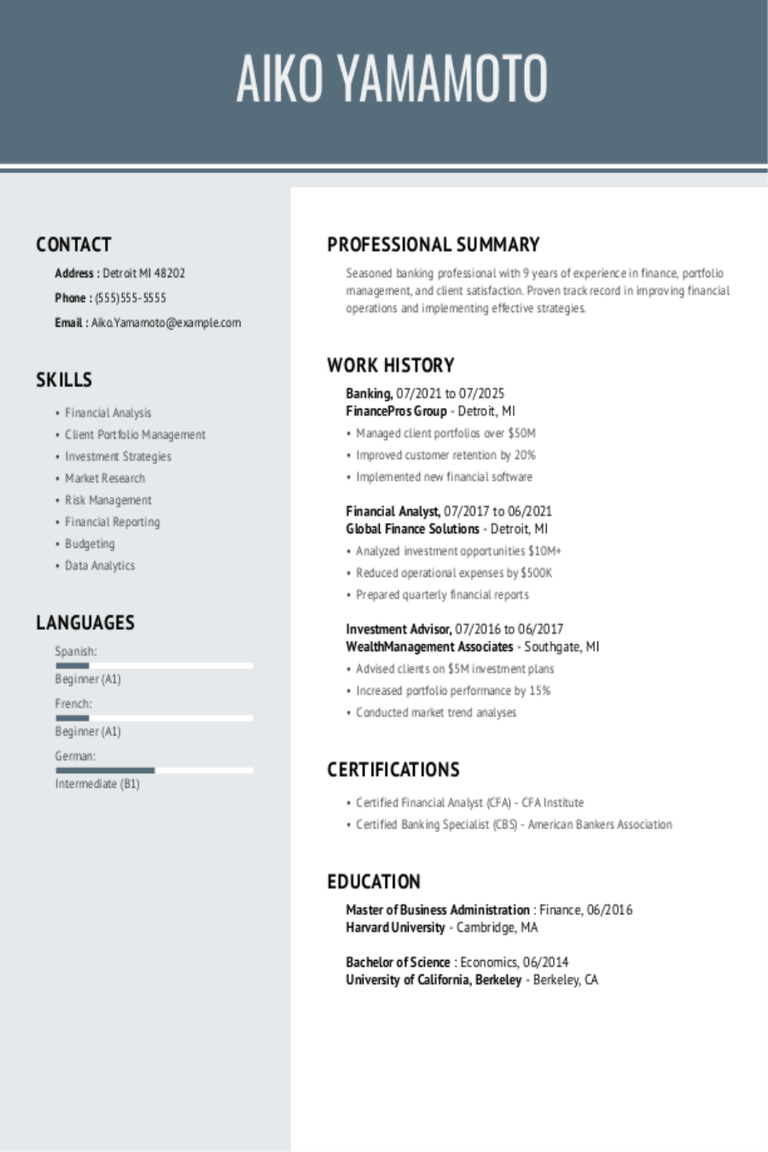

Banking Resume Examples & Templates

Explore banking resume examples to see how to highlight tasks like handling transactions, guiding customers on products, and keeping records accurate. Learn to showcase your money management skills and experience

Personal Banker Resume Examples & Templates

Find personal banker resume examples and tips to help you highlight your banking background and attract potential employers.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies accomplishments: By pulling metrics

Investment Banker Resume Examples & Templates

Explore investment banker resume examples and learn how to show you handle financial deals, analyze market trends, and work with clients.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

Bank Branch Manager Resume Examples & Templates

Discover bank branch manager resume examples and tips to help you highlight your experience in managing teams, boosting sales, and improving branch operations.Build my resumeImport existing resumeCustomize this templateWhy this

Corporate Banking Resume Examples & Templates

Explore corporate banking resume examples and tips to learn how to highlight your finance skills and experience managing client relationships and handling complex financial transactions.Build my resumeImport existing resumeCustomize this