Table of Contents

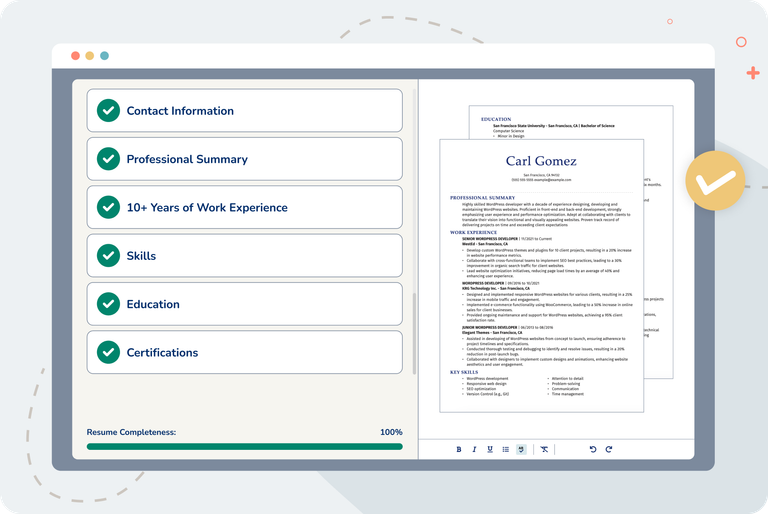

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Measurable accomplishments, such as reducing fraud risk by 30% and transaction anomalies by 15%, showcase the applicant’s measurable impact in financial security.

- Showcases career progression: Starting as a compliance officer and advancing to an AML specialist, the applicant’s career trajectory illustrates steady growth in responsibility and expertise.

- Illustrates problem-solving ability: By mitigating fraud risk through detailed audits and improving detection algorithms, the applicant’s problem-solving skills shine, showcasing their ability to implement effective solutions.

More Banking Resume Examples

Explore more banking resume examples that emphasize analytical skills, attention to detail, and experience in financial compliance. Use these samples to create a resume that showcases your strengths in anti-money laundering roles.

Compliance Officer

Why this resume works

- Effective use of keywords: Strategic inclusion of keywords like “regulatory compliance” and “risk management” helps the applicant’s resume stand out to hiring managers.

- Centers on academic background: Highlighting degrees from Harvard and UC Berkeley shows a strong academic foundation, important for early-career growth.

- Shows digital literacy: Mastery of audit procedures and data analysis reflects essential computer skills, showcasing readiness for tech-driven environments.

Fraud Analyst

Why this resume works

- Points to measurable outcomes: Reducing fraud incidents by 25% in one year showcases the applicant’s effective strategies and impactful contributions to organizational security.

- Demonstrates language abilities: Language skills in Spanish, French, and German improve cross-cultural communication, essential for global interactions.

- Clear contact information: A well-structured resume header ensures employers can effortlessly reach out, boosting chances of interview invitations.

Teller

Why this resume works

- Lists relevant certifications: By including certifications like the Certified Bank Teller, the applicant shows a commitment to expertise and ongoing learning, reinforcing their qualifications.

- Focuses on work history: The applicant uses a chronological resume format, effectively showcasing extensive experience in various banking roles from teller to customer service specialist.

- Emphasizes leadership skills: Demonstrating leadership skills, the applicant led team training initiatives that improved performance metrics by 10%, highlighting their ability to guide and motivate others.

AML Resume Template (Text Version)

John Johnson

Jacksonville, FL 32206

(555)555-5555

John.Johnson@example.com

Professional Summary

Experienced AML Specialist with five years of expertise in risk assessment and compliance management, leveraging advanced analytics to enhance financial security and operational efficiency.

Skills

- AML Strategy

- Risk Assessment

- Compliance Management

- Data Analysis

- Regulatory Adherence

- Team Leadership

- Policy Development

- Fraud Prevention

Certifications

- Certified Anti-Money Laundering Specialist (CAMS) – ACAMS

- Risk Management Certificate – Risk Management Association

Education

Master of Financial Management Finance

Columbia University New York, NY

May 2020

Bachelor of Economics Economics

Boston University Boston, MA

May 2018

Work History

AML Specialist

Financial Integrity Advisors – Jacksonville, FL

June 2022 – June 2025

- Mitigated fraud risk by 30% through detailed audits.

- Implemented AML policies improving compliance score.

- Trained team members on AML best practices.

Risk Management Analyst

SecureBank Group – Tampa, FL

January 2021 – May 2022

- Reduced transaction anomalies by 15%.

- Enhanced risk algorithms boosting detection rate.

- Developed strategic responses for potential threats.

Compliance Officer

Integrity Financial Solutions – Riverview, FL

June 2020 – December 2020

- Audited accounts reducing discrepancies by 20%.

- Standardized compliance checks enhancing workflow.

- Collaborated with regulatory bodies for policy updates.

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- Mandarin – Beginner (A1)

Related Resume Guides

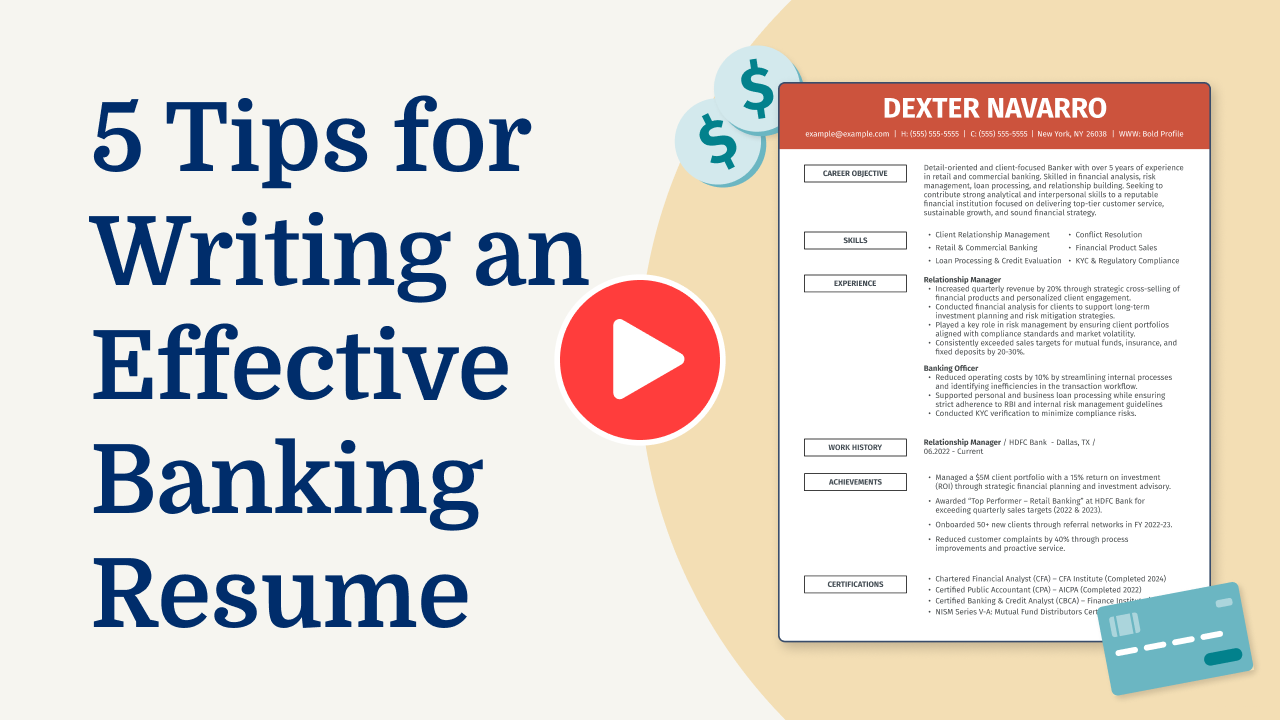

Advice for Writing Your AML Analyst Resume

Explore our tips on how to write a resume tailored for AML analyst roles and discover how to best present your expertise in combating financial crime.

Highlight your most relevant skills

Listing relevant skills when applying for an AML analyst job is important because it helps show how well you fit the role. Employers look for both technical and interpersonal skills to see if you can handle complex tasks while working well with others.

By clearly highlighting your skills, you can quickly catch the attention of hiring managers. It’s a good idea to create a dedicated skills section on your resume that includes a balanced mix of hard skills, like knowledge of regulatory requirements, and soft skills, such as communication and teamwork.

To make your resume stand out even more, try integrating key skills into your work experience section. This shows how you’ve used these abilities in real-life situations. For example, mention a time when your analytical thinking helped identify suspicious transactions or describe how your attention to detail ensured compliance with regulations.

This approach not only highlights your skills but also provides concrete examples of them in action, making your application stronger and more memorable to employers looking for AML professionals.

Select a resume format that highlights your expertise in hiring, policy creation, and HRIS tools.

Showcase your accomplishments

When organizing your work experience as an AML specialist, list jobs in reverse chronological order. Start with your most recent position and work backward. Each job entry should clearly show your job title, the employer’s name, the location, and the dates you worked there. This helps employers quickly see your career path and how you’ve progressed over time.

Instead of just listing tasks you performed, focus on what you achieved. Quantifying accomplishments makes your resume stand out. For example, rather than saying “reviewed transactions,” say something like “analyzed 500+ transactions monthly to identify suspicious activity, reducing false positives by 20%.”

Use numbers to highlight results, such as percentages or time saved. Action words like “improved,” “increased,” or “decreased” can turn duties into achievements that catch a hiring manager’s eye.

By showcasing measurable results in your AML analyst roles, you help potential employers understand your impact and skills quickly. Hiring managers appreciate seeing clear evidence of how you’ve made a difference in previous roles. This approach not only highlights what you can do but also demonstrates how well you’ve done it in past positions.

5 AML analyst work history bullet points

- Conducted thorough investigations into suspicious financial activities, leading to a 40% increase in fraud detection.

- Streamlined the transaction monitoring process, reducing review time by 25% and improving compliance efficiency.

- Developed and implemented new AML policies that improved regulatory adherence, passing audits with zero findings.

- Trained a team of 10 analysts on updated AML procedures, increasing overall team productivity by 15%.

- Collaborated with cross-functional teams to improve data analytics capabilities, resulting in a 30% improvement in risk assessment accuracy.

Choose a resume template that’s simple and tidy. Opt for clear headings and readable fonts, avoiding fancy designs to make your skills and experience stand out.

Write a strong professional summary

A professional summary is a brief introduction at the top of your resume that gives hiring managers a snapshot of who you are and what you bring to the table. It’s important to choose between a summary and a resume objective, based on your experience level and career goals.

A professional summary is typically three to four sentences showing your experience, skills, and achievements. It’s best for experienced applicants who want to showcase their professional identity and value quickly. A strong summary highlights what you’ve accomplished in your career and sets the tone for the rest of your resume.

Resume objectives focus on career goals and are suited for entry-level candidates, career changers, or those with employment gaps. Unlike summaries that focus on past accomplishments, objectives emphasize what you aim to contribute in an aml position.

Next, we’ll provide examples of both summaries and objectives tailored to various industries and experience levels to guide you in crafting effective opening statements for your resume. Explore our full library of resume examples for additional inspiration.

AML analyst resume summary examples

Entry-level

Recent graduate with a bachelor’s degree in finance and a focus on anti-money laundering (AML) compliance. Completed internships in financial institutions, gaining exposure to transaction monitoring, customer due diligence, and regulatory reporting. Certified in AML fundamentals through ACAMS and eager to contribute analytical skills to support compliance initiatives.

Mid-career

AML analyst with 6+ years of experience in banking and financial services, specializing in detecting suspicious activities and ensuring adherence to regulatory standards. Skilled in SAR preparation, improved due diligence reviews, and leveraging AML software tools to mitigate risks. An ACAMS-certified professional known for thorough investigations and maintaining strong relationships with regulatory bodies.

Experienced

Seasoned AML compliance officer with over a decade of experience leading teams and developing risk management frameworks across global financial institutions. Expertise includes designing enterprise-wide AML programs, managing high-profile investigations, and implementing advanced analytics for fraud detection. Recognized for driving organizational compliance strategies that meet evolving regulatory requirements while fostering a culture of integrity.

AML analyst resume objective examples

Recent graduate

Driven and detail-oriented recent graduate with a bachelor’s degree in finance aiming to secure an entry-level position in anti-money laundering. Eager to apply academic knowledge of financial regulations and risk assessment techniques to contribute to safeguarding organizations against money laundering activities.

Career changer

Motivated professional transitioning from retail banking into the field of anti-money laundering, equipped with strong analytical skills and customer service experience. Seeking an opportunity to leverage transferable skills in data analysis and regulatory compliance to protect institutions from illicit financial activities.

Specialized training

Aspiring AML analyst with completed certification courses in AML and fraud prevention, eager to join a forward-thinking financial institution. Passionate about using specialized training to identify suspicious activity and support efforts in maintaining robust compliance frameworks.

Using our Resume Builder makes it easy to create a professional resume quickly with templates and tips, so you can focus on getting that job!

Match your resume to the job description

Tailoring your resume to the job description is important for standing out to employers and passing through applicant tracking systems (ATS). Many companies use ATS to filter resumes, looking specifically for keywords and phrases that match the job posting. By following strategies to customize your resume, you increase your chances of getting noticed by both the software and hiring managers.

An ATS-friendly resume includes keywords from the job description that align with your skills and experiences. When you include these terms, it makes it easier for the system to recognize that you’re a fit for the role. This increases the likelihood of moving forward in the hiring process.

To identify keywords in job postings, pay attention to skills, qualifications, and duties mentioned often. For example, if applying for an AML role, look for phrases like “compliance monitoring,” “risk assessment,” or “financial crimes investigation.”

Incorporate keywords naturally into your resume by weaving them into descriptions of past roles. For instance, instead of saying “Worked on compliance tasks,” write “Conducted compliance monitoring as part of risk assessment efforts.” This way, you maintain clarity while including necessary terms.

Targeted resumes not only improve ATS compatibility but also show employers you’ve done your homework. They demonstrate your understanding of what’s needed for the role and highlight how you’re prepared to meet those needs effectively.

Get noticed by recruiters! The ATS Resume Checker reviews your resume and gives quick tips to improve it for applicant tracking systems.

FAQ

Do I need to include a cover letter with my AML analyst resume?

Yes, including a cover letter with your AML analyst resume can give you an edge by showcasing your attention to detail and genuine interest in the role.

A cover letter allows you to highlight specific AML accomplishments, like successful investigations or regulatory compliance projects, that align with the job requirements.

For instance, if the company specializes in cryptocurrency or fintech compliance, you can emphasize your experience managing AML risks in similar industries. You can use tools like our Cover Letter Generator to draft a professional cover letter tailored to AML analyst roles, focusing on how your skills meet their needs.

Finally, reviewing cover letter examples of AML-specific cover letters can help ensure yours is targeted and impactful while setting you apart from other applicants.

How long should an AML analyst’s resume be?

For an AML role, aim for a one-page resume to efficiently highlight your expertise in risk management, regulatory compliance, and financial investigations.

This length is usually sufficient to demonstrate key skills like knowledge of AML laws and skill in monitoring financial transactions.

If you have extensive experience or specialized qualifications, consider extending it to a two-page resume. Ensure every detail is relevant and adds value, such as successful case studies or certifications that showcase your ability to identify suspicious activities effectively.

Explore our guide on how long a resume should be for examples and tips on tailoring the ideal length for your career stage.

How do you write an AML analyst resume with no experience?

If you don’t have direct experience in AML, emphasize your skills, education, and any related experiences that match an AML analyst’s duties. Here are a few tips to help you get started:

- Emphasize your education: Start by listing your degree in fields like finance, business, or law. Highlight any coursework related to financial regulations or compliance.

- Showcase relevant skills: Detail skills such as analytical thinking, attention to detail, research abilities, and familiarity with regulatory frameworks. These are important for an AML role.

- Include certifications: If you’ve completed any certifications like CAMS (Certified Anti-Money Laundering Specialist), make sure they stand out on your resume.

- Leverage transferable experience: Use internships, volunteer work, or projects where you analyzed data or ensured compliance with rules and regulations as examples of related experience.

- Highlight technical skill: Mention any software tools you’re familiar with that are used in data analysis or compliance tasks.

Explore resources on entry-level resumes to find more tips tailored for those starting in the AML field. Check out how to craft a resume with no experience for additional tips and examples.

Rate this article

AML Analyst

Share this page

Additional Resources

The Illusion of Wage Growth: Where Paychecks Stretch the Farthest

U.S. wages have climbed at one of the fastest rates in modern history. Between 2020 and 2024, the average American worker’s pay rose from about $64,000 to $75,600, an 18%

100+ Resume Objective Statement Examples & Best Practices

In just a sentence or two, a resume objective statement tells hiring managers the role or career path you’re aiming for and the unique skills and value you bring to

150+ Skills for a Resume: Examples for Any Job

Crafting a standout resume starts with highlighting the skills and qualifications that demonstrate your fit for the role. But in a crowded job market, knowing which abilities will actually catch

When to Use a Two Page Resume (With Examples & Formatting Tips)

If you’ve spent years building your skills, growing in your career, and racking up accomplishments, a one-page resume might not cut it. A two-page resume gives you space to present a

How to Make an ATS Friendly Resume (Templates & Guide)

In today’s fast-paced hiring climate, many employers use applicant tracking systems (ATS) to organize, store, and screen candidate information. Optimizing your resume for ATS is essential for ensuring your application passes

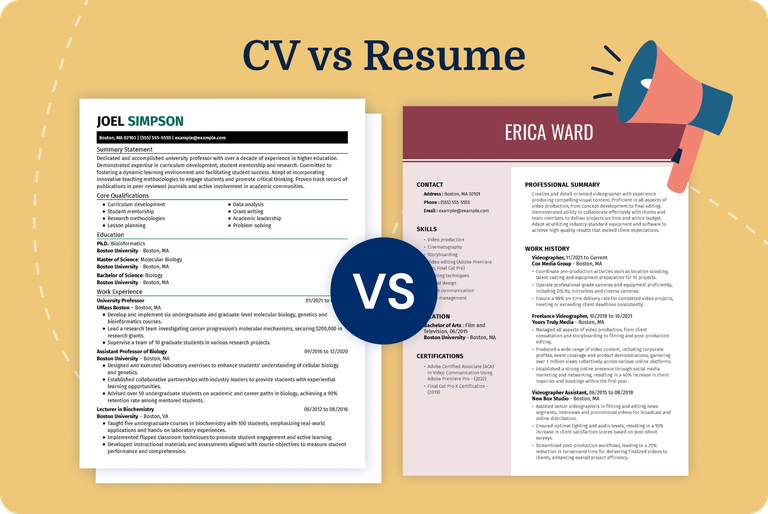

CV vs Resume: What’s The Difference?

Confused about the difference between a resume and a CV? You’re not alone! While both documents help you land a job, they vary in content, structure, and formatting. In this guide, we’ll