Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: By detailing metrics like assessing loans over $500K monthly and improving approval rates by 15%, the applicant’s resume accomplishments reflect a significant impact on financial outcomes.

- Highlights industry-specific skills: With skills in loan evaluation, risk assessment, and credit scoring, the applicant illustrates their fit for roles demanding industry-specific expertise in finance and underwriting.

- Uses action-oriented language: Using action verbs such as “assessed,” “improved,” and “reduced” effectively conveys initiative and effectiveness.

More Mortgage Underwriter Resume Examples

Our mortgage underwriter resume examples provide insights into showcasing your risk assessment, financial analysis, and decision-making skills. Use these banking resume samples to build a strong resume that emphasizes your industry expertise and relevant experience.

Entry-Level Mortgage Underwriter

Why this resume works

- Effective use of keywords: Strategic keyword placement, like “mortgage underwriter” and “financial risk manager,” boosts visibility with applicant tracking systems (ATS).

- Centers on academic background: The education section showcases advanced degrees, emphasizing the applicant’s strong foundation in finance during the early stages of their career.

- Shows digital literacy: Implementing new underwriting software showcases computer skills and digital readiness for modern workplaces.

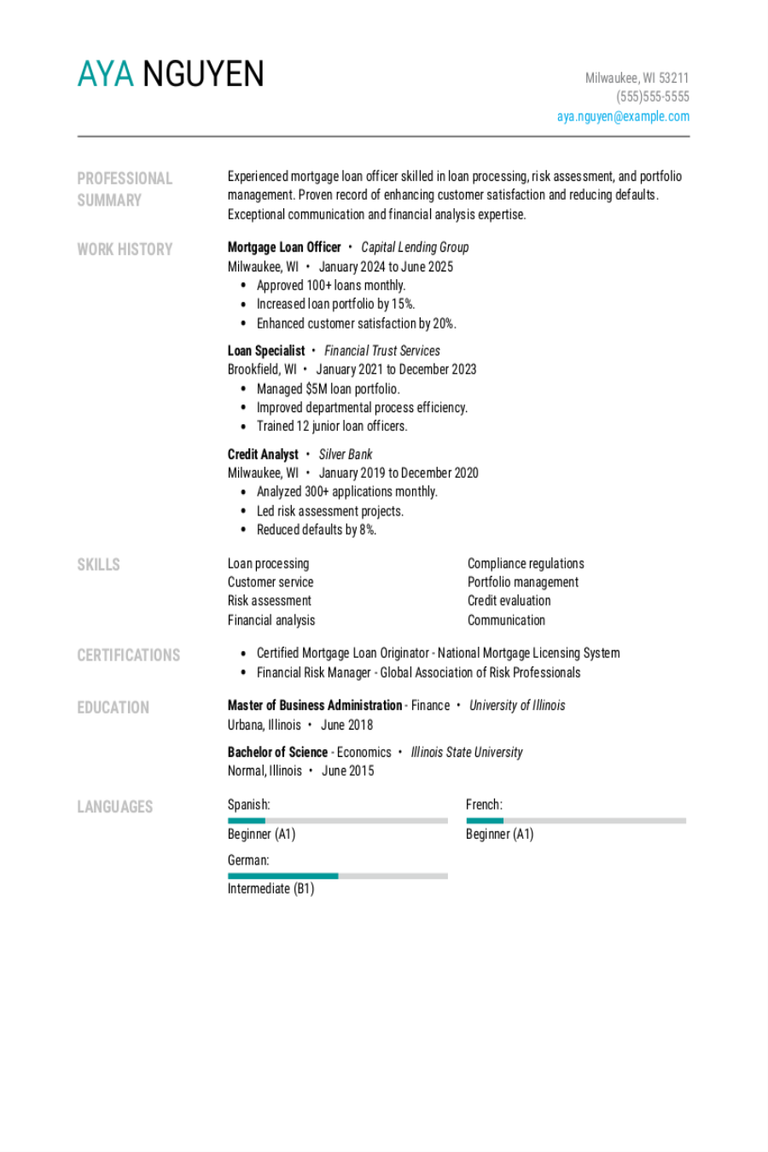

Mid-Level Mortgage Underwriter

Why this resume works

- Points to measurable outcomes: By achieving a 95% approval accuracy rate, the applicant shows their ability to deliver precise and effective mortgage underwriting results.

- Demonstrates language abilities: Language skills in Spanish and French indicate the applicant’s ability for cross-cultural communication, important in today’s global finance market.

- Displays technical expertise: Certification as a Certified Mortgage Underwriter shows the applicant’s commitment to mastering complex financial regulations and risk assessment strategies.

Experienced Mortgage Underwriter

Why this resume works

- Lists relevant certifications: By listing certifications like Certified Mortgage Underwriter, the applicant showcases their expertise and dedication to continuous learning in finance and banking.

- Showcases impressive accomplishments: Achievements such as saving $100K annually demonstrate significant business impact, emphasizing the applicant’s senior-level performance.

- Focuses on work history: Using a chronological resume format, the applicant effectively highlights diverse roles across various cities, showcasing extensive experience.

Mortgage Underwriter Resume Template (Text Version)

Olivia Williams

St. Louis, MO 63103

(555)555-5555

Olivia.Williams@example.com

Professional Summary

Seasoned mortgage underwriter with expertise in risk assessment and loan evaluation. Proven track record in increasing approval rates and improving financial processes using specialized skills and data analytics.

Work History

Mortgage Underwriter

Equity Finance Corp – St. Louis, MO

June 2023 – June 2025

- Assessed loans exceeding 0K monthly

- Improved approval rates by 15%

- Reduced default risk by 20%

Loan Analyst

Summit Lending Group – St. Louis, MO

June 2022 – May 2023

- Reviewed 100+ loans weekly

- Enhanced client satisfaction by 25%

- Achieved compliance with federal regulations

Credit Risk Assessor

Valley Credit Advisors – St. Louis, MO

June 2021 – May 2022

- Evaluated portfolio risk of M

- Implemented risk models boosting accuracy by 30%

- Analyzed credit reports for 200+ clients

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Skills

- Loan Evaluation

- Risk Assessment

- Financial Analysis

- Credit Scoring

- Compliance Management

- Client Relationship

- Data Analytics

- Report Generation

Certifications

- Certified Mortgage Underwriter – National Mortgage Licensing System

- Financial Risk Manager – Global Association of Risk Professionals

Education

Master of Business Administration Finance

University of Finance New York, NY

May 2021

Bachelor of Arts Economics

State University Albany, NY

May 2019

Related Resume Guides

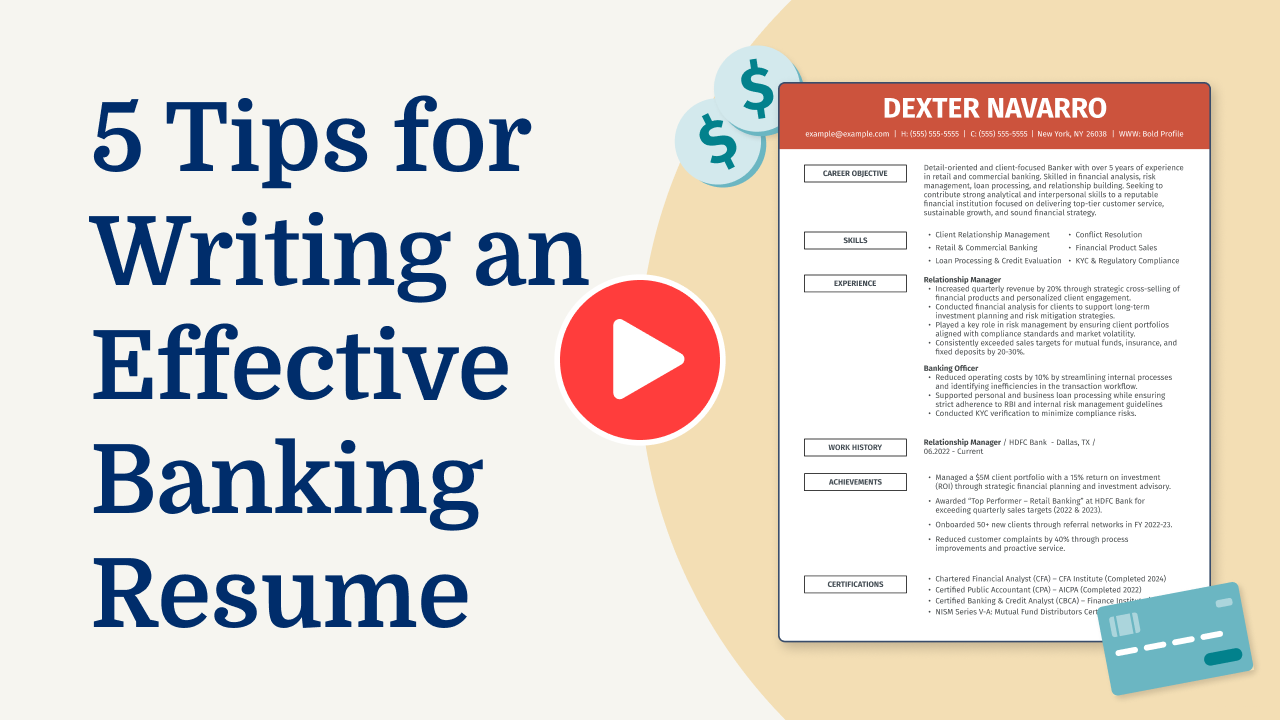

Advice for Writing Your Mortgage Underwriter Resume

Check out our advice on how to write a resume and start crafting a standout resume today. We’ll guide you on how to highlight your skills and experience to stand out in the mortgage industry.

Highlight your most relevant skills

Listing your relevant skills when applying for a mortgage underwriter job is important because it helps employers quickly see why you’re a good fit. Skills show what you can do and how well you can do it. Having a dedicated skills section ensures that the most important abilities stand out.

Balance technical skills, like financial analysis or risk assessment, with interpersonal skills, such as communication or teamwork. This shows you’re not just good at numbers but also great at working with people. Including key skills in your work experience section can make your resume even stronger. Instead of just saying what you did, explain how you used specific skills to achieve results.

For example, mention how your attention to detail helped reduce loan processing errors or how your problem-solving ability led to quicker approvals. This way, employers see real examples of how you’ve applied your skills in the past.

By carefully choosing and placing these skills on your resume, you’ll be more likely to grab the attention of hiring managers looking for a mortgage underwriter who can handle both the technical aspects of the job and work well with others in a team environment.

A resume format that highlights financial analysis, risk assessment, and compliance expertise can help mortgage underwriters stand out.

Showcase your accomplishments

When organizing your work experience as a mortgage underwriter, list it in reverse chronological order to highlight your most recent role first. Each job entry should display your job title, employer name, location, and the dates you worked there. This structured format makes it easy for hiring managers to follow your career path and see how you’ve progressed over time.

To make your resume stand out, focus on quantifying your accomplishments rather than just listing duties. For example, instead of saying “Reviewed loan applications,” you could say “Approved 200+ loan applications monthly with a 95% accuracy rate.”

Use numbers to show results such as percentages, time saved, cost reductions, or efficiency improvements. These specifics turn general responsibilities into concrete achievements that illustrate your impact.

Use action-oriented words to describe what you did and the measurable outcomes you achieved. Words like “increased,” “reduced,” or “streamlined” can effectively convey how you contributed to the success of your team or company. By showcasing quantified accomplishments, you help hiring managers quickly assess the skills and value you bring to the mortgage underwriting role.

5 mortgage underwriter work history bullet points

- Assessed mortgage applications, leading to a 25% increase in approval accuracy and streamlined processing times.

- Implemented a risk assessment framework that reduced default rates by 15% over 12 months.

- Collaborated with loan officers to expedite high-value mortgage approvals, improving turnaround time by 20%.

- Conducted detailed reviews of financial documents, ensuring compliance with federal regulations and reducing audit findings by 30%.

- Trained junior underwriters on best practices, improving team efficiency and cutting review time by half.

Pick a resume template with straightforward sections and readable fonts, keeping it clean and minimal to help employers focus on your skills and experience without distractions.

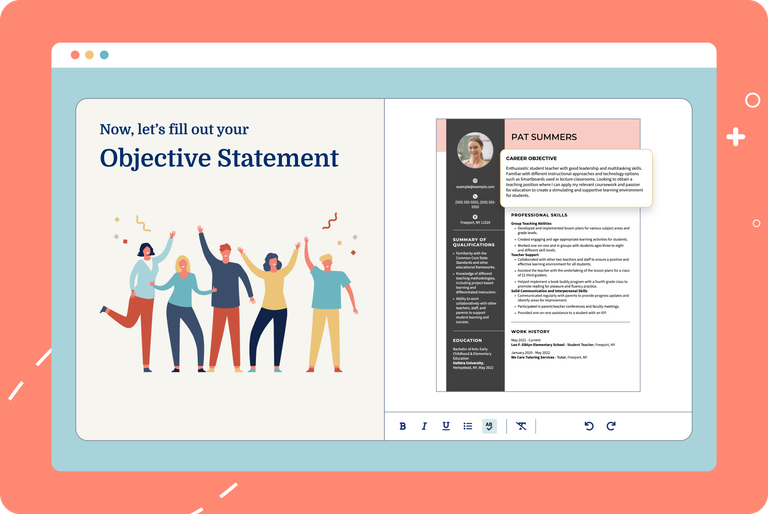

Write a strong professional summary

A professional summary on a resume introduces hiring managers to you, giving them a quick view of who you are. It’s often the first thing they read, so making it strong and compelling is key. Depending on your experience level, you can choose between writing a professional summary or a resume objective.

A professional summary usually consists of three to four sentences and highlights your experience, skills, and achievements. It’s perfect for experienced applicants who want to quickly showcase their professional identity and value. This section helps hiring managers immediately understand what you have to offer.

In contrast, resume objectives emphasize career goals and suit those who are entry-level, switching careers, or have employment gaps. While summaries state “what I’ve accomplished,” objectives reveal “what I aim to contribute.”

Now that we’ve discussed the differences between summaries and objectives, let’s explore examples tailored for various industries and experience levels. Explore our library of resume examples for additional inspiration.

Mortgage underwriter resume summary examples

Entry-level

Recent finance graduate with a concentration in real estate and mortgage lending. Completed an internship at a regional bank where skills in loan processing and risk assessment were developed. Certified Mortgage Loan Originator (MLO) with strong analytical abilities and keen attention to detail, eager to contribute to underwriting teams and support efficient mortgage approval processes.

Mid-career

Results-oriented mortgage underwriter with over six years of experience evaluating residential loan applications for compliance with federal regulations and lender policies. Proven track record of maintaining high approval rates while minimizing delinquency through thorough document analysis and risk assessment. Proficient in automated underwriting systems like DU and LP, known for effective collaboration with loan officers to streamline decision-making.

Experienced

Seasoned mortgage underwriter specializing in complex loan portfolios, including jumbo loans and non-conforming mortgages. Over 15 years in the industry, leading underwriting teams, improving processes that improved efficiency by 20%. Expertise in regulatory changes and market trends impacting lending practices. Committed to mentoring junior underwriters and fostering a culture of precision and integrity.

Mortgage underwriter resume objective examples

Entry-level

Detail-oriented individual with a background in finance and strong analytical skills seeking an entry-level mortgage underwriter position. Eager to contribute to a fast-paced team by applying knowledge of financial regulations and risk assessment to support the loan approval process.

Career changer

Results-driven professional with experience in customer service and data analysis transitioning into mortgage underwriting. Looking to leverage strong communication skills and attention to detail in assessing borrower eligibility and ensuring compliance with lending standards.

Recent graduate

Ambitious recent graduate with a degree in economics aiming for a challenging role as a mortgage underwriter. Committed to using academic knowledge of market trends and financial principles to assist in making sound lending decisions that benefit both clients and the organization.

Create a standout resume effortlessly! Use our Resume Builder to highlight your mortgage underwriter skills with easy-to-follow templates that catch recruiters’ eyes.

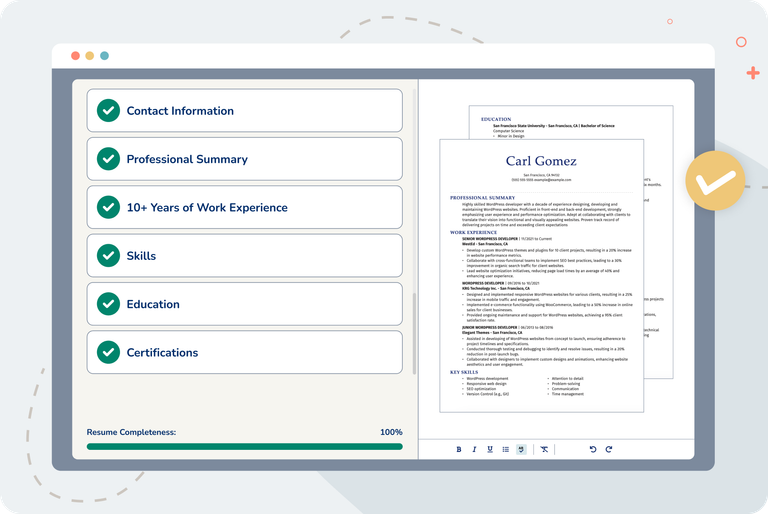

Match your resume to the job description

Tailoring resumes to job descriptions is important because it helps job seekers stand out to employers and pass through applicant tracking systems (ATS). Many companies use ATS to filter resumes before hiring managers review them. These systems scan for specific keywords and phrases from the job posting. By aligning your resume with these keywords, you increase your chances of being noticed.

An ATS-friendly resume uses keywords and phrases that match the job description while highlighting your skills. Including these terms can make it easier for hiring managers to see how well you fit the role. It’s like speaking the same language as the employer, which makes your application more appealing.

To find keywords in a job posting, look for skills, qualifications, and duties mentioned often. For example, if you’re applying for a mortgage underwriter position, notice repeated terms like “loan processing,” “risk assessment,” or “financial analysis.”

Incorporate these terms naturally into your resume by rephrasing your experiences. For instance, instead of saying “Reviewed loan applications,” you might say “Conducted thorough loan processing to ensure compliance.” This subtle shift integrates key phrases smoothly into your work history.

By focusing on targeted resumes that match job descriptions, you can customize your resume effectively and improve ATS compatibility. Tailored resumes are more likely to pass initial screenings and lead to interviews.

Stop your resume from being ignored by ATS software! Our ATS Resume Checker makes sure your resume is set up right and packed with the right words.

FAQ

Do I need to include a cover letter with my mortgage underwriter resume?

Yes, including a cover letter with your mortgage underwriter resume can give you an edge in the hiring process.

It allows you to showcase your understanding of the company’s lending goals and how your skills align with their needs, highlighting specific achievements that demonstrate your expertise in risk assessment and loan approval.

For instance, if a lender specializes in certain types of loans or has unique underwriting requirements, you can address your experience with similar scenarios or express enthusiasm for their approach.

Consider using tools like our Cover Letter Generator to craft a personalized letter that complements your resume, offering structure and content guidance tailored to mortgage underwriting roles.

Additionally, reviewing cover letter examples from our library can inspire and insights into effectively framing your qualifications for this specialized field.

How long should a mortgage underwriter’s resume be?

For a mortgage underwriter, aim for a one-page resume to effectively highlight key skills like risk assessment, financial analysis, and decision-making. Focus on relevant underwriting experience and any specialized training or certifications that showcase your expertise in evaluating loan applications.

If you have extensive experience or multiple notable achievements, a two-page resume is acceptable. Be selective with the information included, concentrating on roles that show your ability to manage complex underwriting processes efficiently.

Explore our guide on how long a resume should be for examples and tips tailored to different career stages.

How do you write a mortgage underwriter resume with no experience?

To create a resume with no experience for a mortgage underwriter position, focus on showcasing your skills, education, and relevant training that match the job’s needs. Here are some practical tips to help you get started:

- Highlight relevant education: Start with your degree in finance, business administration, or a related field. Include details like your GPA if it’s impressive, coursework relevant to underwriting, and any honors you received.

- Use transferable skills: Showcase analytical skills and attention to detail gained from other jobs or academic projects. Mention experiences where you assessed data or made decisions based on detailed information.

- Include industry-specific training: If you’ve completed courses in financial analysis or risk management—even online certifications—add these to show you’re proactively building knowledge essential for an underwriter role.

- Add volunteer or internship experience: If you’ve interned at a bank or volunteered in financial services, describe tasks similar to underwriting duties, such as document review or credit analysis.

Check out guides on entry-level resumes for more examples on how to effectively frame your qualifications without direct work experience.

Rate this article

Mortgage Underwriter

Share this page

Additional Resources

Mortgage Loan Officer Resume Examples & Templates

Explore mortgage loan officer resume examples that showcase essential customer service and financial analysis skills. Learn how to show employers you’re knowledgeable, trustworthy, and ready to guide clients through the

The Illusion of Wage Growth: Where Paychecks Stretch the Farthest

U.S. wages have climbed at one of the fastest rates in modern history. Between 2020 and 2024, the average American worker’s pay rose from about $64,000 to $75,600, an 18%

100+ Resume Objective Statement Examples & Best Practices

In just a sentence or two, a resume objective statement tells hiring managers the role or career path you’re aiming for and the unique skills and value you bring to

150+ Skills for a Resume: Examples for Any Job

Crafting a standout resume starts with highlighting the skills and qualifications that demonstrate your fit for the role. But in a crowded job market, knowing which abilities will actually catch

When to Use a Two Page Resume (With Examples & Formatting Tips)

If you’ve spent years building your skills, growing in your career, and racking up accomplishments, a one-page resume might not cut it. A two-page resume gives you space to present a

How to Make an ATS Friendly Resume (Templates & Guide)

In today’s fast-paced hiring climate, many employers use applicant tracking systems (ATS) to organize, store, and screen candidate information. Optimizing your resume for ATS is essential for ensuring your application passes