Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

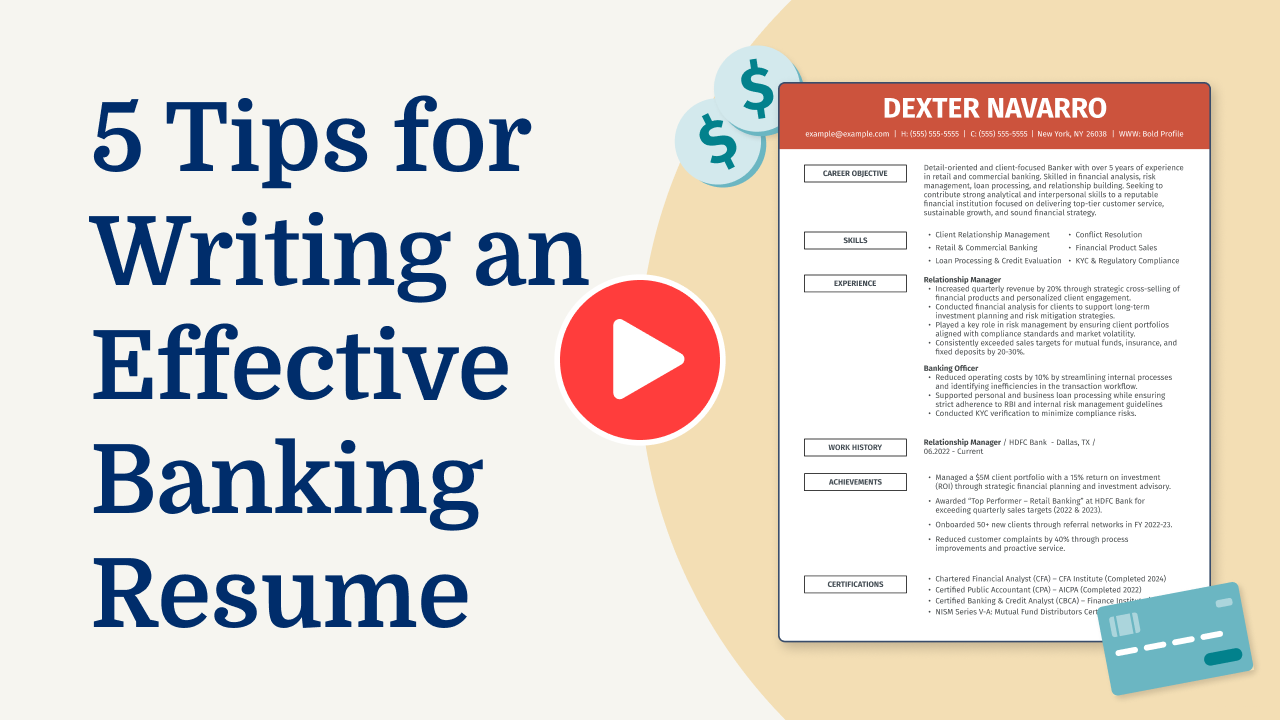

Why this resume works

- Quantifies accomplishments: By pulling metrics like approving over 100 loans monthly, the applicant’s resume accomplishments clearly reflect their significant impact and value in financial roles.

- Uses action-oriented language: Using dynamic action verbs such as “approved” and “improved,” the applicant conveys a proactive approach to achieving measurable results.

- Illustrates problem-solving ability: Initiating a new loan approval protocol illustrates the applicant’s problem-solving skills by addressing inefficiencies with innovative solutions, showcasing critical thinking and initiative.

More Mortgage Loan Officer Resume Examples

See our mortgage loan officer resume examples to learn how to showcase your lending expertise, customer service skills, and knowledge of mortgage products. These banking resume samples will help you create a resume that highlights your experience effectively.

Entry-Level Mortgage Loan Officer

Why this resume works

- Effective use of keywords: Strategically integrating role-specific keywords like “loan origination” and “regulatory compliance” increases the likelihood of passing applicant tracking systems (ATS).

- Centers on academic background: Listing a Master of Business Administration in finance in the education section emphasizes strong academic credentials, important for early career professionals.

- Shows digital literacy: Demonstrating familiarity with technical tools such as financial analysis software showcases the applicant’s computer skills and digital readiness for modern workplaces.

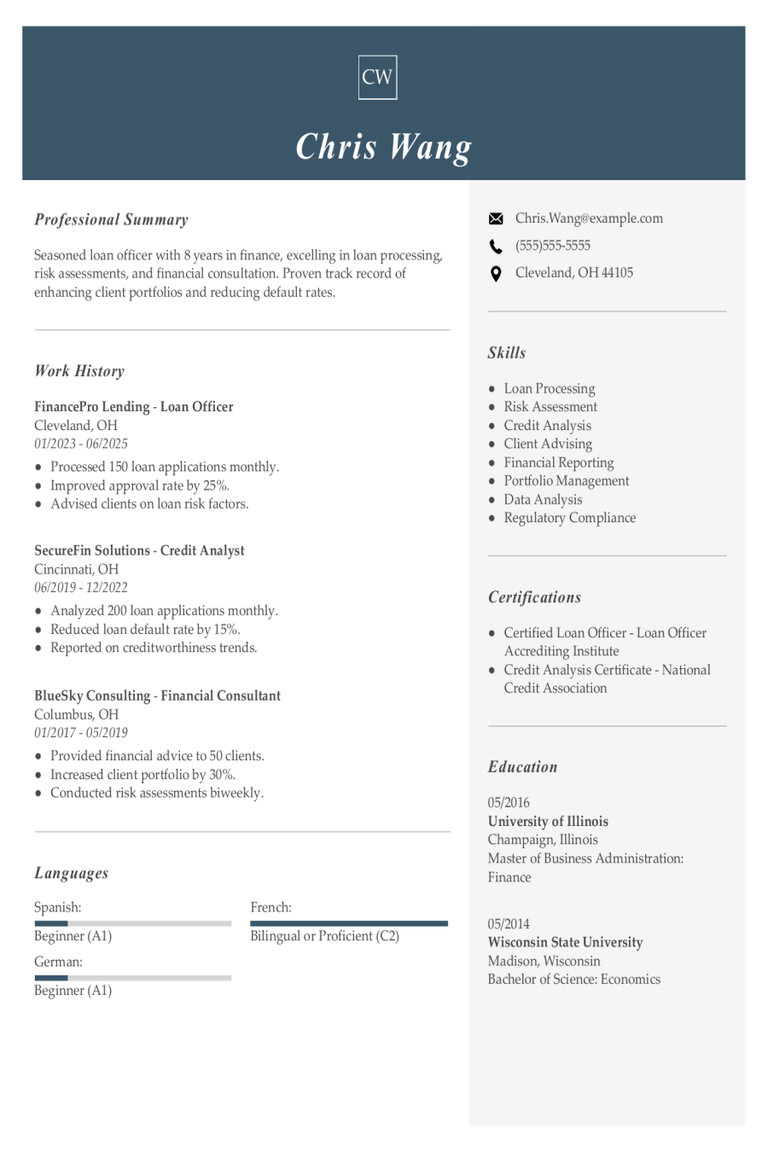

Mid-Level Mortgage Loan Officer

Why this resume works

- Points to measurable outcomes: Increasing loan approvals by 20% and managing a $5M portfolio illustrate the applicant’s knack for delivering impactful, measurable outcomes.

- Displays technical expertise: Holding certifications like Certified Mortgage Advisor and Accredited Financial Counselor showcases specialized knowledge essential for financial roles.

- Demonstrates language abilities: Language skills in Spanish, French, and Mandarin indicate the applicant’s ability for effective cross-cultural communication.

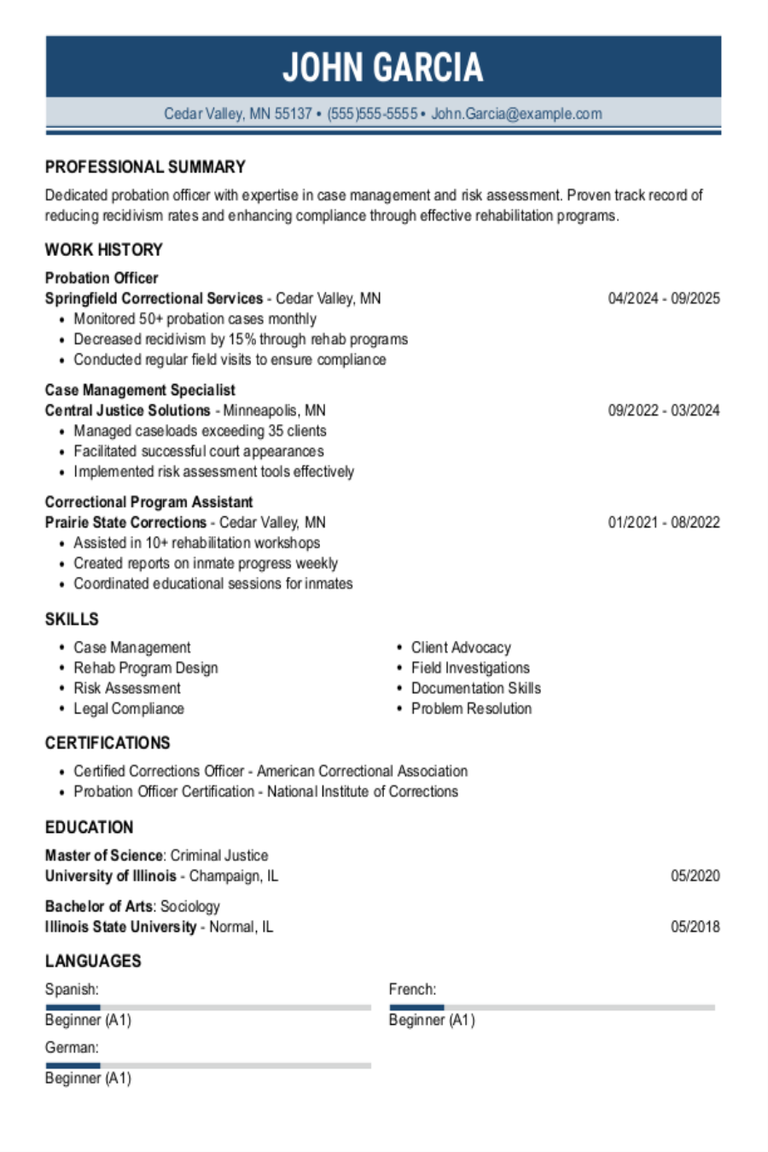

Experienced Mortgage Loan Officer

Why this resume works

- Focuses on work history: Using a chronological resume format, the applicant’s extensive work history shines, highlighting steady career progression.

- Lists relevant certifications: Listing certifications like Certified Mortgage Advisor and Credit Risk Certification, the applicant shows commitment to growth.

- Emphasizes leadership skills: Mentoring junior officers and raising client satisfaction reflect strong leadership skills and management abilities.

Mortgage Loan Officer Resume Template (Text Version)

Aya Nguyen

Milwaukee, WI 53211

(555)555-5555

Aya.Nguyen@example.com

Professional Summary

Experienced mortgage loan officer skilled in loan processing, risk assessment, and portfolio management. Proven record of enhancing customer satisfaction and reducing defaults. Exceptional communication and financial analysis expertise.

Work History

Mortgage Loan Officer

Capital Lending Group – Milwaukee, WI

January 2024 – June 2025

- Approved 100+ loans monthly.

- Increased loan portfolio by 15%.

- Enhanced customer satisfaction by 20%.

Loan Specialist

Financial Trust Services – Brookfield, WI

January 2021 – December 2023

- Managed M loan portfolio.

- Improved departmental process efficiency.

- Trained 12 junior loan officers.

Credit Analyst

Silver Bank – Milwaukee, WI

January 2019 – December 2020

- Analyzed 300+ applications monthly.

- Led risk assessment projects.

- Reduced defaults by 8%.

Skills

- Loan processing

- Customer service

- Risk assessment

- Financial analysis

- Compliance regulations

- Portfolio management

- Credit evaluation

- Communication

Education

Master of Business Administration Finance

University of Illinois Urbana, Illinois

June 2018

Bachelor of Science Economics

Illinois State University Normal, Illinois

June 2015

Certifications

- Certified Mortgage Loan Originator – National Mortgage Licensing System

- Financial Risk Manager – Global Association of Risk Professionals

Languages

- Spanish – Beginner (A1)

- French – Beginner (A1)

- German – Intermediate (B1)

Related Resume Guides

Advice for Writing Your Mortgage Loan Officer Resume

Explore our tips on how to write a resume for a mortgage loan officer role and discover how to highlight your financial expertise, client relationship skills, and ability to navigate the lending process.

Highlight your most relevant skills

Listing relevant skills when applying for a job as a mortgage loan officer is important because it shows that you have the right abilities to do the job well. A skills section on your resume helps employers quickly see what you can bring to their company.

It’s a place where you can highlight both technical skills, like understanding mortgage laws and financial analysis, and soft skills, like communication and customer service. Having a mix of these skills shows that you’re not only good at handling numbers but also great with people.

Integrate these key skills into your work experience section, too. For example, if you’ve helped many clients get approved for loans, mention how your negotiation and analytical skills played a part in that success. By weaving your skills into your job history, you give real examples of how you’ve used them effectively.

For mortgage loan officers, a resume format that highlights sales performance, client relations, and financial expertise can improve your application.

Showcase your accomplishments

When listing your work experience as a mortgage loan officer, start with your most recent job and work backward. Each job entry should show your job title, the name of your employer, the location where you worked, and the dates you were employed there. This reverse chronological order helps hiring managers see your most relevant and recent experience first.

Instead of just listing what you did day-to-day, focus on what you achieved. Use numbers to make your accomplishments stand out. For example, instead of saying “processed loans,” say “processed over 100 loans monthly, increasing approval rates by 20%.”

Use action words like “increased,” “reduced,” or “improved” to describe how you made things better at past jobs. Quantifying your achievements helps employers quickly understand the impact you’ve had in previous roles.

By highlighting specific results like cost savings or efficiency gains, you make it easier for hiring managers to see what skills you bring to their team. Remember, showing how you’ve made a difference can be more compelling than merely describing tasks you’ve completed in each role.

5 mortgage loan officer work history bullet points

- Processed and closed over $15 million in mortgage loans annually, maintaining a 98% customer satisfaction rate.

- Implemented new loan origination software that reduced processing time by 40%, improving client experience.

- Collaborated with real estate agents and attorneys to finalize 150+ successful home purchases each year.

- Conducted detailed financial analyses of applicants, increasing loan approval rates by 20%.

- Led monthly training sessions for junior officers, improving team productivity by 25%.

Choose a simple, organized resume template. Opt for easy-to-read fonts and clear section headings. Avoid too many design elements so your skills and jobs stand out.

Write a strong professional summary

A professional summary on a resume acts as an introduction to hiring managers, giving them a quick overview of who you are and what you bring to the table. When creating your resume, you can decide between writing a summary and a resume objective, each serving different purposes based on your experience level.

A professional summary is a three to four sentence snapshot that highlights your experience, skills, and achievements. It’s best for experienced applicants who want to showcase their professional identity and value quickly. For instance, as a mortgage loan officer, you might highlight years of industry experience, strong client relationship skills, and successful loan closures.

In contrast, a resume objective states career goals and is ideal for those new to the field, like entry-level workers, career changers, or those with employment gaps. Think of it as “what I aim to contribute” versus “what I’ve accomplished.”

Explore examples of both summaries and objectives tailored for various industries and levels of experience. See our full library of resume examples for additional inspiration.

Mortgage loan officer resume summary examples

Entry-level

Recent finance graduate with coursework in mortgage lending, credit analysis, and risk management. Holder of the NMLS license and skilled in loan origination software and financial documentation review. Eager to support clients in navigating home financing processes while building a foundation in the mortgage industry.

Mid-career

Mortgage loan officer with 6+ years of experience assisting clients with diverse financing needs, including FHA, VA, and conventional loans. Experienced in analyzing credit reports, managing loan processing timelines, and providing tailored solutions for first-time homebuyers. Known for strong client relationships and consistently meeting funding goals.

Experienced

Seasoned mortgage loan officer specializing in high-value portfolios and complex financing structures. Expertise in team leadership, strategic planning, and training junior officers on industry standards. Proven track record of driving revenue growth through innovative lending strategies while ensuring compliance with regulatory guidelines.

Mortgage loan officer resume objective examples

Entry-level

Aspiring mortgage loan officer with a background in finance and customer service, eager to apply analytical skills and financial knowledge to assist clients in securing home loans. Committed to providing exceptional client support and fostering positive relationships within the lending industry.

Career changer

Detail-oriented professional transitioning from retail management to mortgage loan officer role, aiming to use strong interpersonal skills and business acumen in facilitating successful loan processes. Excited to contribute a fresh perspective and dedication to helping clients achieve their homeownership dreams.

Recent graduate

Recent finance graduate with a keen interest in the mortgage industry seeking an entry-level position as a mortgage loan officer. Driven to leverage academic knowledge in real estate markets and lending principles while growing professionally within a reputable financial institution.

Stand out as a mortgage loan officer by using our Resume Builder. Choose your favorite template and easily customize it to highlight your skills and experience!

Match your resume to the job description

Tailoring resumes to job descriptions is key because it helps job seekers stand out. Many companies use applicant tracking systems (ATS) to scan resumes for specific keywords and phrases found in job postings. If your resume matches the job description, you’re more likely to pass through the ATS and catch employers’ attention.

An ATS-friendly resume includes keywords from the job posting that match your skills and experience. By using these words, you boost the chances that hiring managers will notice your application. This approach helps align your resume with what employers seek.

To find the right keywords, read the job posting carefully. Look for skills, qualifications, and duties repeated multiple times. For example, if a mortgage loan officer position lists terms like “loan origination,” “client relations,” or “financial analysis,” make sure to use these exact phrases in your resume.

Incorporate these terms naturally into your resume by rewriting parts of your work history or skills section. For instance, instead of saying “Helped clients with loans,” write “Worked on loan origination by assisting clients throughout the process.” This not only uses relevant keywords but also clarifies your experience.

Targeted resumes improve ATS compatibility and help you stand out in a competitive market. By closely customizing your resume with job descriptions, you boost your chances of getting noticed and moving forward in the hiring process.

Make sure your resume gets noticed by using our ATS Resume Checker. It checks if your resume has the right format and keywords to pass ATS software.

FAQ

Do I need to include a cover letter with my mortgage loan officer resume?

Yes, including a cover letter with your mortgage loan officer resume can make a strong impression and set you apart from other candidates.

A cover letter lets you highlight key achievements, such as exceeding sales goals or successfully guiding clients through complex loan processes, while connecting them to the specific job posting.

For example, if the company specializes in FHA loans or has a reputation for excellent customer service, you can share how your experience aligns with those priorities.

You can also use it to explain any gaps in your resume or emphasize transferable skills like relationship-building and financial analysis that are important for this role. Check out these cover letter examples for inspiration.

Many hiring managers appreciate the extra effort of a personalized cover letter, so taking the time to craft one using our Cover Letter Generator could help secure an interview.

How long should a mortgage loan officer’s resume be?

For a mortgage loan officer, a one-page resume is typically sufficient if you have less than 10 years of experience. Focus on key skills like customer service, financial analysis, and loan product knowledge. Highlight your success in closing deals and building client relationships.

If you have extensive experience or unique certifications that make you stand out, consider a two-page resume. Just ensure everything included is directly relevant to the role.

You can learn more about choosing the right length in our guide on how long a resume should be.

How do you write a mortgage loan officer resume with no experience?

To create a resume with no experience for a mortgage loan officer role, emphasize your skills, education, and any relevant activities that demonstrate your potential. Consider strategies like tailoring your resume to the job description and showcasing transferable skills. Here are a few tips to help you get started:

- Emphasize transferable skills: Highlight skills such as customer service, communication, sales, and attention to detail. These are important for a mortgage loan officer and can be developed through various experiences.

- Highlight educational background: If you have taken courses related to finance or real estate, mention them prominently. Include details about your degree, school, and any honors or relevant coursework.

- Showcase related activities: If you’ve participated in internships or volunteer work involving financial services, banking, or real estate transactions, describe these experiences in detail to demonstrate your interest and foundational knowledge.

- Include certifications or licenses: If you’ve completed any training programs or obtained certifications relevant to finance or loans (even if they’re entry-level), list them, as this shows initiative.

Consider using a functional resume format to emphasize your skills over experience while tailoring each application to highlight how your background relates specifically to the mortgage industry.

Rate this article

Mortgage Loan Officer

Share this page

Additional Resources

Loan Officer Resume Examples & Templates

Explore loan officer resume examples that highlight key skills in finance and customer service. Learn how to showcase your experience in helping clients secure loans and stand out to potential

Probation Officer Resume Examples & Templates

Review probation officer resume examples and tips to discover how to showcase your strengths in communication, conflict resolution, and guiding individuals through challenging situations.Build my resumeImport existing resumeCustomize this templateWhy

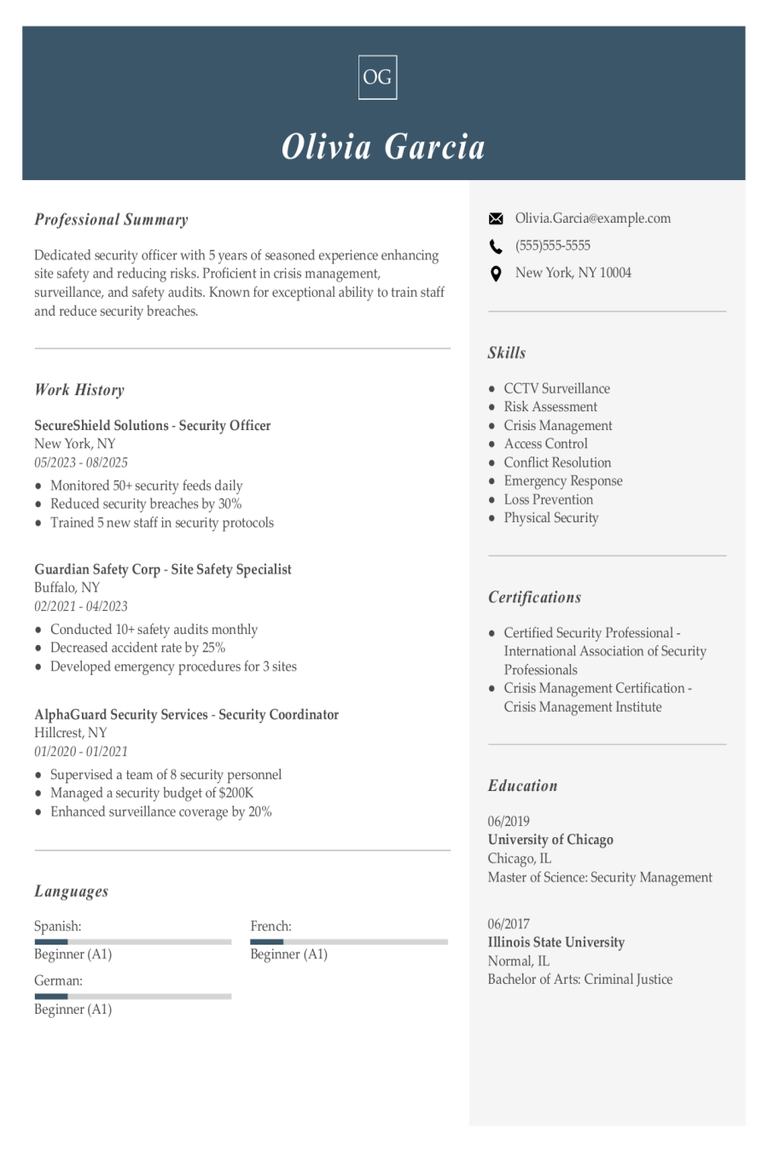

Security Officer Resume Examples & Templates

Discover how security officers can highlight their skills in protecting people and property. These resume examples and tips show how to write about experiences like handling emergencies or monitoring surveillance

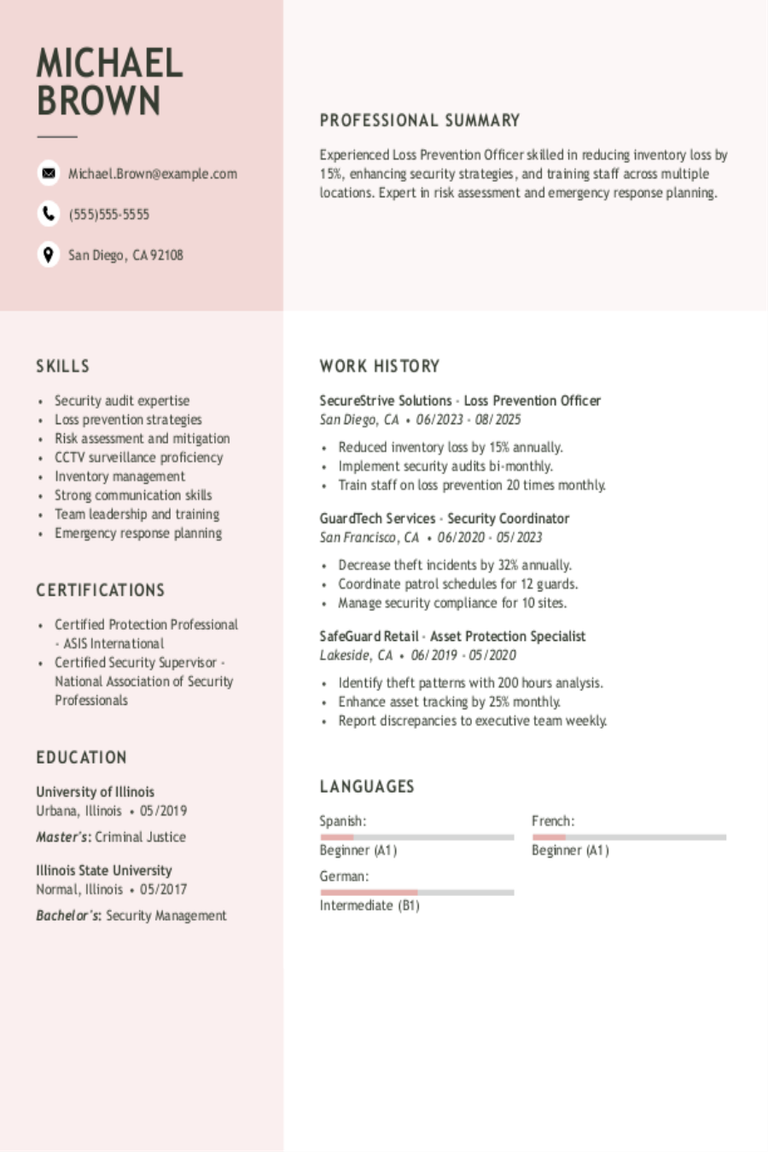

Loss Prevention Officer Resume Examples & Templates

Discover how loss prevention officers can showcase their ability to reduce theft and maintain safety. These resume examples and tips help you highlight your keen observation skills and experience in

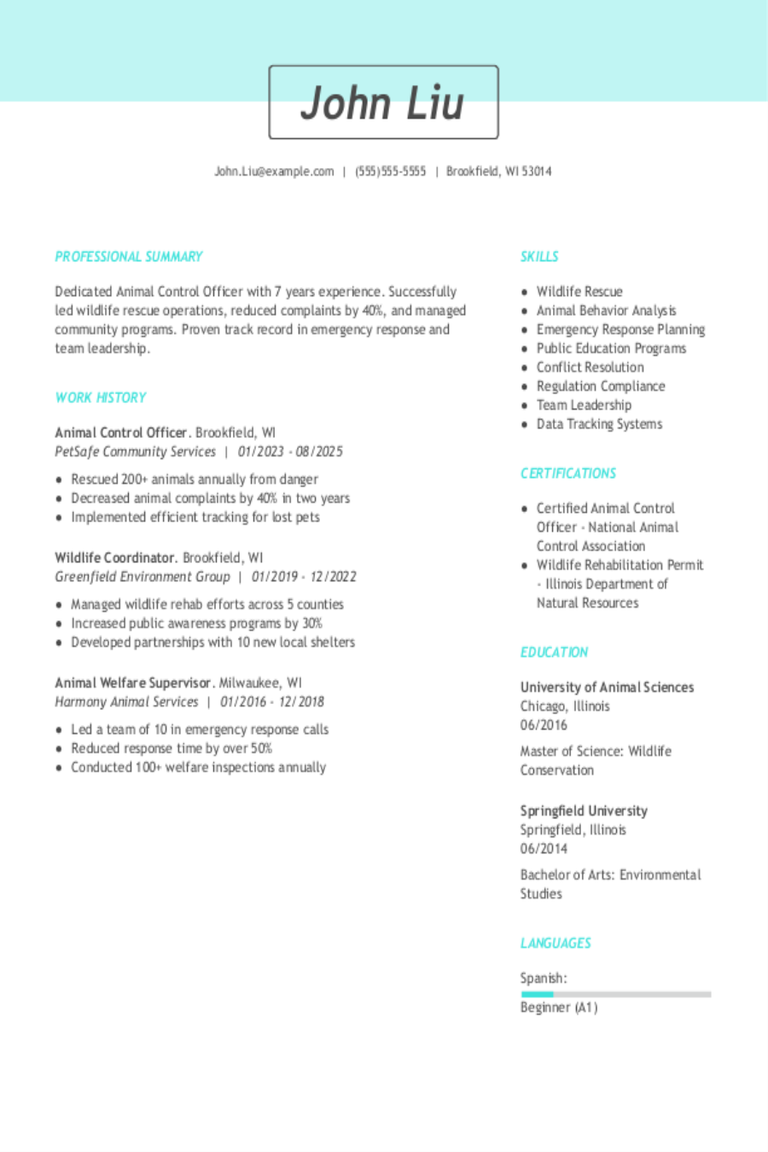

Animal Control Officer Resume Examples & Templates

Discover animal control officer resume examples that highlight key skills like handling animals and managing public safety. Browse tips on showcasing your experience in resolving wildlife issues and working with

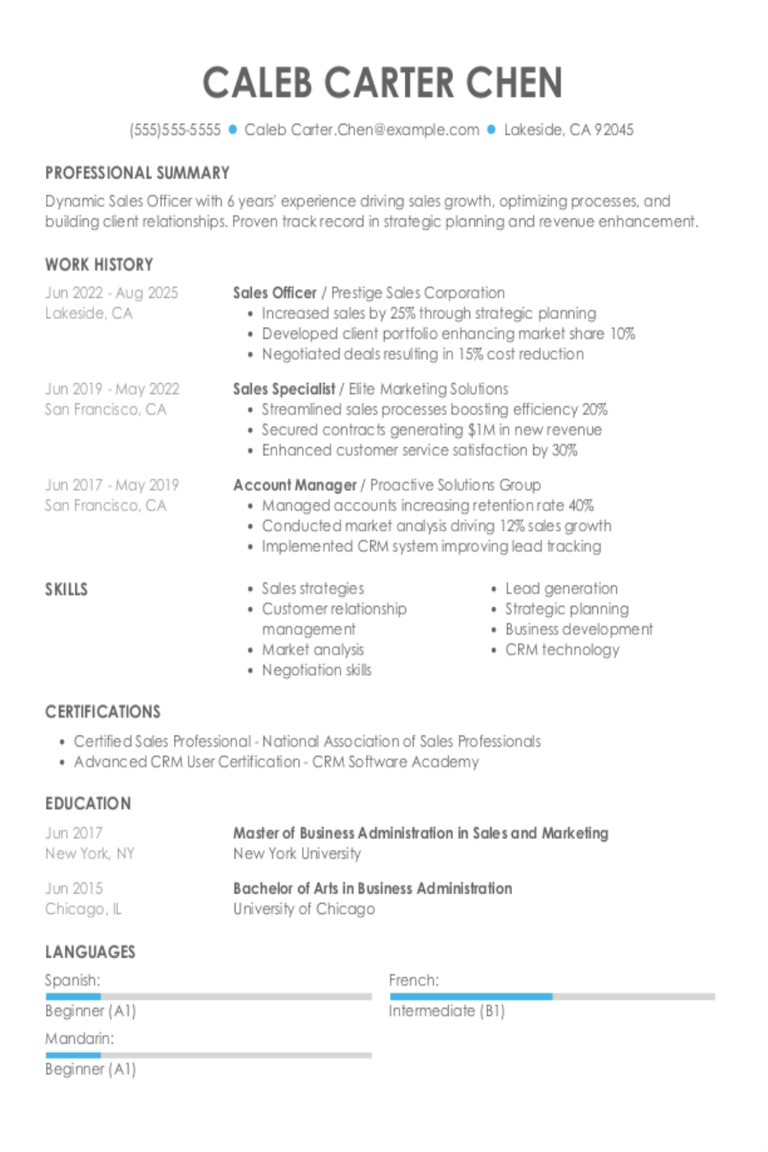

Sales Officer Resume Examples & Templates

Sales officer resumes can showcase more than meeting quotas. Learn how to highlight negotiation skills, relationship building, and teamwork to stand out in a competitive field.Build my resumeImport existing resumeCustomize