Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Highlights measurable accomplishments, such as increasing portfolio holdings by 15%, showcasing the applicant’s impactful achievements and value.

- Showcases career progression: Transitioning from Financial Consultant to Bank Relationship Manager, the applicant’s expanding roles illustrate impressive career progression and growing responsibility over time.

- Illustrates problem-solving ability: Accomplishments like upgrading financial models and delivering a 25% ROI on client investments highlight the applicant’s innovative problem-solving skills, showcasing critical thinking and initiative.

More Bank Relationship Manager Resume Examples

See our bank relationship manager resume examples to learn how to highlight your customer service skills, portfolio management experience, and business development abilities. These banking resume samples will guide you in crafting a compelling industry-standard resume.

Entry-Level Bank Relationship Manager

Why this resume works

- Effective use of keywords: The applicant’s use of keywords like “client relationship management” and “financial analysis” strategically aids their resume in passing applicant tracking systems (ATS) and standing out to hiring managers.

- Centers on academic background: Listing degrees from prestigious institutions in the education section effectively centers the resume on a strong academic foundation early in their career.

- Shows digital literacy: Using financial tools to improve budgeting efficiency by 25% showcases digital literacy, aligning with the necessary computer skills for modern workplaces.

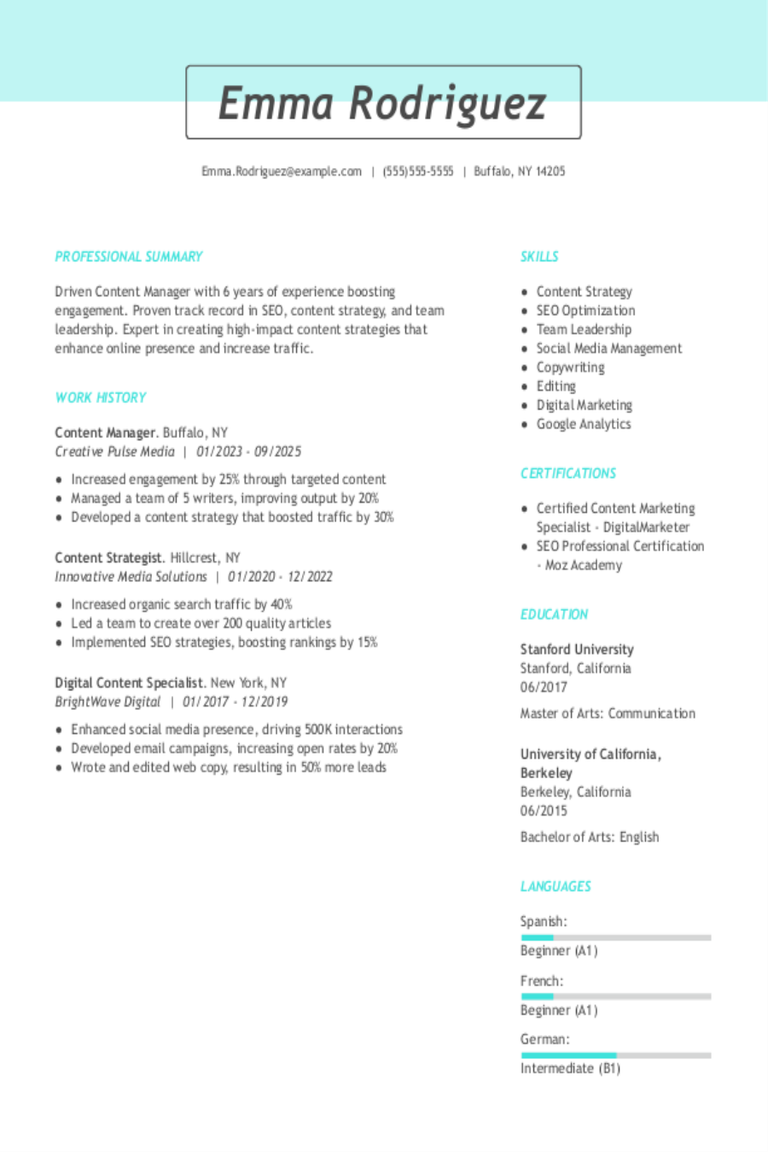

Mid-Level Bank Relationship Manager

Why this resume works

- Includes a mix of soft and hard skills: Combining technical expertise in financial analysis with interpersonal skills, the applicant effectively fosters client relationships while delivering data-driven solutions to improve satisfaction and portfolio growth.

- Demonstrates language abilities: Language skills in Spanish, French, and German support seamless communication with diverse clients and expand opportunities for international collaboration.

- Points to measurable outcomes: Achieving measurable results like boosting investment returns by 25% and reducing service time by 30% highlights a clear focus on efficiency and impactful client outcomes.

Experienced Bank Relationship Manager

Why this resume works

- Lists relevant certifications: Featuring certifications like CFP and CFA, the applicant’s qualifications reflect advanced financial expertise and dedication to continuous growth.

- Showcases impressive accomplishments: Driving results such as boosting client portfolios by 35% showcases impactful achievements that align with senior-level performance.

- Emphasizes leadership skills: Taking charge of initiatives like leading a team to record-breaking sales illustrates strong leadership skills and management abilities.

Bank Relationship Manager Resume Template (Text Version)

Chris Lee

Los Angeles, CA 90016

(555)555-5555

Chris.Lee@example.com

Professional Summary

Seasoned Bank Relationship Manager excelling in client account management, financial planning, and risk assessment. Consistently boosting portfolio returns and enhancing client satisfaction through strategic insights.

Work History

Bank Relationship Manager

Modern Financial Partners – Los Angeles, CA

January 2022 – June 2025

- Managed 200+ high-value client accounts

- Increased portfolio holdings by 15%

- Achieved a 30% rise in client retention

Senior Client Advisor

Liberty Bank & Trust – Riverside, CA

January 2020 – December 2021

- Improved customer engagement by 20%

- Advised clients on savings plans

- Enhanced loan approval efficiency by 12%

Financial Consultant

Capital Advisory Services – San Diego, CA

January 2018 – December 2019

- Analyzed client financial status

- Upgraded financial models effectively

- Delivered 25% ROI on client investments

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Skills

- Client Relationship Management

- Portfolio Analysis

- Financial Planning

- Risk Assessment

- Customer Service Excellence

- Sales Strategy Development

- Market Analysis

- Data-Driven Decisions

Certifications

- Certified Financial Planner (CFP) – Financial Planning Standards Board

- Chartered Banker – Chartered Banker Institute

- Risk Management Certification – Global Association of Risk Professionals

Education

Master of Business Administration Finance

Harvard Business School Cambridge, MA

May 2018

Bachelor of Arts Economics

University of California, Berkeley Berkeley, CA

May 2016

Related Resume Guides

Advice for Writing Your Bank Relationship Manager Resume

Explore our tailored advice on how to write a resume for a bank relationship manager role. Learn how to spotlight your skills in building strong client connections and managing financial portfolios.

Highlight your most relevant skills

Listing your most relevant skills when applying for a job like a bank relationship manager is really important. It helps show you have what it takes to do the job well. Having a dedicated skills section on your resume makes it easy for employers to see at a glance what you can bring to their team.

It’s good to have a mix of technical skills, like financial analysis or data management, and interpersonal skills, such as communication and teamwork. This balance shows you’re well-rounded and able to handle both the numbers side of banking and the people side.

To make your resume even stronger, try weaving key skills into your work experience section. When you describe past jobs you’ve had, mention how you used specific skills in real situations. For example, if you’ve helped clients with investment decisions, talk about how your analytical skills made that happen.

This approach not only lists your abilities but also proves them by showing results from your previous roles. By highlighting both types of skills and integrating them with your work history, you’re giving employers solid evidence that you’re ready for this role.

Showcase your client management skills, financial expertise, and sales achievements by using a resume format tailored for bank relationship managers.

Showcase your accomplishments

When organizing your work experience as a bank relationship manager, list your jobs starting with the most recent. Each entry should have your job title, employer’s name, location, and dates you worked there. This helps potential employers see your career progress at a glance.

Instead of just listing duties, make your resume stand out by showing what you achieved. For example, saying “managed client accounts” is less impactful than “grew client portfolio by 30% in one year.” Numbers show how well you did and help hiring managers quickly understand your skills.

Turning duties into achievements means focusing on results. Use action words like “increased,” “reduced,” or “developed” to describe what you’ve done. If you helped save time or cut costs for the bank, say how much or by what percentage.

Describing efficiency improvements or customer growth with real figures makes your impact clear and shows you’re good at your job. Quantified accomplishments give a strong picture of what you can do and help set you apart from other candidates in the eyes of hiring managers.

5 bank relationship manager work history bullet points

- Managed a portfolio of 150+ high-value clients, increasing customer retention rates by 25% through personalized financial solutions.

- Cross-sold banking products, generating $2.5M in new revenue and achieving 120% of annual sales targets.

- Streamlined client onboarding process, reducing turnaround time by 30% and improving satisfaction ratings.

- Collaborated with teams to resolve complex financial issues, minimizing client complaints by 40%.

- Conducted market analysis to identify growth opportunities, leading to a 15% increase in regional deposits.

Choose a resume template with clear sections and simple fonts. Avoid excessive colors or fancy designs to make your skills and experience stand out without clutter.

Write a strong professional summary

A professional summary on a resume acts as an introduction to hiring managers, giving them a quick overview of your skills and achievements. When writing a resume, you can choose between a summary and an objective. A summary works like a snapshot of your career, while an objective states your future goals.

A professional summary is best for experienced applicants. It’s usually three or four sentences long and highlights your experience, skills, and achievements. This section helps show your professional identity and the value you bring to a company. For example, a bank relationship manager might highlight their ability to build client relationships and drive revenue growth in this section.

On the other hand, resume objectives are short statements about your career goals. They’re great for entry-level applicants, people changing careers, or those with employment gaps. While summaries show “what I’ve accomplished,” objectives focus on “what I aim to contribute.”

Now that you know the difference between summaries and objectives, let’s look at examples tailored for different industries and experience levels. See our full library of resume examples for additional inspiration.

Bank relationship manager resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in Business Administration, specializing in banking and financial services. Certified in Financial Risk Management (FRM) and equipped with foundational knowledge of client relationship management through internships at local banks. Eager to support banks in fostering strong client relationships and delivering exceptional service.

Mid-career

Bank relationship manager with over six years of experience managing portfolios for retail and corporate clients. Skilled in developing tailored financial solutions, maintaining long-term client relations, and driving revenue growth. Known for expertise in credit analysis and risk assessment, holds a Chartered Financial Analyst (CFA) designation, and proven track record of exceeding targets.

Experienced

Seasoned bank relationship manager with 15+ years of experience leading high-performing teams and optimizing client engagement strategies across diverse markets. Expert in complex financial product offerings, regulatory compliance, and strategic planning. Holds an MBA with a focus on finance; recognized for transformative leadership that improves customer satisfaction and achieves sustainable business growth.

Bank relationship manager resume objective examples

Entry-level

Detail-oriented business graduate eager to begin a career as a bank relationship manager. Aiming to leverage strong communication and analytical skills to help clients achieve financial goals while building lasting relationships within the banking industry.

Career changer

Customer service specialist transitioning into a bank relationship manager role, bringing a proven track record of client satisfaction and problem-solving abilities. Excited to apply interpersonal skills and financial knowledge towards fostering positive client experiences in the banking sector.

Recent graduate

Ambitious finance graduate seeking an entry-level position as a bank relationship manager. Committed to using academic knowledge in finance and economics to support clients with tailored banking solutions and contribute to the growth of the financial institution.

Want your bank relationship manager resume to stand out? Use our Resume Builder to easily highlight your skills and achievements in a professional format.

Match your resume to the job description

Tailoring resumes to job descriptions is important for job seekers. It helps them stand out and pass through applicant tracking systems (ATS). Employers use ATS to filter through many resumes, and these systems look for specific keywords from job postings. By aligning your resume with the job description, you increase the chance of catching the employer’s eye.

An ATS-friendly resume includes keywords and phrases that match your skills with what employers seek. When your resume mirrors the language used in the job posting, it becomes more likely to be noticed by hiring managers. This strategy ensures your qualifications are highlighted effectively.

To find these keywords, closely examine job postings for repeated skills, qualifications, and duties. Look for terms like “client relationship management,” “financial analysis,” or “sales target achievement.”

Incorporate these terms naturally into your resume content by rewriting job descriptions thoughtfully. For example, instead of just saying “managed banking clients,” try “successfully managed banking clients to improve financial growth.” This approach showcases how you’ve applied those skills in real situations.

Targeted resumes help ensure compatibility with ATS, increasing your chances of getting an interview. By using this method to customize your resume, you align yourself better with what employers are looking for, making it more likely you’ll advance in the hiring process.

Make your resume stand out by passing through applicant tracking systems! Use our ATS Resume Checker to find typical problems and get advice on how to make your resume better.

FAQ

Do I need to include a cover letter with my bank relationship manager resume?

Yes, including a cover letter with your bank relationship manager resume is advisable as it helps you stand out among other applicants.

A cover letter gives you the opportunity to highlight your specific skills in client management and financial products, which are important for a bank relationship manager role.

You can also detail your experience in improving customer satisfaction or managing high-value accounts, demonstrating the impact you’ve made in previous positions. Consider mentioning any relevant certifications or training that align with the bank’s focus areas or client demographics.

Use resources like cover letter examples to structure your thoughts effectively and ensure you’re addressing key points that will resonate with hiring managers.

You may also find tools such as our Cover Letter Generator helpful for crafting a personalized cover letter that improves your application.

How long should a bank relationship manager’s resume be?

For a bank relationship manager, a one-page resume is usually enough to highlight key skills like client management, financial analysis, and sales expertise.

If you have extensive experience or specialized certifications relevant to your role, a two-page resume can be appropriate.

Ensure every detail is relevant and showcases your ability to manage client relationships effectively. Prioritize recent roles and achievements demonstrating your impact in banking.

Check out our guide on how long a resume should be for tips on determining the ideal length for your career stage.

How do you write a bank relationship manager resume with no experience?

To craft a bank relationship manager resume with no experience, highlight your skills, education, and any related activities that demonstrate your potential for the role. Here are a few tips to help you get started:

- Emphasize your education: List your degree in finance, business administration, or a related field. Include relevant coursework like financial management or customer service that aligns with the role.

- Showcase transferable skills: Highlight skills such as communication, problem-solving, and teamwork from internships, volunteer roles, or part-time jobs. These are important for building strong client relationships in banking.

- Demonstrate interest in finance: Mention any involvement in finance clubs, competitions, or workshops. This indicates your commitment to learning about the industry and gaining practical knowledge.

- Include relevant projects: If you’ve worked on projects at school that involve market analysis or financial planning, detail these experiences to show analytical abilities and attention to detail.

Consider tailoring each section of your resume to align with the bank’s values and mission statement for a stronger impact.

Rate this article

Bank Relationship Manager

Share this page

Additional Resources

Bank Branch Manager Resume Examples & Templates

Discover bank branch manager resume examples and tips to help you highlight your experience in managing teams, boosting sales, and improving branch operations.Build my resumeImport existing resumeCustomize this templateWhy this

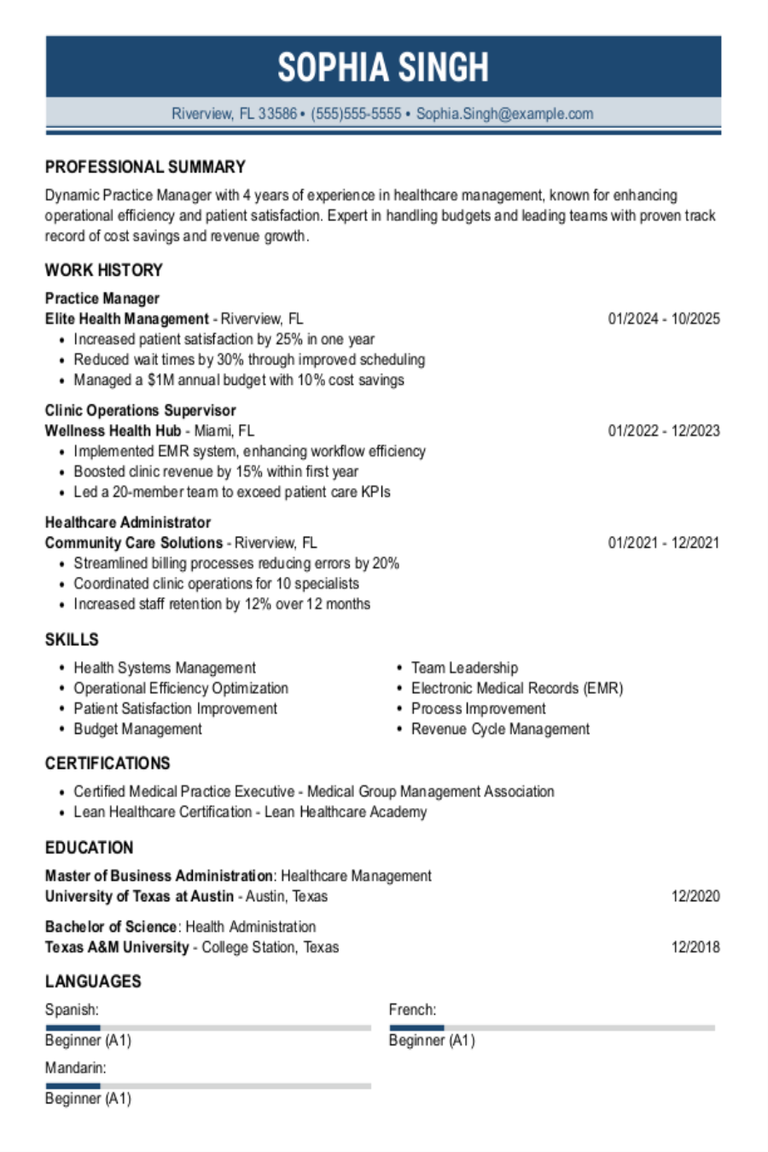

Practice Manager Resume Examples & Templates

Explore practice manager resume examples and tips to learn how to highlight your relevant skills and experience managing staff schedules and improving patient experiences.Build my resumeImport existing resumeCustomize this templateWhy

25 Interview Questions for Managers (With Answers & Tips)

Success in a management interview starts long before the conversation begins. Taking the time to prepare thoughtful responses to common interview questions for managers helps you clearly communicate leadership experience

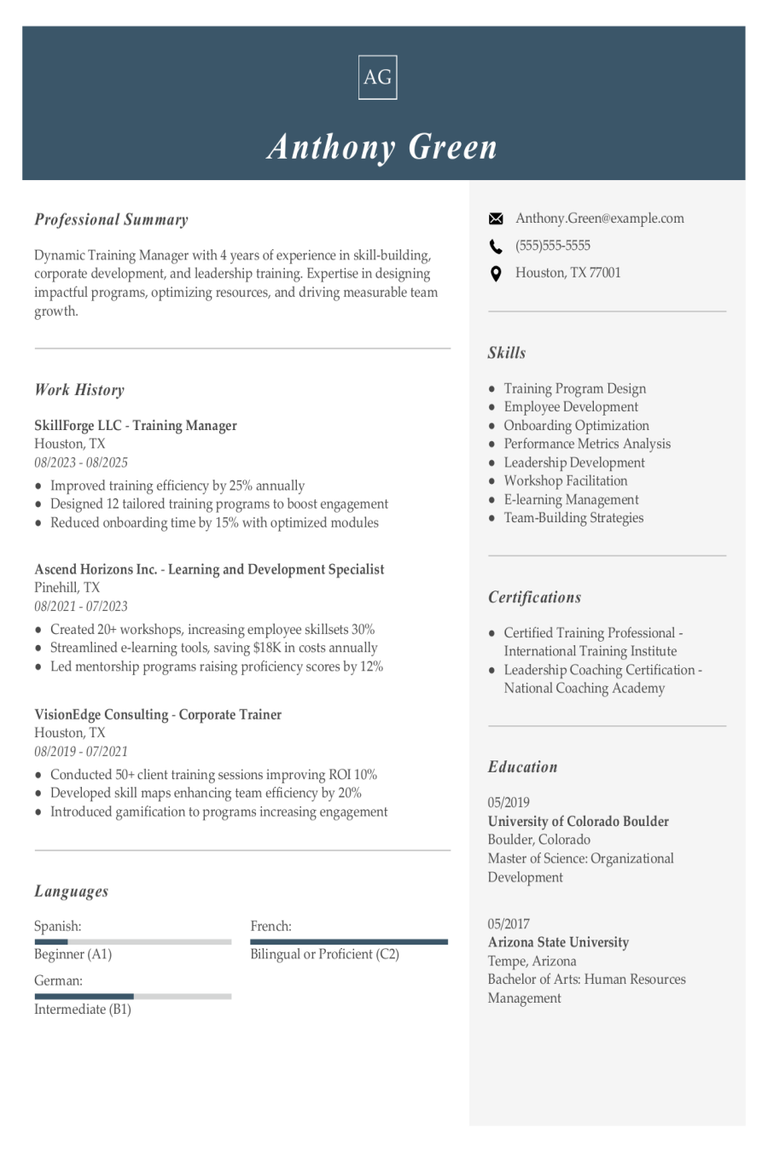

Training Manager Resume Examples & Templates

Discover how training managers showcase their skills in leading workshops and improving employee performance on their resumes. Our examples and tips will help you craft a resume that stands out

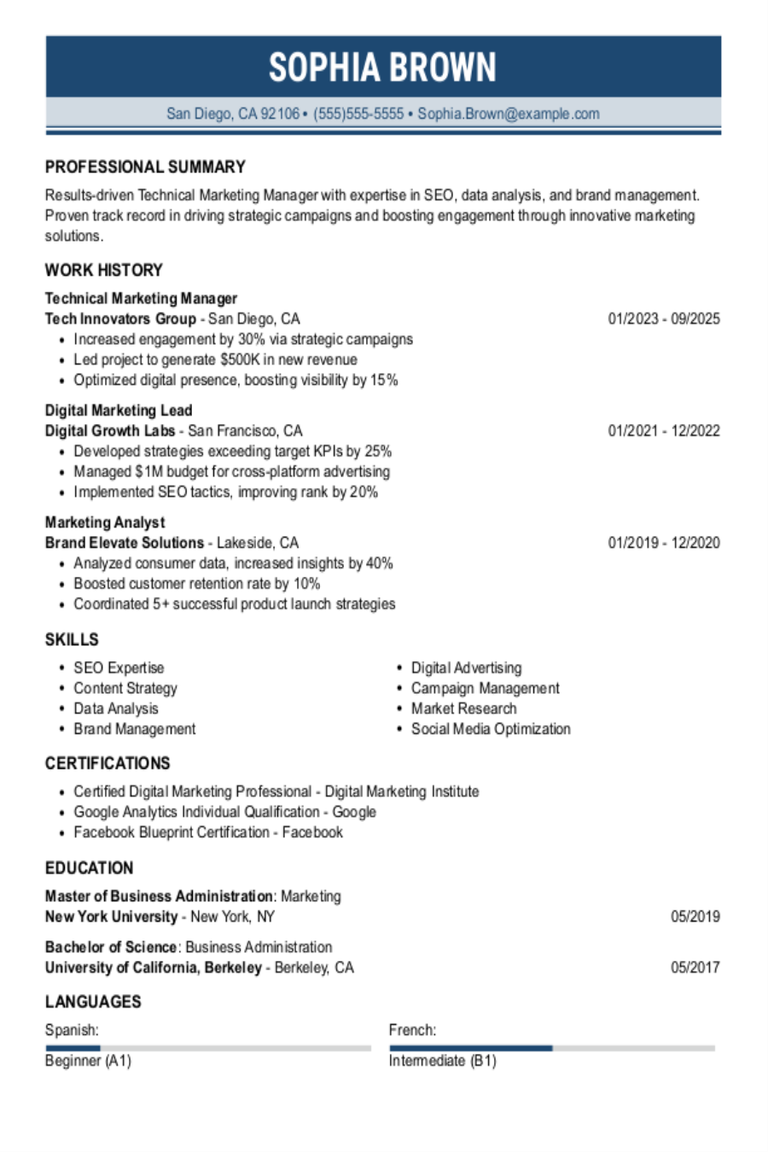

Technical Marketing Manager Resume Examples & Templates

Discover how to craft a technical marketing manager resume that shines. Learn to highlight your tech-savvy skills, marketing strategies, and project successes effectively.Build my resumeImport existing resumeCustomize this templateWhy this

Content Manager Resume Examples & Templates

Browse content manager resume examples to see how to highlight your experience organizing, creating, and sharing engaging materials across platforms. These examples and tips help you showcase creativity, leadership, and