Best Banking Resume Examples

- 30% higher chance of getting a job‡

- 42% higher response rate from recruiters‡

Our customers have been hired at:*Foot Note

Do you enjoy analysis, numbers and working with people? If so, then you should consider a career in banking. There are a variety of well-paying jobs in the banking industry for professionals of all experience levels. In this article, we explain how to get into banking jobs and the benefits of working in this industry. The U.S. Bureau of Labor Statistics (BLS) expects employment in business and financial occupations to grow 7% from 2021 to 2031.

Still, you must write a resume to beat the competition and obtain an excellent banking job. That’s why we’re here. We’ll help you build the perfect banking resume or CV and craft an effective cover letter to accompany it. Plus, we offer some great resume, CV and cover letter examples to get you started.

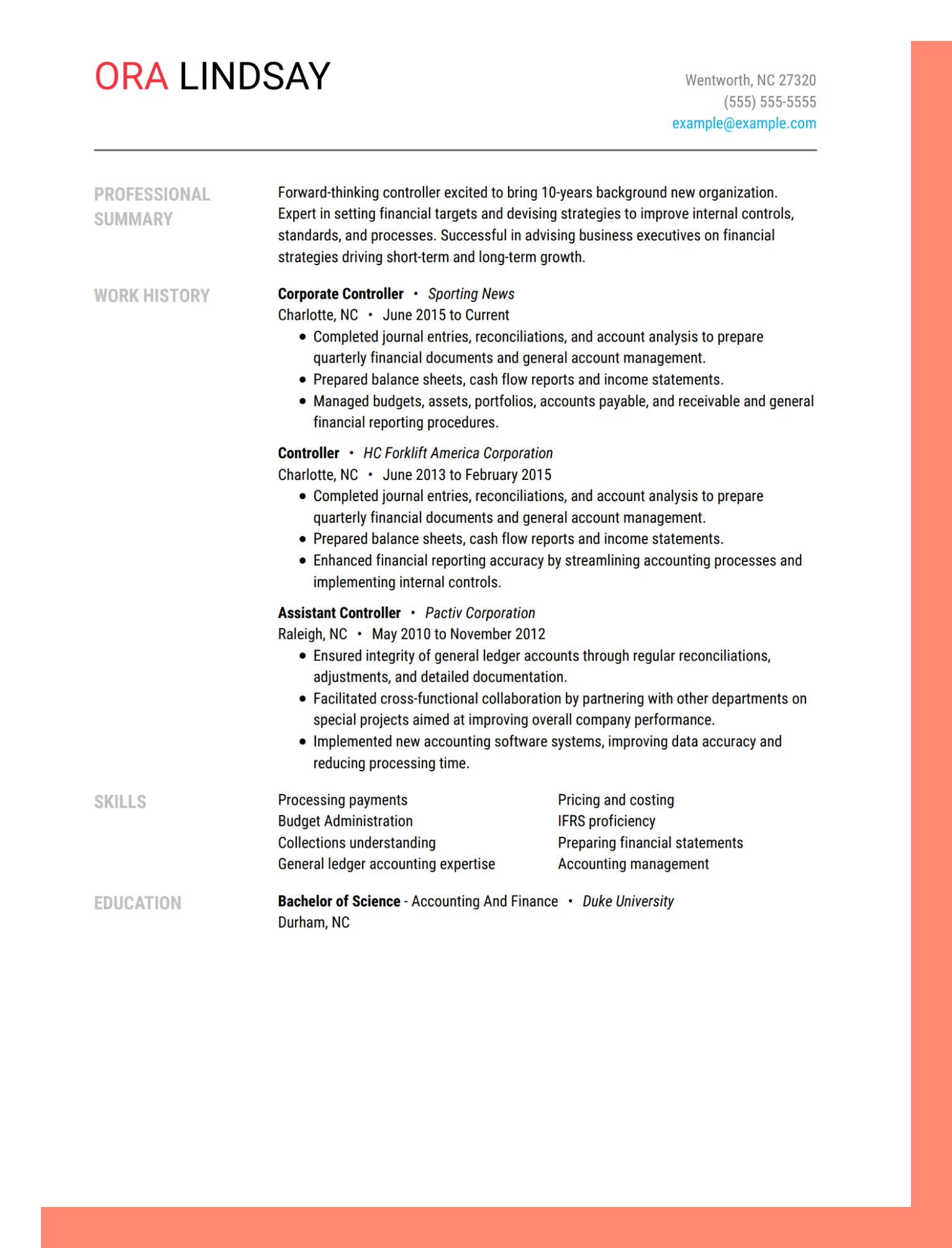

Resume examples for top banking jobs

More banking resumes by job title

Cover letter examples for top banking jobs

Our customer reviews say it best

Our resume builder makes it easy to craft an impressive, ATS-friendly resume in just minutes.

- Free professionally designed templates.

- Expert suggestions for every section of your resume.

- Start a resume from scratch or edit your existing resume.

Banking resume FAQ

What’s the ideal resume format for a banking job resume?

There are three standard resume formats. The one you choose should depend on your level of work experience and career goals.

- Functional format: Entry-level applicants will benefit from this format. The layout focuses on skills, allowing you to showcase everything that you can do.

- Combination format: This format puts the skills and work experience on equal footing. It’s a great option if you have a few years of experience.

- Chronological format: Ideal for seasoned professionals with many years of experience, this format showcases expertise through a detailed work history section.

What are some common skills required for banking jobs?

Hiring managers for banking jobs look for applicants who have a mix of soft and hard skills, specifically:

- Detail-oriented

- Organization

- Customer service

- Business operations

- MS Office Suite

- Time management

- Verbal communication

- Written communication

- Accountability

- Diplomacy

- Math

- Finance

- Analytical thinking

- Forecasting

- Budgeting

- Planning

What qualifications and certifications do employers look for in this industry?

Most banking jobs require a bachelor’s degree in finance, accounting or business. Many banking professionals obtain additional training and advanced degrees to further their careers.

What is the salary potential for banking jobs?

The average salary for a banking job in the United States in 2021 was $76,570.00, but the average salary of a professional banker will differ depending on the specific job title. For example:

- Loan Officers: $63,380.00 average salary per year.

- Personal Finance Advisors: $94,170.00 average salary per year.

- Budget Analyst: $79.940.00 average salary per year.

What does the career progression for someone in the banking industry look like?

Career progression depends on what kind of banking you do, but overall it’s a great time to join this profession.

The Bureau of Labor Statistics expects about 980,200 openings each year for the next 10 years due to industry growth and job replacement needs.