Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: By analyzing claims data to reduce fraud by 15%, the applicant’s achievements prove their ability to drive positive outcomes.

- Highlights industry-specific skills: Presenting skills like fraud detection, risk management, and client relations showcases the applicant’s expertise in navigating the insurance landscape with precision and depth.

- Uses action-oriented language: Action verbs like “analyzed” and “implemented” reflect effectiveness and initiative.

More Claims Adjuster Resume Examples

Our claims adjuster resume examples show how to spotlight your negotiation skills, analytical abilities, and insurance knowledge. Use these insurance resume samples to create a standout resume tailored to various claims roles.

Entry-Level Claims Adjuster

Why this resume works

- Effective use of keywords: Integrating keywords like “claims processing” and “risk assessment” ensures alignment with keywords strategies, optimizing the resume for applicant tracking systems (ATS) compatibility without compromising content depth.

- Shows digital literacy: The applicant’s computer skills are evident through tools used for data analysis and fraud detection, reflecting modern workplace adaptability.

- Puts skills at the forefront: Prioritizing core abilities such as team collaboration at the top reflects a skills-based resume format approach ideal for showcasing transferable expertise.

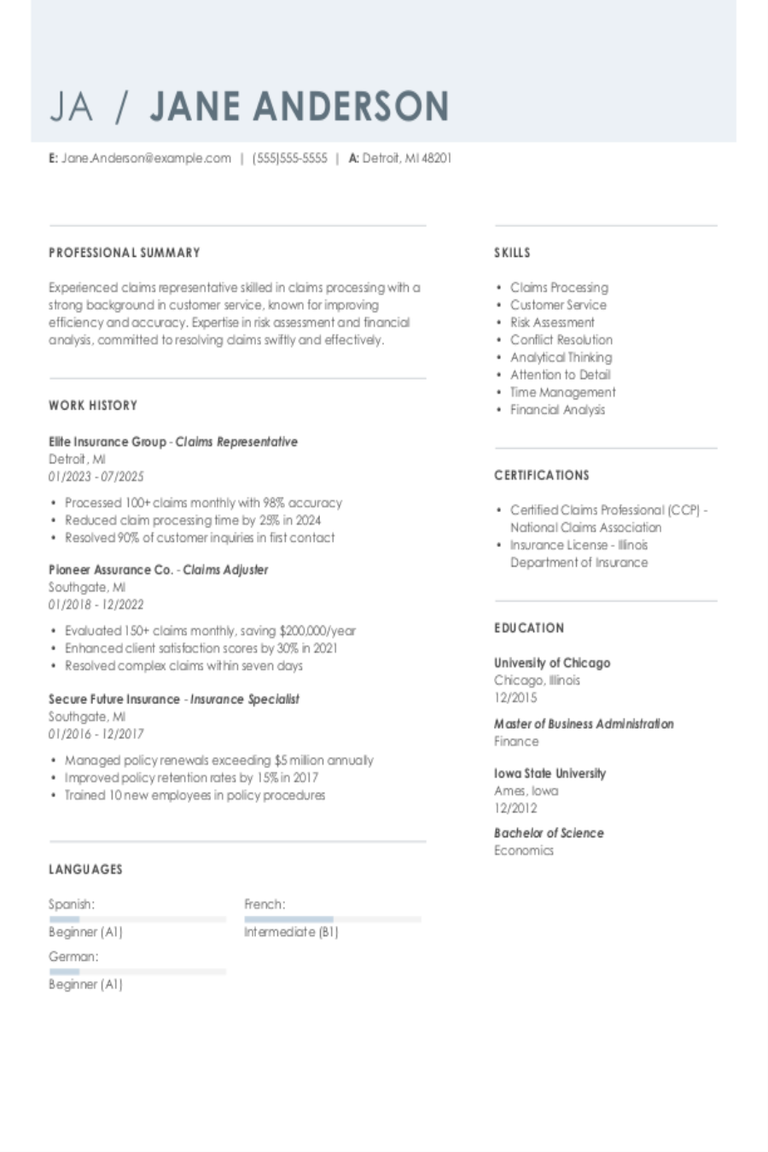

Mid-Level Claims Adjuster

Why this resume works

- Points to measurable outcomes: With achievements like reducing claim processing time by 30%, the applicant’s efficiency and impact in high-pressure environments become evident.

- Includes a mix of soft and hard skills: Combining analytical skills with interpersonal skills, the applicant adeptly balances technical expertise and effective communication to improve team dynamics and client relations.

- Demonstrates language abilities: Knowledge in Spanish, French, and German showcases versatile language skills that strengthen cross-cultural communication essential for diverse workplace interactions.

Experienced Claims Adjuster

Why this resume works

- Lists relevant certifications: Including certifications like Certified Claims Adjuster and Advanced Risk Management showcases ongoing learning and specialized expertise in claims and risk assessment.

- Focuses on work history: Using a chronological resume format effectively emphasizes extensive work experience, guiding readers through years of progressive achievements in claims processing and risk management roles.

- Sections are well-organized: Clear headers paired with concise bullet points make sections easy to scan, allowing quick identification of key accomplishments, skills, and qualifications throughout the resume.

Claims Adjuster Resume Template (Text Version)

Chris Zhang

Jacksonville, FL 32208

(555)555-5555

Chris.Zhang@example.com

Professional Summary

Expert claims adjuster with 7+ years of experience. Proven success in fraud detection, risk management, and portfolio growth within leading insurance companies. Adept at process improvement and client relations, driving substantial cost savings and efficiency enhancements.

Work History

Claims Adjuster

NorthBridge Insurance Services – Jacksonville, FL

January 2023 – August 2025

- Analyzed claims data to reduce fraud by 15%

- Resolved 200+ cases ensuring client satisfaction

- Implemented tracking system boosting efficiency by 20%

Insurance Analyst

Reliable Coverage Group – Miami, FL

January 2019 – December 2022

- Managed portfolio growth of 25% annually

- Conducted audits enhancing compliance by 10%

- Developed training improving risk assessment accuracy

Insurance Coordinator

Premium Risk Solutions – Tampa, FL

January 2016 – December 2018

- Reduced claim processing time by 30%

- Led team project achieving cost savings of $50K

- Validated insurance records increasing data precision

Languages

- Spanish – Beginner (A1)

- French – Bilingual or Proficient (C2)

- Mandarin – Beginner (A1)

Skills

- Claims Analysis

- Risk Management

- Fraud Detection

- Client Relations

- Process Improvement

- Team Leadership

- Data Management

- Audit Compliance

Certifications

- Certified Claims Professional – Claims Institute

- Certified Insurance Analyst – Insurance Institute

- Advanced Risk Management – Risk Management Society

Education

Master of Business Administration Risk Management

Columbia University New York, NY

June 2015

Bachelor of Science Insurance and Finance

University of Pennsylvania Philadelphia, PA

June 2013

Related Resume Guides

Advice for Writing Your Claims Adjuster Resume

Dive into our advice section on how to write a resume tailored for claims adjusters and discover how to highlight your negotiation skills, analytical abilities, and experience in the insurance field.

Highlight your most relevant skills

Listing relevant skills when applying for a job, like a claims adjuster, is essential because it helps employers quickly see what you can bring to the role.

A dedicated skills section lets you highlight both technical skills, such as knowledge of insurance policies and claims software, and soft skills, like communication and problem-solving abilities. This balance shows that you not only understand the technical aspects of the job but also have the interpersonal qualities needed to interact effectively with clients and colleagues.

Integrating key skills into your work experience section makes your resume even stronger. For example, if you’ve successfully managed complex claims or negotiated settlements, mention these achievements while also noting how your analytical skills or attention to detail played a part.

When writing your resume as a claims adjuster, focus on being clear and concise. Use simple language that clearly conveys what you’re good at without overwhelming the reader with jargon. Showing how your skills have helped you succeed in past roles will make a strong impression and increase your chances of landing the job.

Highlight your skills effectively by choosing a resume format that presents tools, dashboards, and data-driven decisions in a clear and structured manner.

Showcase your accomplishments

When organizing your work experience as a claims adjuster, list your jobs in reverse chronological order. This means you start with your most recent position and work backward. For each job entry, include your job title, the name of the employer, the location, and your employment dates. This format helps hiring managers see your most recent and relevant experience first.

To make your resume stand out, focus on quantifying your accomplishments rather than just listing responsibilities. Turn duties into achievements by showing measurable results like percentages or time savings. For example, instead of saying you “handled insurance claims,” say you “processed over 200 claims monthly with a 95% accuracy rate.”

Use action-oriented words to describe what you did and what impact it had. Quantified accomplishments help hiring managers quickly understand how you’ve made a difference in past roles.

By highlighting specific achievements with numbers or clear outcomes, you show potential employers that you’re effective at solving problems and improving processes. This approach makes it easier for them to see the skills you’ll bring to their team as a claims adjuster.

5 claims adjuster work history bullet points

- Investigated and resolved over 150 property damage claims monthly, achieving a 95% customer satisfaction rate.

- Negotiated settlements with policyholders and third-party vendors, resulting in a 20% decrease in claim payout costs.

- Analyzed complex insurance policies to determine coverage limits, reducing erroneous claim approvals by 30%.

- Trained and mentored a team of 10 junior adjusters, improving overall team efficiency by 25%.

- Used data analytics tools to identify fraud patterns, leading to the detection and prevention of $500k in fraudulent claims annually.

Pick a professional resume template that keeps things simple and easy to read. Use clear section headings, stick to basic fonts, and avoid fancy designs to highlight your skills and work history.

Write a strong professional summary

A professional summary on a resume is like an introduction to hiring managers, giving them a snapshot of who you are as a claims adjuster.

A professional summary consists of three to four sentences that showcase your experience, skills, and achievements. It’s ideal for those with some experience under their belt. As a claims adjuster, it highlights your professional identity and the value you bring to potential employers by summarizing what you’ve accomplished in your career so far.

On the other hand, resume objectives focus on career goals and are great for entry-level applicants, those changing careers, or individuals with employment gaps. The key difference is that while a summary shows “what I’ve accomplished,” an objective shares “what I aim to contribute.”

Now that we’ve covered these basics, let’s dive into examples of both summaries and objectives tailored for different industries and experience levels.

Claims adjuster resume summary examples

Entry-level

Recent graduate with a Bachelor of Science in insurance and risk management, eager to leverage academic foundation and internship experience in the claims adjuster role. Holds an Associate in Claims (AIC) certification, skilled in investigative techniques, and familiar with insurance policy analysis. Enthusiastic about joining dynamic teams to contribute to efficient claim processing and customer satisfaction.

Mid-career

Seasoned claims adjuster with over seven years of experience managing auto and property claims for leading insurance companies. Strong track record of effectively negotiating settlements, conducting detailed investigations, and maintaining compliance with industry regulations. Proficient in Xactimate software and known for reducing claim turnaround times through strategic case handling.

Experienced

Veteran claims adjuster with more than 15 years of expertise in complex liability claims management. Proven leader adept at mentoring junior adjusters, streamlining claim operations, and implementing best practices that improve accuracy and efficiency. Certified Senior Claims Adjuster (CSCA) committed to driving team success while ensuring high customer service standards.

Claims adjuster resume objective examples

Entry-level

Detail-oriented and analytical recent business administration graduate seeking an entry-level claims adjuster position. Aiming to leverage strong problem-solving skills and foundational knowledge in insurance principles to accurately assess claims and ensure fair settlement processes within a reputable insurance firm.

Career changer

Dedicated former customer service professional transitioning into a claims adjuster role, with excellent communication and negotiation skills developed over five years in client-facing roles. Eager to use these abilities along with newly acquired insurance training to effectively manage claims and improve customer satisfaction.

Recent graduate

Driven individual with a bachelor’s degree in finance seeking a claims adjuster role to apply analytical skills and attention to detail in assessing complex insurance claims. Committed to contributing positively to a dynamic team environment while gaining valuable industry experience.

As a claims adjuster, you can use our AI Resume Builder to easily organize your experiences and skills with ready-made templates. This makes your resume stand out without extra hassle.

Match your resume to the job description

Customizing your resume to fit a job description is key. It makes you stand out and helps you pass through ATS. ATS software scans resumes for specific keywords and phrases from the job posting. If your resume has these keywords, it’s more likely to catch the employer’s attention.

An ATS-friendly resume includes keywords that align your skills and experiences with those in the job description. This increases your chances of getting noticed by hiring managers. Keywords should be relevant to the role you’re applying for, like “risk management” or “insurance regulations.”

To find keywords in job postings, look for repeated skills, qualifications, and duties. For example, if a posting mentions “claims processing,” “fraud detection,” or “data analysis” several times, use these exact phrases in your resume.

Incorporate these terms naturally into your resume content. Instead of copying phrases directly, rewrite them to fit your experiences. For example, change “conducted audits” to “effectively conducted audits to enhance compliance by 20%.”

Targeted resumes improve compatibility with ATS and show employers that you have what they need. Customizing your resume not only helps it get past digital filters but also shows that you’ve taken the time to understand what the company is looking for.

Make sure your resume gets noticed by hiring managers! Our ATS Resume Checker finds common mistakes and gives advice to help you improve and pass ATS.

Salary Insights for Claims Adjusters

Knowing salary data helps people choose the best career path or decide if they should move.

Top 10 highest-paying states for claims adjusters

Claims Adjusters earn varying salaries across the United States, with a national average of $76,880. The table below highlights the states where claims adjusters command the highest compensation.

Our salary information comes from the U.S. Bureau of Labor Statistics’ Occupational Employment and Wage Statistics survey. This official government data provides the most comprehensive and reliable salary information for claims adjusters across all 50 states and the District of Columbia. The figures presented here reflect the May 2025 dataset, which is the most recent available as of this publication.

| State | Average Salary |

|---|---|

| Connecticut | $93,640 |

| California | $92,060 |

| District of Columbia | $92,830 |

| Maryland | $91,080 |

| New Jersey | $90,390 |

| Alaska | $89,220 |

| New York | $88,020 |

| Massachusetts | $88,090 |

| Rhode Island | $87,280 |

| Washington | $83,810 |

FAQ

Do I need to include a cover letter with my claims adjuster resume?

Yes, including a cover letter with your claims adjuster resume can improve your application by highlighting your unique skills and experiences.

A cover letter lets you emphasize your attention to detail and analytical skills, which are important in assessing insurance claims accurately.

For instance, if the company specializes in auto claims or property damage, you can discuss your experience in these areas or express interest in expanding your expertise.

Consider using a Cover Letter Generator to craft a personalized cover letter that aligns with the job description and showcases your qualifications effectively.

Additionally, reviewing cover letter examples specific to the insurance industry can provide valuable insights into crafting a compelling narrative about why you’re an ideal fit for the role.

How long should a claims adjuster’s resume be?

For a claims adjuster, a one-page resume is often sufficient to showcase key skills like analytical thinking, negotiation abilities, and experience in handling insurance claims.

If you possess extensive experience or specialized certifications, such as in property damage or liability claims, choosing a two-page resume might be more suitable. This allows for detailing your expertise without losing clarity.

Focus on recent and relevant roles that demonstrate your efficiency in adjusting claims. Consider exploring our guide on how long a resume should be to find examples and tips tailored to your career stage.

How do you write a claims adjuster resume with no experience?

When writing a resume with no experience, concentrate on highlighting your skills, education, and any related activities that showcase your potential for the claims adjuster role. Follow these tips:

- Emphasize relevant coursework: If you studied finance, insurance, or business administration, highlight courses that relate to risk management or analysis. This shows foundational knowledge beneficial for a claims adjuster position.

- Showcase transferable skills: Skills like negotiation, problem-solving, and attention to detail are important for claims adjusters. Include any experiences where you’ve demonstrated these abilities, even in unrelated jobs or volunteer work.

- Include industry-related certifications: If you’ve completed any certification like an Associate in Claims (AIC) or a similar program, list them prominently as it demonstrates your commitment to the field.

- Highlight internships or volunteer work: If you’ve interned at an insurance company or volunteered in roles requiring analytical skills, these experiences can substitute formal job experience.

Rate this article

Claims Adjuster

Share this page

Additional Resources

Medical Claims Processor Resume Examples & Templates

Explore medical claims processor resume examples and tips to learn how to highlight your accuracy, attention to detail, and ability to manage complex information efficiently.Build my resumeImport existing resumeCustomize this

Claims Representative Resume Examples & Templates

Discover how claims representatives can highlight their skills in evaluating claims and assisting customers. These resume examples and tips will help you craft a resume that showcases your experience handling

The Illusion of Wage Growth: Where Paychecks Stretch the Farthest

U.S. wages have climbed at one of the fastest rates in modern history. Between 2020 and 2024, the average American worker’s pay rose from about $64,000 to $75,600, an 18%

100+ Resume Objective Statement Examples & Best Practices

In just a sentence or two, a resume objective statement tells hiring managers the role or career path you’re aiming for and the unique skills and value you bring to

150+ Skills for a Resume: Examples for Any Job

Crafting a standout resume starts with highlighting the skills and qualifications that demonstrate your fit for the role. But in a crowded job market, knowing which abilities will actually catch

When to Use a Two Page Resume (With Examples & Formatting Tips)

If you’ve spent years building your skills, growing in your career, and racking up accomplishments, a one-page resume might not cut it. A two-page resume gives you space to present a