Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Measurable accomplishments like reducing costs by 15% and saving 20 hours monthly highlight the applicant’s results-oriented performance.

- Showcases career progression: The career trajectory from bookkeeping associate to accounting specialist shows consistent growth, with increasing oversight of multi-million dollar audits and strategic cost-saving initiatives over time.

- Uses action-oriented language: Action verbs like managed, streamlined, and automated emphasize proactive leadership and efficiency-driven methods.

More Accounting Resume Examples

Our accounting resume examples show how to feature your analytical skills, attention to detail, and financial expertise. Use these samples to create a resume that highlights your strengths and makes you stand out in finance roles.

Entry-Level Accounting Resume

Why this resume works

- Effective use of keywords: Strategically incorporating terms like “accounts payable” and “invoice processing,” the applicant leverages keywords to boost ATS compatibility.

- Shows digital literacy: Using QuickBooks and Excel showcases the applicant’s computer skills, indicating a readiness for tech-driven accounting environments.

- Centers on academic background: Earning an MBA in finance shows the applicant’s commitment to academic excellence, important for those early in their career path.

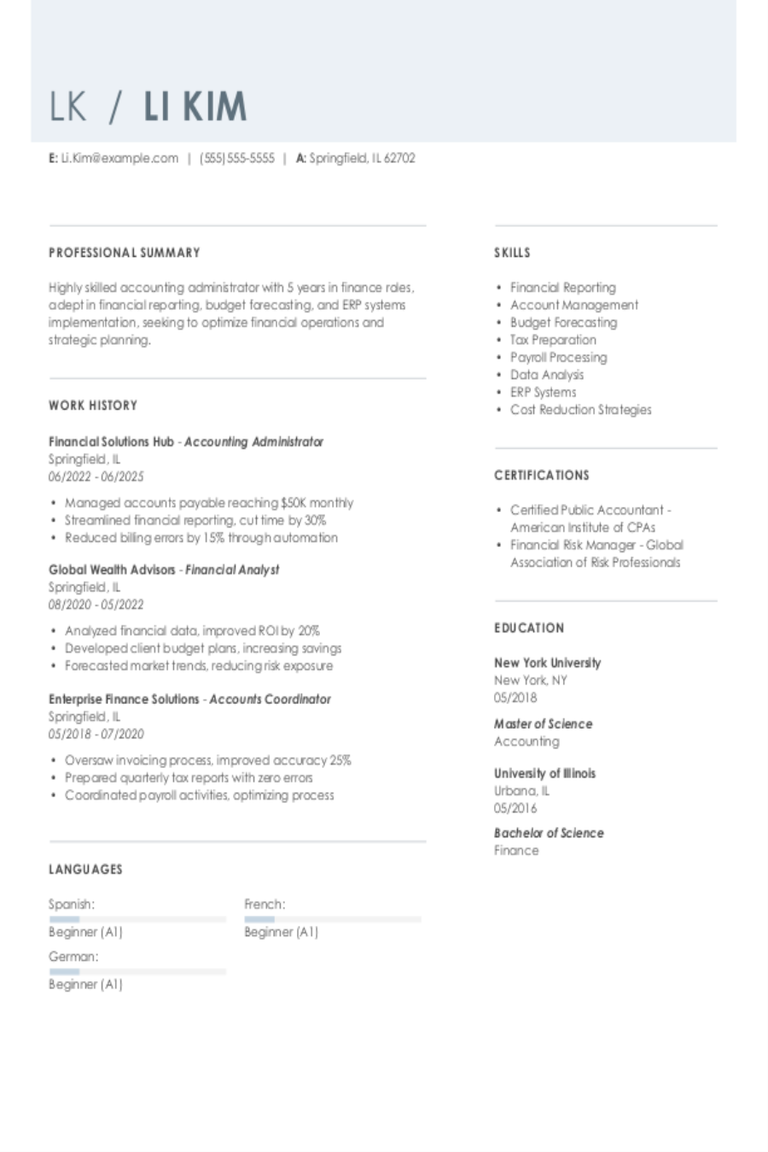

Mid-Level Accounting Resume

Why this resume works

- Points to measurable outcomes: By reducing auditing time by 15% and managing accounts with 98% accuracy, the applicant showcases their efficiency and precision in financial operations.

- Demonstrates language abilities: Language skills in Spanish, French, and Mandarin indicate the applicant’s ability for cross-cultural communication.

- Includes a mix of soft and hard skills: The mix of technical expertise, like GAAP compliance, with interpersonal skills and mentoring roles highlights the applicant’s diverse skill set.

Experienced Accounting Resume

Why this resume works

- Lists relevant certifications: Listing two key certifications, CPA and CMA, strengthens the applicant’s expertise in finance and dedication to continual professional development.

- Showcases impressive accomplishments: By developing a savings plan that cut expenditures by 20%, the applicant’s accomplishments clearly illustrate significant business impact and senior-level performance.

- Emphasizes leadership skills: Managing a team of 12 accountants as a finance manager, the applicant effectively showcases their leadership skills and ability to guide teams towards success.

Explore Even More Accounting Resumes

Accounting Resume Template (Text Version)

Olivia Davis

Westbrook, ME 04098

(555)555-5555

Olivia.Davis@example.com

Professional Summary

Experienced accounting specialist with expertise in audit management, cost reduction, and financial analysis. Proven track record in boosting operational efficiency and driving growth through data-driven strategies.

Work History

Accounting Specialist

Greenfield Corporate Solutions – Westbrook, ME

January 2023 – July 2025

- Managed accounts with 15% cost reduction.

- Automated processes saving 20 work hours monthly.

- Prepared quarterly audits worth $5M.

Financial Analyst

Pacific Finance Group – Westbrook, ME

January 2021 – January 2023

- Forecasted earnings with 95% accuracy.

- Streamlined reporting, reducing errors by 30%.

- Led budget analysis for $10M projects.

Bookkeeping Associate

Harmony Accounting Services – Westbrook, ME

July 2020 – January 2021

- Managed invoicing improving cash flow by 25%.

- Implemented tax compliance reducing liabilities.

- Created expense reports enhancing transparency.

Skills

- Financial Analysis

- Audit Management

- Tax Compliance

- Cost Reduction Strategies

- Automated Reporting

- Budget Management

- Cash Flow Optimization

- Data-Driven Decision Making

Education

Master’s in Accounting Accounting

Columbia University New York, NY

May 2020

Bachelor’s in Finance Finance

New York University New York, NY

May 2018

Certifications

- Certified Public Accountant – American Institute of CPAs

- Financial Risk Manager – Global Association of Risk Professionals

- Chartered Financial Analyst – CFA Institute

Languages

- Spanish – Beginner (A1)

- Mandarin – Beginner (A1)

- French – Intermediate (B1)

Browse Resume Examples by Industry

- Banking

- Billing And Collections

- Biology

- Boating

- Business Operations

- Casino

- Chemistry

- Child Care

- Civil Engineering

- Compliance

- Computer Hardware

- Computer Software

- Construction

- Copywriting

- Cosmetology

- Costco

- Culinary

- Customer Service

- Dance

- Data Systems Administration

- Deloitte

- Dentistry

- Driving

- Education

- Electrical

- Electrical Engineering

- Energy

- Engineering

- Entertainment

- Entrepreneur

- Entry Level

- Environmental

- Environmental Science

- Event Planning

- Executive

- Fashion

- Film

- Finance

- Fitness And Nutrition

- Food Service

- Freelancing

- General Laborer

- Goldman Sachs

- Government

- Graphic Design

- Healthcare Support

- Hospitality

- Human Resources

- HVAC

- Industrial Engineering

- Information Technology

- Insurance

- Interior Design

- Inventory Management

- Janitorial

- Landscaping

- Language Services

- Law

- Law Enforcement

- Library

- Logistics

- Maintenance

- Marketing

- McKinsey

- Mechanical Engineering

- Mechanics

- Media And Communication

- Medical

- Mental Health

- Meta

- Metal Work

- Military

- Mining

- Museum

- Music

- Netflix

- Non Profit

- Nursing

- Pharmaceutical

- Photography

- Physical Therapy

- Plumbing

- Politics

- Production

- Program Manager

- Project Manager

- Psychology

- Purchasing

- Quality Control

- Real Estate

- Religion

- Retail

- Safety And Security

- Sales

- Sciences

- Shipping

- Social Services

- Special Education

- Sports

- Statistics

- Student

- Teaching

- Team Lead

- Tesla

- Training And Development

- Transportation

- Travel

- Veterinary

- Walgreens

- Walmart

- Web Development

Advice for Writing Your Accounting Resume

Explore our tips on how to write a resume for an accounting role and learn how to highlight your skills in financial analysis, bookkeeping, and tax preparation while making your accomplishments shine.

Highlight your most relevant skills

When applying for an accounting job, listing relevant skills is very important. It helps employers quickly see if you have what it takes to do the job well. By creating a dedicated skills section, you can clearly show your strengths and make sure they stand out.

Balance technical skills, like using accounting software or preparing financial statements, with interpersonal skills, like communication and teamwork. This mix shows you’re not only good with numbers but also able to work well with others.

To make your resume even stronger, try to weave key skills into your work experience section. For example, instead of just saying you managed budgets in a past job, explain how your budgeting skills helped save money or improve efficiency. This gives real-life examples of how your skills made a difference.

Doing this helps employers see the value you bring and makes your application more compelling. Remember, showing rather than just telling about your abilities can make all the difference in getting that interview for an accounting role.

For accountants, choose a resume format that highlights your accuracy, analytical skills, and financial expertise right away.

Showcase your accomplishments

When organizing your work experience for an accounting role, list each job in reverse chronological order. This means you start with your most recent position and work backward. Each entry should clearly state your job title, the employer’s name, location, and the dates you were employed there.

This format makes it easy for hiring managers to see your career progression and understand where you’ve gained relevant experience.

Instead of just listing what you did at each job, focus on what you accomplished using numbers to tell your story. For example, rather than saying “handled accounts payable,” say “reduced accounts payable processing time by 30%.”

Use action words like “improved,” “managed,” or “increased” to describe how you made a difference. Think about ways you’ve saved money, increased efficiency, or achieved something noteworthy on the job. Numbers make these achievements stand out and show potential employers that you’re results-driven.

Quantified accomplishments help hiring managers quickly see your impact and skills in accounting. Turning duties into achievements gives them a clearer picture of what you can bring to their team. It shows that you’re not only capable but also effective in improving processes or contributing positively to the company’s bottom line.

5 accounting work history bullet points

- Managed financial reporting processes, resulting in a 25% reduction in report preparation time.

- Implemented a new accounts payable system, decreasing payment cycle times by 30%.

- Reconciled monthly bank statements for accuracy, identifying and resolving discrepancies worth $50,000.

- Collaborated with auditors during annual audits, leading to zero audit findings for two consecutive years.

- Analyzed budget variances quarterly to optimize spending, saving the company $100,000 annually.

Choose a simple and clean resume template with clear section headings and readable fonts, avoiding elaborate designs so your skills and experience stand out effectively.

Write a strong professional summary

A professional summary on a resume serves as an introduction to hiring managers, offering a quick snapshot of your skills and experience. It’s the first impression you’ll make, so it needs to instantly grab their attention. When building your resume, you should decide whether to include a summary or an objective statement based on where you are in your career.

A professional summary typically consists of three to four sentences that showcase your experience, key skills, and accomplishments. This format is ideal for applicants with relevant work history who want to highlight their expertise and value upfront. For instance, in accounting roles, it could emphasize strengths like financial reporting or budgeting while demonstrating measurable success in streamlining processes.

Resume objectives, on the other hand, focus more on career goals rather than past achievements. They’re particularly useful for entry-level job seekers, those switching careers, or individuals re-entering the workforce after time away.

Now that you know the difference between summaries and objectives, let’s explore examples tailored for different industries and stages of experience. See our library of resume examples for additional ideas.

Accounting resume summary examples

Entry-level

Recent accounting graduate with a Bachelor of Science in Accounting and completion of an internship focused on financial reporting and reconciliation. Proficient in using Excel, QuickBooks, and other accounting software to manage budgets and analyze data. Eager to contribute strong analytical skills and attention to detail to support organizational financial goals.

Mid-career

Detail-oriented accountant with 7+ years of experience managing accounts payable, accounts receivable, and month-end closings for mid-sized companies. Skilled in preparing financial statements, ensuring compliance with GAAP standards, and using ERP systems like SAP. Known for streamlining workflows that reduce processing time by 15% while maintaining accuracy.

Experienced

Seasoned accounting professional with over 15 years of leadership experience directing financial operations for multinational firms. Expertise in strategic planning, audit management, and implementation of cost-saving initiatives that resulted in a $2M annual expense reduction. A CPA holder committed to mentoring teams and driving organizational growth through data-driven decision-making.

Accounting resume objective examples

Recent graduate

Detail-oriented recent accounting graduate with a Bachelor of Science in Accounting, aiming to secure an entry-level accounting position. Looking to apply strong analytical skills and academic knowledge in financial reporting, auditing, and tax preparation to contribute effectively to a dynamic finance team.

Career changer

Highly motivated professional transitioning into the accounting field, bringing a solid background in project management and data analysis. Eager to leverage transferable skills such as attention to detail, problem-solving abilities, and skill in Excel to support accurate financial operations and drive organizational success.

Entry-level

Dedicated individual seeking an entry-level accounting role where a foundation in bookkeeping, payroll processing, and financial statement preparation can be used. Committed to continuous learning and contributing to the accuracy of financial records while supporting the overall objectives of the finance department.

Use our Resume Builder to make your accounting resume stand out. It offers easy-to-use templates that let you highlight your skills and experience clearly.

Match your resume to the job description

Tailoring your resume to the job description is key because it helps you stand out and get noticed by employers. Many companies use applicant tracking systems (ATS) to filter resumes. These systems look for specific keywords from the job posting, so matching your resume with these words can make a big difference in getting through to human eyes.

An ATS-friendly resume uses keywords that match both the job description and your skills. This doesn’t just help the ATS recognize you as a strong fit; it also makes sure hiring managers see what they are looking for at a glance.

To find the right keywords, carefully read through the job posting. Look for skills or duties that show up more than once. For example, if you’re applying for an accounting position and see terms like “financial analysis,” “budget management,” or “account reconciliation,” those should be included in your resume.

Incorporating these terms naturally is important. Instead of just listing them, weave them into your work experience. If you’ve done something similar before, describe it using their language—for instance, change “managed company finances” to “performed financial analysis and budget management.”

Targeted resumes increase your chances of passing ATS checks and catching a recruiter’s eye. By aligning your resume with what employers want, you’ll not only get past initial screenings but also make a strong impression when someone reads it.

Want to make sure your resume gets through ATS? Try our ATS Resume Checker to find what needs fixing and boost your chances right away.

FAQ

Do I need to include a cover letter with my accounting resume?

Including a cover letter with your accounting resume can boost your application and show a genuine interest in the role. A cover letter lets you highlight key qualifications, such as skill in financial analysis or regulatory compliance, aligning them with the job description.

For instance, if the company focuses on tax planning or audit services, you can emphasize your relevant certifications (like a CPA) or specific experience in those areas. You can also use it to address unique aspects of your background, such as transitioning from public to corporate accounting or expertise in using software like QuickBooks or SAP.

Taking time to write a tailored cover letter shows attention to detail—a skill highly valued in accounting—and sets you apart from candidates who only submit a resume.

You can use our Cover Letter Generator for professional templates and content suggestions. Explore cover letter examples for more inspiration.

How long should an accounting resume be?

For an accountant, a one-page resume is typically ideal. This length effectively showcases key skills like familiarity with accounting software, accuracy in financial reporting, and experience with audits and tax compliance.

If you have extensive experience or specialized certifications that add value, extending to a two-page resume can be appropriate. Ensure each detail is relevant, focusing on recent roles and achievements to maintain the reader’s interest.

Highlight critical competencies such as analytical abilities and problem-solving skills essential for accounting tasks. Explore our guide on how long a resume should be for examples and tips tailored to your career stage.

How do you write an accounting resume with no experience?

If you’re crafting an accounting resume with no formal experience, focus on highlighting education, skills, and relevant coursework or projects to show your potential for the role. Here are a few tips on writing a resume with no experience:

- Emphasize your education: Start with your degree in accounting or a related field. Include the institution name, graduation date, and any academic honors or awards you received.

- Showcase relevant coursework: List specific accounting courses that are relevant to the job you’re applying for, such as financial accounting, auditing, or tax preparation.

- Highlight software skill: Demonstrate familiarity with accounting software like QuickBooks or Excel. Mention any certifications you’ve earned in these programs.

- Include transferable skills: Focus on skills such as analytical thinking, attention to detail, and problem-solving abilities. If you’ve had internships or volunteer roles involving numbers or data analysis, be sure to include them.

- Add personal projects: Mention any personal projects where you’ve applied accounting principles—like managing budgets for clubs or organizations.

These elements will help present a strong case for your capabilities even without direct experience in accounting roles.

Share this page

Additional Resources

Accounting Officer Resume Examples & Templates

Explore accounting officer resume examples and tips to learn how to showcase your bookkeeping experience, number skills, and exceptional attention to detail.Build my resumeImport existing resumeCustomize this templateWhy this

Accounting Manager Resume Examples & Templates

Explore accounting manager resume examples and tips that can help you highlight your budgeting skills and experience in managing financial reports effectively.Build my resumeImport existing resumeCustomize this templateWhy this resume

Accounting Clerk Resume Examples & Templates

Explore accounting clerk resume examples that highlight key bookkeeping skills. Discover how to showcase your financial experience and grab the attention of hiring managers.Build my resumeImport existing resumeCustomize this templateWhy

Accounting Administrator Resume Examples & Templates

Explore accounting administrator resumes that show how to highlight your ability to manage financial records, handle invoices, and assist with budgeting.Build my resumeImport existing resumeCustomize this templateWhy this resume

The Illusion of Wage Growth: Where Paychecks Stretch the Farthest

U.S. wages have climbed at one of the fastest rates in modern history. Between 2020 and 2024, the average American worker’s pay rose from about $64,000 to $75,600, an 18%

100+ Resume Objective Statement Examples & Best Practices

In just a sentence or two, a resume objective statement tells hiring managers the role or career path you’re aiming for and the unique skills and value you bring to