Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

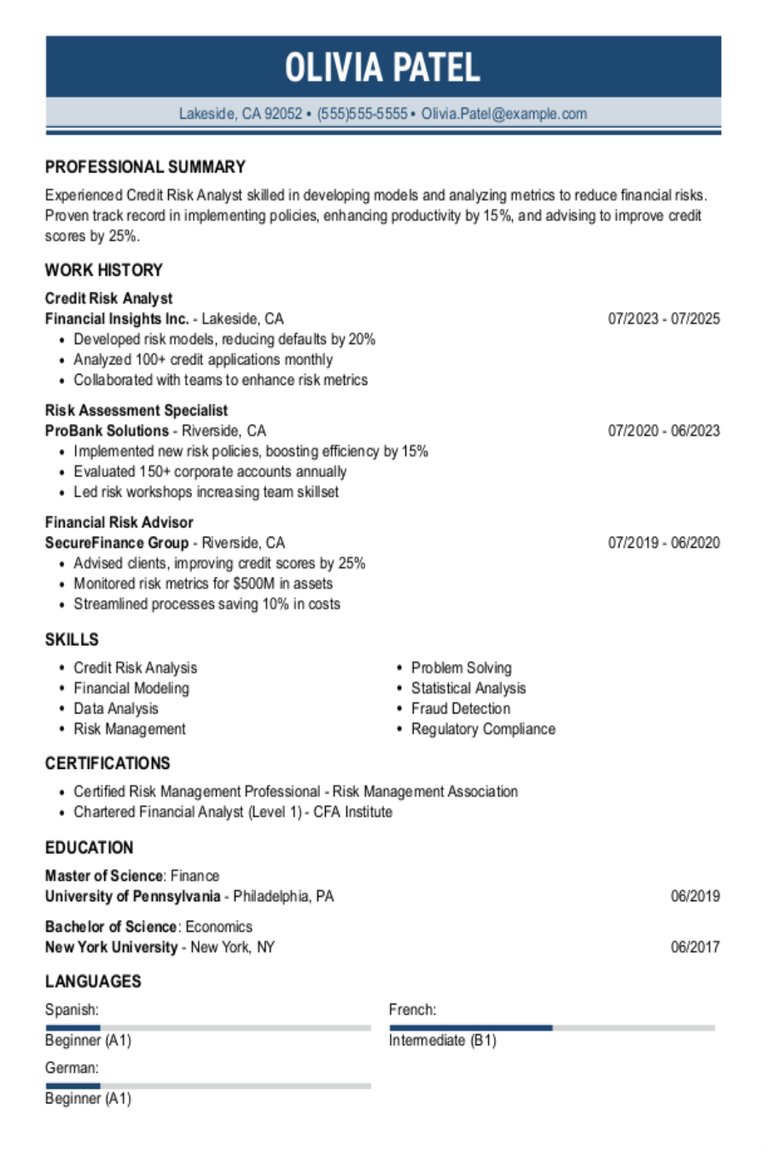

Why this resume works

- Quantifies accomplishments: By pulling metrics like reducing risk incidents by 15% and saving $200K, the applicant’s resume accomplishments show a strong impact on financial safety.

- Uses action-oriented language: The use of action verbs such as “analyzed,” “developed,” and “collaborated” effectively conveys initiative and effectiveness.

- Showcases career progression: Progressing from credit risk analyst to a senior role as risk analyst highlights increasing responsibility and showcases career growth in managing complex financial environments.

More Risk Analyst Resume Examples

See our risk analyst resume examples to learn how to highlight your risk assessment skills, analytical expertise, and ability to manage uncertainty. These business operations resume samples will help you create a resume that meets industry standards and showcases your capabilities effectively.

Entry-Level Risk Analyst

Why this resume works

- Effective use of keywords: Incorporating industry-specific terms like risk assessment and compliance, the applicant skillfully uses keywords to optimize their resume for applicant tracking systems (ATS).

- Puts skills at the forefront: Positioning skills such as financial analysis and leadership prominently, the resume exemplifies a skills-based resume format ideal for showcasing capability over experience.

- Shows digital literacy: By detailing achievements in data modeling and quantitative analysis, the applicant emphasizes essential computer skills that align with modern digital workplace demands.

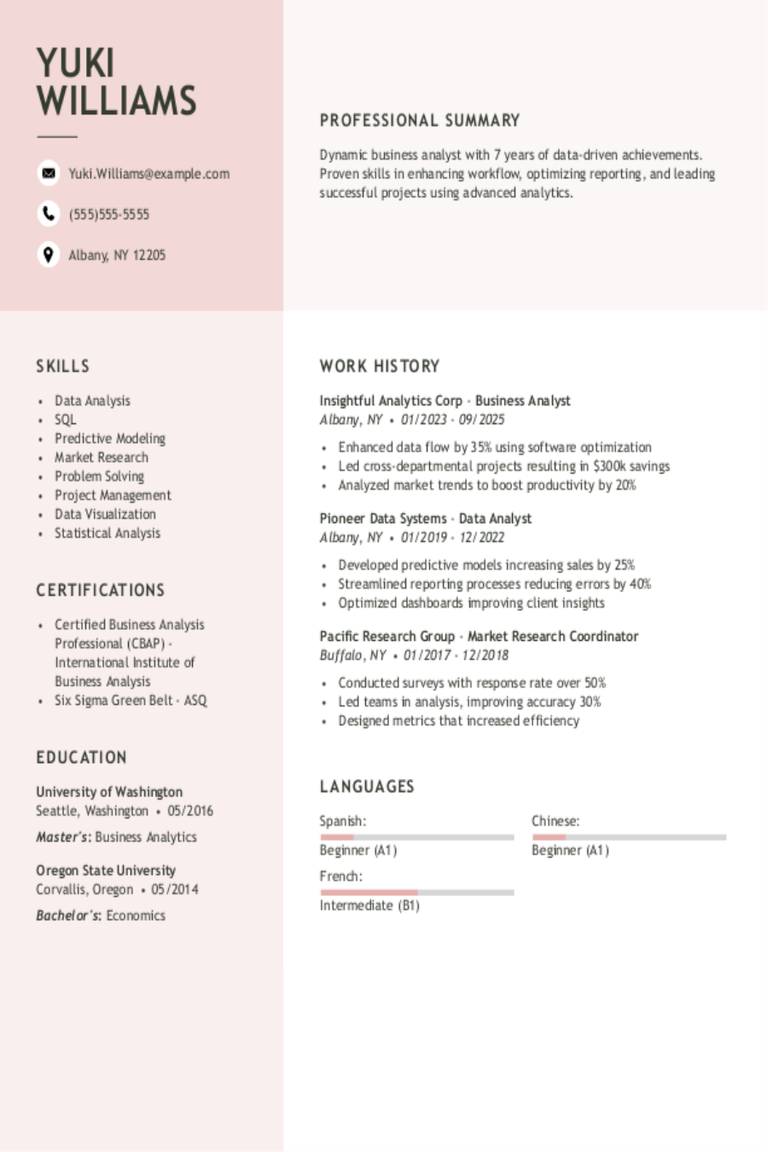

Mid-Level Risk Analyst

Why this resume works

- Points to measurable outcomes: Tackling complex challenges with a results-driven mindset, the applicant’s efforts led to significant reductions in errors and financial losses, showcasing impactful contributions across various roles.

- Displays technical expertise: The applicant’s expertise shines through certifications like Certified Risk Manager, making them well-equipped to handle intricate risk assessment tasks and financial modeling projects effectively.

- Demonstrates language abilities: Possessing language skills in Spanish, French, and Chinese improves the applicant’s ability to engage in cross-cultural communications and international collaborations.

Experienced Risk Analyst

Why this resume works

- Showcases impressive accomplishments: By reducing risks by 25% as a risk analyst and publishing research, this applicant’s accomplishments show their impact and expertise in financial risk management.

- Emphasizes leadership skills: Managing teams to develop assessment tools and mentoring junior analysts showcases the applicant’s leadership skills in fostering team growth and driving successful projects.

- Sections are well-organized: The resume’s clean layout with clear headers and succinct bullet points ensures information is easily accessible, making it reader-friendly and well-organized for quick scanning.

Risk Analyst Resume Template (Text Version)

Suki Chen

Westbrook, ME 04095

(555)555-5555

Suki.Chen@example.com

Professional Summary

Experienced Risk Analyst adept at data-driven risk assessment and financial analysis, enhancing risk mitigation with quantifiable results in high-stakes environments.

Work History

Risk Analyst

Secure Finance Solutions – Westbrook, ME

January 2023 – June 2025

- Analyzed risk data, reducing incidents by 15%

- Developed risk assessment frameworks, saving 0K

- Collaborated with teams for risk mitigation strategies

Financial Risk Specialist

Integrity Investment Partners – Westbrook, ME

January 2021 – December 2022

- Identified risk patterns, boosting efficiency by 10%

- Assessed investment risks, improving returns by 8%

- Managed a team to audit financial processes

Credit Risk Analyst

TrustBank Financial Group – Portland, ME

January 2020 – December 2020

- Analyzed credit data, enhancing credit limits 12%

- Streamlined risk reporting, increasing accuracy by 30%

- Trained staff on risk evaluation procedures

Skills

- Risk Assessment

- Financial Analysis

- Data Interpretation

- Quantitative Analysis

- Strategic Planning

- Financial Modeling

- Problem Solving

- Decision Making

Education

Master of Science Financial Engineering

New York University New York, NY

December 2019

Bachelor of Science Economics

University of California, Los Angeles Los Angeles, CA

December 2017

Certifications

- Certified Risk Management Professional – Global Risk Institute

- Financial Risk Manager – Global Association of Risk Professionals

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Related Resume Guides

- Business Management Professional

- Business Operations Manager

- Compliance Analyst

- Compliance Manager

- Controller

- Director of Operations

- Enterprise Management Trainee

- General Manager

- Global Mobility Specialist

- Manager

- Operations Analyst

- Operations Coordinator

- PMO Analyst

- Process Analyst

- Reporting Analyst

- Vendor Manager

Advice for Writing Your Risk Analyst Resume

Explore our tailored advice on how to write a resume for a risk analyst role and discover how to highlight your analytical skills, attention to detail, and ability to manage uncertainty. Whether you’re crunching numbers or assessing potential threats, our tips will help you craft a resume that stands out in the world of risk management.

Highlight your most relevant skills

Listing relevant skills when applying for a job like a risk analyst is very important because it helps employers quickly see that you have the abilities they need.

By creating a dedicated skills section, you can highlight both your technical skills and interpersonal skills, showing that you’re well-rounded. For example, key technical skills might include data analysis, financial modeling, and risk assessment. Important soft skills could be problem-solving, communication, and attention to detail.

Integrate these key skills into your work experience section to show how you’ve used them in real jobs. This makes your resume stronger because it gives concrete examples of how you’ve applied your abilities in the past.

For instance, instead of just listing “data analysis” as a skill, you could describe a project where you analyzed data to forecast potential risks and helped your team make better decisions. This approach not only lists your skills but also shows how they made an impact in your previous roles.

Pick a resume format that presents tools, dashboards, and data-driven decisions in a clear and logical manner to highlight your insights effectively.

Showcase your accomplishments

When crafting your resume as a risk analyst, it’s important to showcase your accomplishments in reverse chronological order. Start with your most recent job and work backwards. For each position, include your job title, employer name, location, and the dates you were employed. This clear layout helps employers quickly spot where you’ve worked and for how long.

Instead of just listing tasks you performed, focus on what you achieved. Quantifying accomplishments makes your resume stand out. Use numbers to demonstrate impact, like the percentage by which you reduced risks or the cost savings you implemented. Turning duties into achievements shows hiring managers the real value you brought to previous roles.

Use strong action words that highlight core duties and measurable achievements. Words like “improved,” “reduced,” or “increased” paired with specific results help convey your success. Quantified accomplishments give employers a quick understanding of your skills and impact in past roles, making it easier for them to see how you’ll contribute as a risk analyst in their company.

5 risk analyst work history bullet points

- Conducted risk assessments for 20+ financial portfolios, identifying potential threats and reducing losses by 15%.

- Developed and implemented a risk management framework that improved reporting accuracy by 25% across the organization.

- Collaborated with cross-functional teams to streamline risk analysis processes, improving efficiency by 40%.

- Used data analytics tools to monitor market trends, successfully predicting risks and averting potential crises.

- Led training sessions for junior analysts, improving team performance and analysis speed by 30%.

Pick a clean and simple resume template with basic fonts and clear sections, skipping bright colors or images that might distract from the information you want employers to notice.

Write a strong professional summary

A professional summary is a brief introduction at the top of your resume that gives hiring managers a snapshot of who you are. You can decide between a professional summary and a resume objective depending on your experience level and career goals.

A professional summary consists of three to four sentences highlighting your experience, skills, and achievements. It’s ideal for experienced applicants like risk analysts who want to showcase their professional identity and the value they bring to potential employers. This section helps paint a picture of what you’ve accomplished in your field.

In contrast, a resume objective focuses on career goals and is best for entry-level candidates, career changers, or those with employment gaps. While summaries highlight “what I’ve accomplished,” objectives focus on “what I aim to contribute.”

Now that we understand both options, let’s explore examples tailored for various industries and levels of experience, starting with roles like risk analyst. Explore our library of resume examples for additional inspiration.

Risk analyst resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in Finance and a minor in statistics from XYZ University. Completed internships focusing on credit risk analysis and financial modeling. Holds the Financial Risk Manager (FRM) Part I certification. Skilled in data analysis, Excel, and SQL, eager to contribute analytical skills to assist in risk assessment and decision-making processes.

Mid-career

Risk analyst with over seven years of experience managing market and operational risks within the banking sector. Known for developing comprehensive risk assessment reports that drive strategic planning. Successfully implemented risk mitigation strategies that reduced potential losses by 15%. Proficient in using SAS and R for quantitative analysis and holds a Chartered Financial Analyst (CFA) designation.

Experienced

Senior risk analyst specializing in enterprise risk management with more than 15 years of expertise across diverse financial sectors. Proven track record of designing frameworks that improve organizational resilience against emerging threats. Led cross-functional teams to integrate advanced predictive analytics into risk assessments, resulting in a 20% improvement in forecast accuracy. Actively mentors junior analysts while fostering a culture of continuous learning.

Risk analyst resume objective examples

Entry-level

Detail-oriented recent finance graduate aiming to start a career as a risk analyst. Equipped with strong analytical and problem-solving skills, eager to apply quantitative methods and data analysis techniques to identify potential risks and help organizations make informed decisions.

Career changer

Dedicated professional transitioning from project management to risk analysis, bringing extensive experience in strategic planning and stakeholder communication. Seeking an opportunity to leverage transferable skills in analyzing market trends and assessing financial risks to support organizational growth.

Recent graduate

Ambitious economics major with internship experience in financial services seeking a junior risk analyst position. Committed to contributing strong research abilities and a solid understanding of economic principles to assist in evaluating risk factors and improving decision-making processes.

Use our AI Resume Builder to easily create a professional resume that highlights your skills and experience as a risk analyst, making it stand out to employers.

Match your resume to the job description

Customizing resumes to fit job descriptions is key to grabbing an employer’s attention and getting past applicant tracking systems (ATS). ATS software scans for keywords in job postings, so it’s essential to customize your resume with the exact words employers use. Aligning your skills with these keywords helps you stand out and boosts your chances of landing an interview.

An ATS-friendly resume uses specific keywords and phrases that match a job posting. These targeted terms should reflect your actual skills and experiences, making it easier for hiring managers to notice your application.

To find the right keywords, carefully study the job description. Look for repeated mentions of skills or qualifications like “risk assessment,” “data analysis,” or “financial reporting.” Using exact phrases ensures ATS systems recognize your resume as relevant to the risk analyst role you’re applying for.

Incorporate these terms naturally by rewriting parts of your resume. For instance, if a job requires “financial reporting,” describe past work as “prepared detailed financial reports for improved decision-making.” This ensures both humans and machines see how well-suited you are for the position.

Targeted resumes boost compatibility with ATS systems, increasing visibility to employers. By focusing on relevant keywords and integrating them smoothly into your resume, you improve your chances of securing interviews.

Want more job interviews? Use our ATS Resume Checker to find and fix problems in your resume so it can pass through applicant tracking systems easily.

FAQ

Do I need to include a cover letter with my risk analyst resume?

Yes, including a cover letter with your risk analyst resume can make a significant difference in your job application. It allows you to highlight your analytical skills and detail any specific experience relevant to risk management that might not be fully conveyed in your resume.

If the company is known for working in a particular industry, like finance or insurance, you can discuss any previous projects or insights you’ve gained related to that sector.

Consider using tools like our Cover Letter Generator to craft a tailored cover letter that emphasizes your strengths and aligns with the job description.

Additionally, reviewing cover letter examples from our library can offer inspiration and guidance on how to effectively communicate your qualifications and enthusiasm for the role.

How long should a risk analyst’s resume be?

For a risk analyst, a one-page resume typically works best to highlight your analytical skills, risk management expertise, and familiarity with relevant tools.

If you possess extensive experience or specialized certifications in financial risk modeling or regulatory compliance, a two-page resume might be more fitting.

Make sure every section is closely related to the role, focusing on your ability to assess and mitigate risks.

You can also explore our guide on how long a resume should be for advice tailored to various career stages.

How do you write a risk analyst resume with no experience?

If you’re aiming for a risk analyst position with no experience, emphasize your education, skills, and relevant coursework or projects that show your potential. Here are a few tips on crafting a resume with no experience:

- Emphasize your education: Start with your degree in finance, economics, business, or a related field. Include the name of your school, graduation date, and any honors or awards.

- Showcase relevant coursework: List courses that are directly related to risk analysis, such as statistics, financial modeling, data analysis, and risk management. Mention any projects or case studies where you applied these concepts.

- Highlight transferable skills: Focus on analytical skills, attention to detail, problem-solving abilities, and skills in software tools like Excel or SQL. If you’ve done internships or volunteer work that involved data analysis or financial tasks, include those experiences.

- Include certifications: If you’ve completed certifications like CFA Level I or FRM Part I (even if still in progress), include them to show commitment to the field.

Check out our detailed guide on writing a resume with no experience for more insights and examples from experts.

Rate this article

Risk Analyst

Share this page

Additional Resources

Credit Risk Analyst Resume Examples & Templates

Discover credit risk analyst resume examples and learn how to showcase skills in assessing financial risks, analyzing data, and decision-making.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

Business Analyst Resume Examples & Templates

Explore business analyst resume examples to see how to showcase your problem-solving, teamwork, and data skills. Browse tips to highlight your experience turning ideas into action and improving processes to