Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: By saving clients $20K annually and reducing processing time by 30%, the applicant clearly showcases their impact through quantifiable metrics.

- Highlights industry-specific skills: The applicant’s mastery of tax law and accounting software underlines key administrative skills, aligning perfectly with industry demands in financial roles.

- Uses action-oriented language: Action verbs like “prepared” and “implemented” effectively portray initiative and results-driven actions.

More Tax Preparer Resume Examples

Review our tax preparer resume examples to see how to emphasize your attention to detail, knowledge of tax regulations, and client management skills. These finance resume samples help you create a resume that showcases your expertise effectively.

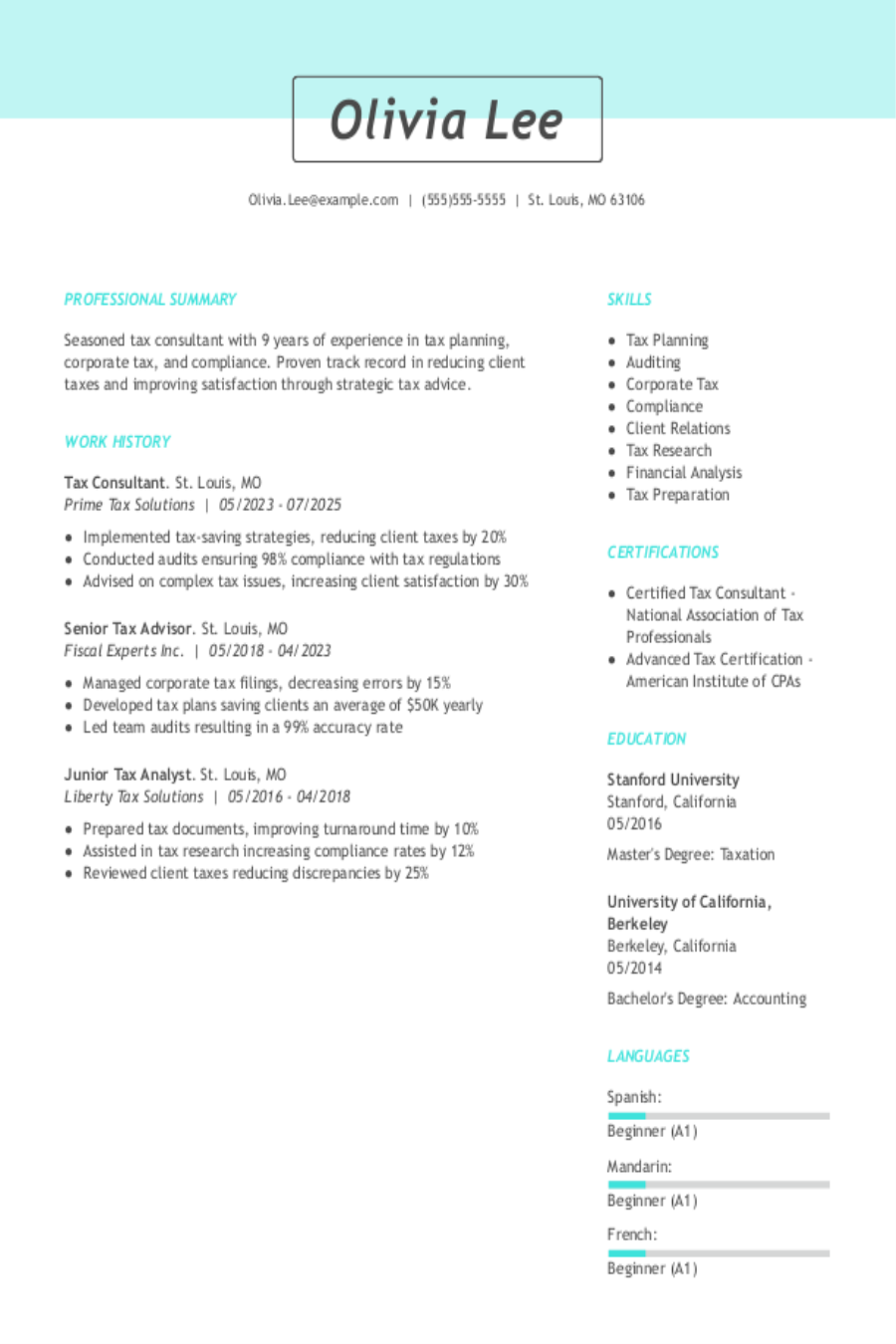

Entry-Level Tax Preparer

Why this resume works

- Effective use of keywords: By strategically embedding industry-specific keywords like “tax planning” and “regulatory compliance,” the applicant gears their resume to breeze through applicant tracking systems (ATS) screening.

- Shows digital literacy: Mastering platforms that improve tax software solutions, the applicant’s computer skills shine, ready for tech-driven environments.

- Puts skills at the forefront: Emphasizing core abilities like tax planning and problem-solving at the top aligns with a skills-based resume format, spotlighting key strengths from the get-go.

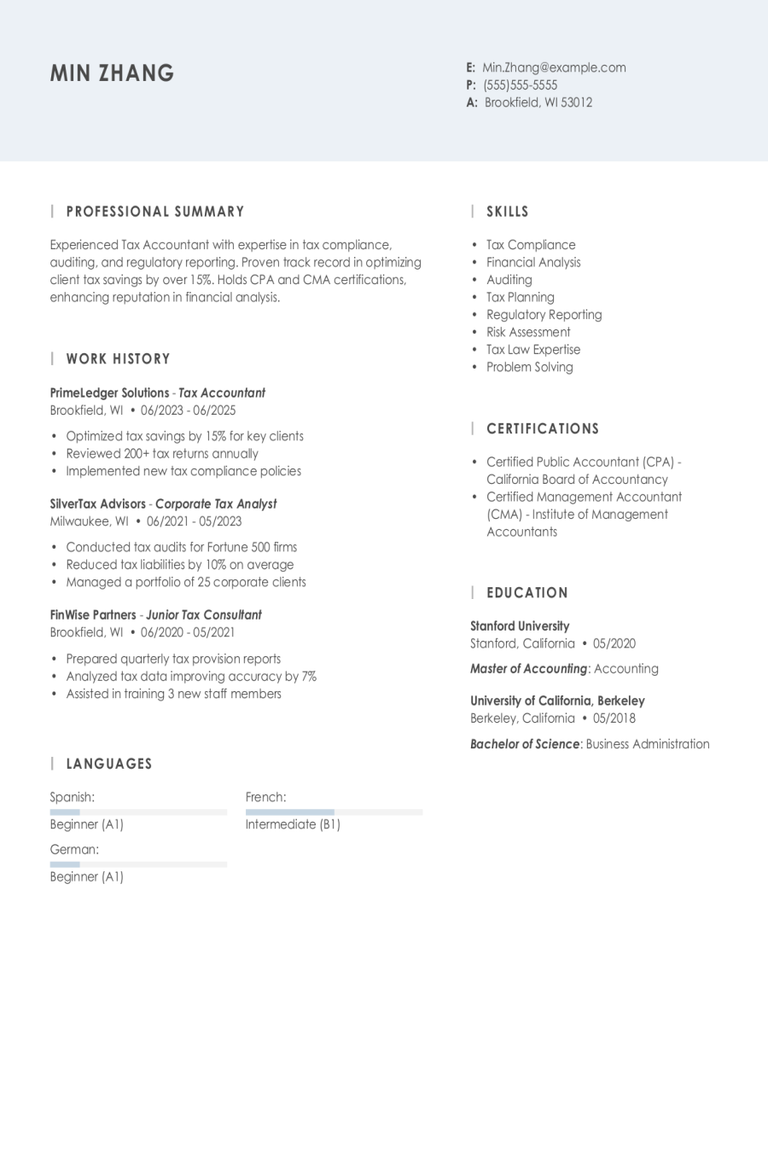

Mid-Level Tax Preparer

Why this resume works

- Points to measurable outcomes: Delivering clear, quantifiable results like increasing client base by 20% in a year shows the applicant’s effectiveness and impact.

- Demonstrates language abilities: Language skills in Spanish, French, and German improve cross-cultural communication, important for international tax consulting.

- Maximizes readability: The effective use of white space and clear section headings help ATS and recruiters quickly scan the resume.

Experienced Tax Preparer

Why this resume works

- Focuses on work history: The applicant’s use of a chronological format for their resume effectively showcases an extensive work history spanning over a decade.

- Showcases impressive accomplishments: By highlighting achievements such as saving clients $200K, the applicant reflects senior-level performance and business impact.

- Emphasizes leadership skills: Leading tax-saving initiatives that annually benefit clients by $50,000 demonstrates leadership skills.

Tax Preparer Resume Template (Text Version)

Chris Park

Los Angeles, CA 90001

(555)555-5555

Chris.Park@example.com

Professional Summary

Experienced tax preparer with expertise in tax compliance, planning, and financial analysis. Proven success in optimizing tax return processes, reducing errors, and enhancing client satisfaction.

Skills

- Tax Preparation

- Tax Planning

- Tax Compliance

- Tax Law

- Financial Analysis

- Auditing

- Accounting Software

- Client Relations

Certifications

- Certified Public Accountant (CPA) – California Board of Accountancy

- Enrolled Agent (EA) – Internal Revenue Service

Education

Master of Science Accounting

University of California, Los Angeles Los Angeles, California

June 2014

Bachelor of Science Business Administration

University of California, Berkeley Berkeley, California

June 2012

Work History

Tax Preparer

FinExpert Solutions – Los Angeles, CA

January 2022 – July 2025

- Prepared complex tax returns for clients, saving K annually

- Utilized tax software, reducing processing time by 30%

- Provided tax advice, improving compliance by 25%

Senior Tax Analyst

TaxPro Advisors – San Diego, CA

January 2017 – December 2021

- Reviewed 150+ tax returns annually for accuracy

- Managed tax audits, recovering K+ for clients

- Implemented new protocols, increasing efficiency by 20%

Junior Tax Associate

AccuTax Services – Los Angeles, CA

January 2015 – December 2016

- Assisted with 200+ tax returns per season

- Researched tax laws, improving accuracy by 15%

- Supported senior accountants, enhancing team productivity

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- Mandarin – Beginner (A1)

Related Resume Guides

Advice for Writing Your Tax Preparer Resume

Discover our tailored tips on how to write a resume for a tax preparer position and learn how to highlight your expertise in tax laws, attention to detail, and ability to maximize client returns.

Highlight your most relevant skills

Listing relevant skills helps potential employers quickly see why you are a good fit for the role. A dedicated skills section makes it easier for hiring managers to find the specific abilities they are looking for, such as knowledge of tax laws or attention to detail.

Balancing technical skills like skill with tax software and soft skills like communication and customer service can show that you have both the hard and interpersonal abilities needed to do the job well.

Integrating key skills into your work experience section can make an even stronger impact. Instead of just listing tasks, describe how you used your skills in real-life situations. For example, say how your understanding of tax regulations helped resolve a complex client issue or how your organizational skills ensured timely filing of all required documents.

This approach not only highlights your abilities but also shows potential employers concrete examples of your success as a tax preparer.

When selecting a resume format for tax preparers, emphasizing your financial expertise, accuracy in calculations, and client satisfaction can improve your application.

Showcase your accomplishments

To organize your work experience as a tax preparer, list your jobs in reverse chronological order. Start with the most recent job first, and then go backward. For each job entry, include your job title, the name of the employer, location, and dates of employment.

When describing your accomplishments, focus on turning duties into achievements by showing measurable results. Instead of just listing responsibilities, mention specific outcomes like how much time you saved or how you improved efficiency.

Use numbers to make your examples more compelling – for instance, “increased client satisfaction by 20%” or “reduced processing time by 15 hours per week.” This helps employers quickly understand the impact you’ve made in past roles.

Use action-oriented words to highlight core duties and measurable achievements. Words like “improved,” “streamlined,” and “boosted” show that you took initiative and made a difference. This approach will make your resume stand out and demonstrate why you’re a strong applicant for the tax preparer role.

5 tax preparer work history bullet points

- Prepared and filed tax returns for over 200 clients annually, ensuring a 98% accuracy rate and timely submission to avoid penalties.

- Streamlined tax documentation processes, reducing preparation time by 20% through the implementation of automated software solutions.

- Conducted comprehensive client consultations to identify potential deductions and credits, resulting in an average tax savings of $1,500 per client.

- Trained junior staff on updated tax codes and filing procedures, improving team productivity by 15% during peak tax season.

- Resolved complex tax discrepancies with IRS officials, successfully recovering $50,000 in refunds for clients over the past fiscal year.

Pick a simple, professional resume template with clear sections. Use easy-to-read fonts and keep design details minimal, so your skills and experience are easy to see.

Write a strong professional summary

A professional summary on a resume is like an introduction to hiring managers. It helps them decide if they want to know more about you. It’s a short paragraph that highlights your experience, skills, and achievements. It’s best for experienced applicants who have a track record in their field and want to show their professional identity and value quickly.

On the other hand, a resume objective is where you state your career goals. It’s good for those just starting out, changing careers, or with gaps in employment. While summaries focus on “what I’ve accomplished,” objectives are about “what I aim to contribute.”

Now that we understand both options, let’s look at examples of summaries and objectives for different industries and experience levels.

Tax preparer resume summary examples

Entry-level

Recent accounting graduate with coursework in tax preparation, financial reporting, and auditing. Holds a certification in IRS Volunteer Income Tax Assistance (VITA) program and skilled in using tax software like TurboTax and QuickBooks. Eager to apply foundational knowledge to assist clients with accurate tax filing and compliance.

Mid-career

Experienced tax preparer with over five years of expertise in individual and small business tax returns. Proficient in navigating complex tax codes, maximizing deductions, and ensuring timely filings. Skilled in client relationship management, resolving tax issues, and using software such as Drake Tax and CCH Axcess for efficient processing.

Experienced

Senior tax preparer specializing in corporate taxation and high-net-worth individuals. Over a decade of experience leading teams through audits, strategic planning for tax minimization, and implementing advanced solutions for compliance challenges. Proven track record in driving operational efficiency while maintaining accuracy across multi-jurisdictional filings.

Tax preparer resume objective examples

Recent graduate

Detail-oriented recent accounting graduate seeking an entry-level tax preparer position to use academic knowledge and analytical skills in a professional setting. Eager to contribute to accurate and efficient tax preparation processes while growing expertise in tax regulations and compliance.

Career changer

Resourceful professional transitioning into the tax field, bringing strong problem-solving abilities and keen attention to detail from previous career experience. Looking to apply transferable skills in an entry-level tax preparer role, with a focus on learning industry standards and contributing to client satisfaction.

Entry-level applicant

Aspiring tax preparer with foundational knowledge gained through coursework and internships, eager to begin a career in tax services. Seeking an opportunity to assist clients in navigating their financial obligations while developing a deeper understanding of tax law and practices.

Showcase your skills as a tax preparer with ease using our AI Resume Builder. Choose a template, add your details, and create a standout resume quickly!

Match your resume to the job description

Tailoring resumes to job descriptions is key for standing out and getting past ATS. Employers often use ATS to filter resumes by searching for specific keywords from the job posting. If your resume matches these keywords, it’s more likely to catch an employer’s eye.

An ATS-friendly resume includes relevant keywords and phrases that match your skills and experiences with what the employer seeks. By aligning your resume language with the job description, you increase your chances of being noticed by hiring managers. To improve this process, take time to customize your resume for each role.

To find keywords in a job posting, look for repeated skills, qualifications, and duties. For example, if a tax preparer role frequently mentions “tax return preparation,” “financial statements,” or “client consultation,” these are important phrases to include in your resume.

Incorporate these terms naturally into your resume by rewriting job descriptions. Instead of saying “prepared taxes,” you could say “prepared detailed tax returns for individual clients.” This approach highlights how you’ve completed tasks similar to those required in the new role.

Targeted resumes help you get through ATS filters and make it easier for employers to see you’re a good fit. By matching your resume closely with the job description, you’re more likely to land an interview.

Try our ATS Resume Checker to find over 30 common problems in your resume’s layout and wording. Get quick tips on how to boost your resume score.

Salary Insights for Tax Preparers

Understanding salary data can help you decide on your career path or where to move.

Top 10 highest-paying states for tax preparers

Tax Preparers earn varying salaries across the United States, with a national average of $54,079. The table below highlights the states where tax preparers command the highest compensation.

Our salary information comes from the U.S. Bureau of Labor Statistics’ Occupational Employment and Wage Statistics survey. This official government data provides the most comprehensive and reliable salary information for writers across all 50 states and the District of Columbia. The figures presented here reflect the May 2025 dataset, which is the most recent available as of this publication.

| State | Average Salary |

|---|---|

| New York | $74,550 |

| Montana | $73,270 |

| Minnesota | $73,290 |

| Alaska | $71,990 |

| California | $69,980 |

| Utah | $67,460 |

| Wyoming | $63,340 |

| Virginia | $63,900 |

| Iowa | $62,170 |

| Massachusetts | $60,620 |

FAQ

Do I need to include a cover letter with my tax preparer resume?

Yes, including a cover letter with your tax preparer resume is a good idea and can make your application more compelling.

A tax preparer cover letter lets you highlight specific skills in tax preparation, such as familiarity with tax codes, software skill, and client management.

You can also use the cover letter examples to explain why you’re interested in the particular firm or position, showing that you’ve done your homework and are genuinely engaged.

Additionally, it provides an opportunity to discuss any relevant experience that may not be fully covered in your resume but is relevant to the role.

Consider using a template or seeking advice from online resources like a Cover Letter Generator to ensure your cover letter is professional and well-structured.

How long should a tax preparer’s resume be?

For a tax preparer, a one-page resume is often ideal to showcase your skills and experience. Focus on key abilities like tax law knowledge, accuracy in preparing returns, and skill with tax software.

If you have extensive experience or certifications like an Enrolled Agent (EA), expanding to a two-page resume may be suitable. Just ensure every detail is relevant to the job you’re applying for.

To find the best length for your career stage, explore tips on how long a resume should be based on your expertise and goals.

How do you write a tax preparer resume with no experience?

When crafting a tax preparer resume with no experience, emphasize your education, relevant skills, and any training or coursework you’ve completed in taxation. Follow these tips:

- Emphasize education: Start by listing any degrees or certifications you have that are related to finance, accounting, or business. If you’ve taken specific courses in taxation or completed a tax preparation program, be sure to include those details.

- Showcase transferable skills: Highlight skills such as attention to detail, analytical thinking, skill in Excel or other financial software, and strong organizational abilities. These are important for success in tax preparation.

- Include volunteer work or internships: If you’ve volunteered with organizations that required you to do budgeting or financial planning, mention these experiences. Even unpaid positions show initiative and a willingness to learn.

- Mention soft skills: Communication is key when dealing with clients’ finances. Mention your ability to explain complex information clearly and your customer service aptitude.

Consider reaching out for informational interviews with professionals already working in the field. This can provide insights into what employers seek in entry-level hires and help tailor your resume further.

Rate this article

Tax Preparer

Share this page

Additional Resources

Tax Preparer Cover Letter Example + Tips

A tax preparer is someone who fills out the forms and files the tax returns for individuals and businesses. This can mean filing tax returns at the federal, state or

Tax Manager Resume Examples & Templates

Explore tax manager resume examples and learn how to show you handle complex tax regulations, lead teams, and improve financial strategies.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

Tax Consultant Resume Examples & Templates

Discover tax consultant resume examples and tips to help you showcase your knack for crunching numbers and navigating tax laws.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

Taxi Driver Resume Examples & Templates

These taxi driver resume examples will show you how to highlight safe driving, city navigation, and friendly passenger service. Use our examples and tips to learn how to showcase your

Tax Accountant Resume Examples & Templates

Explore tax accountant resume examples and tips to learn how to highlight your financial skills and tax expertise to stand out to potential employers in the accounting field.Build my resumeImport

The Illusion of Wage Growth: Where Paychecks Stretch the Farthest

U.S. wages have climbed at one of the fastest rates in modern history. Between 2020 and 2024, the average American worker’s pay rose from about $64,000 to $75,600, an 18%