Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: By detailing achievements like a 20% tax reduction and 30% increase in client satisfaction, the applicant effectively communicates their measurable achievements and impact.

- Uses action-oriented language: Action verbs such as “implemented,” “conducted,” and “advised,” convey initiative and effectiveness clearly.

- Illustrates problem-solving ability: The applicant’s innovative tax-saving strategies showcase their problem-solving skills by addressing client challenges head-on, resulting in reduced taxes and improved satisfaction.

More Tax Consultant Resume Examples

Our tax consultant resume examples demonstrate how to showcase your analytical skills, knowledge of tax laws, and client advisory experience. Use these finance resume samples to build a resume that highlights your expertise in tax consulting roles.

Entry-Level Tax Consultant

Why this resume works

- Effective use of keywords: The applicant’s resume cleverly weaves in keywords like “tax consultancy” and “compliance reviews,” improving its applicant tracking systems (ATS) compatibility while aligning with job roles.

- Centers on academic background: By featuring a Master’s in accounting and taxation in their education section, the applicant emphasizes a strong academic foundation, important for someone early in their career.

- Shows digital literacy: Mastery of tax reporting software illustrates the applicant’s computer skills, showcasing readiness for tech-driven tasks in modern financial environments.

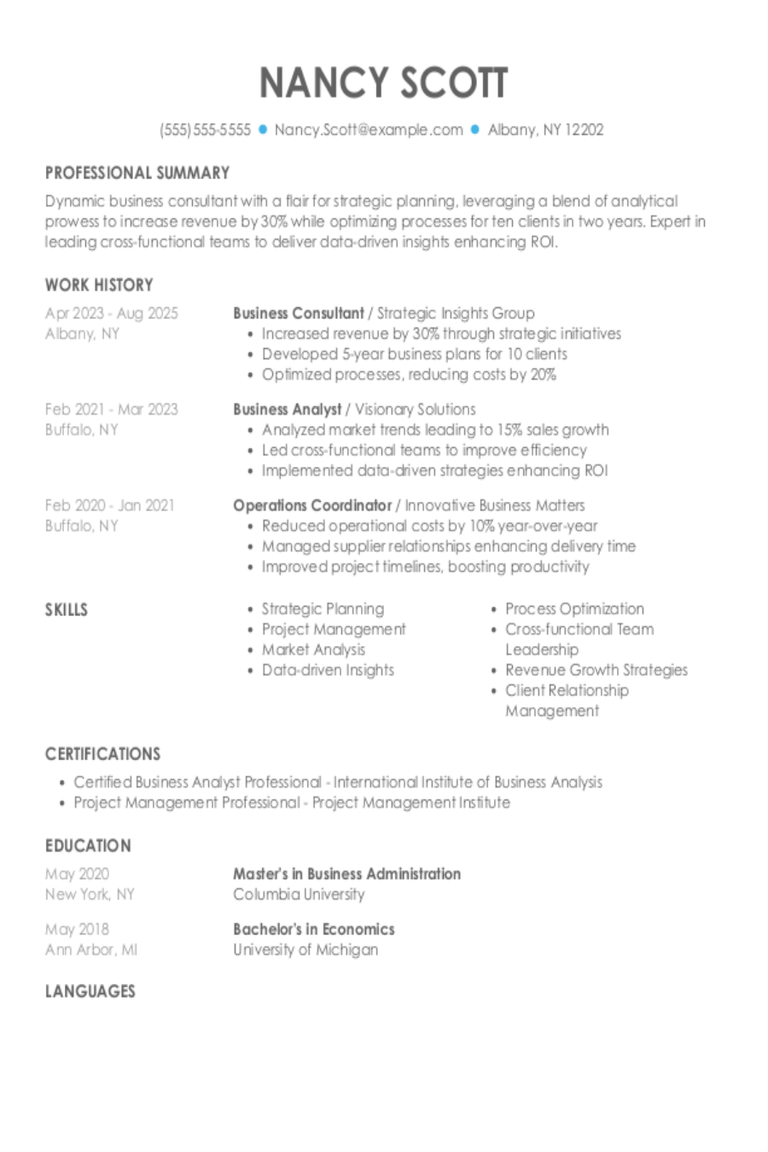

Mid-Level Tax Consultant

Why this resume works

- Demonstrates language abilities: The applicant’s language skills emphasize effective cross-cultural communication, essential for global consulting roles with diverse clients.

- Displays technical expertise: Advanced Taxation Certification highlights specialized knowledge, important for developing optimized tax strategies and reducing client expenses effectively.

- Includes a mix of soft and hard skills: Combining technical skills like financial analysis with strong interpersonal skills in client relationship management showcases a well-rounded professional approach.

Experienced Tax Consultant

Why this resume works

- Focuses on work history: The applicant’s chronological resume effectively narrates their journey from tax specialist to consultant, highlighting progressive career growth and extensive experience.

- Showcases impressive accomplishments: The applicant impressively highlights standout accomplishments, like increasing client tax savings by 25% in just a year, reflecting significant business impact and senior-level performance.

- Lists relevant certifications: With certifications like CPA and CTC listed, the applicant’s certifications show expertise in taxation and an ongoing commitment to professional development.

Tax Consultant Resume Template (Text Version)

Olivia Lee

St. Louis, MO 63106

(555)555-5555

Olivia.Lee@example.com

Professional Summary

Seasoned tax consultant with 9 years of experience in tax planning, corporate tax, and compliance. Proven track record in reducing client taxes and improving satisfaction through strategic tax advice.

Work History

Tax Consultant

Prime Tax Solutions – St. Louis, MO

May 2023 – July 2025

- Implemented tax-saving strategies, reducing client taxes by 20%

- Conducted audits ensuring 98% compliance with tax regulations

- Advised on complex tax issues, increasing client satisfaction by 30%

Senior Tax Advisor

Fiscal Experts Inc. – St. Louis, MO

May 2018 – April 2023

- Managed corporate tax filings, decreasing errors by 15%

- Developed tax plans saving clients an average of K yearly

- Led team audits resulting in a 99% accuracy rate

Junior Tax Analyst

Liberty Tax Solutions – St. Louis, MO

May 2016 – April 2018

- Prepared tax documents, improving turnaround time by 10%

- Assisted in tax research increasing compliance rates by 12%

- Reviewed client taxes reducing discrepancies by 25%

Skills

- Tax Planning

- Auditing

- Corporate Tax

- Compliance

- Client Relations

- Tax Research

- Financial Analysis

- Tax Preparation

Certifications

- Certified Tax Consultant – National Association of Tax Professionals

- Advanced Tax Certification – American Institute of CPAs

Education

Master’s Degree Taxation

Stanford University Stanford, California

May 2016

Bachelor’s Degree Accounting

University of California, Berkeley Berkeley, California

May 2014

Languages

- Spanish – Beginner (A1)

- Mandarin – Beginner (A1)

- French – Beginner (A1)

Related Resume Guides

Advice for Writing Your Tax Consultant Resume

Dive into our tailored advice on how to write a resume and discover how to highlight your knack for navigating complex tax codes and delivering smart financial solutions.

Highlight your most relevant skills

Listing relevant skills when applying for a tax consultant job is important because it helps employers see if you match what they’re looking for. Your skills section should show both technical skills, like tax law knowledge or skill in using financial software, and interpersonal skills, like communication and problem-solving. This gives a well-rounded view of your abilities.

Creating a dedicated skills section makes it easy for hiring managers to quickly find the information they need. Balance hard skills with soft skills to show you can handle both the technical aspects of the job and interact well with clients and team members. For example, mention your experience with tax regulations alongside your ability to explain complex information clearly.

Integrating key skills into your work experience section adds more impact. Instead of just listing tasks, describe how you used specific skills in previous jobs. If you improved client satisfaction by explaining tax details clearly or solved problems using your knowledge of tax laws, include these examples. This approach shows how your skills have made a difference in real-world settings.

Opt for a resume format that highlights your tax expertise, client success stories, and analytical skills to improve your appeal as a tax consultant.

Showcase your accomplishments

When organizing your work experience as a tax consultant, list your jobs in reverse chronological order. This means starting with your most recent position at the top and working backward. For each job entry, include your job title, employer name, location, and the dates you were employed there. This format helps hiring managers quickly see your career progression and recent work.

Quantifying accomplishments is key to making a compelling resume. Instead of just listing duties, turn them into achievements by adding measurable results like percentages, time savings, cost reductions, or efficiency improvements.

For example, instead of saying “prepared tax returns,” say “prepared over 200 tax returns annually with a 98% accuracy rate.” Using action-oriented words like “improved,” “reduced,” or “increased” also highlights what you achieved rather than just what you did.

Quantified accomplishments help hiring managers quickly assess your impact and skills. They show specific outcomes from your work as a tax consultant, making it clear how you contributed to past employers’ success. By focusing on core duties and measurable achievements, you make your resume stand out and easier for hiring managers to evaluate.

5 tax consultant work history bullet points

- Advised on tax-saving strategies for 50+ corporate clients, resulting in an average reduction of tax liability by 15%.

- Conducted comprehensive audits and identified discrepancies, recovering over $200K in unclaimed tax credits for small businesses.

- Developed and implemented a streamlined tax filing process that improved efficiency by 25% and reduced errors by 10%.

- Collaborated with the finance team to ensure compliance with new tax regulations, reducing potential penalties by 30%.

- Trained junior staff on complex tax laws and software usage, increasing team productivity by 20% within six months.

Pick a resume template with clean sections and basic fonts, steering clear of excessive colors or graphics to help hiring managers spot your skills and experience effortlessly.

Write a strong professional summary

A professional summary on a resume is a brief introduction to hiring managers. It’s the first section they read, helping them quickly understand who you are and what you bring to the table.

A professional summary showcases your experience, skills, and achievements in three to four sentences. It’s best for experienced applicants like tax consultants who want to highlight their professional identity and value. A well-crafted summary can make a strong impression right away, showing “here’s what I’ve accomplished.”

Resume objectives state your career goals and are ideal for entry-level individuals, career changers, or those with employment gaps. Unlike summaries that focus on past achievements, objectives emphasize “here’s what I aim to contribute.”

Next, we’ll provide examples of both summaries and objectives tailored to different industries and levels of experience.

Tax consultant resume summary examples

Entry-level

Recent accounting graduate with a Bachelor of Science in accounting from a top-tier university and certified as an Enrolled Agent (EA). Strong foundation in tax regulations, tax preparation, and financial analysis. Eager to contribute analytical skills and attention to detail in a dynamic tax consultancy team.

Mid-career

Skilled tax consultant with over seven years of experience working with diverse clients across various industries. Expert in preparing individual and corporate tax returns, identifying tax-saving opportunities, and ensuring compliance with federal and state regulations. Known for delivering accurate work under tight deadlines and building long-term client relationships.

Experienced

Seasoned tax consultant with over 15 years of experience in leading complex tax planning strategies for multinational corporations. Specialized in international taxation and mergers & acquisitions. Proven track record of reducing clients’ tax liabilities through innovative solutions while mentoring junior consultants to foster professional growth within the firm.

Tax consultant resume objective examples

Recent graduate

Driven and detail-oriented recent graduate with a bachelor’s degree in accounting seeking an entry-level tax consultant role to apply foundational knowledge of tax regulations and financial analysis. Committed to supporting clients in navigating complex tax scenarios and achieving compliance.

Career changer

Adaptable professional transitioning into the field of tax consulting, leveraging analytical skills and experience in financial management to deliver effective solutions for diverse client needs. Eager to contribute a fresh perspective while learning and growing within a dynamic team environment.

Aspiring consultant with relevant training

Ambitious individual with formal training in tax preparation software and coursework in federal taxation seeking an entry-level opportunity as a tax consultant. Focused on applying learned skills to assist clients with accurate filings and provide strategic advice for optimizing their financial outcomes.

Easily stand out as a tax consultant by using our AI Resume Builder. Choose a template, add your info, and get a professional resume quickly!

Match your resume to the job description

Tailoring resumes to job descriptions helps job seekers stand out to employers and ensures their resume passes through ATS. ATS scans resumes for specific keywords and phrases from job postings, so including these can make a significant impact.

An ATS-friendly resume includes keywords and phrases that align with the job description. By matching your skills with these terms, you increase the chances of getting noticed by hiring managers. This means your resume should mirror the language used in the job posting.

To identify keywords from job postings, examine closely the skills, qualifications, and duties mentioned frequently. For example, if a tax consultant role often mentions “tax planning,” “compliance,” or “client consultation,'” ensure these exact phrases are present in your resume.

Incorporate these terms organically into your resume by rewriting job descriptions. For instance, instead of saying “handled client taxes,” you could say “managed comprehensive tax planning and compliance for clients.” This demonstrates relevant experience while using appropriate keywords.

Targeted resumes improve ATS compatibility because they directly address what employers seek. By customizing your resume to match the job description, you improve your chances of securing an interview and advancing in the hiring process.

Try out our ATS Resume Checker to find over 30 issues in your resume’s layout and wording. Get quick tips on boosting your resume score right away.

FAQ

Do I need to include a cover letter with my tax consultant resume?

Yes, including a cover letter with your tax consultant resume can make your application more compelling and tailored to the job.

A cover letter lets you highlight your expertise in areas like tax compliance, financial planning, or client advisory services while explaining why you’re interested in the specific role or firm.

You can use a Cover Letter Generator to help structure this effectively.

You can also use a cover letter to demonstrate soft skills like communication and problem-solving—traits that are essential for building trust with clients and handling complex tax matters.

Reviewing cover letter examples might give you ideas on how best to present these skills.

How long should a tax consultant’s resume be?

For a tax consultant, a one-page resume usually works well to highlight skills like tax law expertise, analytical thinking, and client consultation experience.

But if you’ve got extensive experience or several specialized certifications, going with a two-page resume might make sense.

Keep everything relevant by emphasizing your recent roles and achievements that show off your strengths in tax planning and compliance. For more advice on formatting based on your career stage, check out our guide on how long a resume should be.

How do you write a tax consultant resume with no experience?

If you’re new to the field, your tax consultant resume should highlight your education, transferable skills, and any related experience, even if it’s informal or unpaid. Here’s how to create a resume with no experience that stands out:

- Highlight relevant coursework: If you studied accounting, finance, economics, or taxation in school, list those courses under your education section. Include academic achievements like a high GPA or honors.

- Showcase transferable skills: Focus on skills such as attention to detail, problem-solving abilities, skill in tools like Excel or tax software (even if learned independently), and strong analytical thinking—qualities essential for tax consulting.

- Include internships or volunteer work: If you’ve interned at an accounting firm or volunteered to help individuals prepare taxes during filing season, highlight these experiences with specific tasks performed and outcomes achieved.

- Add certifications and training: Mention any completed certifications like QuickBooks Online ProAdvisor or IRS Volunteer Income Tax Assistance (VITA), as they show initiative and foundational knowledge.

Rate this article

Tax Consultant

Share this page

Additional Resources

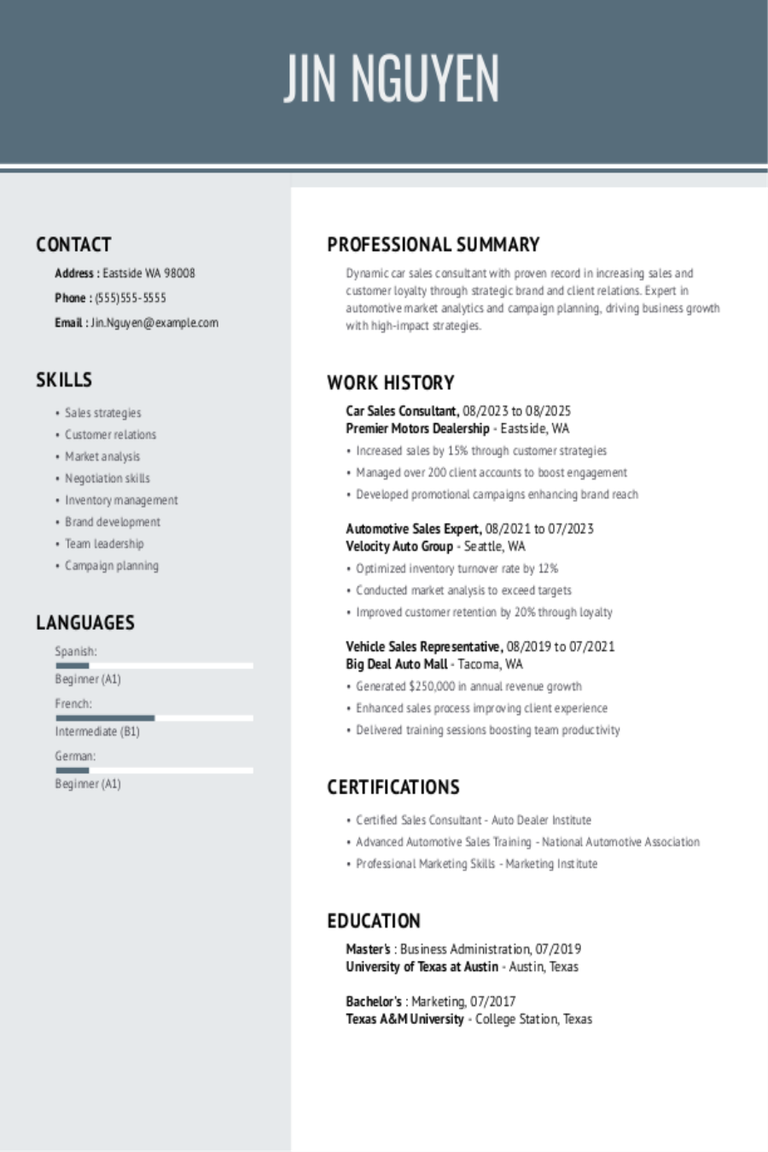

Car Sales Consultant Resume Examples & Templates

Discover car sales consultant resumes that shine by focusing on customer service, product knowledge, and closing deals. Learn how to show employers you’re friendly, knowledgeable, and ready to drive sales

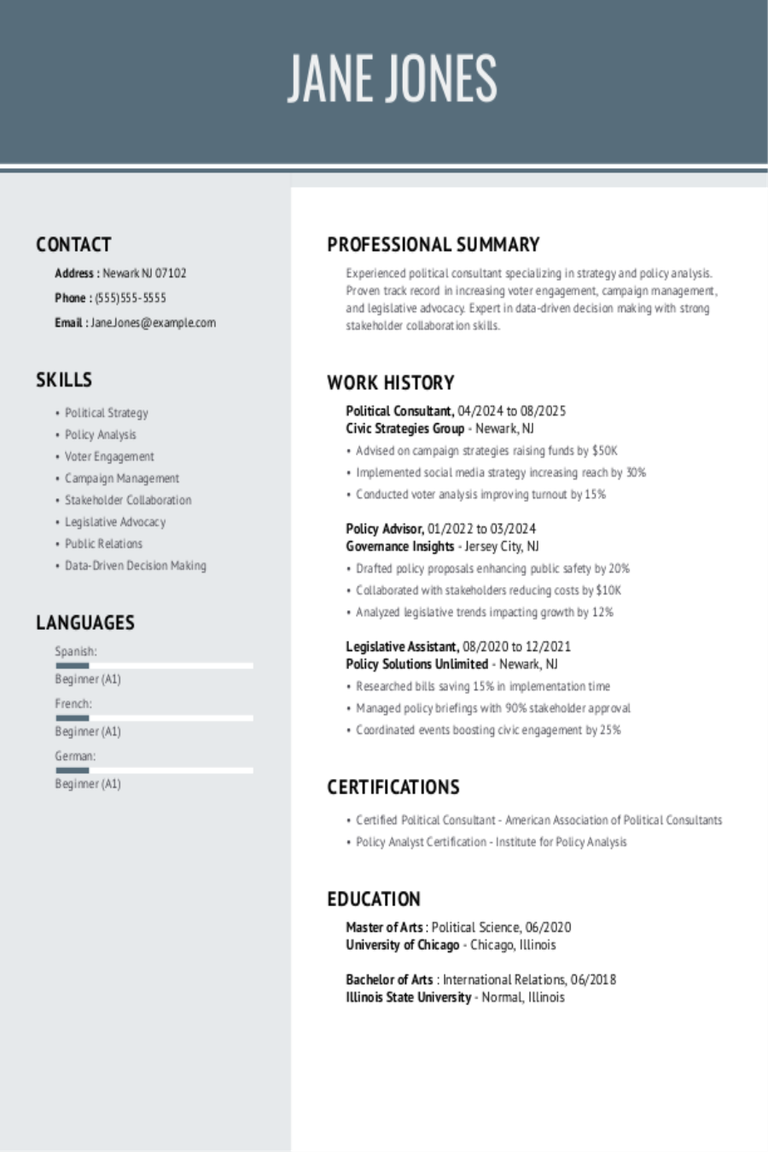

Political Consultant Resume Examples & Templates

Explore political consultant resume samples and learn how to showcase your ability to influence decisions and drive successful political outcomes.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies accomplishments: By

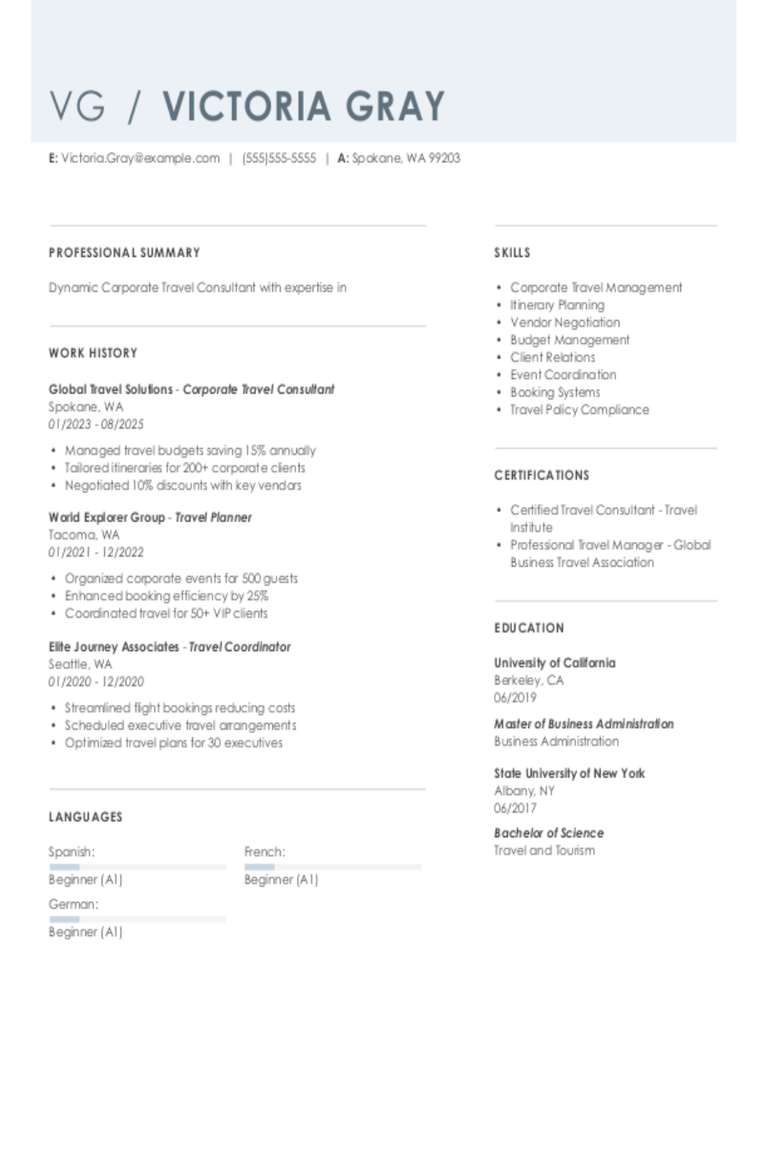

Corporate Travel Consultant Resume Examples & Templates

Corporate travel consultant resume examples show how demonstrate your ability to plan trips, manage budgets, and solve problems on the go. Get tips to highlight your skills in booking, customer

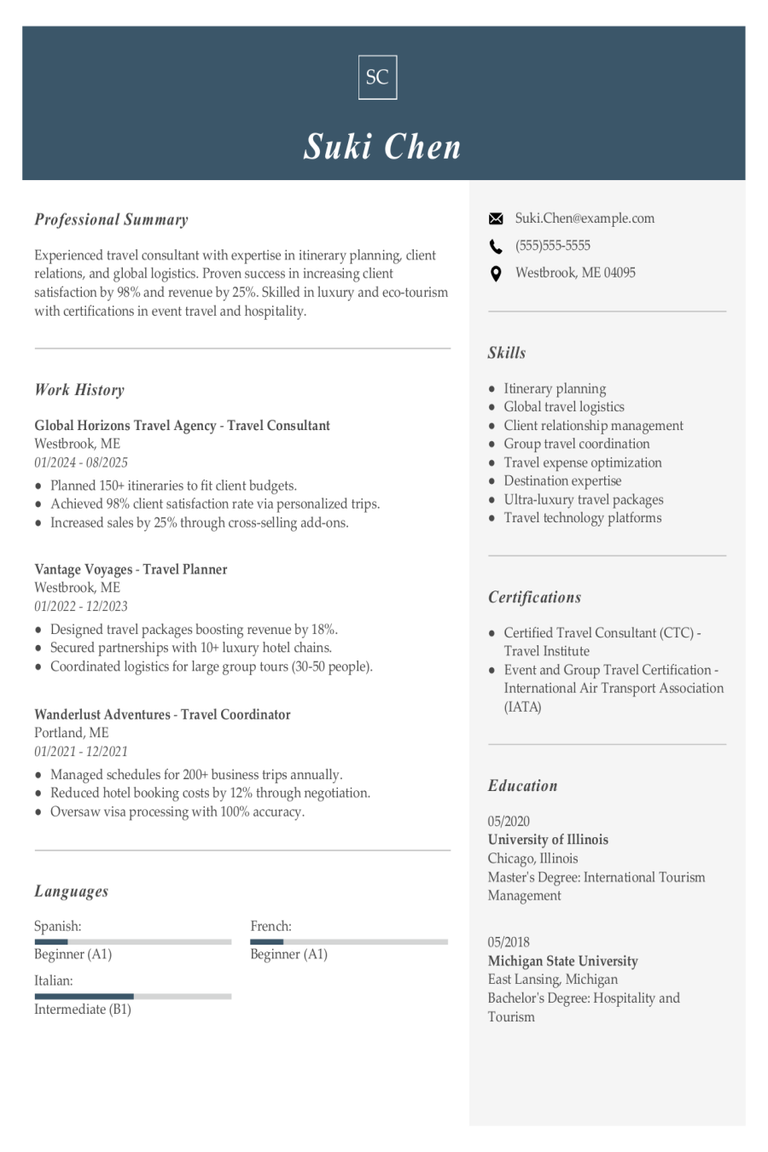

Travel Consultant Resume Examples & Templates

Travel consultant resume examples show you how to demonstrate your ability to plan trips, give advice, and handle bookings. Use our examples to help you highlight your knowledge of destinations

Business Consultant Resume Examples & Templates

Discover top business consultant resume examples that highlight your analytical skills and consulting experience. Learn how to showcase your strategic insights and impress potential employers.Build my resumeImport existing resumeCustomize this

Tax Preparer Resume Examples & Templates

Check out these tax preparer resume examples to learn how to highlight your skills in tax filing and client management. Discover tips on showcasing your experience so you can stand