Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Increasing tax compliance rates by 15% and boosting efficiency by 20% , the applicant’s measurable achievements reflect significant value and impact.

- Uses action-oriented language: Action verbs like “managed” and “improved” convey dynamic initiative and decisive effectiveness, reinforcing their proactive approach.

- Illustrates problem-solving ability: By implementing innovative tax models that boost efficiency by 20%, the applicant showcases exceptional problem-solving skills, emphasizing critical thinking.

More Tax Manager Resume Examples

Browse our tax manager resume examples to discover how to highlight your leadership, compliance expertise, and strategic planning skills. These finance resume samples will guide you in crafting a resume that effectively showcases your experience.

Entry-Level Tax Manager

Why this resume works

- Effective use of keywords: By weaving role-specific keywords like “tax compliance” and “process automation” throughout, the applicant optimizes their resume for applicant tracking systems (ATS).

- Shows digital literacy: The use of automated tax systems reveals computer skills, aligning well with modern workplace expectations.

- Puts skills at the forefront: Positioning core expertise such as strategic tax planning upfront uses the approach of a skills-based resume format, ideal for showcasing strengths effectively.

Mid-Level Tax Manager

Why this resume works

- Demonstrates language abilities: Knowledge of Spanish and French bolster the applicant’s language skills, supporting cross-cultural interactions in diverse tax environments.

- Points to measurable outcomes: Managing $5M in client portfolios while reducing tax liabilities by 15% showcases a strong focus on achieving measurable financial outcomes for clients.

- Includes a mix of soft and hard skills: The applicant effectively combines technical expertise in tax compliance with strong interpersonal skills to foster productive client relationships.

Experienced Tax Manager

Why this resume works

- Showcases impressive accomplishments: By integrating standout achievements like saving $500K annually, the applicant’s impressive accomplishments reflect a high-level impact in tax management and efficiency.

- Focuses on work history: Using a chronological resume, the applicant effectively emphasizes extensive career experience, showcasing a robust work history from tax associate to manager.

- Emphasizes leadership skills: Exemplifying strong leadership skills, the applicant led a team of 10, boosting efficiency by 25% and mentoring junior analysts for improved output.

Tax Manager Resume Template (Text Version)

Aya Nguyen

Milwaukee, WI 53211

(555)555-5555

Aya.Nguyen@example.com

Professional Summary

Accomplished Tax Manager with 9 years in financial analysis. Proven track record in enhancing tax compliance. Expert in audit management and tax planning.

Skills

- Tax Compliance

- Financial Analysis

- Audit Management

- Tax Planning

- Risk Assessment

- Budget Optimization

- Client Advisory

- Legislative Interpretation

Certifications

- Certified Public Accountant (CPA) – Illinois Board of Examiners

- Certified Tax Advisor – American Institute of Tax Professionals

Education

Master of Business Administration Finance

University of Chicago Chicago, IL

May 2015

Bachelor of Science Accounting

Illinois State University Normal, IL

May 2013

Work History

Tax Manager

Maple Financial Services – Milwaukee, WI

August 2022 – July 2025

- Managed tax deadlines and saved K annually.

- Led audits, reducing review times by 30%.

- Enhanced tax strategy, increasing compliance by 15%.

Senior Tax Consultant

Greenfield Accounting Solutions – Brookfield, WI

March 2019 – July 2022

- Created tax plans, optimizing 0K budgets.

- Reviewed financial statements, cutting errors by 40%.

- Advised clients, increasing returns by 25%.

Tax Analyst

Golden Gate Fiscal Advisors – Milwaukee, WI

May 2016 – March 2019

- Developed tax models, boosting efficiency 20%.

- Conducted research, saving clients K.

- Tracked legislative changes, ensuring 100% compliance.

Languages

- Spanish – Beginner (A1)

- French – Beginner (A1)

- German – Intermediate (B1)

Related Resume Guides

Advice for Writing Your Tax Manager Resume

Dive into our tips on how to write a resume for a tax manager role and discover how to highlight your expertise in tax regulations, strategic planning, and team leadership.

Highlight your most relevant skills

Listing relevant skills helps show employers that you have the right abilities to succeed in the role. Skills give a quick snapshot of what you can bring to the company, making it easier for hiring managers to see your strengths.

To do this well, create a skills section on your resume that balances both hard and soft skills. Hard skills could include tax law knowledge or software skill, while soft skills might be leadership or communication.

Integrating these key skills into your work experience section can make an even stronger impact. For example, instead of just listing “leadership” as a skill, mention how you led a team during a busy tax season in one of your past roles.

This way, you’re showing rather than just telling about your abilities. By doing this, potential employers can see real-life examples of how you’ve used these skills effectively in the past, which makes them more confident in your ability to handle the responsibilities of a tax manager position.

For tax managers, choose a resume format that highlights your expertise in compliance, analytical skills, and leadership experience prominently.

Showcase your accomplishments

When writing your resume for a tax manager position, organize your work experience in reverse chronological order. Start with your most recent job and move backward. Each job entry should include your job title, the name of the employer, the location, and the dates you worked there.

Instead of just listing your responsibilities, focus on quantifying your accomplishments. Quantified achievements make your resume more compelling by showing what you’ve done and how it made a difference.

Use numbers to showcase results like cost savings, efficiency improvements, or time reductions. For example, if you streamlined a tax filing process that saved 20% in time annually or reduced errors by 15%, highlight those specifics.

Use action words to describe what you did and emphasize measurable outcomes. Words like “increased,” “reduced,” or “implemented” followed by specific results can help paint a clear picture of your impact as a tax manager.

5 tax manager work history bullet points

- Led the preparation of corporate tax returns for over 50 multinational clients, ensuring compliance and reducing audit risks by 25%.

- Implemented tax planning strategies that saved $2 million annually in liabilities for a major client.

- Managed a team of 10 tax professionals, improving departmental efficiency and workflow by 30%.

- Streamlined the tax reporting process using advanced software tools, cutting processing time by 40%.

- Conducted comprehensive risk assessments that identified potential savings opportunities totaling $500,000.

Choose a resume template with clear sections and simple fonts. Avoid too many colors or fancy designs so employers can easily find your experience and skills without distraction.

Write a strong professional summary

A professional summary on a resume introduces hiring managers to your experience and skills. It’s the first thing they see, so making it impactful is key.

The professional summary is a brief paragraph that shows your experience, key skills, and major achievements. This approach suits experienced applicants who want to showcase their professional identity and value. A strong summary quickly informs employers about your career accomplishments.

Resume objectives focus on career goals and are perfect for entry-level job seekers, those switching careers, or individuals with employment gaps. While summaries emphasize “what I’ve accomplished,” objectives highlight “what I aim to contribute.”

Let’s explore examples of both summaries and objectives tailored for various industries and experience levels to help you craft yours effectively.

Tax manager resume summary examples

Entry-level

Recent graduate with a Bachelor of Science in accounting and a focus on tax management. Completed internships in corporate finance departments, gaining foundational skills in tax preparation and compliance. Certified Public Accountant (CPA) eligible, with strong analytical abilities and attention to detail. Eager to contribute to a team by applying knowledge of federal tax regulations and accounting principles.

Mid-career

Tax manager with over seven years of experience in public accounting firms, specializing in corporate tax planning and compliance. Proven track record of implementing effective tax strategies that optimize financial performance for diverse clients. Holds CPA certification and adept at managing multiple client portfolios while maintaining up-to-date knowledge of evolving tax laws. Recognized for excellent problem-solving skills and ability to work collaboratively with cross-functional teams.

Experienced

Seasoned tax manager with 15+ years of expertise in international taxation and strategic planning for multinational corporations. Skilled leader known for developing high-performing teams and spearheading initiatives that drive efficiency in tax operations. Extensive experience in navigating complex regulatory environments and negotiating favorable outcomes during audits. Committed to leveraging deep industry insights to influence executive decision-making and improve organizational growth.

Tax manager resume objective examples

Entry-level

Detail-oriented graduate with a Bachelor of Science in accounting aspiring to start a career as a tax manager. Eager to apply academic knowledge and foundational skills in tax regulations and compliance to support financial reporting and ensure accurate filing processes.

Career changer

Experienced auditor transitioning into the role of tax manager, leveraging analytical skills and attention to detail developed in auditing to improve tax strategy execution. Excited to contribute to a collaborative environment while learning new aspects of taxation and regulatory requirements.

Specialized training

Certified public accountant with specialized training in corporate taxation seeking an entry-level position as a tax manager. Passionate about using technical expertise and problem-solving abilities to assist companies in optimizing their tax liabilities and improving overall financial health.

Save time and create a polished resume with our AI Resume Builder. It’s easy to use and highlights your tax manager skills effectively.

Match your resume to the job description

Customizing your resume to job descriptions is important because it helps you stand out to employers and get past ATS. Many companies use ATS to scan resumes for specific keywords and phrases from job postings. If your resume doesn’t include these terms, it might not even reach a human recruiter.

An ATS-friendly resume includes relevant keywords and phrases that match the skills required for the job. Using these words increases your chances of getting noticed by hiring managers. It’s important to align the language in your resume with the job description to show you’re a good fit for the position.

To find keywords, carefully read the job posting. Look for skills, qualifications, and duties mentioned multiple times. For example, a tax manager position might list “tax compliance,” “financial reporting,” or “team leadership.” Use these exact terms in your resume.

Incorporating these terms naturally into your content is key. Instead of just listing duties, rewrite them to include keywords. For instance, change “handled taxes” to “managed tax compliance and financial reporting for improved accuracy.”

Customize your resume to increase your chances of landing an interview and show you understand the role’s requirements. Tailoring makes your application stronger and more relevant.

Want to make sure your resume gets past ATS? Our ATS Resume Checker checks important details and helps you boost your score quickly.

FAQ

Do I need to include a cover letter with my tax manager resume?

Yes, including a cover letter with your tax manager resume can give you a competitive edge.

It lets you highlight your specific interest in the firm and detail relevant experiences that demonstrate your expertise in tax management and compliance.

If the company focuses on certain industries or has unique clients, mention any experience you have in those areas to align with their needs.

Consider using tools like a Cover Letter Generator to craft a personalized letter based on your resume or to start fresh with expert guidance tailored for tax professionals.

Additionally, reviewing cover letter examples for similar roles can provide inspiration and ensure your cover letter is both professional and impactful.

How long should a tax manager’s resume be?

For a tax manager, a one-page resume is often enough if you have less than 10 years of experience. Focus on key skills like tax compliance, audit preparation, and leadership in managing tax teams.

If you have an extensive career history or advanced certifications (like CPA or MST), a two-page resume can work well. Ensure each detail supports the responsibilities of a tax manager role.

Check out our guide on how long a resume should be for tips tailored to your experience level.

How do you write a tax manager resume with no experience?

Without direct experience, crafting a tax manager resume should focus on showcasing relevant skills, education, and related projects or coursework that highlight your potential for the role.

Check out these tips on writing a resume with no experience:

- Highlight education and certifications: Start with your educational background, such as a degree in accounting or finance. Mention any coursework related to taxation, auditing, or financial management. If you’ve obtained certifications like CPA or enrolled agent status, make sure to include these prominently.

- Showcase relevant skills: Focus on skills that are important for a tax manager, such as analytical thinking, attention to detail, and skill in tax software. You can also include soft skills like leadership and communication if you’ve developed them through group projects or presentations.

- Include any internships or volunteer experiences: Even if they aren’t directly related to tax management, roles in accounting firms or finance departments where you handled data analysis or supported financial reporting can be valuable. Detail your responsibilities and any achievements.

Rate this article

Tax Manager

Share this page

Additional Resources

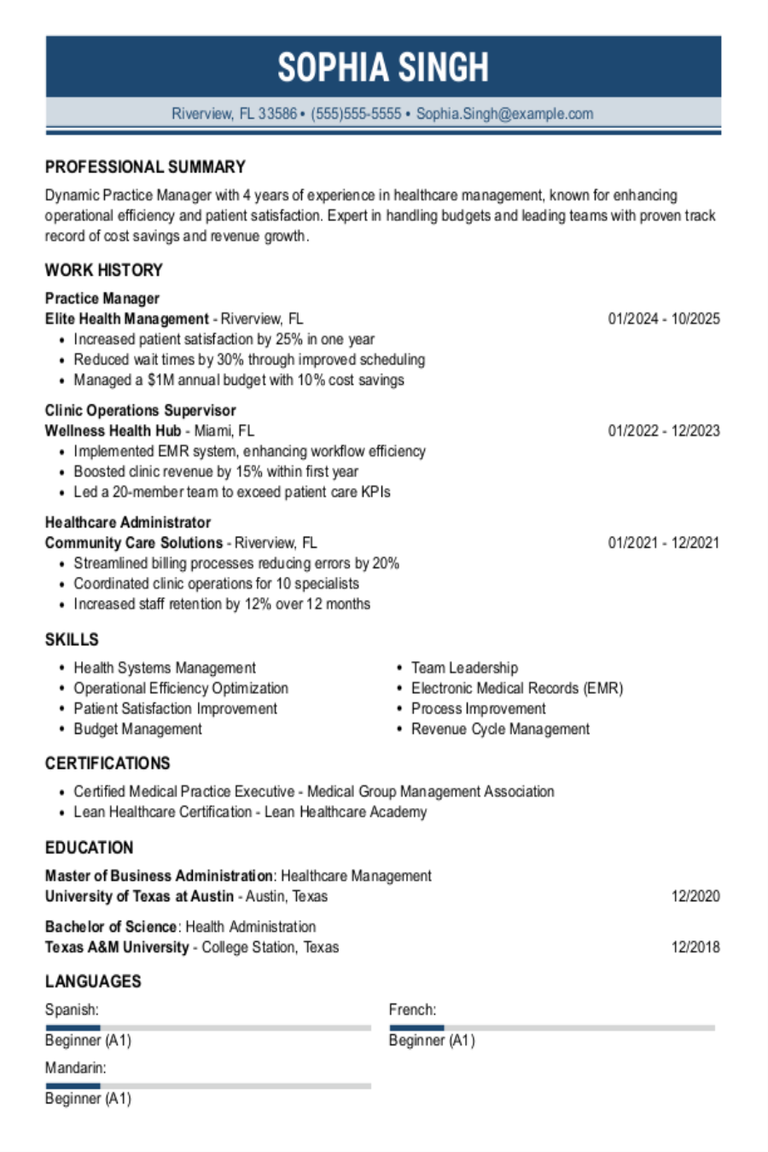

Practice Manager Resume Examples & Templates

Explore practice manager resume examples and tips to learn how to highlight your relevant skills and experience managing staff schedules and improving patient experiences.Build my resumeImport existing resumeCustomize this templateWhy

25 Interview Questions for Managers (With Answers & Tips)

Success in a management interview starts long before the conversation begins. Taking the time to prepare thoughtful responses to common interview questions for managers helps you clearly communicate leadership experience

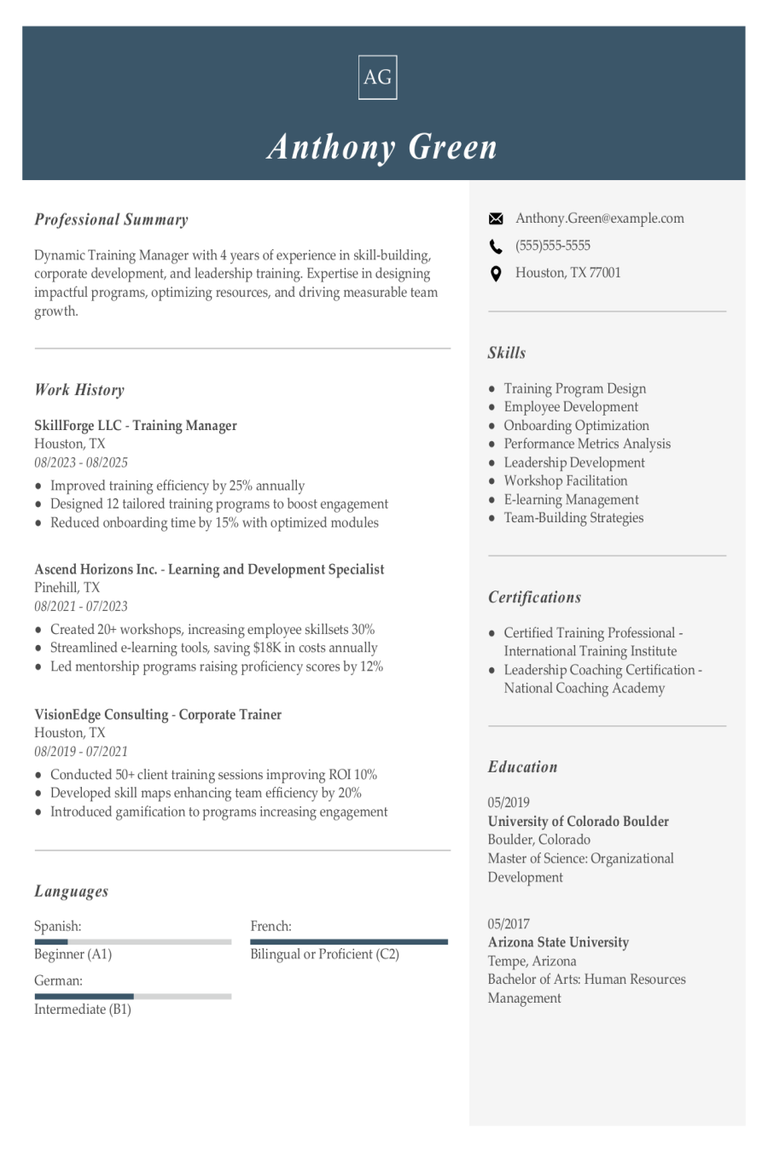

Training Manager Resume Examples & Templates

Discover how training managers showcase their skills in leading workshops and improving employee performance on their resumes. Our examples and tips will help you craft a resume that stands out

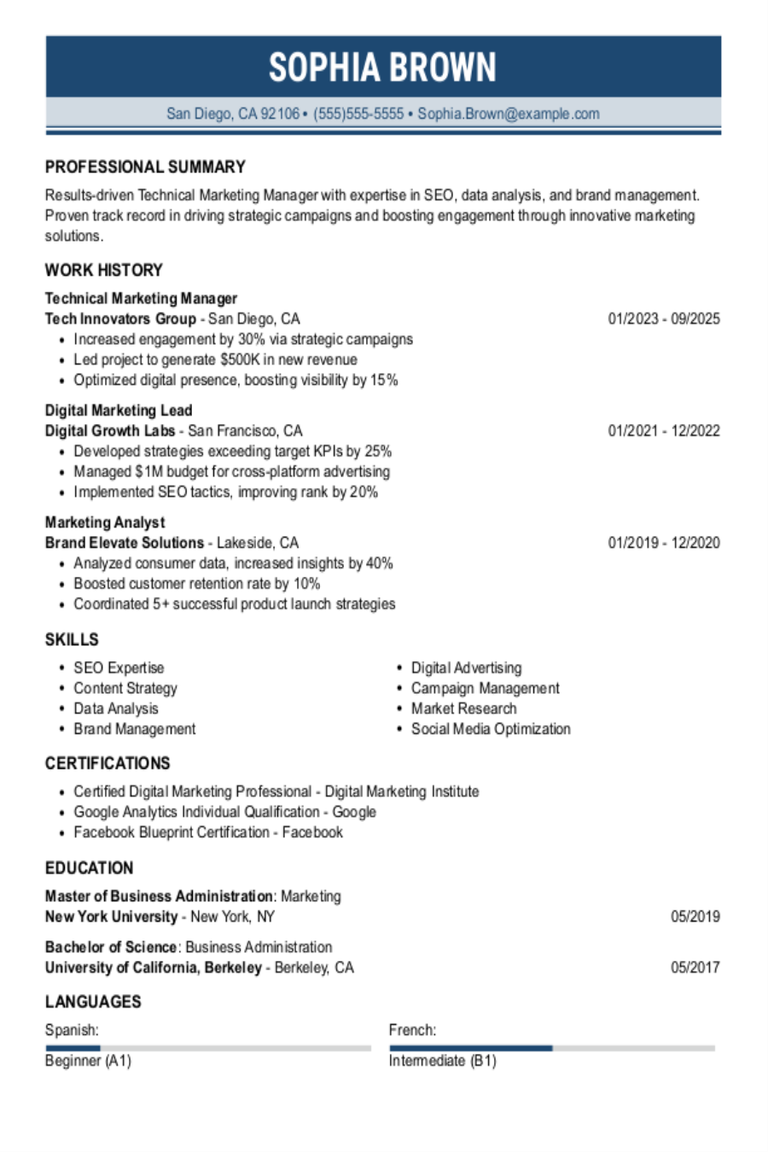

Technical Marketing Manager Resume Examples & Templates

Discover how to craft a technical marketing manager resume that shines. Learn to highlight your tech-savvy skills, marketing strategies, and project successes effectively.Build my resumeImport existing resumeCustomize this templateWhy this

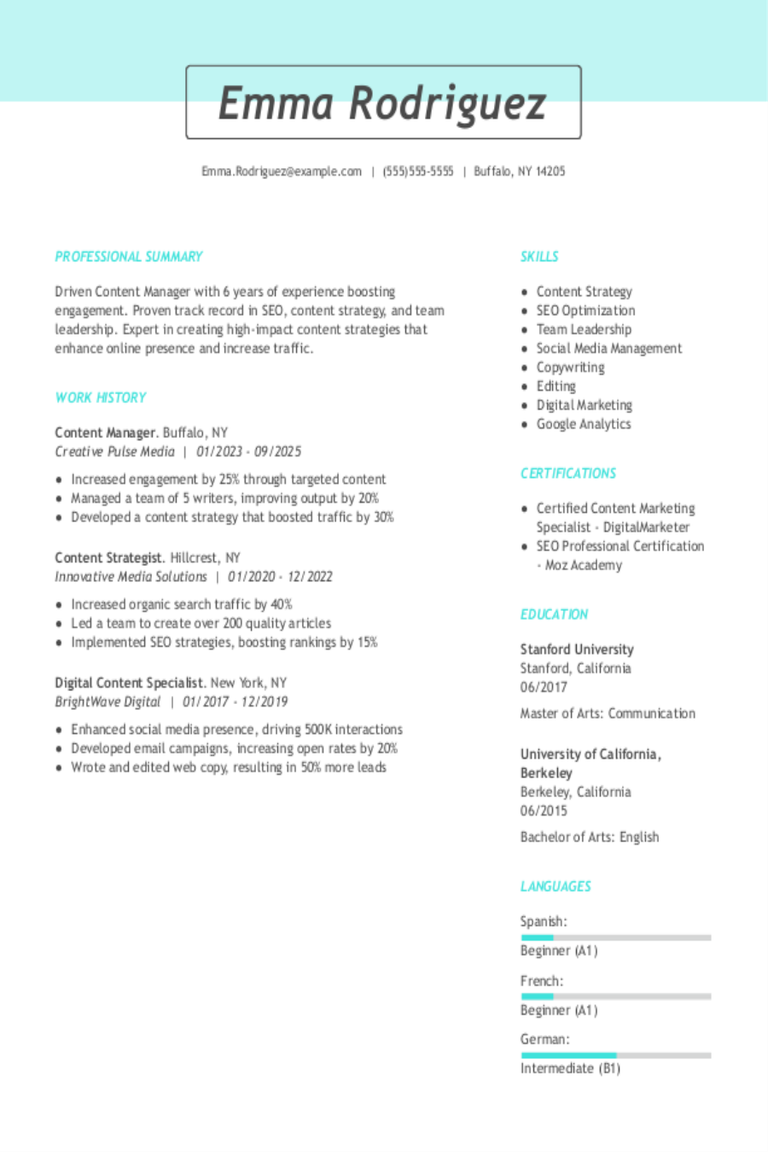

Content Manager Resume Examples & Templates

Browse content manager resume examples to see how to highlight your experience organizing, creating, and sharing engaging materials across platforms. These examples and tips help you showcase creativity, leadership, and

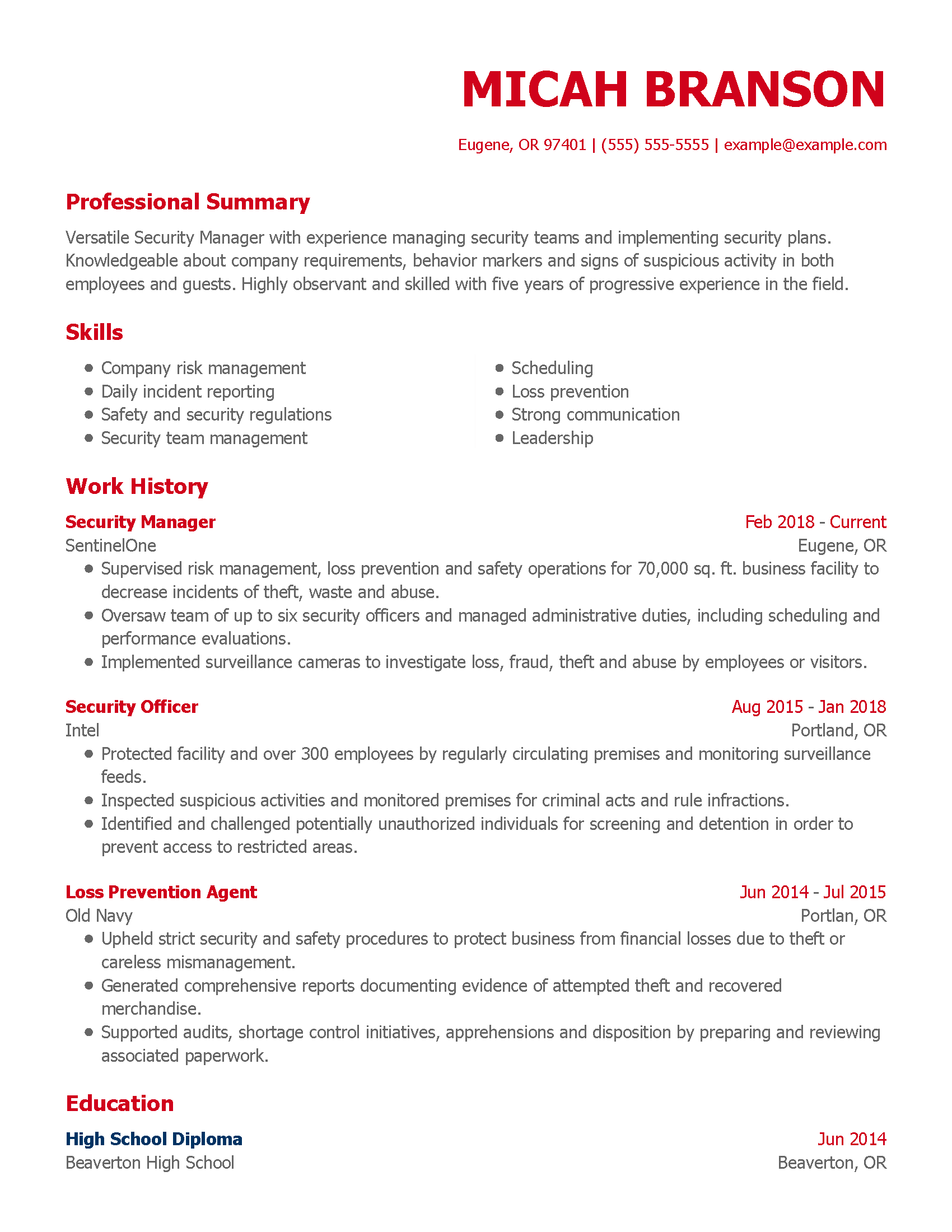

Security Manager Resume Examples & Templates

Explore security manager resume examples that showcase leadership, emergency response, and risk management. Get tips to highlight your skills and experience in keeping people and property safe.Build my resumeImport existing