Free Resume Templates

Get noticed by recruiters with a professionally-designed, customizable resume template. Add professional, pre-written content & Download in Word or PDF format. 42% higher response rate from recruiters‡

Our customers have been hired at: *Foot Note

Get Hired Fast With our Free Resume Templates:

Watch to discover why MyPerfectResume is the key to securing your dream job.

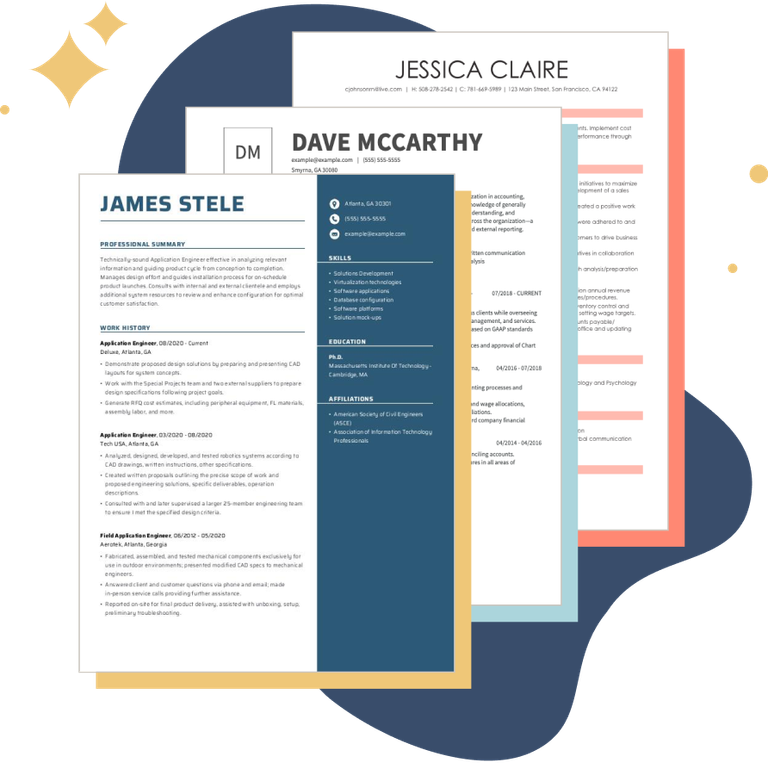

Professional designs for any industry

From creative resume designs to minimalistic and basic resume templates, we’ve got the right look for any job, industry or career level.

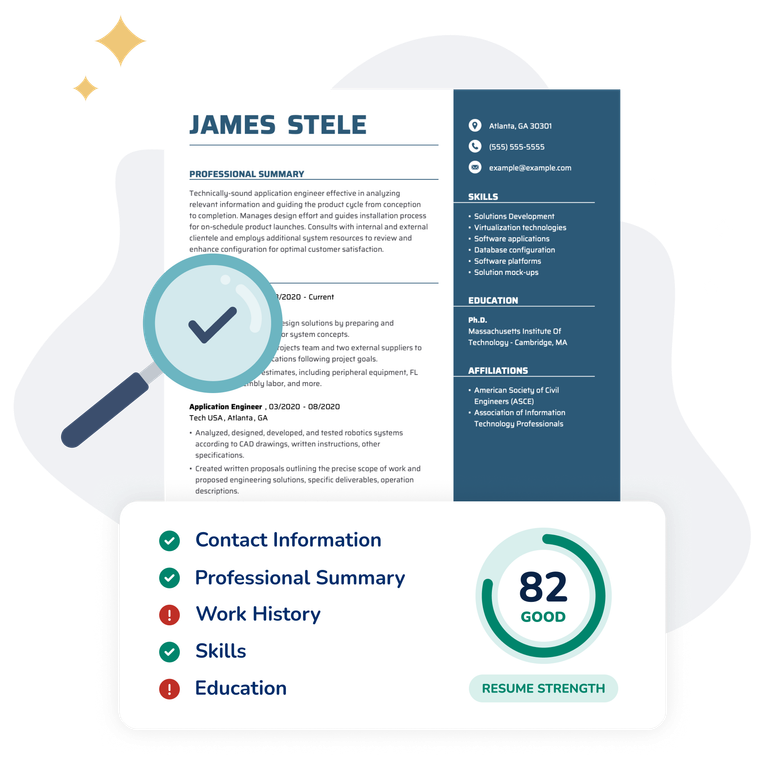

Layouts with ATS best practices in mind

Analyze your resume with our ATS Resume Checker for suggestions on improving your resume score and increasing your chances of being seen by hiring managers.

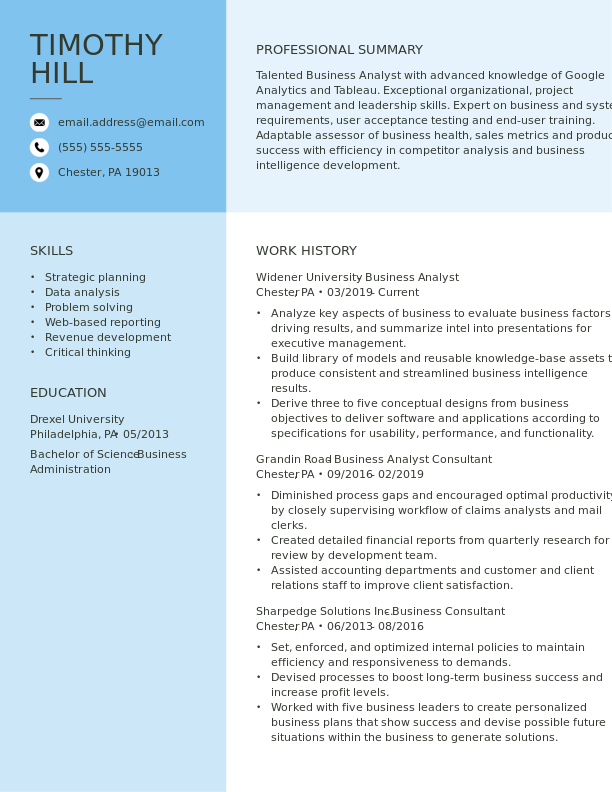

Easily customize to any experience level

Depending on your needs, you can customize the layout and design of your resume template to highlight your skills, experience or education.

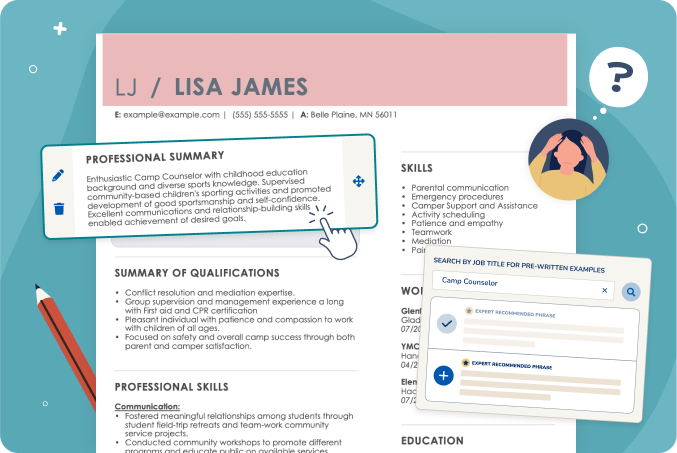

Expert tools do the heavy lifting for you

Our Resume Builder and professional templates help you create a standout resume that recruiters will notice and hiring managers will love.

Free modern resume templates

Choose a modern resume design when applying to organizations with strong brands and for jobs requiring up-to-the-minute knowledge of business, technology, or cultural trends. We have lots of great resume templates that are free to download.

Free creative resume templates

Use a creative resume template when you want to impress employers with an artistic look, particularly for design professions.

Free basic resume templates

Sometimes simple is the way to go, and our basic resume templates communicate all your essential information effectively, without the need for unnecessary flourish.

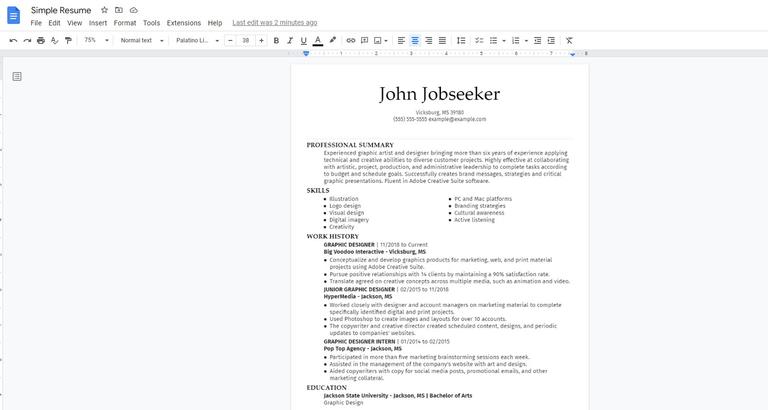

Free Google Docs Templates

Google Docs resume templates are another excellent choice for your resume because they allow for document sharing and flexibility in format downloads. Pick a matching Google Doc cover letter for your resume.

Free Microsoft Word templates

Microsoft Word is one of the most common file types for professional resumes. Find a matching word cover letter template for your resume.

Create a Job-Winning Resume

Upload a current resume

Update details and move everything into a new template

Create a new resume

We’ll guide you step-by-step and help you write

Job Seekers Love Our Resume Templates

Search Professionally Written Resume Examples

Our resume examples are crafted to showcase sought-after skills and experience in your industry. Choose one for your job title and customize it to your liking!

Enter a job title or industry below:

Top Resume Examples

Search Professionally Written Cover Letter Examples

Our cover letter examples are crafted to showcase sought-after skills and experience in your industry. Choose one for your job title and customize it to your liking!

Enter a job title or industry below:

Top Cover Letter Examples

Search Professionally Written CV Examples

Our CV examples showcase the key skills and experience employers look for in your industry. Choose one for your job title, customize it, and learn when to use a CV instead of a resume!

Enter a job title or industry below:

Top CV Examples

FAQ

Does MyPerfectResume have free resume templates?

Yes, we offer free resume templates in various styles and file formats. You can download our free templates from the following pages:

- Modern resume templates

- Creative resume templates

- Simple resume templates

- Microsoft Word resume templates

- Google Docs resume templates

- PDF resume templates

- Plain text resume template

We also recommend exploring our library of professional resume templates, which are available for customization with our Full Access plan.

What is the best resume template?

The best resume template is one that is easy to read and tailored to your industry or skill level. Here are a few key features of standout resume templates:

- Professional Design: A great resume template has a polished and professional design that catches the attention of employers or recruiters.

- Clean and Uncluttered Layout: A clean and uncluttered layout with well-organized sections helps to focus attention on your core competencies and achievements.

- Customizable Sections: Look for a template that allows you to easily customize and rearrange sections to highlight your most relevant skills, experience and achievements.

- ATS-Formatting: Choose a template that follows applicant tracking systems (ATS) guidelines to ensure your resume is parsed and scanned properly.

Remember to highlight your qualifications and match the specific job requirements. Choose a resume template that compliments your style and makes your top qualities stand-out to recruiters.

Why should I use a resume template?

Using a resume template can offer several advantages, especially when you want to create a professional and visually appealing resume quickly.

Here are some key reasons to consider using a resume template:

- Professional Design: Templates provide a structured layout and design that adhere to professional standards. This ensures your resume looks polished and is easy to read, which can make a strong first impression.

- Time-Saving: allow you to focus on filling in your details without worrying about the format and design. This can save a significant amount of time, particularly if you are applying for multiple jobs and need to adapt your resume for different positions.

- ATS Best Practices: Our templates are professionally crafted to follow ATS-formatting guidelines, which companies use to screen resumes. A resume designed with these in mind is more likely to be properly read and processed by these systems.

- Consistency: A template ensures that the formatting is consistent throughout the document, such as font size, headings and spacing. Consistency in your resume makes it easier for hiring managers to find the information they need.

- Avoid Common Mistakes: Using a template can help you avoid common formatting errors and oversights, such as misaligned text, inappropriate font choices or poor organization of information.

Overall, a resume template can be a useful tool for improving your resume or creating a new one that stands out to employers.

What is an Applicant Tracking System?

An Applicant Tracking System (ATS) is software used by employers to manage the hiring process. It helps organize, track and sort job applications and resumes.

The software scans resumes for specific keywords, skills, experiences or other criteria relevant to the job. It ranks candidates based on how well their resumes match the job description.

Since ATSs scan for specific keywords that match the job description, it’s crucial to tailor your resume to include relevant terms and skills that the software is likely to recognize.

Our resume templates use clear headings, straightforward language, and a clean layout to help the ATS effectively parse your resume.

See our guide, what does a resume look like, for additional advice from career experts.

Do you have free Microsoft Word resume templates?

Yes! MyPerfectResume offers free and premium Microsoft Word templates. Choose from professional, creative, modern, and simple resume template styles.

Do employers prefer one-page resume templates?

Employers typically only spend a few seconds scanning an individual resume, so we recommend sticking with a one-page resume if you can include all of your most crucial job qualifications.

However, a two-page resume is acceptable if you’re applying for a job that favors extensive experience.

Whether you end up with one page or two, our resume templates have you covered with easily adjustable formatting available in our builder.

What should I include in my resume?

Every professional resume must include the following sections:

- A resume header with the job applicant’s contact information.

- A professional summary or an objective statement.

- A work history section focused on accomplishments.

- At least one skills section highlighting a mix of relevant hard and soft skills.

- A resume education section with the job seeker’s credentials.

Our professional resume templates contain all of the resume sections you need and allow you to customize your resume to include optional qualifications such as awards.

We also recommend seeing what to put on a resume for additional tips and examples.

Do you have matching cover letter templates?

Yes, we design our cover letter templates to match our resume templates, ensuring consistency in job applications.

Remember that your cover letter should complement your resume, not simply repeat it. Touch on these points in your cover letter:

- Explain why you’re interested in the job and think you’re a good fit.

- Give more details about an achievement or skill you have that’s relevant to the job.

- Communicate your enthusiasm for the opportunity.

See how to write a cover letter for step-by-step guidance for writing a compelling letter that impresses hiring managers.