Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: By detailing a 20% portfolio increase and managing over $50 million in assets, the applicant’s resume accomplishments clearly show their significant impact and value.

- Showcases career progression: The journey from financial consultant to advisor highlights increasing responsibility, showing a clear path of career growth through improved client management and asset optimization skills.

- Uses action-oriented language: Action verbs like “increased,” “managed,” and “optimized” reveals initiative and effectiveness.

More Financial Advisor Resume Examples

Review our financial advisor resume examples to see how to emphasize your client management, financial planning expertise, and investment strategy success. These finance resume samples help you craft a resume that showcases your skills and experience effectively.

Entry-Level Financial Advisor

Why this resume works

- Effective use of keywords: By weaving in role-relevant terms like “financial planning” and “investment management,” the applicant optimizes their resume for keywords that appeal to applicant tracking systems (ATS).

- Shows digital literacy: The applicant’s fluency with financial platforms and tools subtly reflects their computer skills, showcasing readiness for tech-driven workplace environments.

- Puts skills at the forefront: Positioning skills like client relationship management prominently aligns with a skills-based resume format, making it an effective choice for highlighting core competencies.

Mid-Level Financial Advisor

Why this resume works

- Points to measurable outcomes: By showcasing achievements like a 30% portfolio growth and reducing tax liabilities by $500k, the applicant clearly communicates their strong impact on financial outcomes.

- Demonstrates language abilities: The applicant’s language skills improve cross-cultural communication, important for global finance roles.

- Displays technical expertise: With qualifications like Chartered Financial Analyst and Certified Financial Planner, the applicant reveals a solid foundation in specialized finance skills important for advisory roles.

Experienced Financial Advisor

Why this resume works

- Lists relevant certifications: By listing certifications like CFP and CFA, the applicant showcases a commitment to expertise and continual learning.

- Showcases impressive accomplishments: The applicant’s achievements, such as boosting ROI by 25%, illustrate impactful performance.

- Focuses on work history: The applicant effectively uses a chronological resume format to highlight extensive career growth.

Financial Advisor Resume Template (Text Version)

Aiko Williams

Jacksonville, FL 32205

(555)555-5555

Aiko.Williams@example.com

Professional Summary

Dynamic financial advisor with proven success in asset management and client relations. Expertise in portfolio optimization leading to increased ROI and improved client outcomes. Skilled in delivering tailored financial solutions.

Work History

Financial Advisor

Greenwood Financial Solutions – Jacksonville, FL

January 2023 – July 2025

- Increased client portfolio by 20%

- Managed assets worth over million

- Optimized investment strategies by 15%

Investment Counselor

Riverbank Wealth Management – Jacksonville, FL

January 2021 – December 2022

- Advised over 50 clients annually

- Enhanced ROI by 10% with research

- Streamlined risk assessment processes

Financial Consultant

Sunrise Capital Advisors – Tampa, FL

July 2019 – December 2020

- Guided asset allocation for clients

- Achieved a 30% increase in savings

- Led workshops on financial literacy

Languages

- Spanish – Beginner (A1)

- French – Beginner (A1)

- Mandarin – Intermediate (B1)

Skills

- Portfolio Management

- Risk Assessment

- Financial Planning

- Investment Strategies

- Client Relations

- Asset Allocation

- Market Analysis

- Wealth Management

Certifications

- Certified Financial Planner (CFP) – CFP Board

- Chartered Financial Analyst (CFA) – CFA Institute

Education

Master of Business Administration Finance

Harvard University Cambridge, MA

May 2019

Bachelor of Economics Economics

University of California, Berkeley Berkeley, CA

May 2017

Related Resume Guides

Advice for Writing Your Financial Advisor Resume

Dive into our advice section on crafting the perfect resume with tailored tips to highlight your skills in finance and client management.

Highlight your most relevant skills

A dedicated skills section helps employers quickly see what you bring to the table.

This section should have both technical skills, like financial analysis and investment strategies, and interpersonal skills, such as communication and relationship building. Technical skills show you understand the numbers, while interpersonal skills help you connect with clients and explain complex ideas clearly.

Putting key skills in your work experience section makes them even more powerful. When you talk about past jobs, highlight how these skills helped you succeed or solve problems. For example, mention how your communication skills led to better client understanding or how your analytical abilities improved investment returns.

By weaving your skills into real-life examples, employers can better picture how you’ll do in the role of a financial advisor. Balancing hard and soft skills this way shows you’re not just good at numbers but also great at working with people.

Choosing a resume format that highlights analytical skills, client relationship-building, and financial planning achievements can distinguish financial advisors.

Showcase your accomplishments

To showcase your accomplishments as a financial advisor, start by organizing your work experience in reverse chronological order. This means listing your most recent job first and working backward. For each position, include the job title, employer name, location, and dates of employment. This format helps employers quickly see your career progression and relevant experience.

Instead of just listing duties, focus on quantifying your accomplishments to make your resume stand out. Use numbers to highlight the impact you made in each role. For example, instead of saying you managed client portfolios, mention how you increased portfolio returns by 15% over two years.

Turning duties into achievements with measurable results like percentages or cost savings shows potential employers that you can deliver tangible benefits.

Use strong action words to describe what you did and what you achieved. Words like “improved,” “increased,” or “reduced” paired with specifics help convey the value you’ve added in past roles. Quantified accomplishments allow hiring managers to quickly gauge your skills and impact as a financial advisor, painting a clearer picture of what you could bring to their team.

5 financial advisor work history bullet points

- Developed personalized financial plans for over 150 clients, resulting in a 25% increase in client satisfaction and retention.

- Managed a $50 million investment portfolio, achieving an average annual return of 8% over five years.

- Conducted comprehensive market analysis that led to a 15% growth in new business opportunities within the first year.

- Implemented strategic asset allocation strategies, reducing client risk exposure by 20% during volatile markets.

- Led educational workshops on financial literacy, increasing community engagement by 30% and attracting new clientele.

Opt for a resume template that’s clean and simple with clear headings to highlight your skills effectively, steering clear of flashy designs or excessive colors that can divert attention from key details.

Write a strong professional summary

A professional summary on a resume serves as an introduction to hiring managers, offering a snapshot of who you are as an applicant.

A professional summary is a brief section that highlights your experience, skills, and achievements in three to four sentences. It’s best suited for experienced applicants like financial advisors who want to show their professional identity and value right away.

In contrast, resume objectives focus on career goals and are ideal for those new to the field, changing careers, or with employment gaps. While summaries say “what I’ve accomplished,” objectives express “what I aim to contribute.”

Next, we’ll look at examples of both summaries and objectives tailored for different industries and experience levels.

Financial advisor resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in Finance. Completed internships in financial analysis and investment research, gaining foundational skills in data interpretation and market trend analysis. Certified Financial Planner (CFP) applicant dedicated to assisting clients with budget management and financial goal setting.

Mid-career

Results-driven financial advisor with over seven years of experience in asset management and retirement planning. Demonstrated ability to develop tailored financial strategies that increase portfolio growth while minimizing risk. Holds Series 7 and Series 66 licenses, recognized for building lasting client relationships through transparent communication and strategic guidance.

Experienced

Seasoned financial advisor with a strong background in wealth management and tax optimization strategies. Over 15 years of experience leading advisory teams to achieve record-breaking growth in client assets under management. Chartered Financial Analyst (CFA) certified, known for innovative solutions that improve client satisfaction and drive long-term success.

Financial advisor resume objective examples

Recent graduate

Dedicated and analytical recent finance graduate seeking an entry-level financial advisor position to apply academic knowledge and strong quantitative skills in a professional setting. Committed to helping clients achieve their financial goals through personalized advice and strategic planning.

Career changer

Resourceful project manager transitioning into financial advising, with a solid background in budget management and client relations. Eager to leverage transferable skills in data analysis and problem-solving to provide insightful financial guidance and support for diverse clientele.

Specialized training

Certified financial planner with specialized training in retirement planning and investment strategies aiming to join a forward-thinking advisory firm. Passionate about using expertise to help clients navigate complex financial landscapes and secure their long-term financial well-being.

Make your resume shine! Use our Resume Builder to highlight your financial skills and make a strong impression on employers.

Match your resume to the job description

Tailoring resumes to job descriptions is key because it helps job seekers stand out to employers and pass through ATS. ATS scans for specific keywords and phrases from job postings. If your resume lacks these terms, it might not reach a human recruiter. By customizing your resume, you can ensure it aligns with the job requirements, boosting your chances of getting noticed.

An ATS-friendly resume incorporates keywords and phrases that match the skills listed in the job description. Aligning your skills with these terms improves the likelihood that hiring managers will see your application. This alignment shows you have the qualifications needed for the role.

To identify keywords from job postings, look for skills, qualifications, and duties mentioned repeatedly. For example, if a role emphasizes “patient care,” “clinical assessments,” or “healthcare team collaboration,” use these exact phrases in your resume. Including these words verbatim helps ensure ATS recognizes your relevant experience.

Incorporate these terms naturally into your resume content by rewriting job descriptions. For instance, change “provide high-quality patient care” to “delivered high-quality patient care to improve overall health outcomes.” This method highlights your experience while including important keywords.

Targeted resumes benefit ATS compatibility by matching job requirements precisely. This strategy ups the chance of passing initial screenings and landing an interview. Tailoring each application makes you a more attractive applicant to potential employers.

Boost your resume quickly! Our ATS Resume Checker reviews your resume and gives instant tips to help you stand out to hiring managers.

Salary Insights for Financial Advisors

Understanding salary data can help you make smart choices about your career path or moving to a new place.

Top 10 highest-paying states for financial advisors

Financial Advisors earn varying salaries across the United States, with a national average of $140,929. The table below highlights the states where financial advisors command the highest compensation.

Our salary information comes from the U.S. Bureau of Labor Statistics’ Occupational Employment and Wage Statistics survey. This official government data provides the most comprehensive and reliable salary information for writers across all 50 states and the District of Columbia. The figures presented here reflect the May 2025 dataset, which is the most recent available as of this publication.

| State | Average Salary |

|---|---|

| New York | $225,930 |

| South Dakota | $174,340 |

| Maryland | $173,120 |

| California | $170,480 |

| New Jersey | $170,950 |

| Louisiana | $166,400 |

| Kansas | $164,480 |

| Pennsylvania | $164,140 |

| Kentucky | $162,520 |

| Indiana | $158,560 |

FAQ

Do I need to include a cover letter with my financial advisor resume?

Yes, including a cover letter with your financial advisor resume can significantly improve your application.

A cover letter allows you to highlight why you’re drawn to the specific firm or opportunity, and how your skills align with their needs.

For instance, if the firm specializes in a particular area like retirement planning or investment management, you can emphasize your expertise or passion in that field.

Consider using tools such as Cover Letter Generator to craft a personalized and polished letter that complements your resume perfectly.

Additionally, reviewing samples from cover letter examples can provide inspiration and ensure yours is tailored effectively for the financial advisory role.

How long should a financial advisor’s resume be?

For a financial advisor, a one-page resume is usually best for effectively showing your main skills, qualifications, and experience. Focus on showcasing your expertise in investment strategies, client relationship management, and financial planning.

If you have extensive experience or advanced certifications like CFP or CFA, opting for a two-page resume can be suitable. Highlight achievements that show your ability to grow client portfolios and improve financial outcomes. Keep the content relevant and recent to hold the reader’s attention.

Explore our guide on how long a resume should be for more examples and tips tailored to different career stages.

How do you write a financial advisor resume with no experience?

When creating a financial advisor resume and you have no direct experience, highlight your education, relevant skills, and any related experiences that show your potential.

Follow these tips on writing a resume with no experience:

- Emphasize your education: Highlight any degrees in finance, economics, or business. Include the institution’s name, graduation date, and any honors or relevant coursework like investment management or financial planning.

- Showcase transferable skills: Mention skills such as analytical thinking, communication, customer service, and skill in financial software. These are highly relevant for a financial advisor role.

- Include internships or volunteer work: If you’ve interned at a bank or volunteered in a role involving financial literacy programs, describe these experiences with specific accomplishments and responsibilities that align with advising clients.

- Highlight certifications: If you’ve pursued certifications like Series 7 or CFP coursework, list them prominently as they show commitment to the field.

Rate this article

Financial Advisor

Share this page

Additional Resources

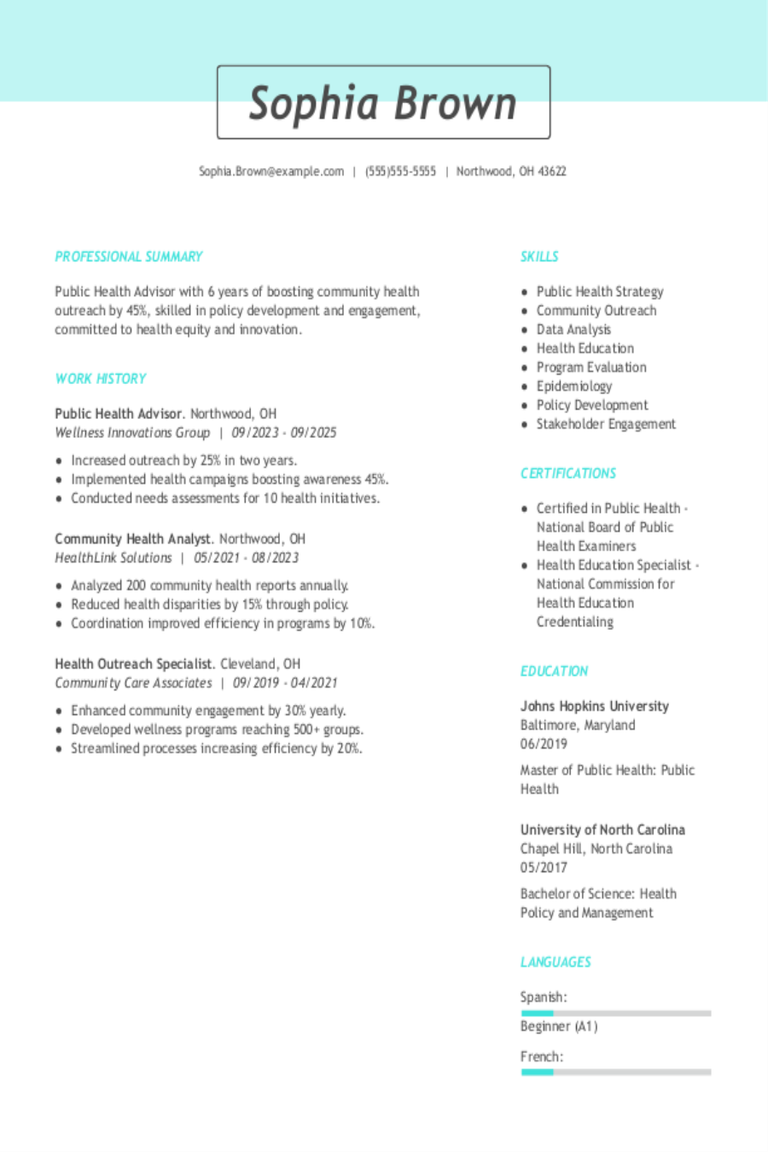

Public Health Advisor Resume Examples & Templates

Explore public health advisor resume examples that focus on promoting community wellness and managing health programs. These samples and tips will help you show your experience in planning, problem-solving, and

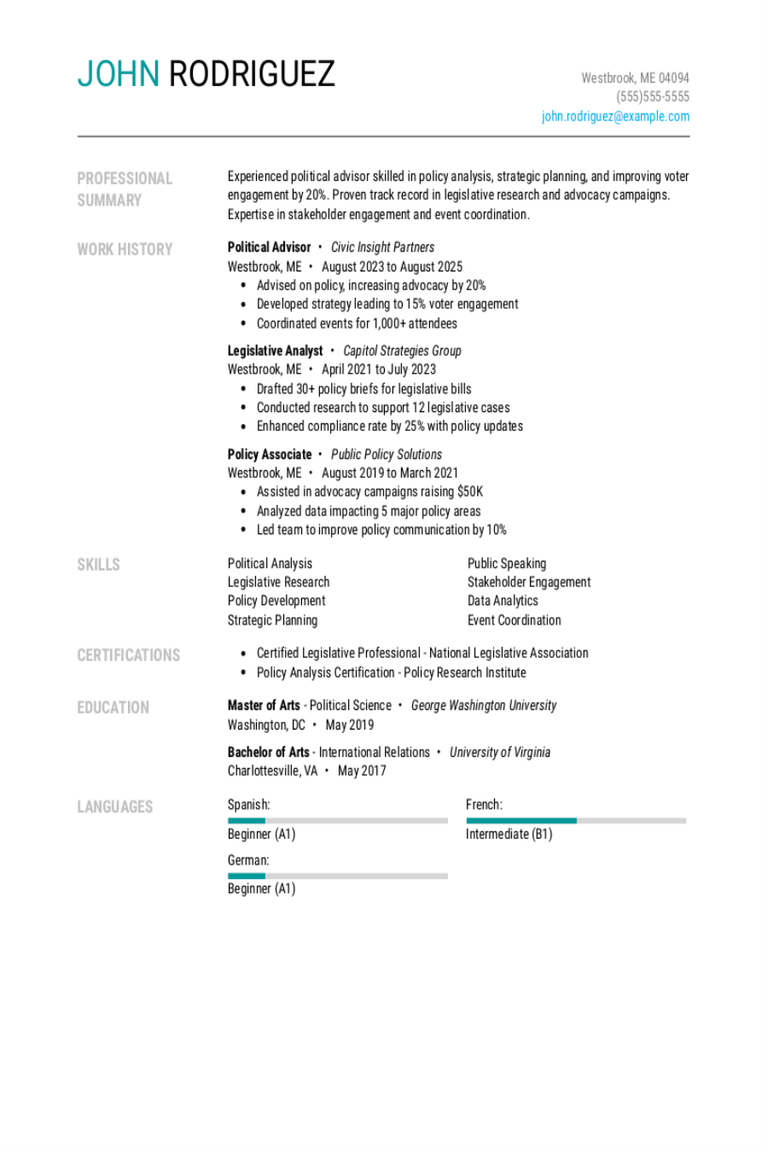

Political Advisor Resume Examples & Templates

Discover political advisor resume examples and use these tips to showcase your experience in guiding leaders and influencing decisions effectively.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies accomplishments: By

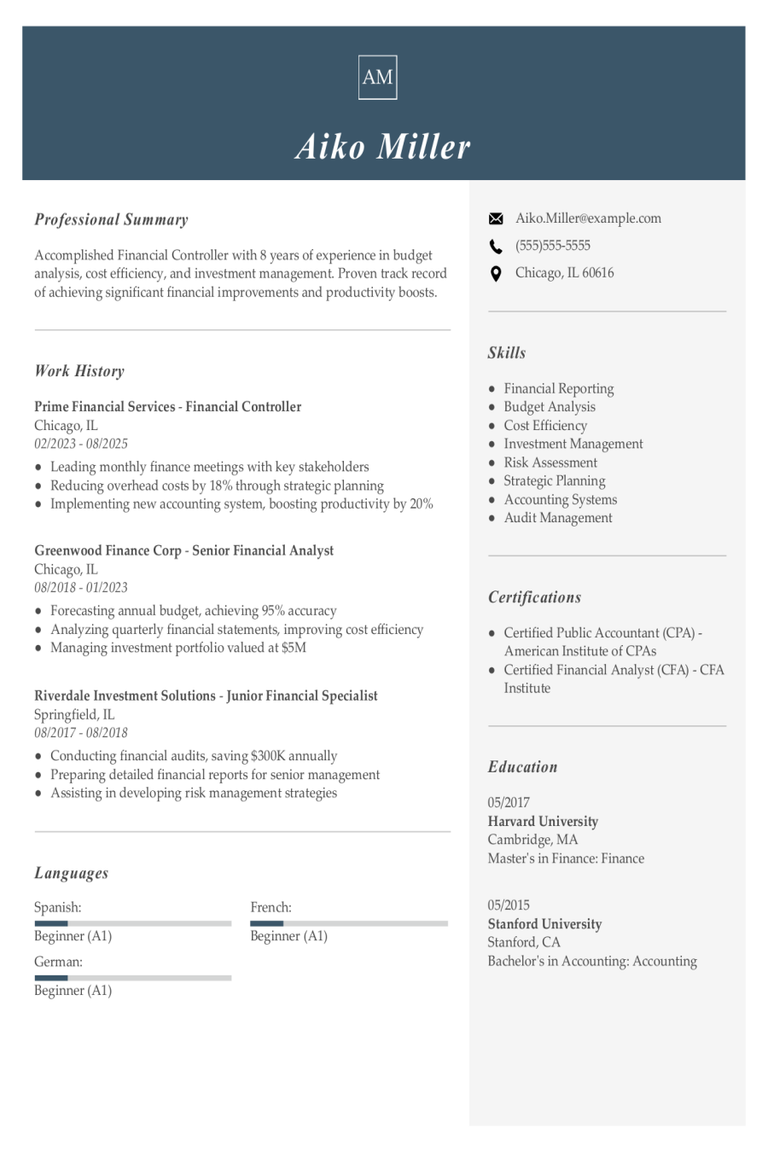

Financial Controller Resume Examples & Templates

Discover how to craft a financial controller resume that stands out. Learn to showcase your skills in budgeting, managing financial reports, and leading accounting teams effectively.Build my resumeImport existing resumeCustomize

Financial Project Manager Resume Examples & Templates

Discover financial project manager resume examples and learn how to show you handle budgets, lead teams, and keep projects on track.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

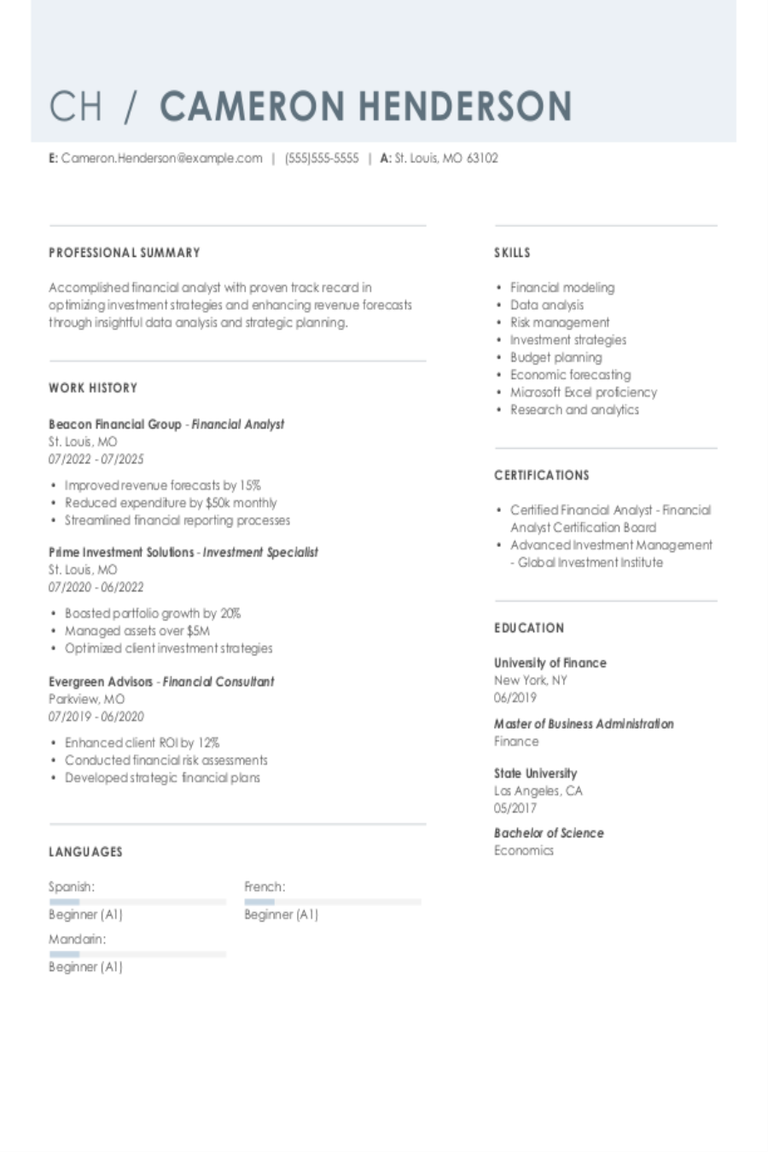

Financial Analyst Resume Examples & Templates

Discover financial analyst resume examples and learn how to showcase your knack for crunching numbers and making smart money decisions.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies accomplishments: By

Financial Consultant Resume Examples & Templates

Discover financial consultant resume examples and tips to learn how to highlight your skills in advising clients, analyzing financial trends, and managing investments.Build my resumeImport existing resumeCustomize this templateWhy this