Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: By including measurable accomplishments, such as optimizing tax savings by 15% and reviewing over 200 tax returns annually, the applicant effectively showcases their impact and value.

- Uses action-oriented language: Employing action verbs like “optimized,” “implemented,” and “conducted” reveals an initiative-driven approach to tasks.

- Illustrates problem-solving ability: Solving client tax challenges with innovative strategies that reduced liabilities by 10% highlights the applicant’s problem-solving skills and critical thinking.

More Tax Accountant Resume Examples

Our tax accountant resume examples show how to emphasize your expertise in financial analysis, tax preparation, and compliance. Use these finance resume samples to create a resume that showcases your skills and experience in the accounting field.

Entry-Level Tax Accountant

Why this resume works

- Effective use of keywords: Strategically including role-relevant keywords like “tax compliance” and “financial analysis” helps the resume pass applicant tracking systems (ATS) and stand out to hiring managers.

- Shows digital literacy: Listing skills like Excel expertise and auditing methods reveals the applicant’s computer skills and digital readiness for modern workplaces.

- Puts skills at the forefront: The skills-based resume format highlights skills like tax strategy and financial reporting, showcasing the applicant’s relevant expertise.

Mid-Level Tax Accountant

Why this resume works

- Points to measurable outcomes: By showcasing achievements like reducing errors by 25% and saving $200K, the applicant highlights impressive professional contributions.

- Displays technical expertise: Holding CPA and CMA certifications alongside skills in tax management and audit preparation showcases the applicant’s deep technical expertise, essential for finance roles.

- Includes a mix of soft and hard skills: Balancing analytical skills with interpersonal skills like client communication, the applicant effectively combines hard and soft strengths.

Experienced Tax Accountant

Why this resume works

- Showcases impressive accomplishments: By including measurable successes like saving $500K annually and reducing audit risk by 20%, the applicant showcases accomplishments that reflect strategic thinking and senior-level impact.

- Focuses on work history: The chronological resume format highlights extensive experience across roles, emphasizing progression in tax, finance, and auditing expertise over many years.

- Emphasizes leadership skills: Leading initiatives such as implementing a tax filing system and managing accounts with high accuracy demonstrates the applicant’s leadership skills in driving efficiency-focused projects.

Tax Accountant Resume Template (Text Version)

Min Zhang

Brookfield, WI 53012

(555)555-5555

Min.Zhang@example.com

Professional Summary

Experienced Tax Accountant with expertise in tax compliance, auditing, and regulatory reporting. Proven track record in optimizing client tax savings by over 15%. Holds CPA and CMA certifications, enhancing reputation in financial analysis.

Work History

Tax Accountant

PrimeLedger Solutions – Brookfield, WI

June 2023 – June 2025

- Optimized tax savings by 15% for key clients

- Reviewed 200+ tax returns annually

- Implemented new tax compliance policies

Corporate Tax Analyst

SilverTax Advisors – Milwaukee, WI

June 2021 – May 2023

- Conducted tax audits for Fortune 500 firms

- Reduced tax liabilities by 10% on average

- Managed a portfolio of 25 corporate clients

Junior Tax Consultant

FinWise Partners – Brookfield, WI

June 2020 – May 2021

- Prepared quarterly tax provision reports

- Analyzed tax data improving accuracy by 7%

- Assisted in training 3 new staff members

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Skills

- Tax Compliance

- Financial Analysis

- Auditing

- Tax Planning

- Regulatory Reporting

- Risk Assessment

- Tax Law Expertise

- Problem Solving

Certifications

- Certified Public Accountant (CPA) – California Board of Accountancy

- Certified Management Accountant (CMA) – Institute of Management Accountants

Education

Master of Accounting Accounting

Stanford University Stanford, California

May 2020

Bachelor of Science Business Administration

University of California, Berkeley Berkeley, California

May 2018

Related Resume Guides

Advice for Writing Your Tax Accountant Resume

Explore our tips on how to write a resume for a tax accountant position and learn how to highlight your expertise in tax regulations, number crunching, and helping clients navigate financial complexities. Dive into resume advice tailored to your field and create a standout application that reflects your skills and experience.

Highlight your most relevant skills

Listing relevant skills when applying for a tax accountant role helps show employers that you’re prepared to handle the job’s responsibilities. A dedicated skills section on your resume lets you highlight abilities that align with the position, such as preparing financial records, managing audits, or using tax software.

Balancing technical skills like knowledge of tax regulations and accounting principles with soft skills like attention to detail and communication shows you’re well-rounded. Employers want someone who can manage complex tasks while collaborating effectively with clients or team members.

To make your resume stronger, integrate key skills into your work experience section as well. For example, instead of just listing “tax preparation” in your skills section, include phrases in your experience entries like “prepared accurate tax returns for multiple clients using specialized software.”

This approach ties your abilities directly to real accomplishments and makes them more memorable. Combining both approaches ensures that recruiters quickly see why you’re a great fit for their needs.

Showcase your financial expertise, attention to detail, and professional achievements by choosing a resume format suited for tax accountants.

Showcase your accomplishments

When organizing your work experience as a tax accountant, start with your most recent job and move backward. Each entry should clearly state your job title, the employer’s name, location, and the dates you worked there. This structure helps hiring managers quickly see your career progression and understand your professional journey.

Focus on turning your duties into achievements by showcasing measurable results. Instead of just listing what you did, highlight how well you did it. Use numbers to make your accomplishments stand out—like saying you reduced audit time by 30%, saved $50,000 in costs through tax planning strategies, or improved reporting efficiency by 15%. These figures provide proof of your skills and show the impact of your work.

Use strong action words to describe what you’ve done as a tax accountant. Words like “led,” “improved,” “reduced,” or “optimized” give energy to your resume and draw attention to the difference you’ve made in each role. Quantified accomplishments help hiring managers quickly grasp not only what you’ve done but how effectively you’ve done it, making them more likely to see the value you’d bring to their team.

5 tax accountant work history bullet points

- Prepared and filed tax returns for over 100 clients annually, achieving a 99% accuracy rate and minimizing audit risks.

- Implemented a new tax software system that reduced processing time by 25%, improving team productivity and client satisfaction.

- Advised small businesses on tax strategies, resulting in an average annual savings of $50,000 per client.

- Conducted detailed tax audits and reviews, identifying discrepancies that led to a recovery of $200,000 in missed deductions.

- Managed quarterly tax reporting for a portfolio of 30 corporate clients, ensuring compliance with federal and state regulations.

Choose a resume template that’s neat and simple, with clear headings and easy-to-read fonts. Avoid excessive colors or graphics to help employers spot key details fast.

Write a strong professional summary

A professional summary on a resume serves as an introduction for hiring managers, letting them quickly understand what you bring to the table and helping them decide if they should keep reading. When choosing between a summary and an objective, consider your experience and what message you want to convey first.

A professional summary typically consists of three to four sentences that showcase your experience, skills, and achievements. It’s ideal for seasoned applicants who want to present their professional identity and value upfront by sharing what they’ve accomplished in their career so far.

In contrast, a resume objective outlines your career goals. Resume objectives are well-suited for entry-level applicants, those changing careers, or individuals with gaps in their work history. While summaries focus on “what I’ve accomplished,” objectives shift attention to “what I aim to contribute.”

Next, we’ll provide examples of both summaries and objectives tailored to various industries and levels of experience, including how a tax accountant might craft theirs. Explore our full library of resume examples for additional inspiration.

Tax accountant resume summary examples

Entry-level

Recent accounting graduate with a Bachelor of Science in Accounting and successful completion of the CPA exam. Strong foundation in tax laws, preparation of individual and corporate tax returns, and use of accounting software like QuickBooks. Eager to contribute analytical skills to help optimize tax strategies within a dynamic team environment.

Mid-career

Tax accountant with over five years of experience specializing in federal and state compliance for small businesses and corporations. Proven track record in managing audits, preparing complex tax returns, and leveraging knowledge of IRS regulations to minimize liabilities. Known for attention to detail and ability to navigate rapidly changing tax codes.

Experienced

Senior tax accountant with expertise in strategic planning and advisory services for multinational corporations. Extensive experience leading teams through high-stakes audits, implementing advanced tax optimization techniques, and achieving significant cost savings across diverse industries. Recognized for leadership abilities and a deep understanding of international taxation policies.

Tax accountant resume objective examples

Entry-level

Detail-oriented recent accounting graduate seeking an entry-level tax accountant position to leverage academic knowledge and analytical skills in a dynamic accounting firm. Committed to contributing to efficient tax preparation and compliance while gaining practical experience in the field.

Career changer

Motivated professional transitioning into tax accounting, bringing a strong background in financial analysis and problem-solving. Eager to apply transferable skills and newfound tax knowledge to support accurate and timely tax filings within a collaborative team environment.

Recent graduate

Ambitious Bachelor of Science in Accounting graduate ,aspiring to start a career as a tax accountant. Passionate about using educational background and internship experience to assist with tax planning, compliance, and reporting for diverse client portfolios.

Try our AI Resume Builder to make your tax accountant resume. It’s easy to use and lets you add your skills and experience quickly!

Match your resume to the job description

Tailoring resumes to job descriptions is key for standing out to employers and getting through applicant tracking systems (ATS). Employers use ATS to filter applications by scanning for specific keywords from job postings. By customizing your resume with these targeted words, you make it more likely that it will catch the attention of hiring managers.

An ATS-friendly resume includes keywords and phrases found in the job description. When these match your skills, they increase the chances of your application being noticed. This involves using those exact terms in your resume so it aligns well with what the employer is seeking.

To find keywords from a job posting, focus on repeated skills, qualifications, and duties. For instance, if a tax accountant position frequently mentions “financial analysis,” “tax regulations,” or “client communication,” ensure these are incorporated into your resume if they reflect your experience.

Incorporate these terms naturally into your content. Rather than simply listing tasks, phrase them as accomplishments. For example, instead of “Manage tax filings,” write “Managed tax filings, ensuring compliance with updated regulations,” which highlights both action and impact.

Targeted resumes not only help pass ATS but also demonstrate to employers that you’ve taken the time to align with their needs. This can improve your chances of landing an interview as a tax accountant.

Want your resume to get noticed by employers? Our ATS Resume Checker looks at important parts and helps you boost your score right away.

FAQ

Do I need to include a cover letter with my tax accountant resume?

Yes, adding a cover letter to your tax accountant resume can boost your application and distinguish you from other applicants. A cover letter allows you to explain your interest in the specific company or role and how your skills align with their needs, like tax compliance or financial reporting.

If the company specializes in certain industries (like real estate, healthcare, or manufacturing), highlight any experience with clients in those areas. You might find cover letter examples helpful for ideas on showcasing these skills.

Use your cover letter to demonstrate soft skills such as attention to detail, problem-solving, or client communication—key qualities for a successful tax accountant. To craft each cover letter effectively, consider using our Cover Letter Generator to create tailored letters that highlight key skills, like reducing tax liabilities or managing audits.

How long should a tax accountant’s resume be?

For a tax accountant, the ideal one-page resume length is usually recommended if you have under 10 years of experience. This helps focus on key qualifications like tax prep skills, understanding of tax laws, and skill in accounting software. Hiring managers value concise resumes that emphasize relevant skills and achievements.

If you possess extensive experience or advanced certifications (like a CPA), a two-page resume might be suitable. Just ensure every detail directly supports your role qualifications, such as complex tax filings or audit leadership.

Check out our guide on how long a resume should be to grasp what works best for your career stage and view examples tailored to different experience levels.

How do you write a tax accountant resume with no experience?

If you’re starting as a tax accountant without experience, it’s important to focus your resume on your education, skills, and any coursework or projects that show your potential in the field:

- Highlight your education: List your accounting degree prominently, including the institution, graduation date, and any honors. If you’ve completed courses related to tax law or financial accounting, emphasize those too.

- Showcase relevant coursework: Detail specific classes or projects that involved tax preparation or analysis. Explain what you learned or accomplished during these activities, which can help connect your academic work to real-world applications.

- Develop transferable skills: Focus on skills like attention to detail, analytical thinking, and skill with accounting software such as Excel or QuickBooks. These are important for a tax accountant role and can be acquired through internships or volunteer experiences.

Explore our guide on crafting a resume with no experience to find more strategies for highlighting your strengths when you’re new to the field.

Rate this article

Tax Accountant

Share this page

Additional Resources

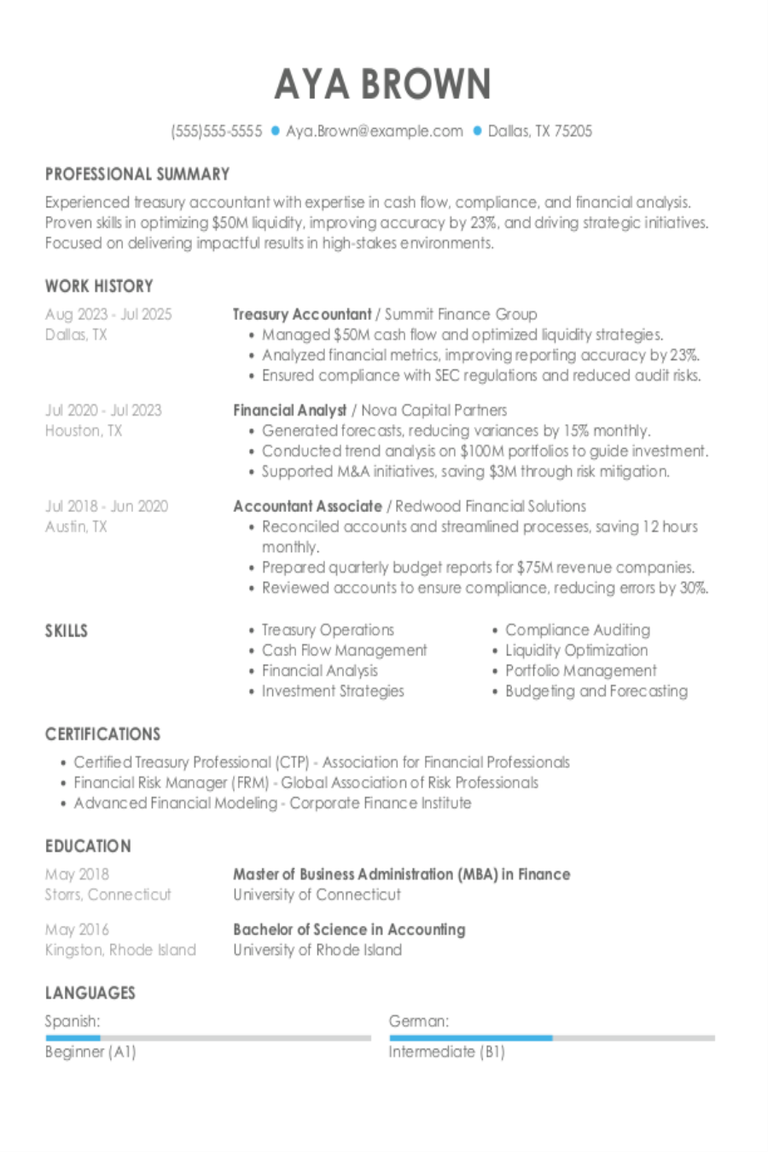

Treasury Accountant Resume Examples & Templates

Explore treasury accountant resume examples and learn how to show you handle cash flow, manage investments, and analyze financial data.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies accomplishments: By

Tax Preparer Resume Examples & Templates

Check out these tax preparer resume examples to learn how to highlight your skills in tax filing and client management. Discover tips on showcasing your experience so you can stand

Tax Manager Resume Examples & Templates

Explore tax manager resume examples and learn how to show you handle complex tax regulations, lead teams, and improve financial strategies.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

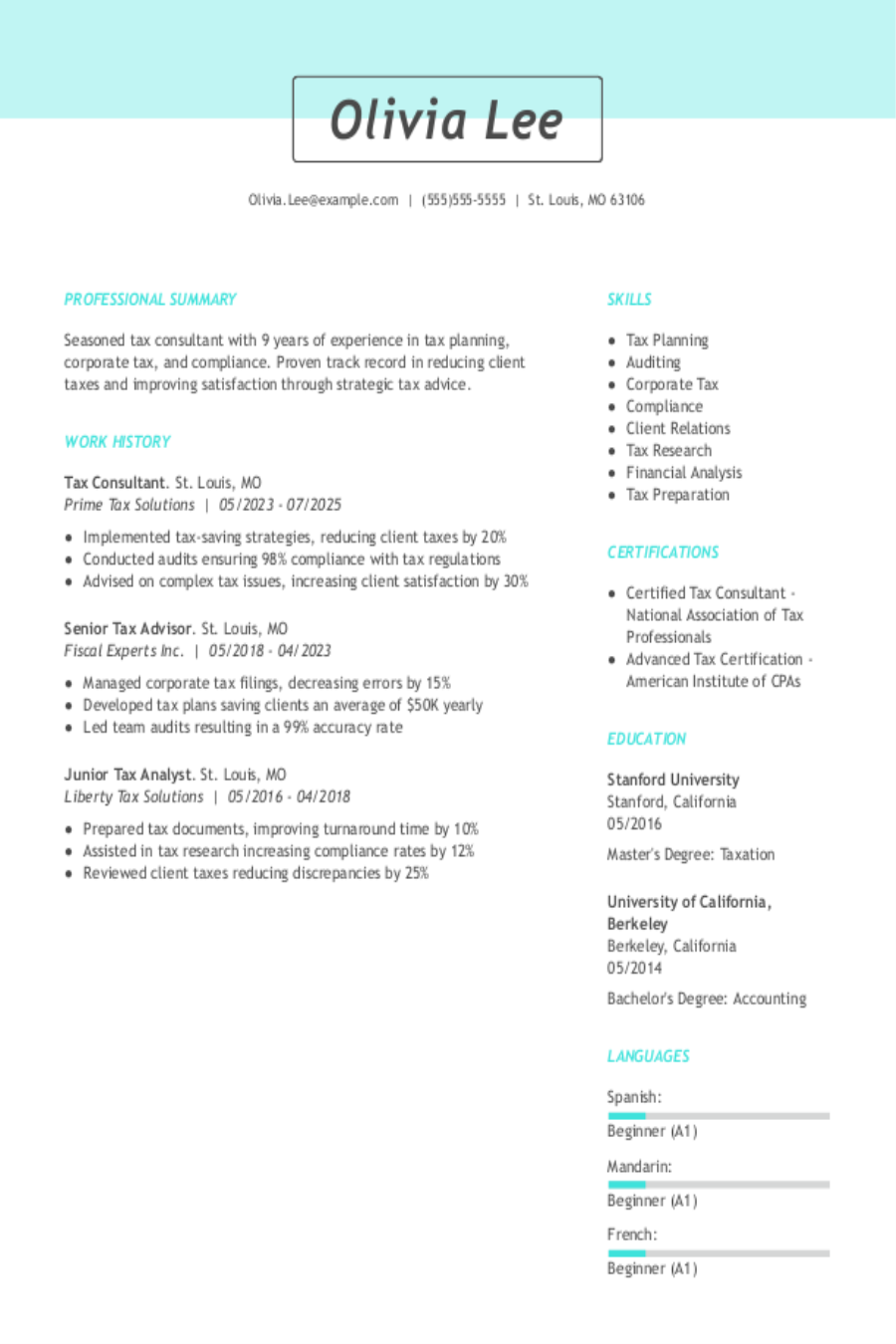

Tax Consultant Resume Examples & Templates

Discover tax consultant resume examples and tips to help you showcase your knack for crunching numbers and navigating tax laws.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

Taxi Driver Resume Examples & Templates

These taxi driver resume examples will show you how to highlight safe driving, city navigation, and friendly passenger service. Use our examples and tips to learn how to showcase your

Project Accountant Resume Examples & Templates

Explore project accountant resume examples and tips to learn how to highlight your experience managing budgets and tracking financial progress.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies