Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: By improving KYC accuracy by 15% and reducing verification time by 20%, the applicant showcases impactful results.

- Highlights industry-specific skills: Expertise in AML/KYC compliance and risk assessment shows the applicant’s alignment with finance industry roles, improving their fit for specialized positions.

- Illustrates problem-solving ability: Initiating new AML guidelines to improve security displays the applicant’s problem-solving skills.

More KYC Analyst Resume Examples

Our KYC analyst resume examples provide insights into showcasing your compliance knowledge, due diligence skills, and attention to detail. Use these finance resume samples to create a resume that highlights your expertise in financial regulations and customer verification processes.

Entry-Level KYC Analyst

Why this resume works

- Effective use of keywords: Incorporating industry-specific terms like AML, KYC, and fraud prevention aligns with keywords strategies to optimize applicant tracking system (ATS) compatibility and emphasize expertise in financial compliance.

- Centers on academic background: The applicant’s education section features a Master’s degree in financial crime prevention, reflecting a strong foundation for roles early in the applicant’s career.

- Shows digital literacy: The applicant’s experience in transaction monitoring and data analysis showcases computer skills important for navigating modern digital tools in regulatory compliance workflows.

Mid-Level KYC Analyst

Why this resume works

- Points to measurable outcomes: Implementing new software to reduce processing rimw by 20% and streamline operations reveals the applicant’s commitment to measurable outcomes and operational efficiency.

- Demonstrates language abilities: Leveraging language skills in Spanish, French, and German supports effective cross-cultural communication, essential for global financial compliance roles.

- Displays technical expertise: Applying new KYC policy to increase compliance by 35% showcases technical expertise in process optimization critical for KYC analyst positions.

Experienced KYC Analyst

Why this resume works

- Showcases impressive accomplishments: Highlighting quantifiable achievements like reducing fraudulent transactions by 30% proves senior-level performance and significant business impact.

- Emphasizes leadership skills: Leading a project team to reduce compliance costs by $50,000 annually emphasizes leadership skills through effective project management and initiative-taking.

- Lists relevant certifications: Listing certifications such as Certified KYC Professional and AML Specialist Certification supports the applicant’s expertise and commitment to continual learning.

KYC Analyst Resume Template (Text Version)

Tao Wang

Portland, ME 04110

(555)555-5555

Tao.Wang@example.com

Professional Summary

Experienced KYC Analyst with a robust background in AML compliance and risk management, driving process improvements and ensuring regulatory alignment. Proven expertise in financial analysis and data-driven decision making.

Work History

KYC Analyst

ClearView Financial Services – Portland, ME

May 2023 – July 2025

- Led KYC team, improved accuracy by 15%

- Reduced verification time by 20%

- Trained team on KYC software, increased efficiency

Compliance Specialist

Prime Banking Solutions – Westbrook, ME

May 2020 – April 2023

- Implemented compliance checks, reduced risk by 25%

- Monitored transactions, ensured regulatory alignment

- Updated compliance policies, improved adherence

AML Officer

Global Trust Bank – Westbrook, ME

August 2019 – April 2020

- Reviewed 200+ transactions daily for anomalies

- Conducted audits, lowered AML breaches

- Developed new AML guidelines, enhanced security

Languages

- Spanish – Beginner (A1)

- French – Beginner (A1)

- Mandarin – Intermediate (B1)

Skills

- Risk assessment

- AML/KYC compliance

- Financial analysis

- Data analytics

- Regulatory reporting

- Team leadership

- Problem-solving

- Process optimization

Certifications

- Certified Anti-Money Laundering Specialist (CAMS) – ACAMS

- KYC and CDD Certification – IFCCE

Education

Master of Business Administration Finance

Stanford University Stanford, California

May 2019

Bachelor of Arts Economics

University of Washington Seattle, Washington

May 2017

Related Resume Guides

Advice for Writing Your KYC Analyst Resume

Discover our tailored tips on how to write a resume for a KYC analyst role and learn how to highlight your skills in risk assessment, compliance, and attention to detail. Uncover strategies to make your resume stand out in the world of know your customer processes.

Highlight your most relevant skills

Listing relevant skills on your resume helps employers quickly see how well you match the role. A dedicated skills section lets you highlight both technical skills, like knowledge of compliance regulations and data analysis, and soft skills, like communication and attention to detail.

Balancing these skills shows you’re not only capable of doing the work but also good at working with others.

Incorporating your key skills into your work experience section can make your resume even stronger. For example, you might mention how your analytical skills helped uncover discrepancies in customer records or how your teamwork improved compliance checks. This approach gives real-life examples of how you’ve used these skills before, making them more believable and impactful to potential employers.

When writing about your skills, keep it clear and straightforward so anyone reading can understand. Focus on those that best fit the KYC analyst role to make sure you’re presenting yourself as the right choice for the job. By carefully crafting this part of your resume, you’ll stand out better during the hiring process and increase your chances of landing an interview.

A resume format that highlights attention to detail, compliance skills, and experience with financial regulations can help KYC analysts make a strong impression.

Showcase your accomplishments

When organizing your work experience on a resume, list your jobs in reverse chronological order. Start with your most recent position and work backward. Each job entry should clearly state your job title, employer name, location, and employment dates. For a KYC analyst role, this helps employers quickly understand your career progression and relevant experience.

Focus on turning duties into achievements by quantifying your accomplishments. Instead of just listing what you did, show how well you did it. Use numbers to highlight results like percentages of time saved, cost reductions achieved, or improvements in efficiency. For example, if you streamlined a process that reduced the client onboarding time by 20%, that’s an achievement worth noting.

Use action words to describe what you accomplished as a KYC analyst. Words like “improved,” “increased,” and “developed” can make your resume more dynamic and engaging. Quantified accomplishments help hiring managers see the impact you’ve made at previous jobs. This not only showcases your skills but also makes it easier for them to envision you making similar contributions in their organization.

5 KYC analyst work history bullet points

- Conducted thorough due diligence and improved customer risk assessments for over 500 high-risk clients, leading to a 20% decrease in potential compliance issues.

- Analyzed financial transactions and identified suspicious activities, resulting in the filing of 150+ SARs (Suspicious Activity Reports) with regulatory bodies.

- Streamlined KYC processes by implementing automated solutions, reducing client onboarding time by 30% and improving efficiency across the department.

- Collaborated with cross-functional teams to update KYC policies and procedures, ensuring adherence to evolving regulatory requirements and minimizing audit findings by 25%.

- Trained and mentored junior analysts on KYC best practices, improving team productivity and contributing to a 15% increase in overall case resolution rates.

Pick a resume template that uses clear sections and simple fonts, avoiding flashy designs or excess colors to ensure your skills and experience stand out effectively.

Write a strong professional summary

A professional summary is a brief introduction at the top of your resume that gives hiring managers a glimpse of who you are. It’s your chance to leave a strong first impression, helping them decide if they want to keep reading.

A professional summary is usually three to four sentences long and highlights your key achievements, skills, and work history. It works best for individuals with some relevant experience under their belt. The main goal of this section is to showcase the value and expertise you bring to potential employers.

On the other hand, resume objectives focus on career goals and are ideal for entry-level job seekers, career changers, or those re-entering the workforce after employment gaps. While summaries emphasize past accomplishments, objectives outline what you plan to contribute in a future role.

Below, we’ll share examples of both summaries and objectives customized for various industries and roles, including positions like KYC analyst.

KYC analyst resume summary examples

Entry-level

Recent graduate with a Bachelor of Science in finance, specializing in compliance and risk management. Completed internship in KYC analysis, gaining foundational skills in customer verification and regulatory requirements. Certified Anti-Money Laundering Specialist (CAMS) and eager to contribute to team efforts in ensuring compliance.

Mid-career

KYC analyst with over five years of experience in financial institutions, adept at performing due diligence on high-risk accounts and identifying potential risks. Proven track record in streamlining verification processes and supporting AML investigations. Holds a CAMS certification and recognized for collaboration across departments to improve compliance standards.

Experienced

Senior KYC analyst with expertise in leading complex regulatory compliance projects. Over 10 years of experience managing teams and implementing robust KYC frameworks within multinational banks. Holds certifications in advanced KYC methodologies and has successfully reduced risk exposure through strategic process improvements. Committed to driving excellence in client onboarding while maintaining stringent compliance.

KYC analyst resume objective examples

Recent graduate

Detail-oriented recent finance graduate with a strong understanding of compliance and regulations aiming to start a career as a KYC analyst. Eager to apply analytical skills and knowledge of anti-money laundering practices in ensuring the accuracy and security of client information within a reputable financial institution.

Career changer

Driven professional transitioning into KYC analysis, equipped with transferable skills in investigation and data management gained from previous roles in customer service. Looking to contribute energy and dedication towards supporting compliance initiatives and improving the integrity of client verification processes.

Entry-level

Aspiring KYC analyst with academic background in economics seeking an opportunity to enter the financial sector. Prepared to apply research skills and attention to detail in identifying potential risks while supporting efforts to uphold regulatory standards and protect organizational interests.

Save time and make your KYC analyst resume stand out! Use the Resume Builder to quickly add skills, create strong summaries, and format it like a pro.

Match your resume to the job description

Tailoring resumes to job descriptions is essential because it helps job seekers stand out to employers and pass through ATS. ATS software scans resumes for specific keywords and phrases from job postings. By matching your resume content with these keywords, you increase the chances of your application being noticed by hiring managers.

An ATS-friendly resume includes keywords that align with your skills and experience. This means using terms directly from the job description, which can help ensure that your resume gets flagged as a good match. When applying for a KYC analyst role, incorporating relevant industry terms can significantly boost your visibility.

To identify keywords in job postings, look for skills and duties mentioned often. For example, if a KYC analyst posting repeatedly mentions “customer verification,” “risk assessment,” or “compliance checks,” those are key terms to include in your resume. Using exact phrases shows you have read the posting carefully and understand what the employer needs.

Incorporate these terms naturally into your resume. Instead of just listing duties, describe achievements using these keywords. For instance, change “conducted customer verification” to “conducted thorough customer verification ensuring compliance with regulations.”

Customize your resume to offer better chances at passing ATS filters. By closely aligning your experience with what the employer seeks, you make it easier for both technology and hiring managers to see you as an ideal applicant for the position.

Use our ATS Resume Checker to find over 30 common mistakes in your resume’s layout and wording. Get quick tips on how to boost your resume score.

FAQ

Do I need to include a cover letter with my KYC analyst resume?

Yes, including a cover letter with your KYC analyst resume can improve your application and increase interview opportunities.

A cover letter gives you the chance to highlight your interest in the specific company and role, while elaborating on skills like attention to detail and knowledge of compliance regulations.

If the firm is known for its innovative approach to customer due diligence or faces specific KYC challenges, you can mention your experience related to those areas.

Consider using resources like Cover Letter Generator that offer guidance on crafting effective cover letters tailored to financial roles.

Browsing through cover letter examples for KYC analyst positions can also provide insights into structuring yours effectively for maximum impact.

How long should a KYC analyst’s resume be?

For a KYC analyst, aim for a concise one-page resume that highlights your expertise in areas like customer due diligence, risk assessment, and regulatory compliance. Recruiters value clarity and relevance, so focus on showcasing skills such as familiarity with AML/KYC regulations, data analysis, and attention to detail.

If you have extensive experience or advanced certifications (e.g., CAMS), a two-page resume can work—just ensure every section is directly applicable to the role. Highlight recent achievements like successful investigations or process improvements to demonstrate impact.

Explore our guide on how long a resume should be for more tips tailored to your career stage.

How do you write a KYC analyst resume with no experience?

When crafting a KYC analyst resume with no experience, emphasize your skills, education, and relevant coursework or training that matches the role.

Follow these tips on creating a resume with no experience:

- Emphasize academic achievements: Start by listing your degree in finance, business, or a related field. Include key courses like compliance and risk management that relate directly to KYC responsibilities.

- Showcase transferable skills: Highlight skills such as analytical thinking, attention to detail, and skill in research—skills essential for KYC analysis. If you have experience using databases or tools that support data review and verification processes, make sure to mention these.

- Include internships or projects: Any internships or projects involving financial compliance or customer verification should be detailed under experience. Describe what you did and how it relates to KYC tasks like verifying identities and conducting due diligence.

Rate this article

KYC Analyst

Share this page

Additional Resources

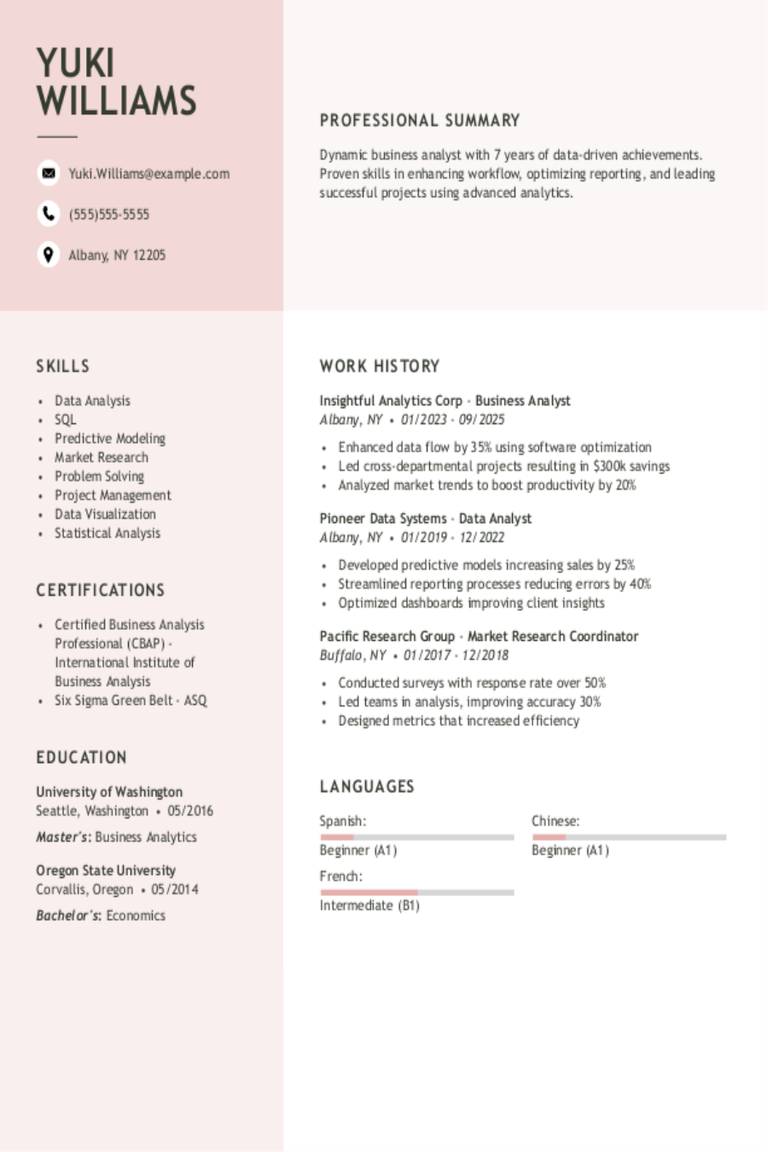

Business Analyst Resume Examples & Templates

Explore business analyst resume examples to see how to showcase your problem-solving, teamwork, and data skills. Browse tips to highlight your experience turning ideas into action and improving processes to

Quality Control Analyst Resume Examples & Templates

Discover how quality control analysts showcase their skills in monitoring products and ensuring standards are met. These resume examples will help you highlight your experience with testing processes and improving

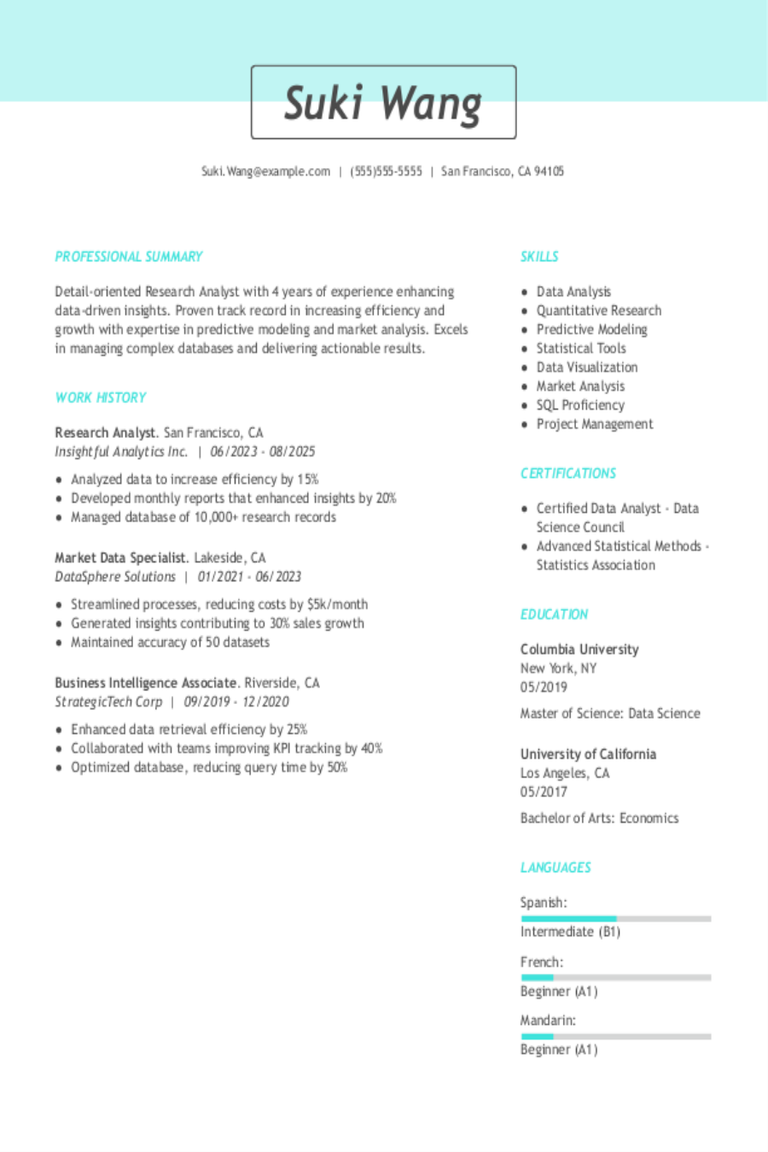

Research Analyst Resume Examples & Templates

Browse research analyst resume examples and learn how to spotlight your skills in data analysis, problem-solving, and research techniques.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies accomplishments: By

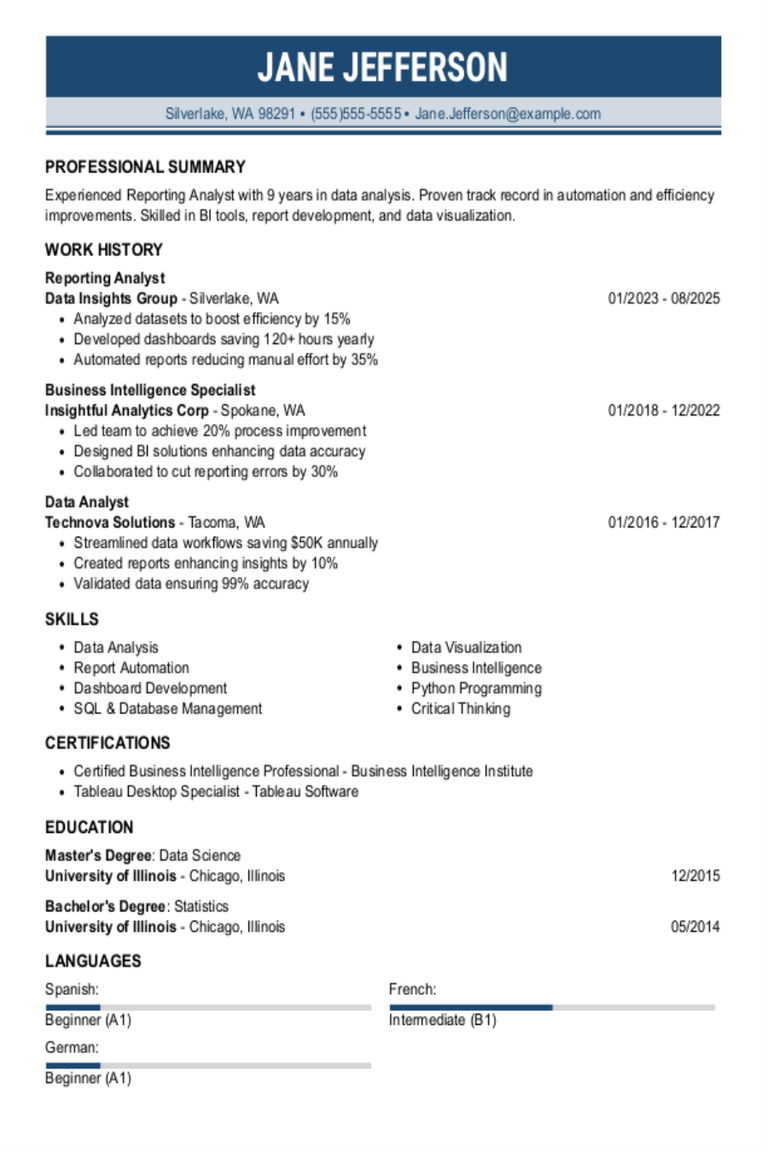

Reporting Analyst Resume Examples & Templates

Discover reporting analyst resume examples and learn to showcase your experience in creating reports and making insights stand out to potential employers.Build my resumeImport existing resumeCustomize this templateWhy this resume

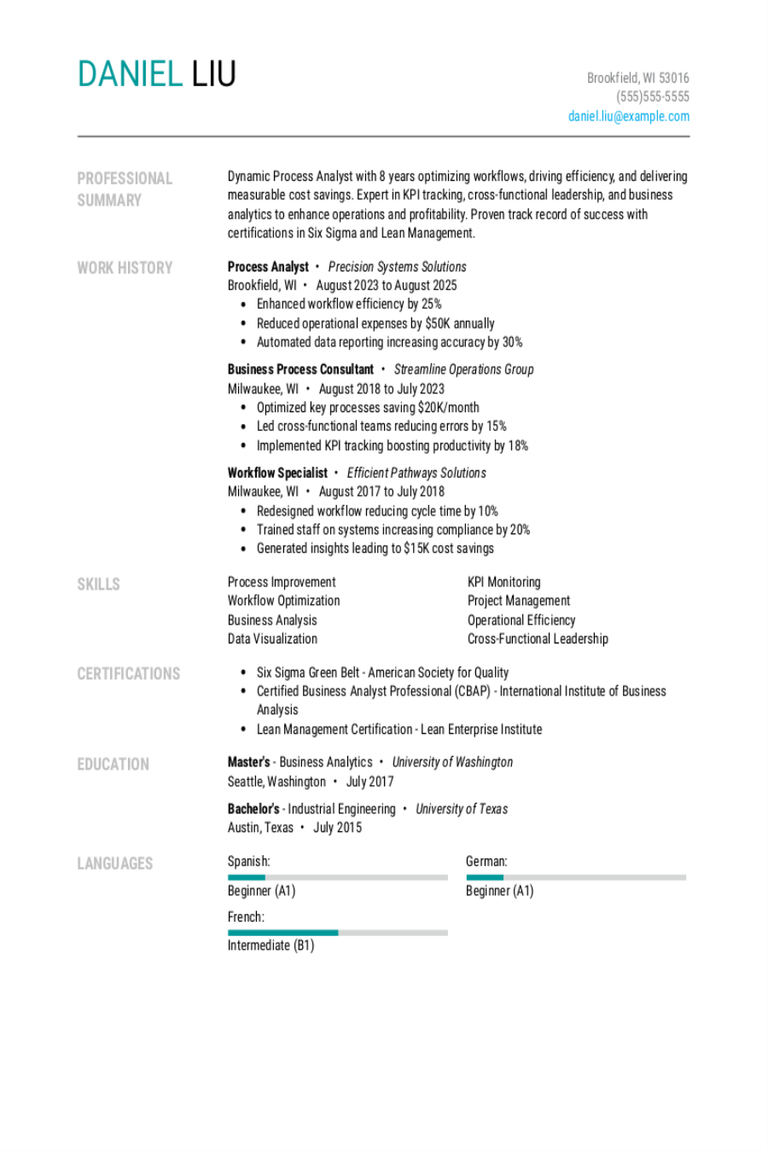

Process Analyst Resume Examples & Templates

Explore process analyst resume examples that show how to spotlight problem-solving and data analysis skills. These tips help you highlight your experience in improving workflows and boosting efficiency.Build my resumeImport

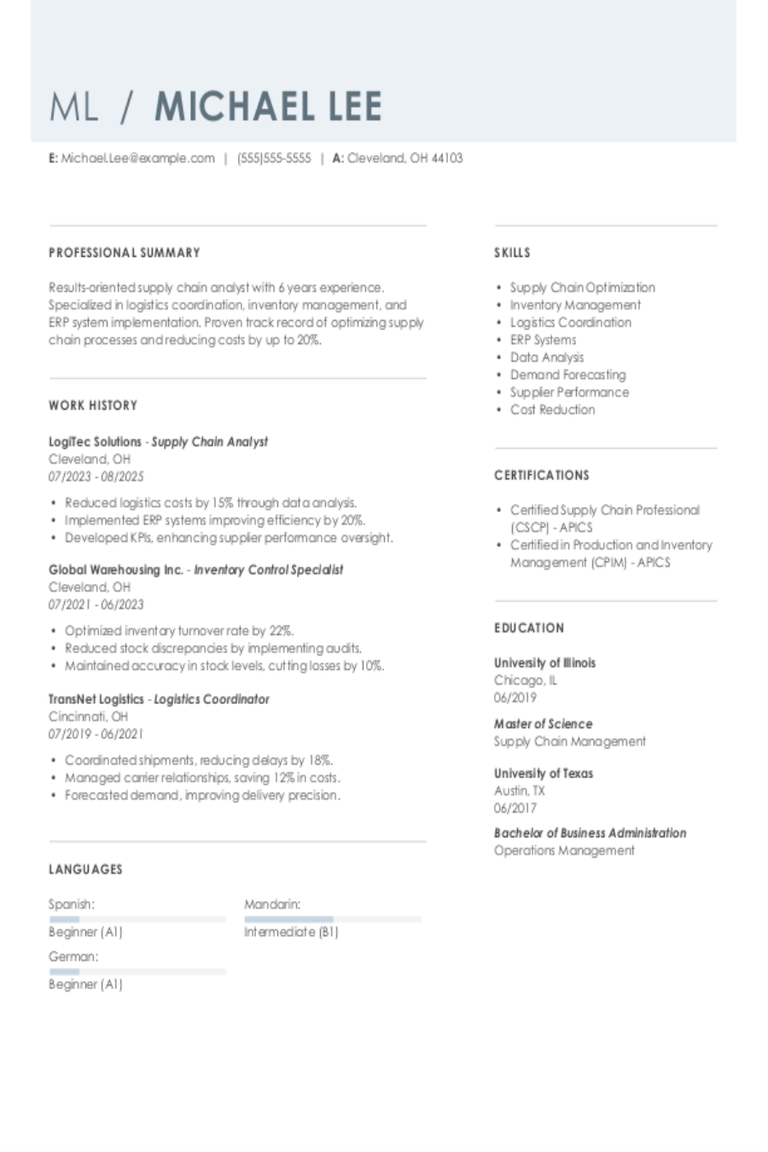

Supply Chain Analyst Resume Examples & Templates

Browse supply chain analyst resume examples to see how to highlight your logistics and planning skills. Learn how to showcase your experience in managing inventory, optimizing processes, and improving supply