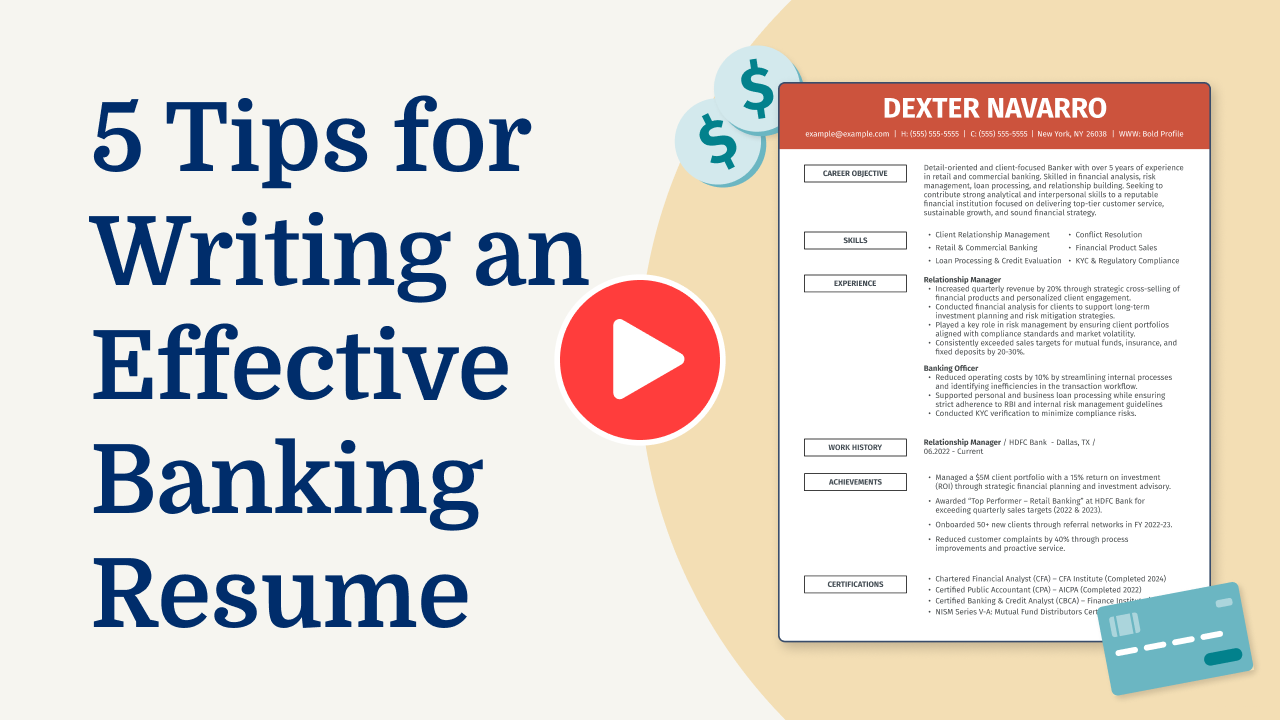

Why this resume works

- Quantifies accomplishments: Measurable accomplishments, like managing a $50M credit portfolio and cutting delinquent accounts by 20%, highlight the applicant’s tangible impact and value.

- Showcases career progression: The applicant’s career path from financial analyst to credit manager illustrates increasing responsibilities, highlighting significant growth and adaptability in the finance sector.

- Illustrates problem-solving ability: Developing a credit risk model that saved $500K showcases innovative problem-solving skills, which are essential for effective financial management.

More Credit Manager Resume Examples

Explore more credit manager resume examples to see how to emphasize your financial expertise, risk assessment skills, and ability to manage credit portfolios. Use these banking resume samples to design a resume that showcases your strengths and positions you as a strong applicant.

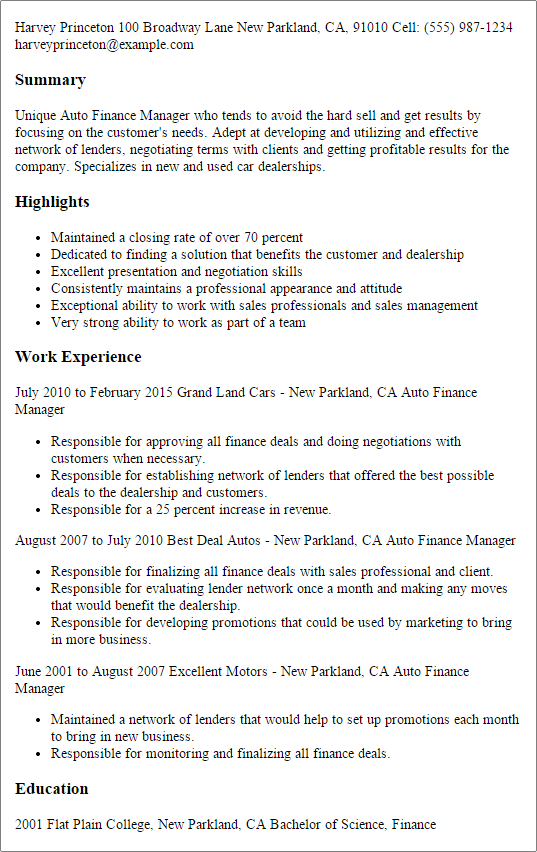

Entry-Level Credit Manager

Why this resume works

- Effective use of keywords: Using role-relevant keywords such as “credit risk management” and “portfolio management,” the applicant ensures their resume passes ATS checks and stands out to hiring managers.

- Shows digital literacy: Demonstrating digital literacy through tools like financial reporting software and credit analysis platforms, the applicant showcases computer skills and readiness for today’s tech-driven workplaces.

- Puts skills at the forefront: By emphasizing skills like “team leadership” and “financial analysis” at the top, this resume follows a skills-based resume format, ideal for entry-level applicants.

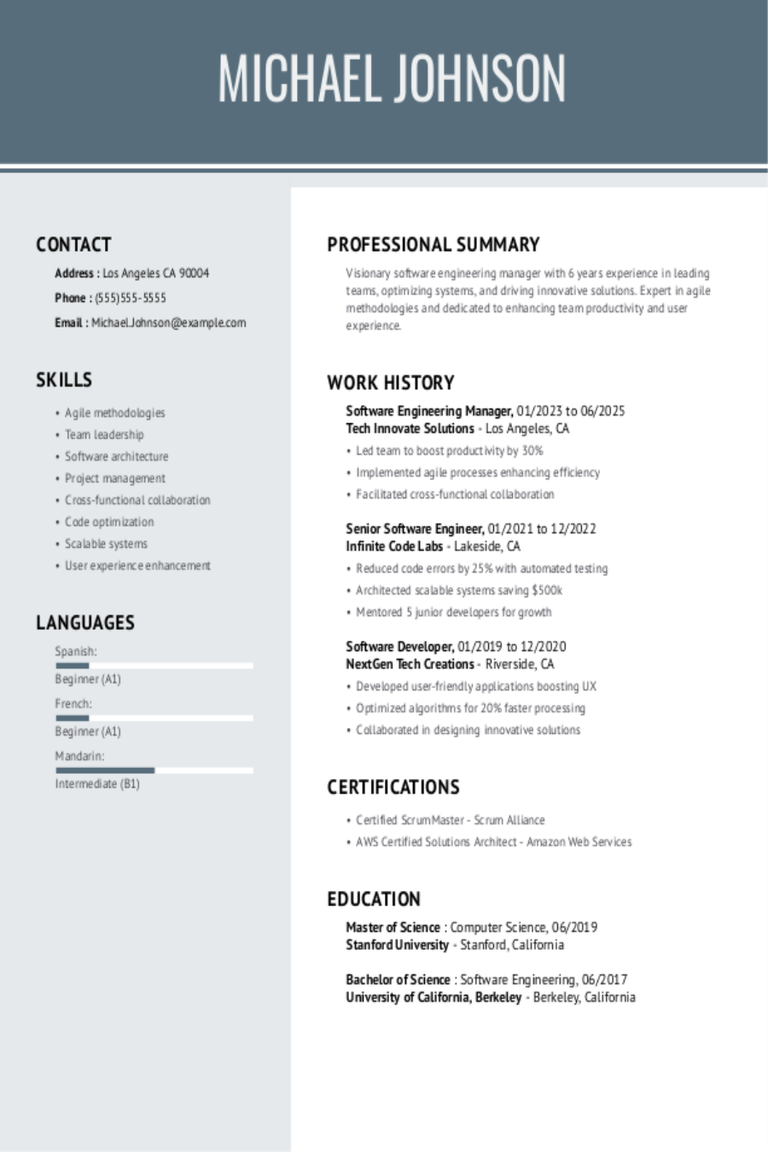

Mid-Level Credit Manager

Why this resume works

- Points to measurable outcomes: By achieving a 20% increase in credit approvals, the applicant showcases their impact on operational success and financial growth.

- Includes a mix of soft and hard skills: The resume mixes technical prowess with interpersonal skills, highlighting the applicant’s ability to manage portfolios while fostering client relationships effectively.

- Demonstrates language abilities: Language skills in Spanish, French, and German support seamless cross-cultural communication for international finance roles.

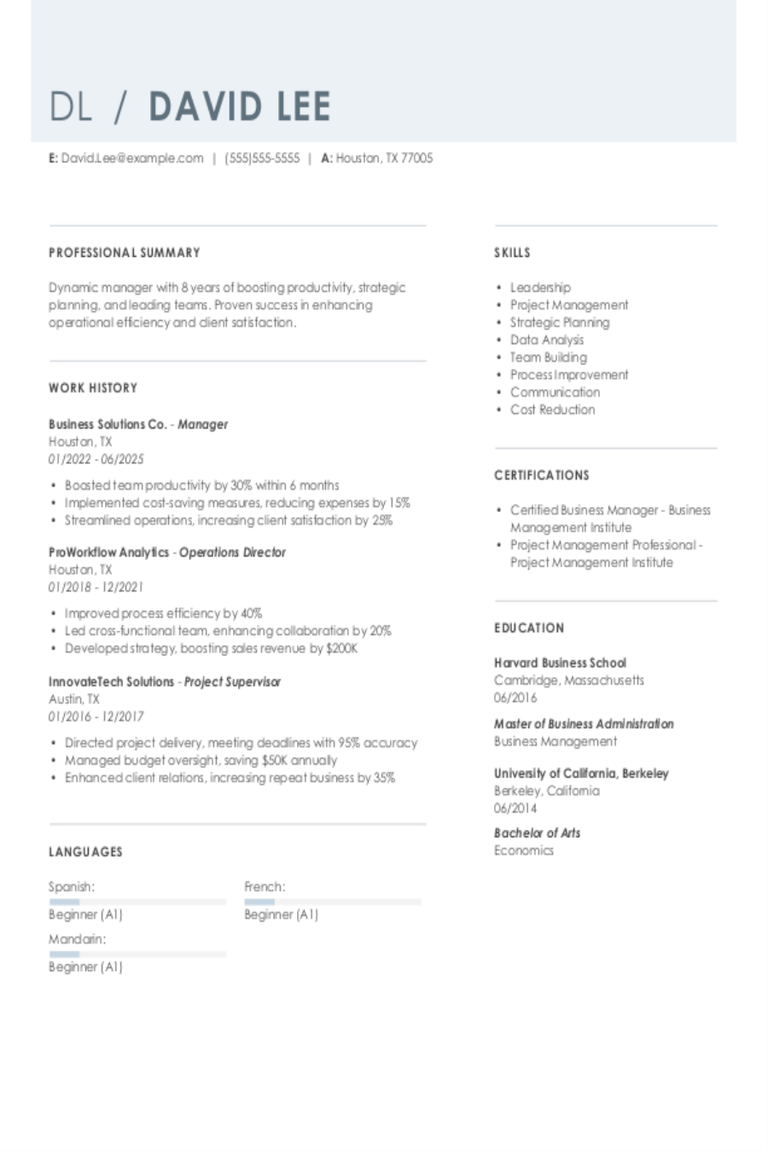

Experienced Credit Manager

Why this resume works

- Lists relevant certifications: By listing certifications like Certified Credit Professional, the applicant showcases their commitment to staying updated in the field.

- Showcases impressive accomplishments: Impressive achievements, such as reducing bad debt costs by $2M, highlight impactful business contributions that make their accomplishments stand out.

- Sections are well-organized: Bullet points and headers organize information logically, creating a reader-friendly resume that’s easy to scan for essential details.

Credit Manager Resume Template (Text Version)

Emily Lee

Crestwood, KY 40021

(555)555-5555

Emily.Lee@example.com

Professional Summary

Experienced Credit Manager skilled in risk analysis, financial planning, and portfolio management. Achieved significant reductions in credit losses using innovative strategies. Equipped with advanced business acumen and a strong focus on client relationships.

Work History

Credit Manager

FinTrust Banking Corp – Crestwood, KY

May 2023 – June 2025

- Managed credit portfolio of M.

- Reduced delinquent accounts by 20%.

- Improved credit approval process efficiency.

Loan Officer

CapitalGrowth Financial – Crestwood, KY

May 2021 – May 2023

- Approved M in loans annually.

- Maintained 5% default rate.

- Expanded client base by 15%.

Financial Analyst

SafeGuard Investments – Louisville, KY

May 2020 – May 2021

- Analyzed credit risks effectively.

- Enhanced portfolio by 18%.

- Developed investment models.

Skills

- Credit Risk Analysis

- Financial Planning

- Loan Origination

- Portfolio Management

- Quantitative Modeling

- Regulatory Compliance

- Customer Relationship Management

- Debt Recovery Strategies

Education

Master of Business Administration Finance

Rutgers University New Brunswick, New Jersey

May 2020

Bachelor of Science Economics

Princeton University Princeton, New Jersey

May 2018

Certifications

- Certified Credit Professional – National Credit Union

- Financial Risk Manager – Global Association of Risk Professionals

Languages

- Spanish – Beginner (A1)

- Mandarin – Beginner (A1)

- French – Bilingual or Proficient (C2)

Related Resume Guides

Advice for Writing Your Credit Manager Resume

Explore our tips on how to write a resume for a credit manager position and discover how to highlight your financial expertise and leadership skills. Tailor your resume to stand out in the competitive world of finance management, ensuring you present the best version of yourself to potential employers.

Highlight your most relevant skills

When applying for a credit manager position, listing your relevant skills is important. It helps employers quickly see if you’re a good fit for the job. By creating a dedicated skills section, you give them an easy way to find both your technical and interpersonal skills.

Technical skills might include knowledge of credit analysis or financial reporting, while interpersonal skills could be strong communication or leadership abilities. This balance shows that you can handle the numbers and work well with people.

To make your resume stronger, try adding key skills directly into your work experience section, too. For example, instead of just listing “managed credit risks,” you could say, “used analytical skills to manage credit risks effectively.”

This approach not only highlights your expertise but also provides context showing how you’ve applied these abilities in real situations. Doing this makes it easier for employers to see how your past roles have prepared you to succeed as a credit manager.

Select a resume format that highlights your skills in audits, budgets, and compliance to showcase your accuracy and reliability.

Showcase your accomplishments

When showcasing your accomplishments as a credit manager, organize your work experience in reverse chronological order. This means listing your most recent job first and working backward. For each position, include the job title, employer name, location, and dates of employment. This format helps hiring managers quickly see what you’ve done most recently.

Focus on turning duties into achievements by incorporating measurable results. Instead of just listing tasks, show how you made a difference. Did you reduce costs or save time? Maybe you improved efficiency by a certain percentage or increased collections? Use numbers to tell your story; this makes your resume more compelling than simply stating responsibilities.

Use strong action words that highlight what you achieved in each role. Words like “improved,” “implemented,” or “increased” make it clear that you took initiative and delivered results. Quantified accomplishments help hiring managers quickly assess your impact and skills.

5 credit manager work history bullet points

- Streamlined credit approval processes, reducing approval time by 40% and increasing customer satisfaction.

- Managed a portfolio of over $10 million in accounts receivable, achieving a 98% collection rate.

- Implemented risk assessment protocols that lowered delinquency rates by 25% within the first year.

- Led a team of 4 analysts to develop forecasting models, improving the accuracy of credit decisions by 30%.

- Negotiated favorable terms with vendors, resulting in a cost savings of $500,000 annually.

Choose a resume template that’s simple and organized. Opt for clear section titles with easy-to-read fonts, avoiding fancy styles to keep your experience and skills visible.

Write a strong professional summary

A professional summary is a snapshot at the top of your resume that introduces hiring managers to your background. It’s where you make your first impression, so it’s important to choose between a summary and an objective based on your experience and career stage.

A professional summary is typically three to four sentences long and highlights your experience, skills, and achievements. It’s best for those with experience who want to showcase their professional identity and the value they bring to an organization. A strong summary focuses on what you’ve accomplished in past roles and how these successes can benefit future employers.

On the other hand, a resume objective states your career goals. It’s suited for entry-level applicants, career changers, or those with employment gaps. While a summary says “what I’ve accomplished,” an objective says “what I aim to contribute.”

Next, we’ll provide examples of both summaries and objectives tailored for different industries and levels of experience. Explore our library of resume examples for additional inspiration.

Credit manager resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in Finance from Temple University, equipped with foundational knowledge in credit analysis and risk management. Completed internship at ABC Bank, gaining experience in evaluating credit applications and assisting in the preparation of financial reports. Eager to contribute analytical skills and fresh perspectives to support credit management teams.

Mid-career

Results-driven credit manager with over six years of experience in commercial banking. Proven track record in assessing creditworthiness, managing loan portfolios, and minimizing risks while maintaining strong client relationships. Possesses an MBA in Finance and known for implementing effective credit policies that have reduced default rates by 15% within two years.

Experienced

Accomplished senior credit manager with 15+ years of expertise in corporate lending and risk assessment. Demonstrated leadership in guiding teams to optimize credit processes and improve portfolio performance. Holds CFA designation, skilled in strategic planning, and renowned for driving growth through innovative risk management strategies, resulting in a 20% increase in client retention.

Credit manager resume objective examples

Recent graduate

Ambitious recent finance graduate with a strong understanding of credit risk assessment and financial analysis seeking an entry-level credit manager position. Eager to apply academic knowledge and analytical skills to support the credit department in minimizing risks and optimizing client portfolios.

Career changer

Detail-oriented professional with experience in customer service and sales transitioning into the credit management field. Looking for an opportunity as a credit manager to leverage communication skills, problem-solving abilities, and a solid foundation in finance to help businesses manage their credit operations effectively.

Entry-level applicant

Diligent individual with internship experience in banking and finance, aiming for an entry-level credit manager role. Passionate about using research skills, attention to detail, and understanding of credit policies to assist in evaluating loan applications and maintaining healthy financial practices within the organization.

Highlight your skills quickly! Our Resume Builder helps you showcase your experience as a credit manager, making it easy to stand out.

Match your resume to the job description

Tailoring your resume to the job description is key. Employers use applicant tracking systems (ATS) to scan resumes for specific keywords from their job postings. This means if your resume doesn’t include these words, it might not even get seen by a person. By customizing your resume to match the job description, you can stand out and increase your chances of getting an interview.

An ATS-friendly resume uses keywords that match the skills and experiences listed in the job posting. For a credit manager role, this could mean including terms like “credit analysis,” “risk assessment,” or “financial reporting.” When your resume reflects these keywords, it’s more likely to catch the attention of hiring managers.

To find the right keywords, carefully read the job posting. Look for repeated skills and qualifications like “customer service” or “loan processing.” These are good indicators of what employers want. Use exact phrases from the job description whenever possible.

Incorporate these terms naturally into your resume. Instead of saying “Managed financial tasks,” try “Performed detailed credit analysis to manage financial risks.” This subtle change aligns more closely with what employers are seeking.

Targeted resumes not only help pass ATS but also show employers you’re a strong fit for their role. By aligning your experience with their needs, you make it clear why you’d be an excellent addition to their team as a credit manager.

Don’t let mistakes cost you a job! Use our ATS Resume Checker to find formatting errors, missing keywords, and issues in your resume before applying.

FAQ

Do I need to include a cover letter with my credit manager resume?

Yes, adding a cover letter to your credit manager resume can give you an edge over other applicants. A cover letter lets you showcase your financial expertise and explain why you’re interested in the specific company or sector.

For instance, if the company emphasizes risk management or customer-centric services, you can detail your experience in those areas. Consider using tools like our Cover Letter Generator to create a personalized cover letter that complements your resume and highlights your strengths.

You might also find it helpful to look at cover letter examples of credit manager cover letters in our library for inspiration and guidance.

How long should a credit manager’s resume be?

For a credit manager, aim for a one-page resume if you have less than 10 years of experience. Focus on key skills like risk assessment, credit analysis, and your ability to manage credit lines effectively. Highlight relevant achievements that show your impact on financial stability and customer relationships.

If you have more extensive experience or specialized certifications, opting for a two-page resume can be a smart choice. Ensure every detail is relevant, showcasing your expertise in credit management processes and leadership abilities while reflecting recent roles and contributions.

Check out our guide on how long a resume should be for examples and tips to find the ideal length for your career stage.

How do you write a credit manager resume with no experience?

If you have no experience in credit management, focus on your relevant skills, education, and any financial training that shows your potential for the role. Here are some tips to help you get started:

- Emphasize your education: Start with your degree in finance, accounting, or a related field. Mention any relevant coursework, such as risk analysis, financial reporting, or business law, that pertains to credit management.

- Showcase transferable skills: Highlight skills like analytical thinking, attention to detail, and communication. If you’ve worked in customer service or another financial role, mention how those experiences honed these abilities.

- Include internships or volunteer work: If you’ve interned at a bank or volunteered for financial literacy programs, treat these as valuable experience. Describe tasks like reviewing credit applications or assisting with budgeting workshops.

- Highlight certifications: List any finance-related certifications, like CFA Level I or courses from platforms like Coursera on credit risk management.

Explore our guide on how to write a resume with no experience for more tips on crafting a resume without direct experience.

Rate this article

Credit Manager

Additional Resources

Credit Manager Resume Example + Salaries, Writing tips & Information

As an auto finance manager, you know the value of a well-crafted pitch, so drafting a winning resume shouldn’t be too much of a stretch. Your resume needs to highlight

Event Manager Resume Examples & Templates for 2025

Working as an event manager is an exciting and rewarding career. It involves planning, organizing, and managing events such as weddings, conferences, concerts and more. Event managers must be highly

Construction Project Manager Resume Examples & Templates for 2025

Construction project managers plan and oversee building projects from beginning to the end, including budgeting, inventory management, collaborating with subcontractors, and ensuring regulations are met and permits acquired. This job

Construction Manager Resume Examples & Templates for 2025

A construction manager oversees and leads a range of building projects from beginning to end. They are responsible for setting and keeping schedules, monitoring finances and ensuring that everybody completes

Software Engineering Manager Resume Examples & Templates for 2025

A great job as a software engineering manager demands a perfect software engineering manager resume and we are here to help you create one. Our guide to crafting a perfect

Manager Resume Examples & Templates for 2025

A manager resume is crucial for job seekers looking to advance their careers in management. This document represents a candidate’s professional experience, skills and achievements in management. A well-crafted manager