Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: By managing credit portfolios worth $20M and reducing delinquency rates by 15%, the applicant’s resume accomplishments clearly show significant financial impact.

- Showcases career progression: Progressing from a loan officer to a credit manager, the applicant’s career path highlights increasing responsibilities and expertise in financial analysis and management.

- Illustrates problem-solving ability: Tackling high delinquency rates with innovative strategies, the applicant’s ability to reduce them by 15% illustrates strong problem-solving skills.

More Credit Manager Resume Examples

See our credit manager resume examples to learn how to highlight your credit risk assessment, portfolio management skills, and financial analysis expertise. These finance resume samples will help you craft a resume that stands out to employers.

Entry-Level Credit Manager

Why this resume works

- Effective use of keywords: Strategically incorporating keywords like “loan approval processes” and “risk assessment accuracy,” the applicant ensures their resume is optimized for applicant tracking systems (ATS).

- Shows digital literacy: Using data analysis tools to manage multimillion-dollar accounts and draft detailed credit reports showcases the applicant’s computer skills.

- Centers on academic background: The applicant’s education section features an MBA, emphasizing the applicant’s strong academic foundation which is important for early career development in finance.

Mid-Level Credit Manager

Why this resume works

- Points to measurable outcomes: Reducing overdue accounts by 35% and saving $2M annually showcases a knack for achieving tangible results in credit management.

- Demonstrates language abilities: The applicant’s language skills support cross-cultural communication, improving their ability to manage diverse client interactions.

- Displays technical expertise: Showcasing certifications like Certified Credit Specialist highlights technical expertise important for effective credit risk management and financial analysis.

Experienced Credit Manager

Why this resume works

- Focuses on work history: A chronological format helps the applicant highlight a progressive career path with impactful roles like credit manager and senior credit analyst.

- Lists relevant certifications: Listing certifications such as Certified Credit Specialist and Advanced Loan Underwriting on a resume supports expertise and dedication to growth.

- Emphasizes leadership skills: Managing $5M monthly portfolios and implementing cost-saving initiatives showcase leadership capabilities that align with leadership skills necessary for driving team success.

Credit Manager Resume Template (Text Version)

Aya Yamamoto

Cedar Valley, MN 55128

(555)555-5555

Aya.Yamamoto@example.com

Professional Summary

Experienced Credit Manager skilled in portfolio management, risk assessment, and team leadership. Proven track record in enhancing revenue growth and reducing delinquency rates. MBA in Finance from the University of Chicago.

Work History

Credit Manager

FinTrust Bank – Cedar Valley, MN

July 2022 – July 2025

- Managed credit portfolios worth M

- Reduced delinquency rate by 15%

- Supervised team of 5 credit analysts

Financial Analyst

Capitol Finance Group – Minneapolis, MN

July 2017 – July 2022

- Analyzed financial data using SQL

- Forecasted revenue growth by 25%

- Created monthly financial reports

Loan Officer

Regional Credit Union – Minneapolis, MN

July 2016 – July 2017

- Processed 100+ loan applications monthly

- Approved loans totaling M

- Conducted credit risk assessments

Skills

- Credit Analysis

- Risk Management

- Financial Reporting

- Portfolio Management

- SQL

- Team Leadership

- Revenue Forecasting

- Customer Service

Certifications

- Certified Financial Analyst – CFA Institute

- Credit Risk Management Certification – American Bankers Association

Education

Master of Business Administration Finance

University of Chicago Chicago, Illinois

June 2016

Bachelor of Science Business Administration

University of Texas Austin, Texas

June 2014

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Related Resume Guides

Advice for Writing Your Credit Manager Resume

Dive into our tips on how to write a resume tailored for a credit manager role and discover how to highlight your financial expertise and leadership in managing credit operations.

Highlight your most relevant skills

Listing relevant skills on your resume shows employers why you’re a good fit for the job. For a credit manager, this means highlighting both technical skills like financial analysis and risk assessment, and soft skills like communication and leadership.

Make sure to include a skills section on your resume where you can easily show these abilities. This helps hiring managers quickly see that you have what it takes to succeed in the role.

Balancing hard and soft skills is key. While technical know-how is necessary for understanding credit reports and managing portfolios, interpersonal skills are also needed to lead teams and communicate with clients effectively. When listing your skills, think about how they relate to the tasks of a credit manager. Use bullet points to make this section easy to read.

To make an even stronger impression, weave these key skills into your work experience. Instead of just stating past responsibilities, explain how you used specific skills in real situations. For instance, describe managing a team by using leadership to improve productivity or employing analytical skills to reduce loan defaults.

Highlighting your analytical skills, financial acumen, and leadership in a resume format can help credit managers stand out.

Showcase your accomplishments

When showcasing your accomplishments as a credit manager, start by organizing your work experience in reverse chronological order. This means listing your most recent job first and working backward. For each job entry, include the job title, employer name, location, and employment dates. This helps hiring managers quickly see your career progression and understand where you’ve gained relevant experience.

Instead of just listing your responsibilities, focus on quantifying your achievements. Turning duties into measurable accomplishments makes your resume stand out. Use numbers to highlight results like percentages of cost reductions or improvements in efficiency.

Use action-oriented words that emphasize core duties and achievements. Words like “developed,” “implemented,” or “optimized” can make descriptions more dynamic.

Quantified accomplishments help hiring managers quickly assess the skills you bring to the table and demonstrate how you’ve made a difference in previous roles. By focusing on measurable successes, you’ll make it easier for employers to see the value you can add to their team.

5 credit manager work history bullet points

- Managed a portfolio of over 200 client accounts, improving credit recovery rates by 25% within 12 months.

- Implemented a new credit risk assessment model, reducing default rates by 18% and saving $500k annually.

- Led a team of 4 credit analysts in restructuring debt agreements, resulting in a 15% increase in client retention.

- Streamlined the credit approval process, cutting approval time from 5 days to under 48 hours.

- Negotiated with major clients to restructure payment plans, recovering $2 million in overdue receivables.

Choose a straightforward, well-structured resume template. Opt for readable fonts with clear sections, avoiding excessive colors or graphics to highlight your experience and skills.

Write a strong professional summary

A professional summary on a resume serves as an introduction to hiring managers, providing a quick overview of your career highlights and skills. It’s the first thing employers see, so it should make a strong impression.

A professional summary is typically three to four sentences that highlight your experience, skills, and achievements. It works well for experienced applicants who want to showcase their professional identity and the value they bring to potential employers. For instance, in the role of credit manager, you might use this section to show your track record in managing credit risks and improving collection processes.

On the other hand, resume objectives focus on future career goals and are ideal for entry-level individuals, those changing careers, or people with employment gaps. Unlike summaries that show what you’ve accomplished, objectives emphasize what you aim to contribute.

Next, we’ll provide examples of both summaries and objectives tailored for various industries and experience levels to guide you in crafting the perfect introduction for your resume.

Credit manager resume summary examples

Entry-level

Recent graduate with a Bachelor of Business Administration in finance, specializing in credit management. Completed internships in financial institutions focusing on credit risk assessment and account analysis. Proficient in using financial software tools and familiar with the principles of loan processing and customer service. Eager to contribute analytical skills and grow within a dynamic credit management team.

Mid-career

Credit manager with over seven years of experience in consumer and commercial lending environments. Proven track record in evaluating creditworthiness, managing portfolios, and reducing delinquency rates through strategic credit policies. Experienced in leading cross-functional teams to streamline credit operations and improve client relationships. Holds an MBA with a focus on financial management from a top-tier university.

Experienced

Seasoned credit manager with over 15 years of leadership experience in corporate banking, specializing in large-scale risk assessments and portfolio management. Expert at developing comprehensive credit strategies that improve profitability while minimizing risks. Demonstrated success in mentoring teams, optimizing lending processes, and implementing innovative solutions for complex financial challenges. Recognized for driving business growth through effective credit policies.

Credit manager resume objective examples

Entry-level

Aspiring credit manager with a recent degree in finance and hands-on internship experience in credit analysis. Seeking to leverage strong analytical skills and attention to detail to contribute to a dynamic financial team, ensuring accurate risk assessments and informed lending decisions.

Career changer

Detail-oriented professional with a background in customer service transitioning into the role of credit manager. Bringing excellent communication skills and a proven ability to manage client relationships, eager to develop expertise in credit management and support the financial stability of clients.

Recent graduate

Finance graduate with coursework in risk management and loan evaluation seeking an entry-level credit manager position. Passionate about using academic knowledge and problem-solving abilities to assist in evaluating creditworthiness, managing credit policies, and contributing to the growth of the organization.

Save time and get organized! Use our Resume Builder to quickly create a clear and professional resume for your credit manager job.

Match your resume to the job description

Tailoring resumes to job descriptions is key for job seekers who want to stand out and pass through ATS. ATS scans for specific keywords and phrases from job postings, helping hiring managers identify the best matches quickly. By aligning your resume with the job description, you increase your chances of getting noticed.

An ATS-friendly resume includes keywords and phrases that match the skills required for the role. For a credit manager position, this means highlighting relevant experience in financial analysis, risk assessment, and customer service. Incorporating these terms can make your resume more attractive to hiring managers who use ATS to sift through applications.

To identify keywords from job postings, examine closely the listed skills, qualifications, and duties. Look for repeated mentions of specific capabilities like “credit analysis,” “risk management,” or “customer portfolio management.” Using exact phrases can help ensure your resume ranks higher in ATS searches.

Incorporate these terms naturally into your resume by aligning them with your experiences. Instead of writing “managed customer accounts,” you could say “oversaw customer accounts to ensure accurate credit analysis and effective risk management.” This shows how your past roles align with the job description.

Targeted resumes improve ATS compatibility by clearly demonstrating how your skills and experiences meet employer needs. When you customize your resume, it not only helps you pass initial screenings but also positions you as a strong applicant for interviews.

Make sure your resume stands out! Use our ATS Resume Checker to find and fix formatting mistakes, missing keywords, and other issues before you send it to employers.

FAQ

Do I need to include a cover letter with my credit manager resume?

Yes, including a cover letter with your credit manager resume can make a strong impression and boost your chances of landing an interview.

It gives you the chance to highlight your leadership skills, financial expertise, and ability to manage credit risk while tailoring your application to the company’s specific needs.

For example, use this space to showcase your experience in improving credit policies or implementing systems that reduced delinquency rates for past employers.

A well-crafted cover letter also allows you to express genuine interest in the organization’s goals, such as optimizing cash flow or fostering strong client relationships.

To make yours stand out, explore cover letter examples for financial roles or use tools like a Cover Letter Generator to ensure it complements your resume seamlessly.

How long should a credit manager’s resume be?

For a credit manager, aim for a concise one-page resume that emphasizes key skills like financial analysis, risk assessment, and team leadership. This length usually highlights your qualifications and experience in credit management effectively.

If you have extensive experience or specialized certifications, moving to a two-page resume can be acceptable. Ensure every detail is relevant—focus on achievements like successful credit policy implementations or significant risk reductions showcasing your expertise.

Explore our guide on how long a resume should be for examples and tips on determining the ideal length for your career stage.

How do you write a credit manager resume with no experience?

If you lack direct experience, focus your credit manager resume on skills, education, and any relevant experiences that align with the role. Follow these tips on writing a resume with no experience:

- Emphasize education: List your degree in finance, accounting, or a related field at the top. Include any courses or projects related to credit management or financial analysis.

- Leverage internships and volunteer work: If you’ve interned at a bank or volunteered for a financial institution, highlight these experiences. Detail any tasks involving credit assessments or financial data analysis.

- Showcase transferable skills: Highlight skills like attention to detail, analytical thinking, and strong communication. Mention specific software proficiencies like Excel or any CRM platforms if applicable.

- Include relevant coursework and certifications: Mention classes such as risk management, finance principles, and any certifications in financial planning or analysis.

Rate this article

Credit Manager

Share this page

Additional Resources

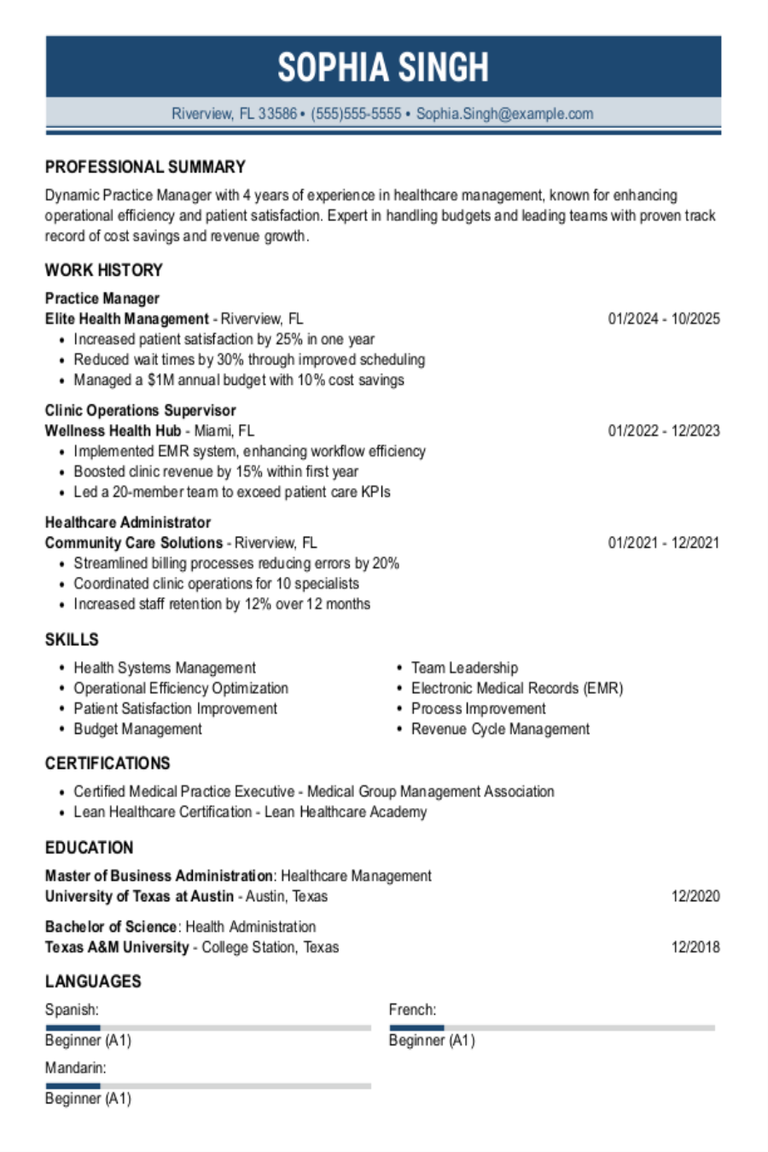

Practice Manager Resume Examples & Templates

Explore practice manager resume examples and tips to learn how to highlight your relevant skills and experience managing staff schedules and improving patient experiences.Build my resumeImport existing resumeCustomize this templateWhy

25 Interview Questions for Managers (With Answers & Tips)

Success in a management interview starts long before the conversation begins. Taking the time to prepare thoughtful responses to common interview questions for managers helps you clearly communicate leadership experience

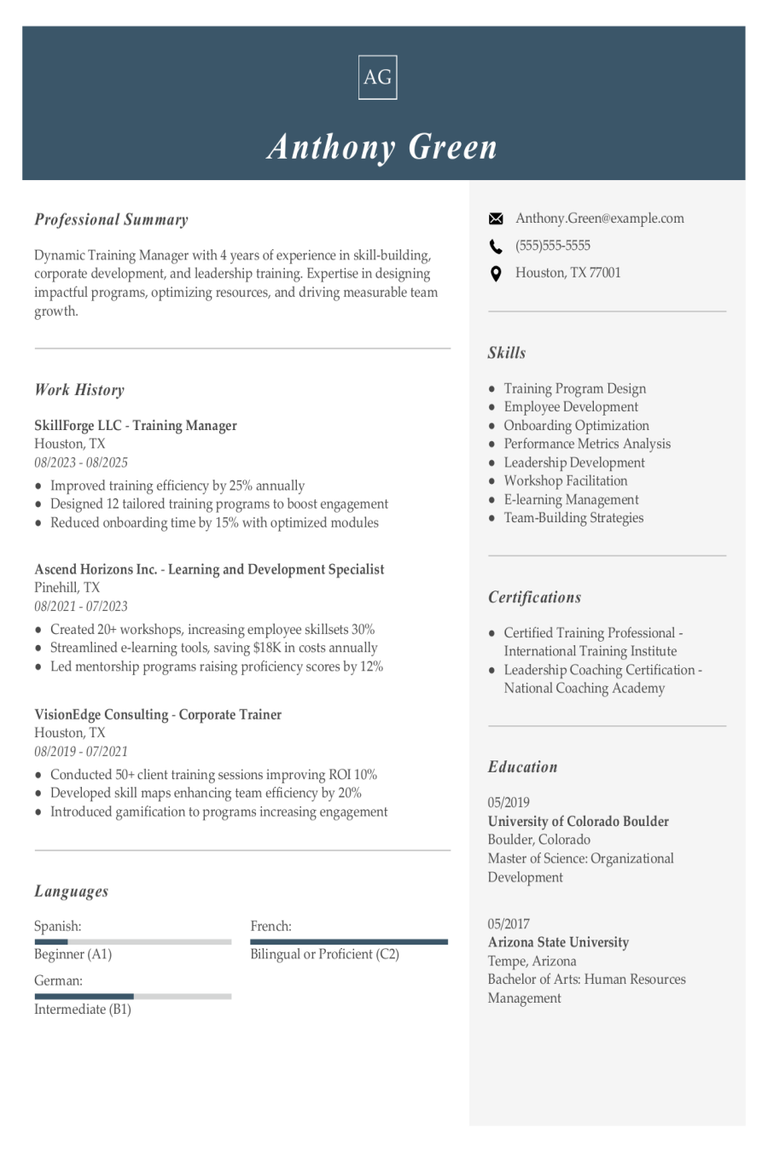

Training Manager Resume Examples & Templates

Discover how training managers showcase their skills in leading workshops and improving employee performance on their resumes. Our examples and tips will help you craft a resume that stands out

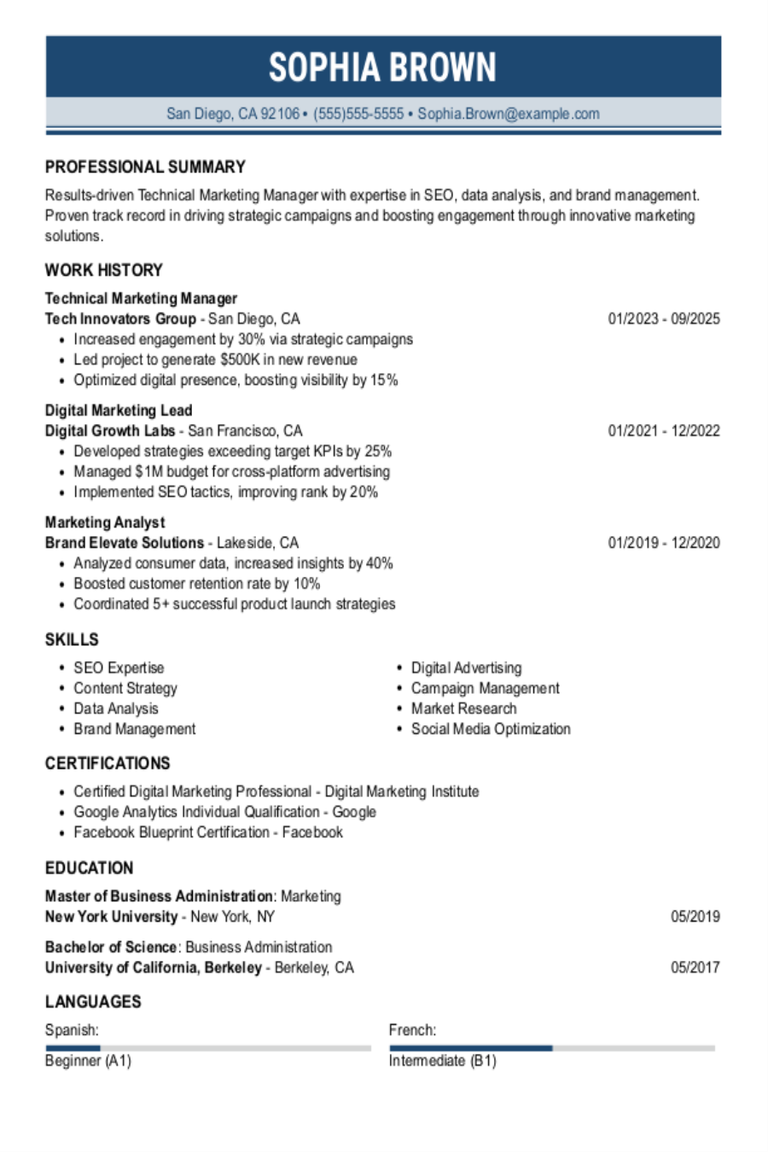

Technical Marketing Manager Resume Examples & Templates

Discover how to craft a technical marketing manager resume that shines. Learn to highlight your tech-savvy skills, marketing strategies, and project successes effectively.Build my resumeImport existing resumeCustomize this templateWhy this

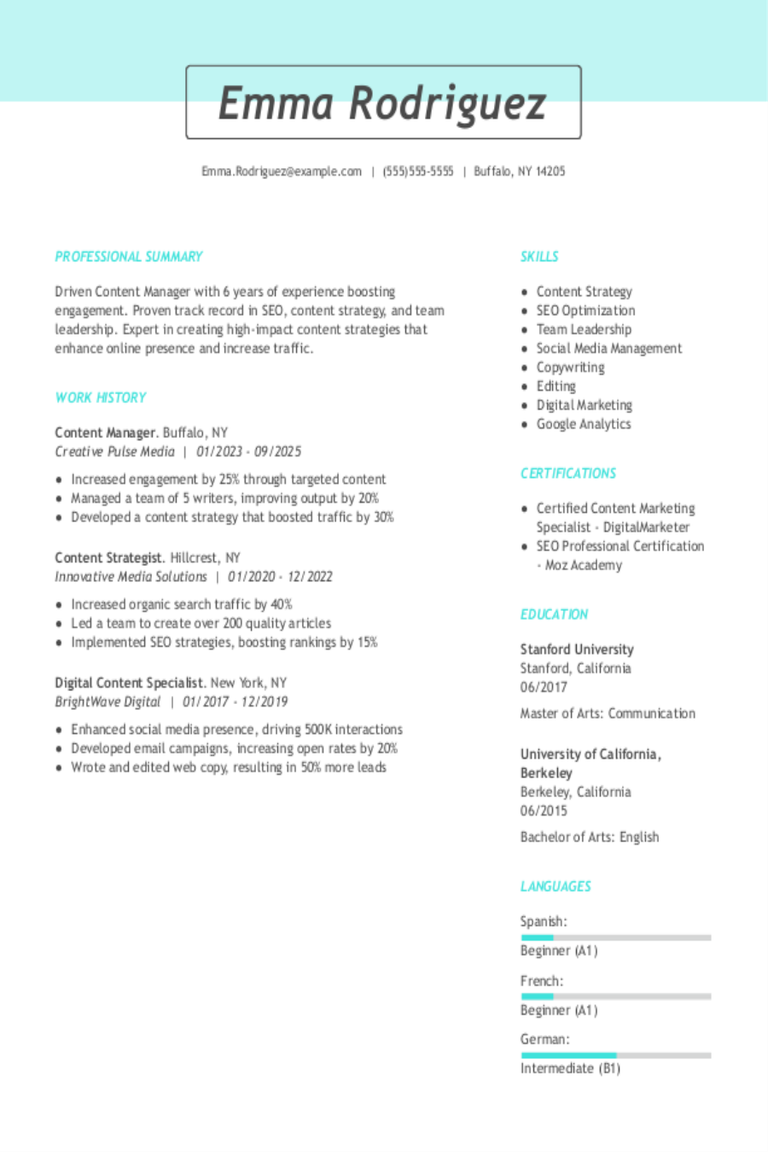

Content Manager Resume Examples & Templates

Browse content manager resume examples to see how to highlight your experience organizing, creating, and sharing engaging materials across platforms. These examples and tips help you showcase creativity, leadership, and

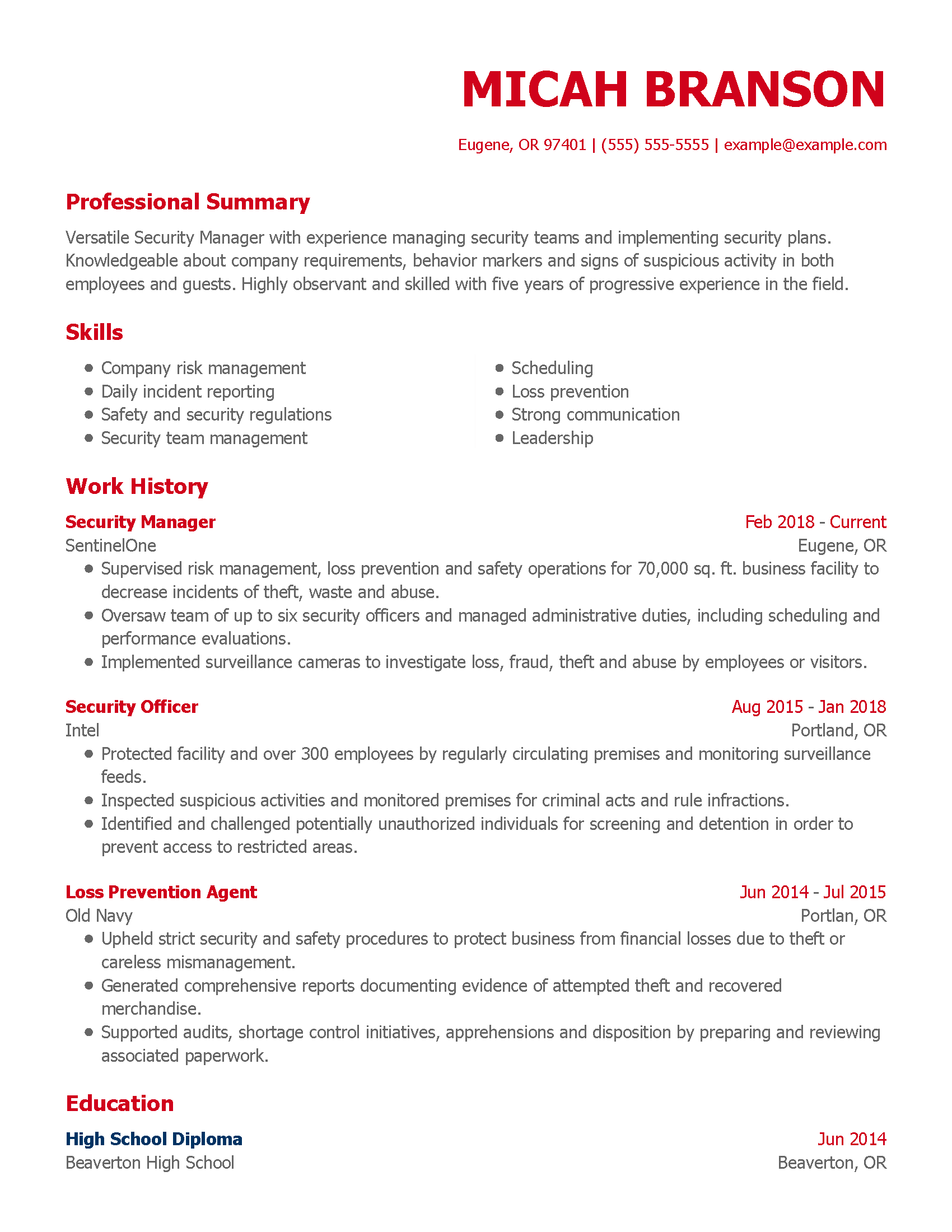

Security Manager Resume Examples & Templates

Explore security manager resume examples that showcase leadership, emergency response, and risk management. Get tips to highlight your skills and experience in keeping people and property safe.Build my resumeImport existing