Editors’ Picks

Interview Question: Setting Goals & Following Through

You’ve made it to the interview — good work! After reviewing your work history and skills, the interviewer hits you with a common behavioral question: “Tell me about a time

Top Ten Behavioral Interview Questions & Answers

Whew! You’ve made it to the interview portion of your job application process — Congratulations! Interviews can be nerve-wracking, but they don’t have to be. With some preparation and practice, you

Why Did You Choose This Career?

When an interviewer pulls out the “Why did you choose this career?” question, there are a million different answers you could provide. Similar interview questions include “What made you decide

What Two or Three Things Are Most Important to You in Your Job?

There are some interview questions that do not always seem directly related to the tasks you might take on in a new job because they are phrased like personal preference

Common Questions

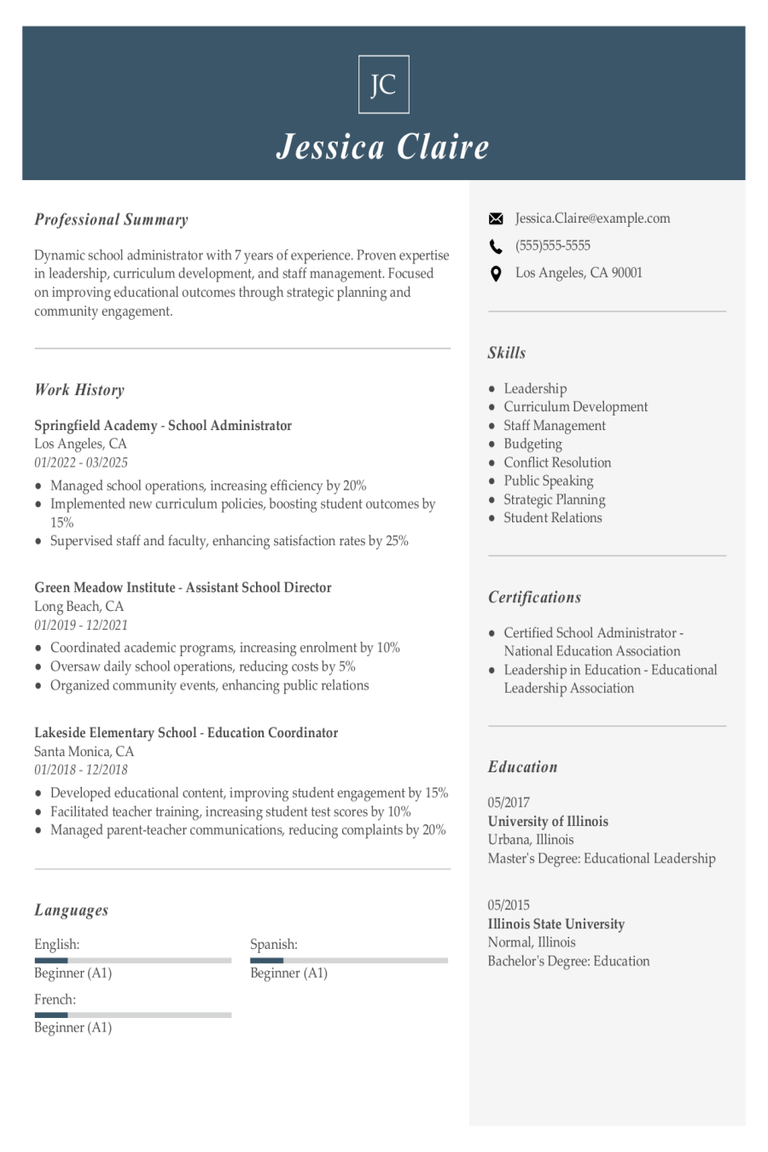

School Administrator Resume Examples & Templates

Explore school administrator resume examples to learn how to highlight your leadership skills and experience with staff supervision and school operations.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

Dean of Students Resume Examples & Templates

A dean of students oversees administration and academic processes for students at high schools, colleges and universities. This job’s responsibilities include addressing everything from admissions, financial aid and health services

School Superintendent Resume Examples & Templates

A superintendent is a top school district executive who oversees day-to-day operations, including the management of educational programs and facilities. Superintendents supervise staff, manage educational policies, organize board meetings and

Special Education Teacher Cover Letter Examples & Templates

Special education teachers are compassionate and highly trained professionals who help students with physical, emotional or developmental needs thrive in a school environment. A strong special education teacher cover letter

Sales Executive Cover Letter Example & Templates

Start by editing this sample cover letter for a sales executive or explore our 250+ cover letter examples to find the best match for you.

Principal Cover Letter Example & Templates

As shown in the free principal cover letter sample, a cover letter should be three or four paragraphs that convince the hiring manager to contact you for an interview. The

Library Assistant Cover Letter Example & Templates

Start by editing this library assistant cover example, or explore our collection of more than 250 cover letter examples to find the best match for you.

Graduate Assistant Cover Letter Example & Templates

Start by editing this graduate assistant cover example, or explore our collection of more than 250 cover letter examples to find the best match for you.

Executive Director Cover Letter Example & Templates

When you write your version of this free executive director cover letter sample, there are some important things to keep in mind. First, keep it short and to the point.

Case Manager Cover Letter Example & Templates

The strength or weakness of your cover letter may determine whether or not you are considered for a job position. In order to receive an interview, it can be important

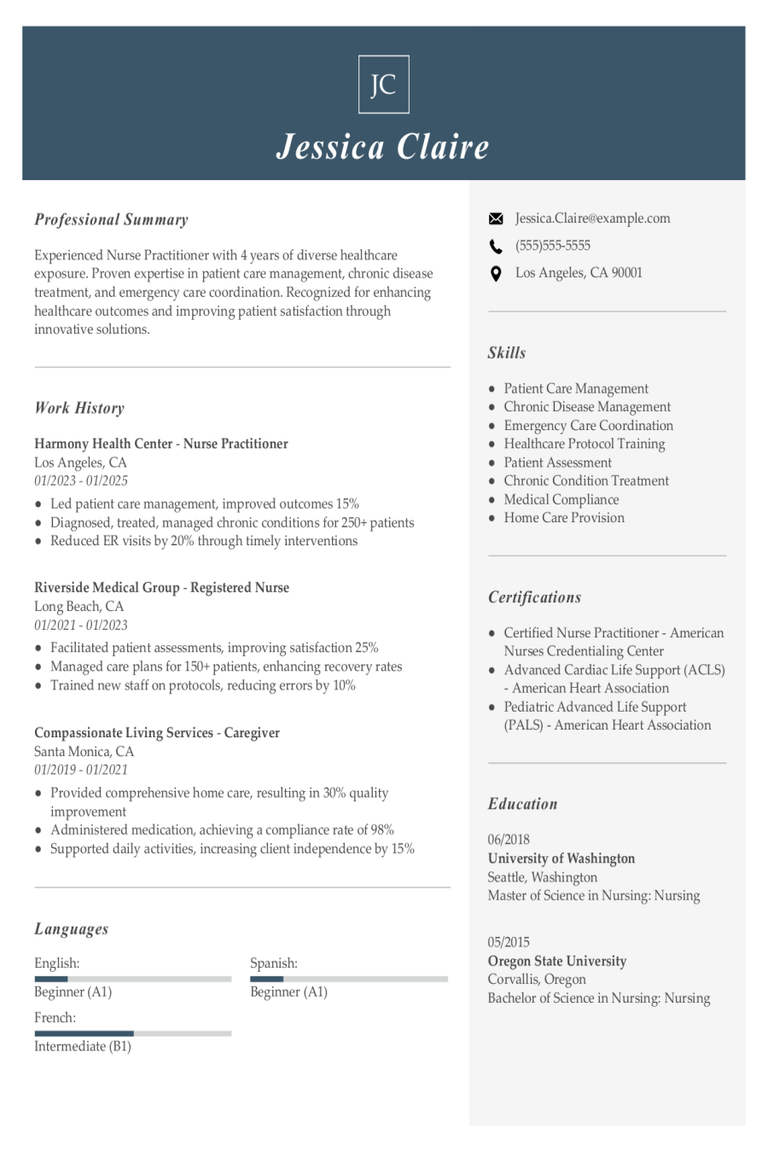

Nurse Practitioner Resume Examples & Templates

Explore nurse practitioner resume examples that showcase how to highlight your clinical experience, advanced nursing skills, and patient care expertise.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies accomplishments: Includes

Engineer Resume Examples & Templates

There are many types of engineering careers, and they all have one thing in common: building and creating things, from bridges and dams to machines, textiles and prosthetic limbs. The

Medical Doctor Resume Examples & Templates

Entry-level

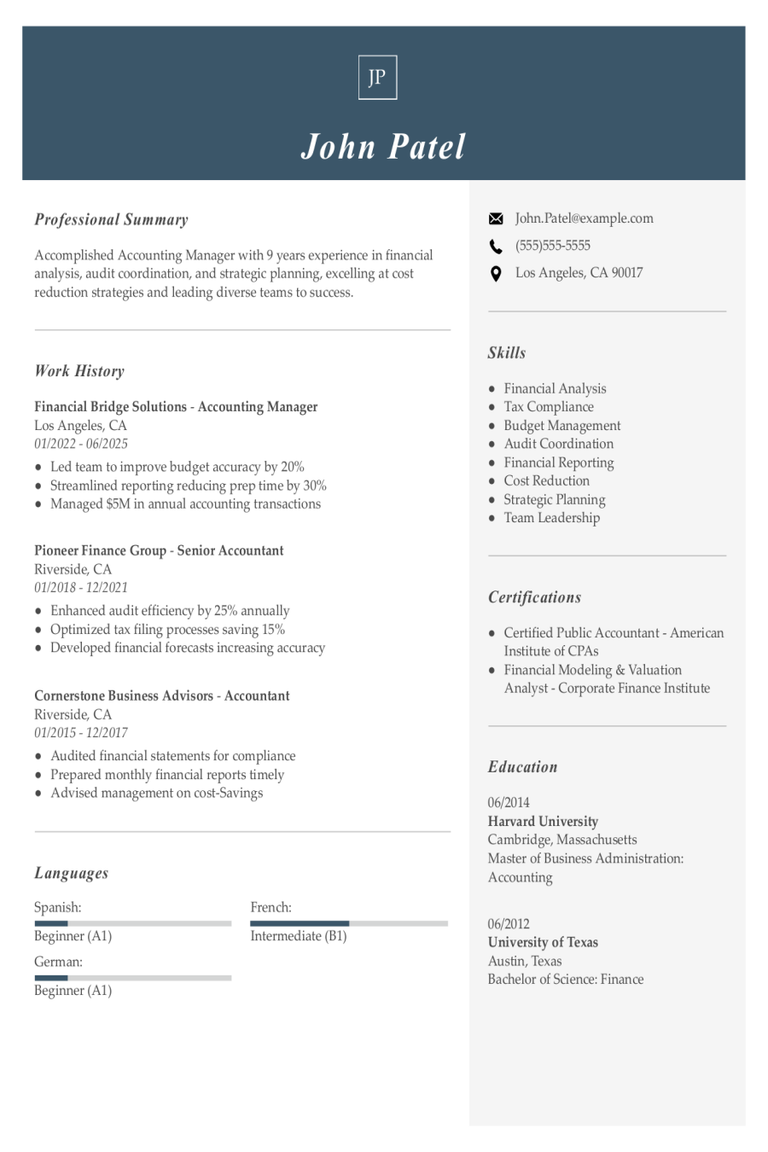

Accounting Manager Resume Examples & Templates for 2025

Accounting managers play a critical role in managing the financial operations of a company or organization. They ensure that financial records are accurate, budgets are handled efficiently, and compliance with

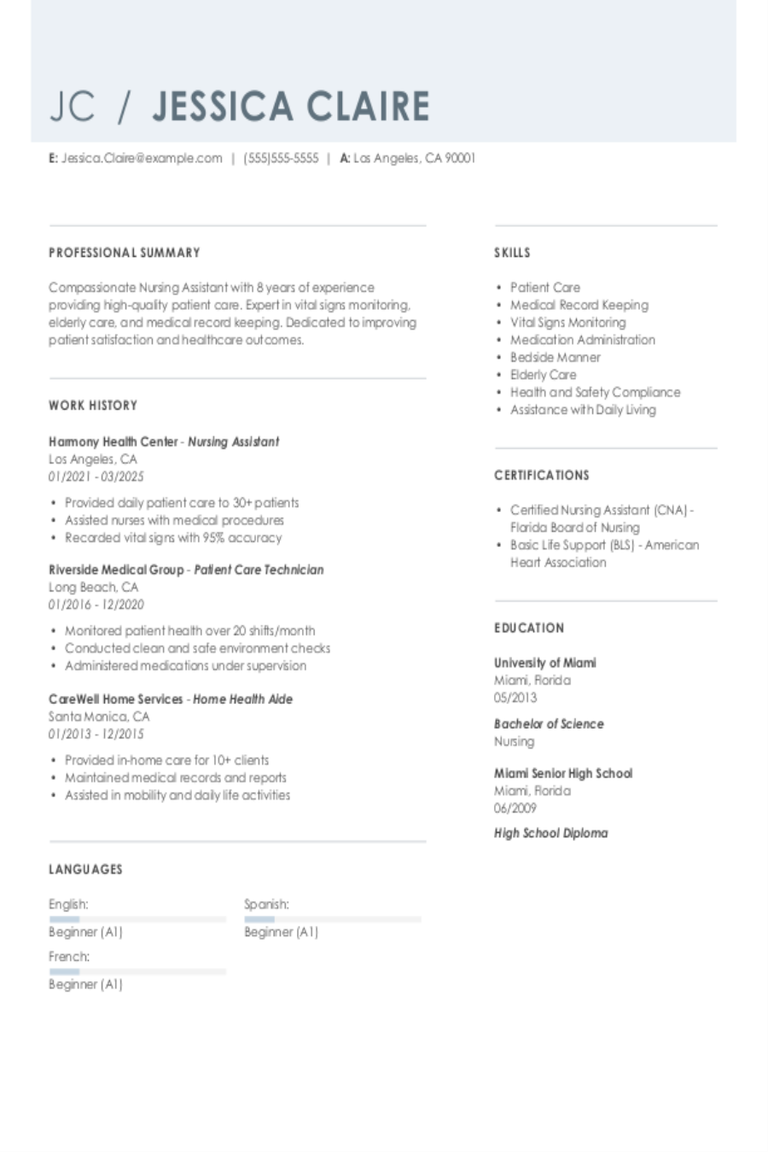

Best Nursing Assistant Resume Examples + Guide & Pro Tips

Explore nursing assistant resume examples and writing tips to learn how to highlight your hands-on experience and patient care skills effectively.Build my resumeImport existing resumeCustomize this templateWhy this resume worksHighlights

Operating Room Registered Nurse & Templates

An operating room registered nurse is one of those professions that is easy to identify thanks to its constant portrayal in movies and television shows. But there is a great

Administrative Assistant Cover Letter Examples & Templates

Administrative assistants are indispensable for the success of any organization. Whether handling documents, managing schedules, answering phones and emails or interacting with clients, their support is invaluable. When paired with

Executive Assistant Cover Letter Examples & Templates

Start by editing this sample cover letter for an executive assistant or explore our cover letter templates to find the best match for you.

Data Entry Specialist Cover Letter Examples & Templates

Start by editing this cover letter sample for a data entry specialist or explore our cover letter templates to find the best match for you.

Director Cover Letter Example & Templates

Directors lead companies and advance businesses to the next level. They are the bosses–the ones who make the important decisions. They must be able to complete the following tasks:Assigning tasks Assessing

Bartender Cover Letter Example & Templates

A well-written bartender cover letter can help you differentiate yourself from the competition. Along with a well-written resume, highlighting your exceptional interpersonal skills and problem-solving skills will give you an

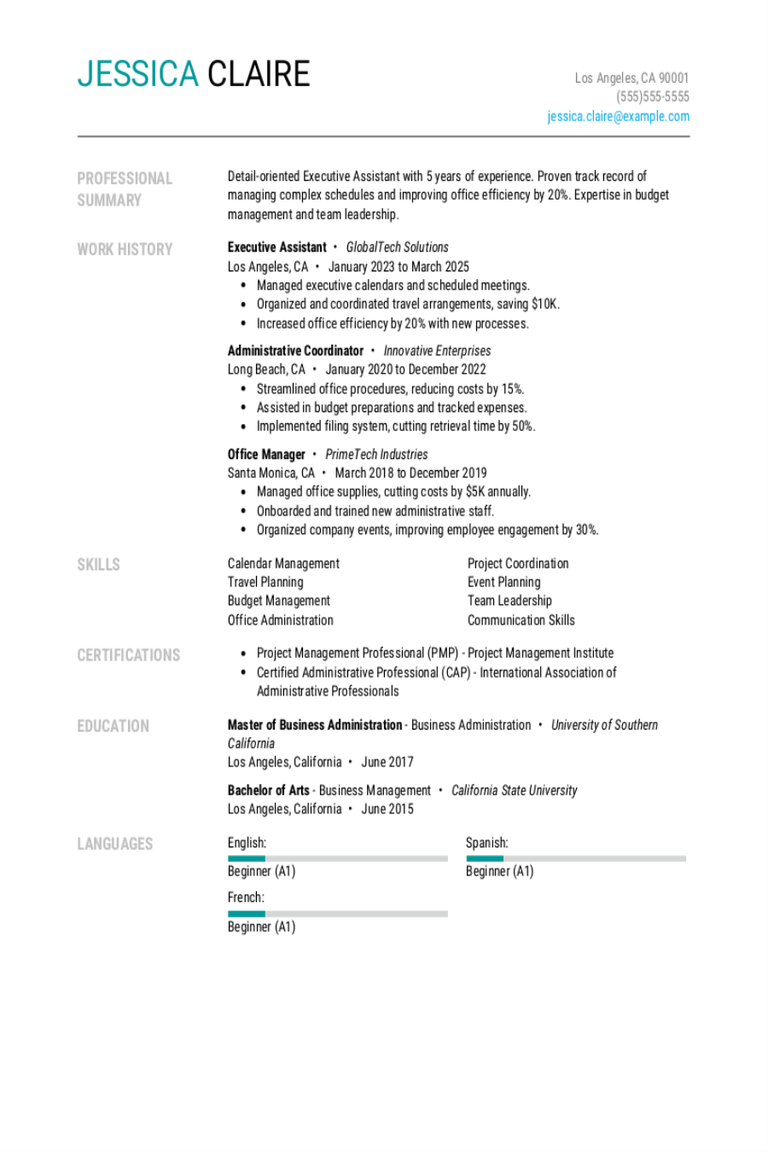

Executive Assistant Resume Examples & Templates

Browse executive assistant resume examples to see how to showcase strengths like managing schedules and coordinating meetings. Get expert writing tips to create a resume that reflects your experience and

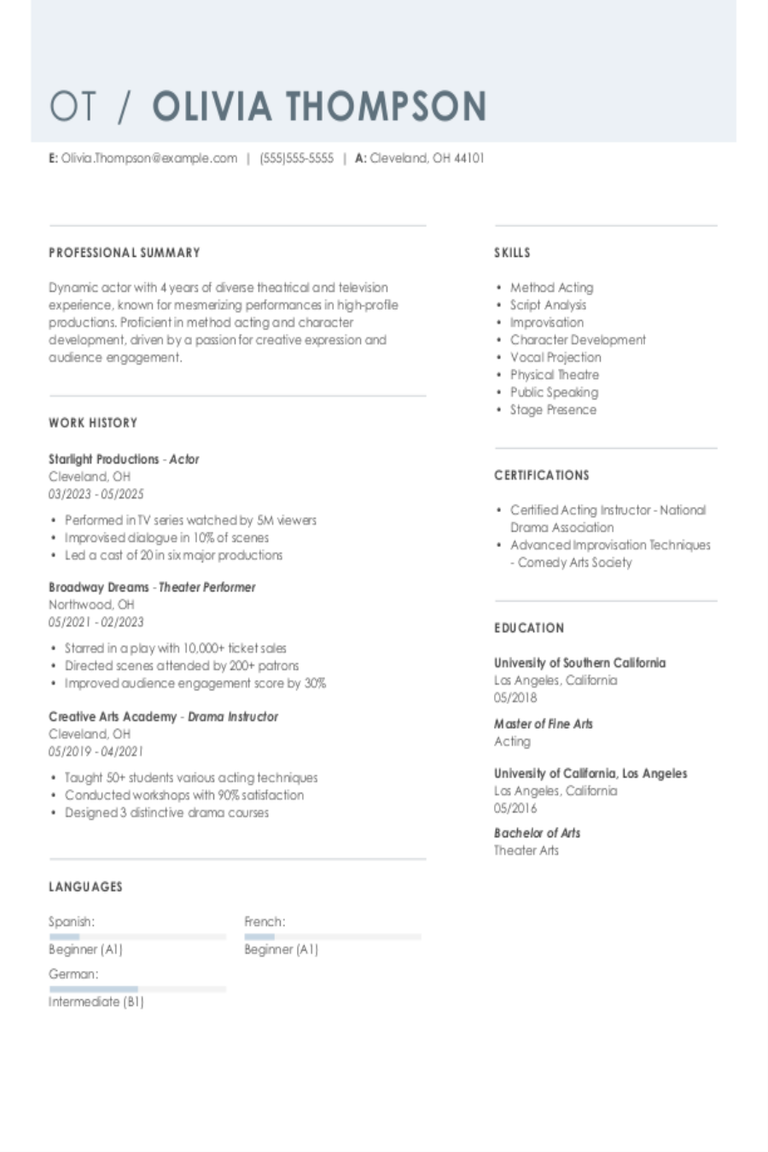

Actor Resume: Example & Tips

Discover acting resume examples that help you share your talents and experience. We’ll show you how to showcase your roles, skills, and training in a way that catches attention and

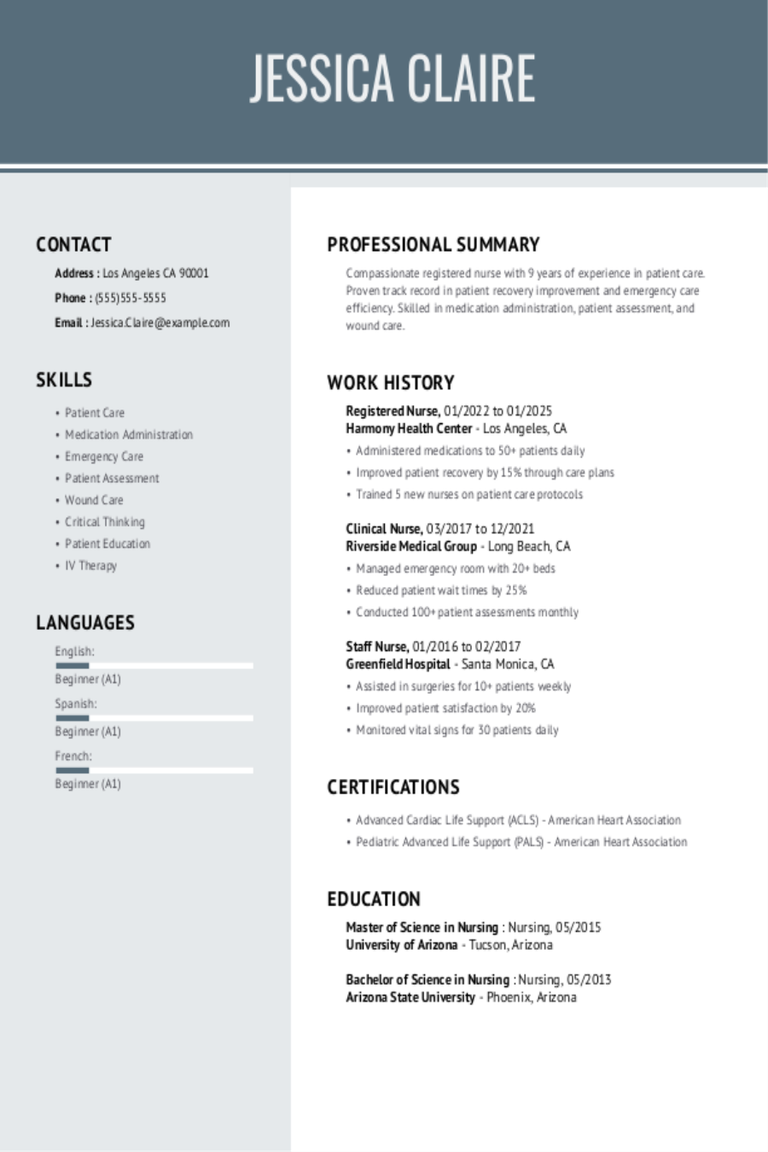

Registered Nurse Resume Examples & Templates

Explore top registered nurse resume examples that showcase your essential clinical skills. Learn how to effectively present your patient care experience and medical expertise to impress healthcare employers.Build my resumeImport

Nursing Aide Resume Examples & Templates

You need a great resume if you want a job as a nursing aide, so we’re here to help you build one. Our guide to crafting an effective resume for

Customer Service Representative Resume Examples & Templates

Explore customer service representative resume examples to learn how to highlight your communication skills, problem-solving abilities, and customer-focused experience. Browse expert tips to create a resume that stands out.Build my

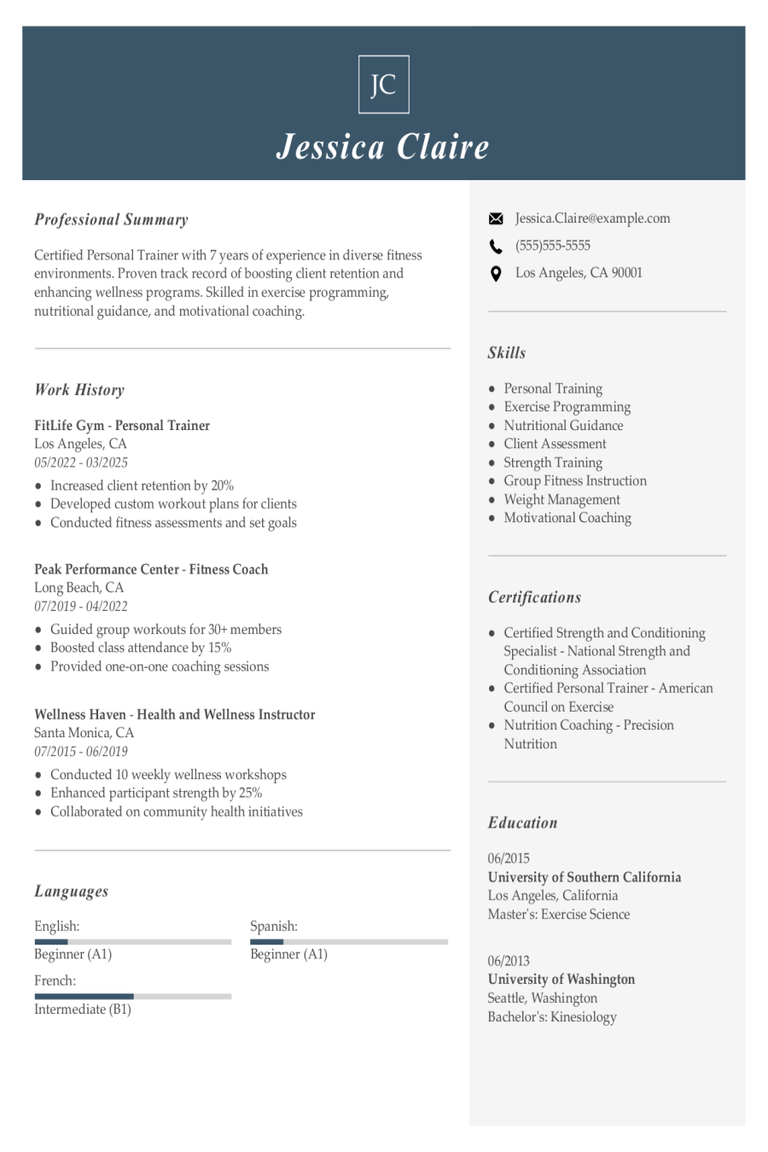

Personal Trainer Resume Examples & Templates

See how a strong personal trainer resume highlights your fitness expertise. These examples will help you showcase key skills like client programming, coaching, and motivation to stand out.Build my resumeImport

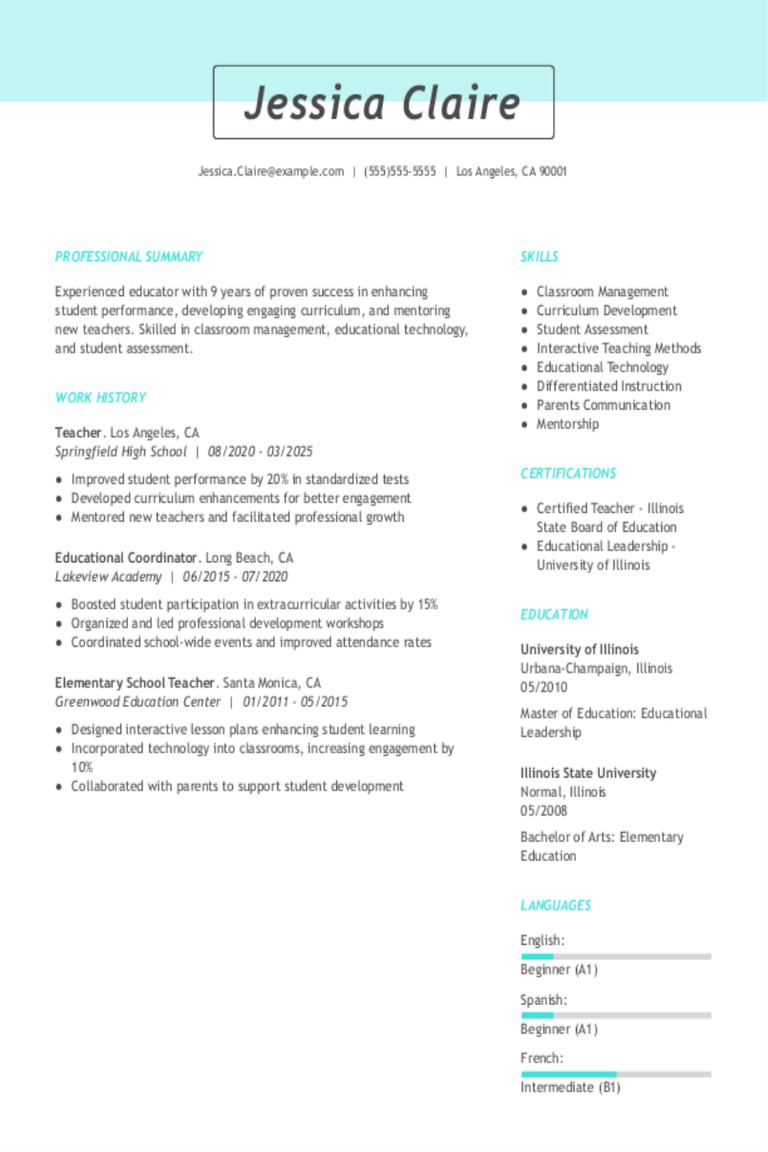

Teacher Resume Examples & Templates

Explore a variety of teacher resume examples that demonstrate how to organize your resume, highlight essential teaching skills, and showcase your classroom experience.Build my resumeImport existing resumeCustomize this templateWhy this

Information Technology Resume Examples & Templates

Information technology (IT) professionals perform a wide range of tasks related to managing and maintaining computer systems, networks and software. Get expert tips on how to write a resume that

Best Law Enforcement Resume Examples & Templates

Your community connections, law knowledge and commitment to protection can help you pursue a career in law enforcement. Time to write a resume to stand out from the applicant pool. We’re

Retail Resume Examples & Templates

Retail service professionals play a vital role in delivering excellent customer service, driving sales and maintaining a retail store’s overall operations. Discover how to write a resume that highlights your customer

Healthcare Support Cover Letter Examples & Templates

Healthcare support provides assistance to doctors and nurses while providing emotional support to patients and their families. Your role is as much technical as it is interpersonal. An efficient healthcare

Behavioral Situational

Tell Me About a Time When You Were Forced to Think on Your Feet

As you apply to certain positions, there are a number of job-specific questions that you can expect during an interview. These common questions, such as ‘What skill make you a

Interview Question: Tell Me About a Time You Failed

During an interview, your potential employer wants to get to know you more than they did just by reading over your resume. They want to get to know the depth

Interview Question: Good Judgement & Logic in Problem Solving

Behavioral interview questions often throw people for a loop when they first encounter them, because their goals and methods are not as clear and easy to comprehend as those of

Interview Question: Experience with Suggesting Process Improvements

During your interview, you will likely face far more behavioral interview questions than traditional questions. The unique aspect of this kind of interview question is that they are not based

Interview Question: Tell Me About a Time You Missed a Deadline

The days have passed when interviewers are only interested in your concrete skills and information such as where you went to college. Today, potential employers are focusing more on figuring

Interview Question: Using Fact-Finding Skills to Solve a Problem

During an interview, you will undoubtedly be faced with a variety of questions. A great deal of these will be behavioral interview questions such as ‘Give me an example of

About The Workplace

Answers: Why Should We Hire You?

One of the most common — and challenging — job interview questions is, “Why should I hire you?” Hiring managers ask this question to see if you’re the perfect fit

What’s Your Availability?

For jobs that are not standard 9-to-5 positions, one of the most common interview questions to be asked is “What’s your availability?” Other variations of this question include “What hours

Ready to take the next step in your career?

Our expert advice will help you craft the perfect resume or cover letter. Showcase your unique skills and qualifications to stand out to employers and get hired faster.