Why this resume works

- Quantifies accomplishments: Measurable accomplishments, such as recovering $850K in overdue payments and reducing debts by 18% annually, highlight the applicant’s significant impact on financial stability and efficiency.

- Showcases career progression: Progressing from a finance assistant to an accounts receivable specialist shows the applicant’s growing expertise and responsibility in managing complex financial tasks and portfolios.

- Illustrates problem-solving ability: Solving client disputes promptly and implementing a debt recovery system highlights the applicant’s problem-solving skills, initiative, and critical thinking.

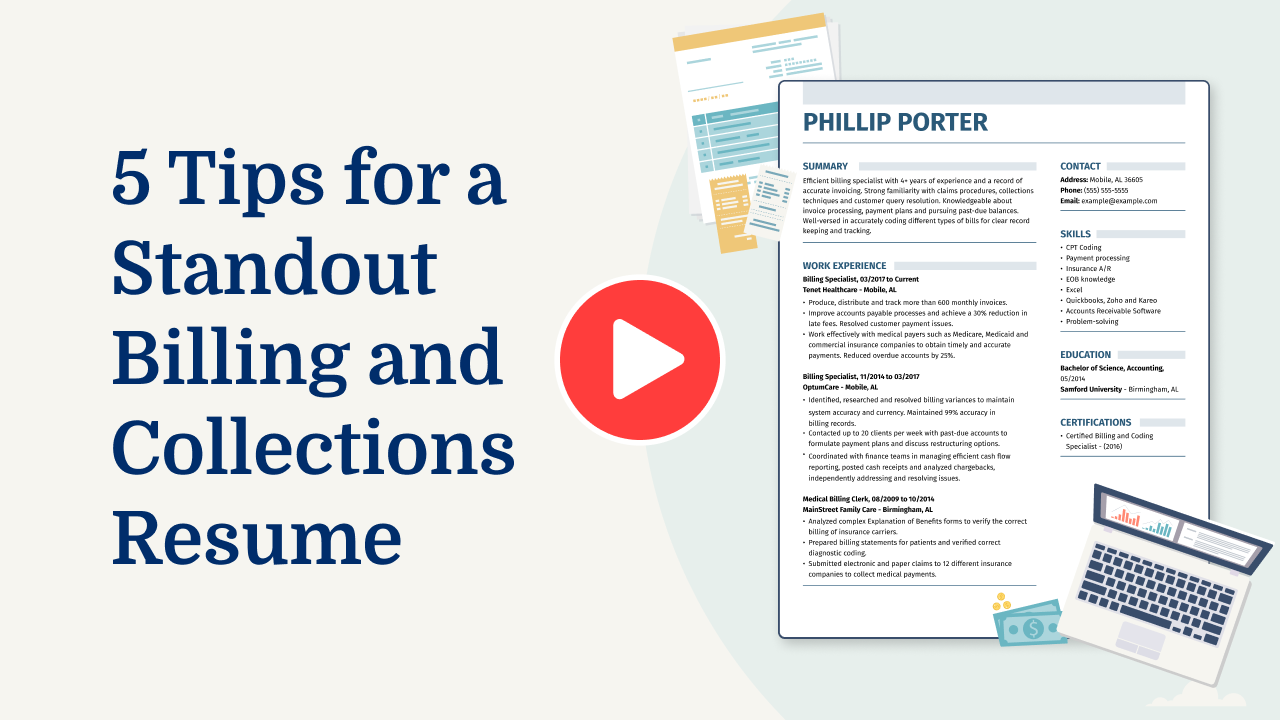

More Accounts Receivable Resume Examples

Check out our accounts receivable resume examples to understand how to highlight your financial skills, billing experience, and attention to detail. These billing and collections resume samples will help you craft a resume that appeals to finance employers.

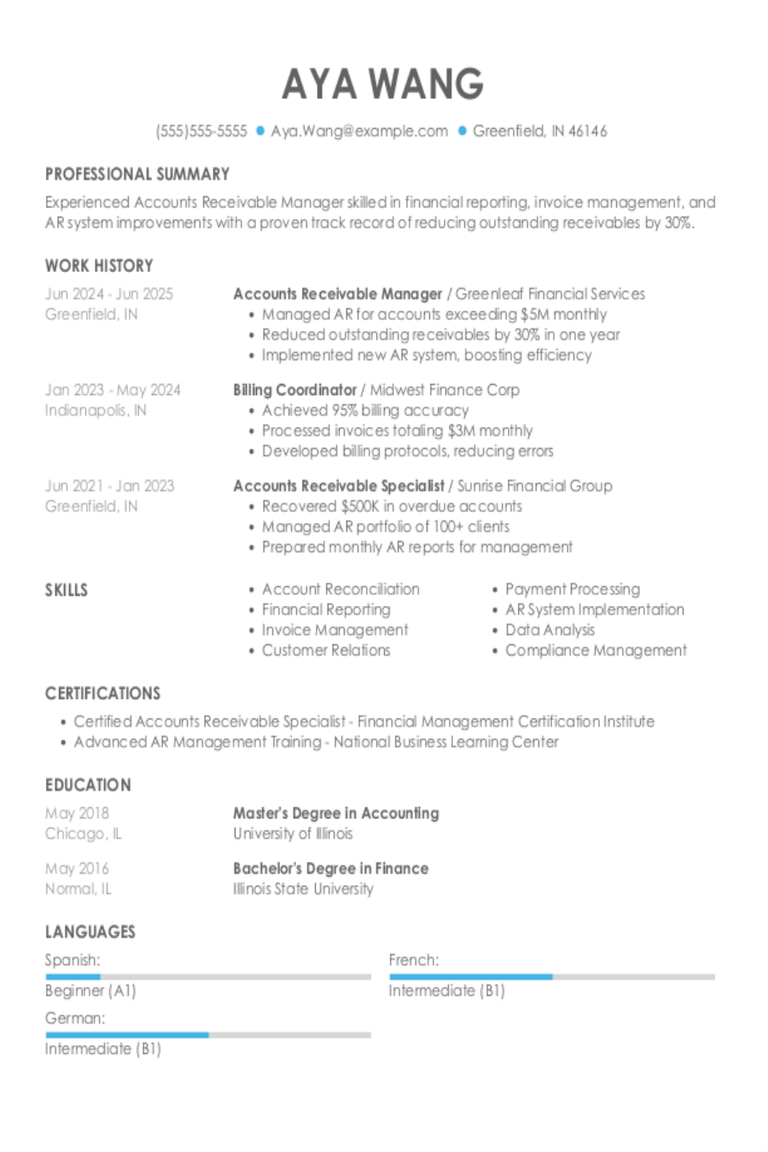

Entry-Level Accounts Receivable

Why this resume works

- Centers on academic background: Showcasing advanced degrees in the education section illustrates the applicant’s strong academic foundation early in their finance career.

- Shows digital literacy: Using computer skills to manage complex billing processes highlights readiness for tech-driven roles and modern workplace demands.

- Puts skills at the forefront: A skills-based resume format prominently features expertise in accounts receivable management, capturing attention for entry-level finance positions.

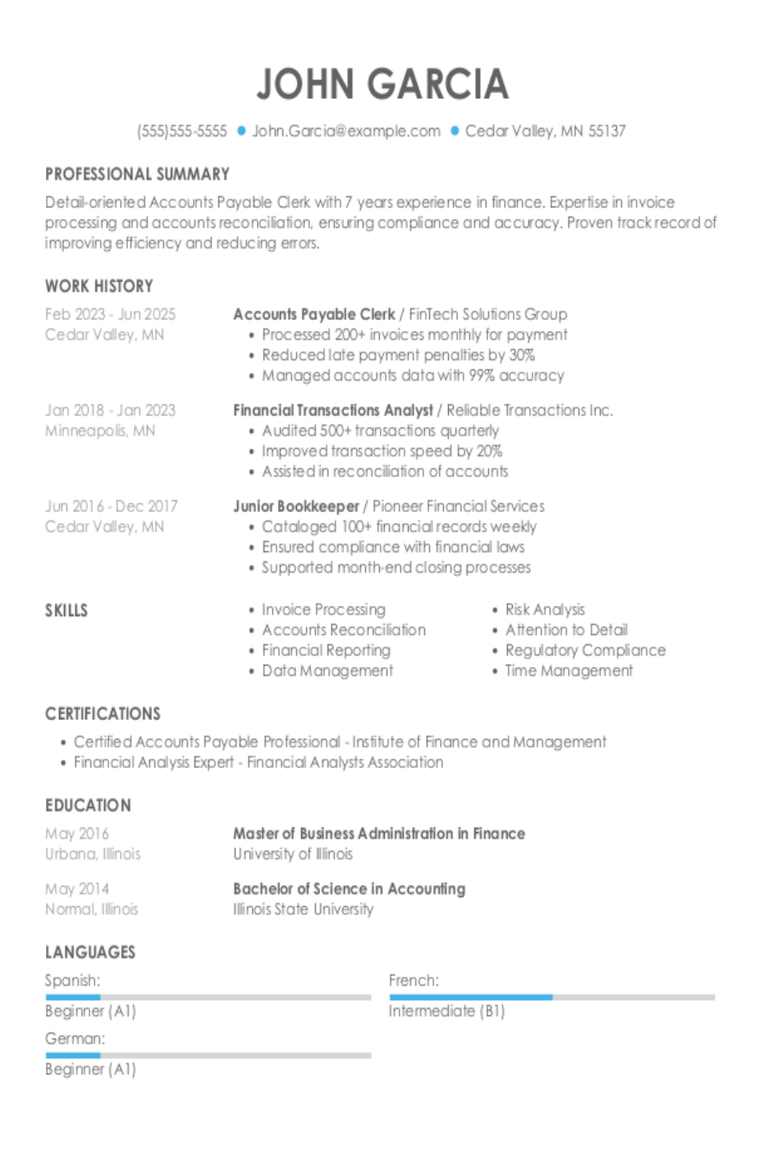

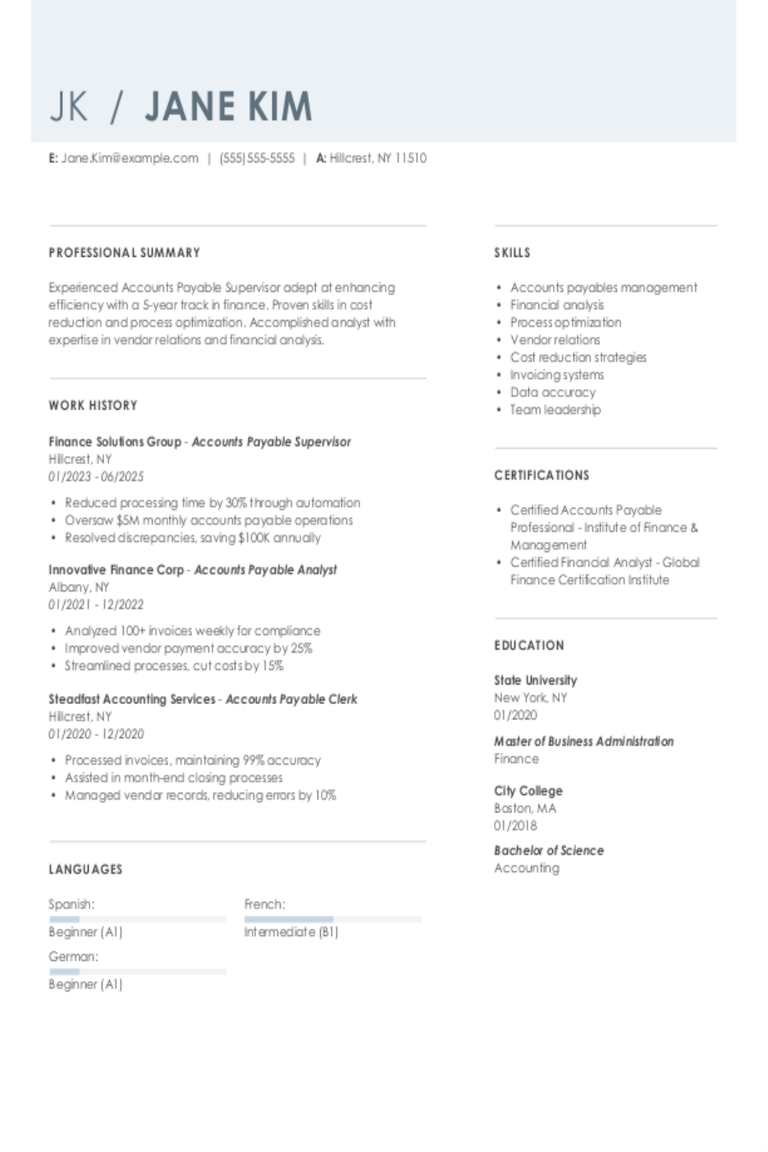

Mid-Level Accounts Receivable

Why this resume works

- Points to measurable outcomes: By cutting overdue payments by 30% and saving 10 hours weekly, the applicant shows a clear knack for achieving significant, measurable improvements in financial operations.

- Demonstrates language abilities: Language skills in Spanish, French, and Mandarin support cross-cultural communication and facilitate international business dealings effectively.

- Includes a mix of soft and hard skills: Merging technical prowess with interpersonal skills, the applicant excels in customer negotiation and team collaboration alongside expertise in accounts management and financial reporting.

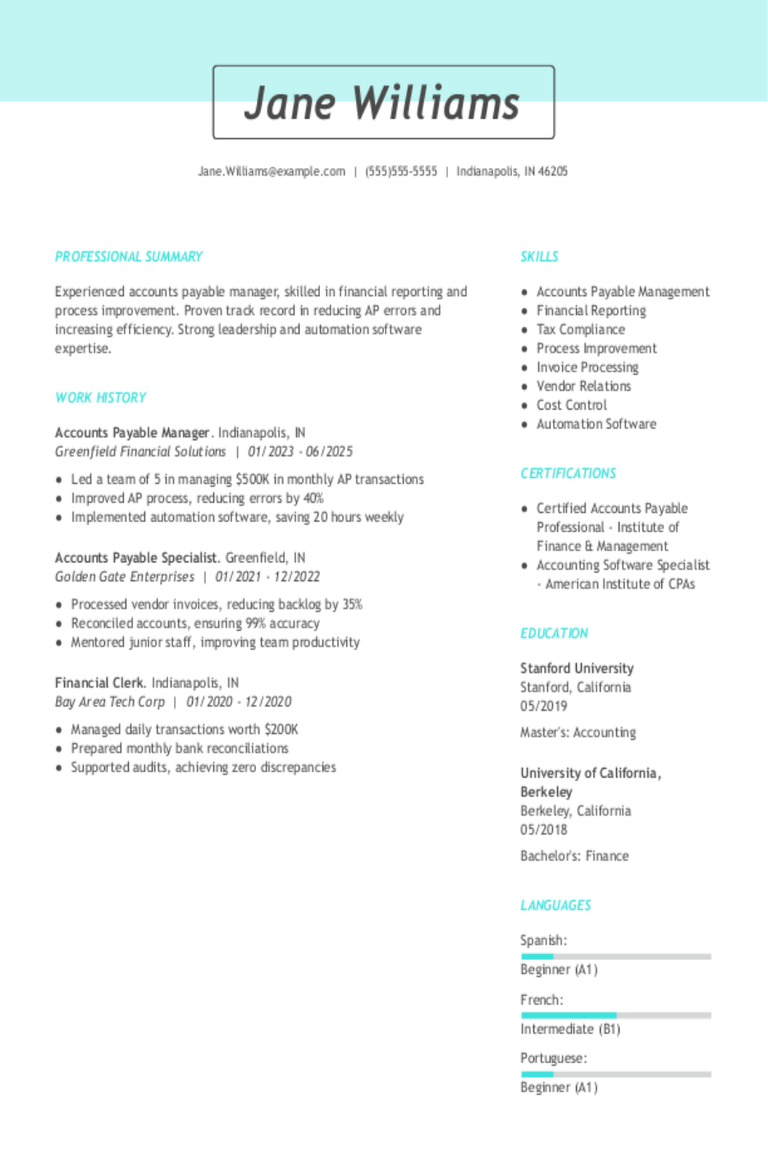

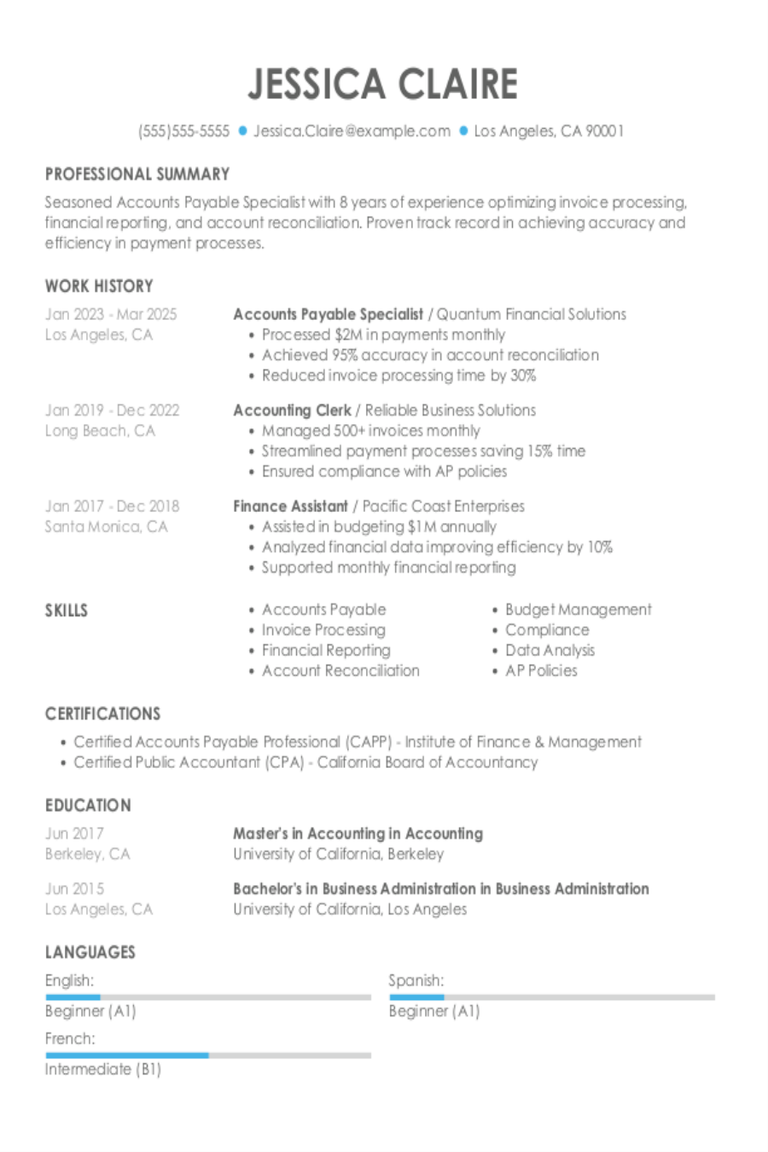

Experienced Accounts Receivable

Why this resume works

- Focuses on work history: Using a chronological resume format, the applicant’s extensive career emphasizes growth from credit officer to accounts receivable analyst over a decade.

- Showcases impressive accomplishments: The applicant includes standout accomplishments, like reducing debts by 40% and saving $200,000, showing a strong business impact.

- Emphasizes leadership skills: Demonstrating leadership skills, the applicant leads collection teams to high recovery rates and trains junior staff in best practices.

Accounts Receivable Resume Template (Text Version)

Olivia Johnson

Springfield, IL 62706

(555)555-5555

Olivia.Johnson@example.com

Professional Summary

Results-driven Accounts Receivable Specialist with 5 years of experience optimizing invoicing, reducing debts, and ensuring financial compliance. Proven track record of managing portfolios of up to $15M and improving operational efficiency by 30%. Adept at using accounting software, streamlining processes, and delivering exceptional client service.

Work History

Accounts Receivable Specialist

Fidelity Financial Services – Springfield, IL

January 2023 – June 2025

- Reduced outstanding debts by 18% annually.

- Managed client accounts worth M monthly.

- Streamlined invoicing process, boosting efficiency by 30%.

Billing and Collections Analyst

Precision Invoice Solutions – Springfield, IL

January 2021 – December 2022

- Recovered 0K in overdue payments within 6 months.

- Generated and audited 1,200 invoices weekly.

- Improved payment compliance rates by 25%.

Finance Assistant

Summit Capital Management – Springfield, IL

January 2020 – December 2020

- Prepared monthly financial reports for M portfolio.

- Ensured 98% accuracy in payment processing tasks.

- Optimized account reconciliation time by 20%.

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Skills

- Invoice processing

- Debt collection

- Reconciliation

- Payment compliance

- Financial reporting

- Accounts management

- Customer communication

- Financial analysis

Certifications

- Certified Accounts Receivable Specialist – National Association of Credit Management

- Advanced Financial Operations – Global Finance Institute

Education

Master’s Degree Accounting

University of Texas Austin, Texas

May 2020

Bachelor’s Degree Finance

University of Houston Houston, Texas

May 2018

Related Resume Guides

Advice for Writing Your Accounts Receivable Resume

Explore advice on how to write a resume for an accounts receivable role and discover how to highlight your knack for managing invoices, payments, and customer interactions. We’ll guide you through tailoring your resume to spotlight skills like attention to detail and communication.

Highlight your most relevant skills

Listing relevant skills when applying for an accounts receivable job is important because it shows employers you’re a good match for the role. Having a dedicated skills section on your resume helps highlight what you can do and makes it easy for hiring managers to see why you’d be great at the job.

Balance technical skills, like using accounting software or managing ledgers, with soft skills, such as communication and problem-solving. This mix shows that you not only know how to handle numbers but also work well with others.

To make your resume even stronger, try weaving these key skills into your work experience section. For example, when describing past jobs, mention how you used specific accounting software to process payments or how your attention to detail helped reduce errors in billing.

This approach gives real-life examples of your abilities and lets employers see them in action. It paints a fuller picture of how you use your skills every day and makes your application stand out from the rest.

Choosing a resume format that emphasizes accurate record-keeping, timely collections, and relationship-building can help accounts receivable professionals stand out.

Showcase your accomplishments

Organizing your work experience in reverse chronological order is key to creating a clear and effective resume for an accounts receivable role. Start with your most recent job, then work backward. Each entry should include your job title, employer name, location, and employment dates. This format helps employers see your career path and understand where you’ve gained the skills relevant to their needs.

Quantifying accomplishments makes your resume stand out by showcasing what you’ve achieved rather than just listing duties. Instead of saying “managed account collections,” try adding measurable outcomes like “reduced outstanding accounts by 20% within six months.”

Numbers help tell a story of success, showing potential employers how you can bring value to their team. It’s important to transform duties into achievements that highlight efficiency improvements or cost reductions whenever possible.

Use action-oriented words like “streamlined,” “increased,” or “implemented” when describing your core duties and achievements in accounts receivable. These words draw attention to what you’ve accomplished and make it easy for hiring managers to assess your impact quickly.

Quantified accomplishments are powerful because they clearly illustrate skills and results, helping you leave a strong impression on those reading your resume.

5 accounts receivable work history bullet points

- Streamlined invoicing process, reducing payment cycles by 25% and improving cash flow.

- Implemented automated reminders for overdue accounts, decreasing outstanding receivables by 30%.

- Conducted detailed account reconciliations, identifying discrepancies and recovering $50K in missed payments.

- Collaborated with the sales team to resolve billing issues, increasing customer satisfaction ratings by 15%.

- Led a project to integrate new accounting software, resulting in a 40% increase in processing efficiency.

Resumes need to be clear and professional, so choose a resume template with straightforward headings and readable fonts. Avoid fancy designs that could obscure your skills and experiences.

Write a strong professional summary

A professional summary is a brief intro at the top of your resume that quickly grabs hiring managers’ attention, helping them understand who you are and what you offer. When crafting a resume, you can opt for either a professional summary or a resume objective to make that important first impression.

The professional summary typically consists of three to four sentences highlighting your experience, skills, and achievements. It’s most effective for those with work history looking to spotlight their professional identity and value immediately. This approach is ideal if you have accomplishments from past roles as an accounts receivable specialist or similar positions.

Resume objectives articulate career ambitions and suit entry-level applicants, career changers, or those with employment gaps. While summaries emphasize “what I’ve accomplished,” objectives focus on “what I aim to contribute.”

Next, we’ll showcase examples of both summaries and objectives across diverse industries and levels of experience so you can see how they apply to various situations. See our full library of resume examples for additional inspiration.

Accounts receivable resume summary examples

Entry-level

Recent graduate with a Bachelor of Science in accounting and a focus on accounts receivable. Completed internships involving invoice processing, payment tracking, and assisting with month-end close procedures. Proficient in Microsoft Excel and QuickBooks, with strong attention to detail and a commitment to timely financial reporting.

Mid-career

Accounts receivable specialist with over five years of experience managing billing cycles and collections for mid-sized companies. Demonstrated expertise in reconciliations, reducing days sales outstanding (DSO) by 15% through streamlined processes. Known for building strong client relationships and effectively communicating with cross-functional teams to resolve discrepancies.

Experienced

Senior accounts receivable manager with a proven track record of leading teams to optimize cash flow and improve revenue collection strategies. Over 10 years of experience in diverse industries, leveraging ERP systems like SAP and Oracle for efficient financial operations. Recognized for implementing automation solutions that increased collection efficiency by 25% while fostering team development and performance excellence.

Accounts receivable resume objective examples

Recent graduate

Recent graduate with a Bachelor of Science in Accounting seeking an accounts receivable position to use strong analytical skills and attention to detail. Eager to contribute to a dynamic finance team and support efficient cash flow management while gaining industry experience.

Career changer

Dedicated professional transitioning into accounts receivable, bringing a background in customer service and data management. Excited to apply problem-solving abilities and organizational skills in a finance role, contributing to accurate invoicing and timely payments.

Entry-level applicant

Highly motivated individual with coursework in accounting principles seeking an entry-level accounts receivable role. Looking forward to leveraging numerical aptitude and familiarity with financial software to assist in maintaining accurate financial records and improving departmental efficiency.

Use our Resume Builder to easily organize your accounts receivable experience. Customize sections to highlight your skills, like tracking payments and managing invoices.

Match your resume to the job description

Tailoring resumes to job descriptions is key for standing out to employers and getting through applicant tracking systems (ATS). These systems scan resumes for specific keywords from job postings. By matching your resume with the job description, you increase your chances of catching a hiring manager’s attention.

An ATS-friendly resume includes keywords and phrases that match the skills needed for the job. This means using words from the job posting that describe what you can do. When your resume uses these terms, it’s more likely to be noticed by both the ATS and human readers.

To find keywords in a job posting, look for skills, qualifications, and duties mentioned often. For example, if an accounts receivable position lists “invoice processing,” “customer service,” or “account reconciliation” repeatedly, make sure those appear in your resume exactly as written.

To customize your resume, incorporate these terms naturally into your resume by rewriting your experiences. If a job duty says “Manage invoice processing efficiently,” you could write “Managed efficient invoice processing to ensure timely payments.”

Check your resume with our ATS Resume Checker to find and fix over 30 common problems. Get quick tips on boosting your resume score!

FAQ

Do I need to include a cover letter with my accounts receivable resume?

Yes, adding a cover letter to your accounts receivable resume can increase your chances of catching the eye of potential employers. A cover letter lets you showcase your skills in managing invoices, collections, and customer interactions while conveying your genuine interest in the company and role.

If the company values specific software like SAP or QuickBooks, emphasize your experience with those tools or your eagerness to learn them.

Consider using resources like our Cover Letter Generator to create a professional document that complements your resume by highlighting key achievements and relevant experiences.

Additionally, reviewing cover letter examples focused on finance roles may offer helpful insights and inspiration for tailoring yours effectively.

How long should an accounts receivable’s resume be?

For an accounts receivable role, a one-page resume is generally ideal for highlighting your key skills, like accounting software, attention to detail, and experience in managing invoices and payments.

If you have extensive experience or specialized certifications, extending to a two-page resume is acceptable. Ensure every detail is relevant, focusing on your ability to streamline collection processes, improve cash flow management, and maintain accuracy in financial records.

Explore our guide on how long a resume should be for more examples and tips tailored to different career stages.

How do you write an accounts receivable resume with no experience?

If you’re crafting an accounts receivable resume with no direct experience, highlight your relevant skills, education, and related experiences to show your capability for the role. Here are a few tips to help you get started:

- Emphasize transferable skills: Highlight skills like attention to detail, communication, skill in Excel or accounting software, and problem-solving. These are important for handling financial records and customer interactions.

- Leverage educational background: If you have a degree in finance, accounting, or business, list it prominently. Include courses or projects related to financial management or bookkeeping.

- Include internships or volunteer work: If you’ve interned at a company’s finance department or volunteered in roles involving transaction handling or customer service, describe these experiences, focusing on responsibilities that relate to accounts receivable tasks.

- Showcase relevant achievements: Discuss times you improved efficiency in a process or successfully managed a project. Even if not directly related to accounts receivable, these achievements show potential employers your ability to handle responsibilities effectively.

For more tips, check out our guide on creating a resume with no experience. Tailor each resume section to reflect how your background aligns with the core duties of accounts receivable positions.

Rate this article

Accounts Receivable

Additional Resources

Accounts Receivable Manager Resume Examples & Templates for 2025

Explore accounts receivable manager resume examples and tips to learn how to highlight your financial skills and experience managing invoices and collections.Build my resumeImport existing resumeCustomize this templateWhy this resume

Accounts Receivable Clerk Cover Letter Example + Tips

Nearly all businesses, from government entities and non-profit organizations to hospitals and manufacturers, need AR clerks to handle their incoming payments. These positions take on a variety of financial tasks,

Accounts Payable Clerk Resume Examples & Templates for 2025

An accounts payable clerk maintains and processes accounts payable transactions. Duties include preparation of bills, logging invoices, verifying, computing, and recording data, keeping track of expenditures and payments, and providing

Accounts Payable Manager Resume Examples & Templates for 2025

Browse accounts payable manager resume examples to learn how to highlight your experience with invoice handling, payment processing, and vendor relations.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

Accounts Payable Supervisor Resume Examples & Templates for 2025

Explore accounts payable supervisor resume examples and tips and see how to highlight your experience organizing invoices, tracking expenses, and managing payments.Build my resumeImport existing resumeCustomize this templateWhy this

Accounts Payable Specialist Resume Examples + Expert Tips

Explore accounts payable specialist resume examples that demonstrate how to showcase essential skills like invoice processing, vendor management, and attention to detail.Build my resumeImport existing resumeCustomize this templateWhy this