Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Measurable accomplishments, such as a 25% increase in collections, showcase the applicant’s impact and value.

- Uses action-oriented language: Using action verbs such as “streamlined” and “implemented,” the applicant communicates initiative and effectiveness throughout their experience.

- Illustrates problem-solving ability: Facing challenges head-on, the applicant is implementing a CRM system to boost productivity, illustrating strong problem-solving skills and initiative.

More Collection Manager Resume Examples

Take a look at our collection manager resume examples to see the best ways to highlight your organizational, analytical, and negotiation skills. These billing and collections resumes will help you create a resume that captures your asset management expertise effectively.

Entry-Level Collection Manager

Why this resume works

- Effective use of keywords: Strategically incorporating role-relevant keywords like “collections” and “debt recovery” helps the resume pass ATS filters, ensuring visibility for finance positions.

- Shows digital literacy: Highlighting tools like billing processing systems and tracking software showcases the applicant’s computer skills and digital readiness for tech-driven finance roles.

- Centers on academic background: The education section spotlights significant academic achievements such as an MBA in finance, emphasizing a strong foundation essential early in their career.

Mid-Level Collection Manager

Why this resume works

- Points to measurable outcomes: By showcasing substantial increases in collections and error reductions, the applicant emphasizes a commitment to achieving measurable results and demonstrates a clear impact on organizational success.

- Displays technical expertise: Highlighting certifications like Certified Credit and Risk Analyst, the applicant’s profile reflects a strong foundation in technical skills essential for advanced collection roles.

- Includes a mix of soft and hard skills: Mixing data-driven decision making with interpersonal skills, the resume presents a well-rounded skill set important for effective team leadership and client interactions.

Experienced Collection Manager

Why this resume works

- Focuses on work history: Using a chronological resume format, the applicant’s extensive work history shines through, showcasing roles like Collection Manager over time.

- Showcases impressive accomplishments: Impressive accomplishments such as managing $3M+ monthly collections and reducing overdue accounts by 35% reflect senior-level impact.

- Emphasizes leadership skills: Leadership skills are emphasized with examples like leading a team of 15 for efficient collections and training staff.

Collection Manager Resume Template (Text Version)

Ming Li

Jacksonville, FL 32201

(555)555-5555

Ming.Li@example.com

Professional Summary

Dynamic Collection Manager expert in debt recovery and process optimization. Proven record in increasing collections and reducing overdue accounts. Skilled in leadership and financial analysis.

Work History

Collection Manager

Financial Solutions Corp – Jacksonville, FL

June 2023 – June 2025

- Increased collections by 25% in one quarter.

- Streamlined processes to reduce cost by 15%.

- Led team to achieve monthly targets consistently.

Debt Recovery Specialist

CrediTrust Management – Jacksonville, FL

June 2021 – May 2023

- Recovered 40% of outstanding debts annually.

- Coordinated with legal for dispute resolution.

- Implemented CRM system improving productivity.

Accounts Receivable Analyst

Commerce Lending Group – Miami, FL

June 2019 – May 2021

- Managed portfolio reducing overdue by 10%.

- Enhanced reconciliation process efficiency.

- Analyzed accounts increasing cash flow by 5%.

Skills

- Debt Recovery

- Account Management

- Financial Analysis

- Negotiation

- Team Leadership

- CRM Implementation

- Process Optimization

- Cash Flow Management

Education

Master of Business Administration Finance

New York University New York, NY

June 2019

Bachelor of Science Business Administration

University of California Los Angeles, CA

June 2017

Certifications

- Certified Collections Specialist – National Creditors Association

- Advanced Financial Analysis – Finance Professional Institute

Languages

- Spanish – Beginner (A1)

- French – Beginner (A1)

- Mandarin – Intermediate (B1)

Related Resume Guides

Advice for Writing Your Collection Manager Resume

Explore our tips on how to write a resume for a collection manager role and discover how to highlight your knack for organizing, evaluating, and preserving valuable items.

Highlight your most relevant skills

When applying for a collection manager job, listing relevant skills is very important. Employers look for specific abilities that match the role to ensure you can do the tasks required. Creating a dedicated skills section helps highlight your strengths clearly and quickly.

Include both technical skills, like database management or familiarity with collection software, and interpersonal skills, such as negotiation or communication abilities. Balancing technical and soft skills shows you’re well-rounded.

Technical skills prove you have the necessary knowledge to handle data and systems efficiently, while soft skills show you can interact well with clients and team members. For a stronger impact, integrate key skills into your work experience section.

For example, explain how your negotiation skills helped recover debts successfully in your previous job. This makes your resume more compelling by showing real-world use of these abilities.

It’s useful to be concise yet detailed when listing your skills. Avoid long lists that seem generic; focus on those most relevant to being a collection manager. This targeted approach helps employers see you as a good fit for the role right away.

Highlight your skills in audits, budgets, and compliance by selecting a resume format that showcases accuracy and reliability.

Showcase your accomplishments

As a collection manager, organizing your work experience is important to show your career growth and achievements. List your jobs in reverse order, starting with the most recent one. Each entry should include your job title, the company’s name, where it’s located, and the dates you worked there. This helps hiring managers see how you’ve progressed in your roles over time.

To make your resume stand out, focus on what you’ve accomplished rather than just listing tasks. You can do this by using numbers to show results. For example, instead of saying “managed debt recovery,” you might say “increased debt recovery rate by 20% within six months.”

This kind of detail gives a clear picture of your impact and skills. Use action verbs like “achieved,” “boosted,” or “reduced” to highlight what you did and how well you did it.

Quantified accomplishments are key because they quickly tell hiring managers about your abilities and successes. They help paint a picture of how effective you are in getting things done as a collection manager. By turning duties into measurable outcomes, you demonstrate not only what you’ve done but how it benefited your employer.

5 collection manager work history bullet points

- Managed a team of 10 collection agents, increasing recovery rates by 25% over 6 months.

- Implemented new billing software that reduced processing time by 40% and improved accuracy in collections.

- Developed training programs for new hires, resulting in a 20% improvement in agent performance within the first year.

- Negotiated payment plans with delinquent accounts, recovering over $500,000 in outstanding debts annually.

- Analyzed collection data to identify trends and improve strategies, leading to a 15% increase in overall efficiency.

Pick a resume template that’s tidy and readable. Use simple fonts and clear sections, steering clear of flashy graphics or colors that might obscure key details for employers.

Write a strong professional summary

A professional summary on resumes acts as an introduction to hiring managers, providing a snapshot of your career achievements and skills. When crafting this section, you can decide between writing a summary or an objective based on your experience level.

A professional summary is best for experienced applicants. It’s a three to four sentence overview that showcases your experience, key skills, and major achievements. Its purpose is to highlight your professional identity and the value you bring to the role. For example, a collection manager might emphasize their expertise in debt recovery and team leadership.

In contrast, resume objectives are short statements about your career goals. They’re ideal for entry-level workers, career changers, or those with employment gaps. While summaries focus on “what I’ve accomplished,” objectives address “what I aim to contribute.”

Next, we’ll provide examples of both professional summaries and resume objectives tailored for different industries and levels of experience. See our full library of resume examples for additional inspiration.

Collection manager resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in Accounting and a strong understanding of credit management principles. Completed internships focusing on debt collection processes, client communication, and financial reporting. Certified in Microsoft Excel and eager to apply analytical skills to improve collection strategies.

Mid-career

Experienced collection manager with over five years in the financial services industry. Proven track record in managing accounts receivable, negotiating payment plans, and reducing delinquency rates. Skilled in using CRM software, analyzing debtor data, and leading team efforts to improve collection efficiency.

Experienced

Seasoned collection manager specializing in large-scale debt recovery operations for corporate clients. Over a decade of experience leading teams, implementing advanced collection techniques, and achieving significant reductions in outstanding debts. Expertise in regulatory compliance, risk assessment, and strategic planning for long-term financial stability.

Collection manager resume objective examples

Entry-level

Driven individual with a background in finance and customer service seeking an entry-level collection manager position. Eager to apply strong negotiation skills and understanding of financial processes to assist in efficient debt recovery while maintaining positive customer relationships.

Career changer

Detail-oriented professional transitioning from retail management to collections management, aiming to leverage leadership and conflict resolution abilities. Excited to contribute to a collaborative team environment by optimizing collections strategies and improving client satisfaction.

Recent graduate

Ambitious recent business administration graduate looking for a collection manager role where analytical skills and knowledge of financial systems can be used. Committed to developing innovative solutions for effective debt collection while supporting organizational goals.

Boost your chances of getting hired as a collection manager with our AI Resume Builder, which offers easy-to-use templates to highlight your skills and experience effectively.

Match your resume to the job description

Tailoring your resume to job descriptions is key because it helps you stand out to employers and ensures your resume passes through applicant tracking systems. These systems are used by many companies to filter resumes before they reach hiring managers. ATS scans for specific keywords and phrases from job postings, so matching your resume to the job description increases your chances of being noticed.

An ATS-friendly resume includes relevant keywords that align with your skills and experiences. The goal is to make sure the words in your resume match those in the job posting, which shows that you have the qualifications they are looking for.

To find the right keywords, carefully read the job posting and look for repeated skills, qualifications, and duties. For example, if you’re applying for a collection manager position, focus on terms like “debt recovery,” “account management,” or “financial reporting.”

Incorporate these terms naturally into your resume content. Instead of just listing duties, rewrite them to include keywords. For instance, change “managed accounts” to “managed account portfolios to optimize debt recovery outcomes.”

Targeted resumes improve ATS compatibility because they speak directly to what employers need. By customizing your resume, you increase the chances of advancing through both automated systems and human review processes.

Check your resume with our ATS Resume Checker to find over 30 typical mistakes in layout and wording. Get quick tips on improving your resume’s rating.

FAQ

Do I need to include a cover letter with my collection manager resume?

Yes, including a cover letter with your collection manager resume can make a big difference. A cover letter gives you the chance to highlight your expertise in managing collections and improving recovery rates, which is key for this role.

You can explore various cover letter examples to see how others have emphasized their skills. You can also use it to explain your specific interest in the company and how your skills match their goals or any challenges they might be facing.

If there are particular achievements or technologies you’ve used that aren’t fully detailed on your resume, the cover letter is the right place to elaborate on those points. Consider using our Cover Letter Generator to effectively communicate these details.

How long should a collection manager’s resume be?

For a collection manager, aim for a one-page resume if you have less than ten years of experience. This length helps you spotlight key skills like debt collection strategies, team leadership, and compliance knowledge.

If you have over a decade’s worth of experience or specialized certifications, extending to a two-page resume can be fitting. Make sure each detail is relevant and showcases your expertise in managing collections efficiently.

Check out our guide on how long a resume should be for examples and tips tailored to your career stage.

How do you write a collection manager resume with no experience?

When crafting a resume with no experience for a collection manager role, emphasize skills and experiences that match the job’s duties instead of direct experience. Here are a few tips to help you get started:

- Emphasize transferable skills: Highlight skills such as negotiation, communication, problem-solving, and attention to detail. These are critical in managing collections effectively.

- Showcase relevant coursework or projects: If you’ve taken any finance, accounting, or business courses, include them. Mention any projects where you handled budgeting or financial analysis.

- Include internships or volunteer work: Even if not directly related to collections management, roles where you managed data or interacted with clients can demonstrate applicable experience.

- Highlight software skill: Familiarity with Microsoft Excel or any financial software can be a plus. Mention these tools along with your skill level.

- Focus on soft skills and achievements: Leadership roles in clubs or organizations show managerial potential. Include specific accomplishments that demonstrate your ability to handle responsibility.

Remember to highlight abilities like organization, communication, and financial management to showcase your potential fit.

Rate this article

Collection Manager

Share this page

Additional Resources

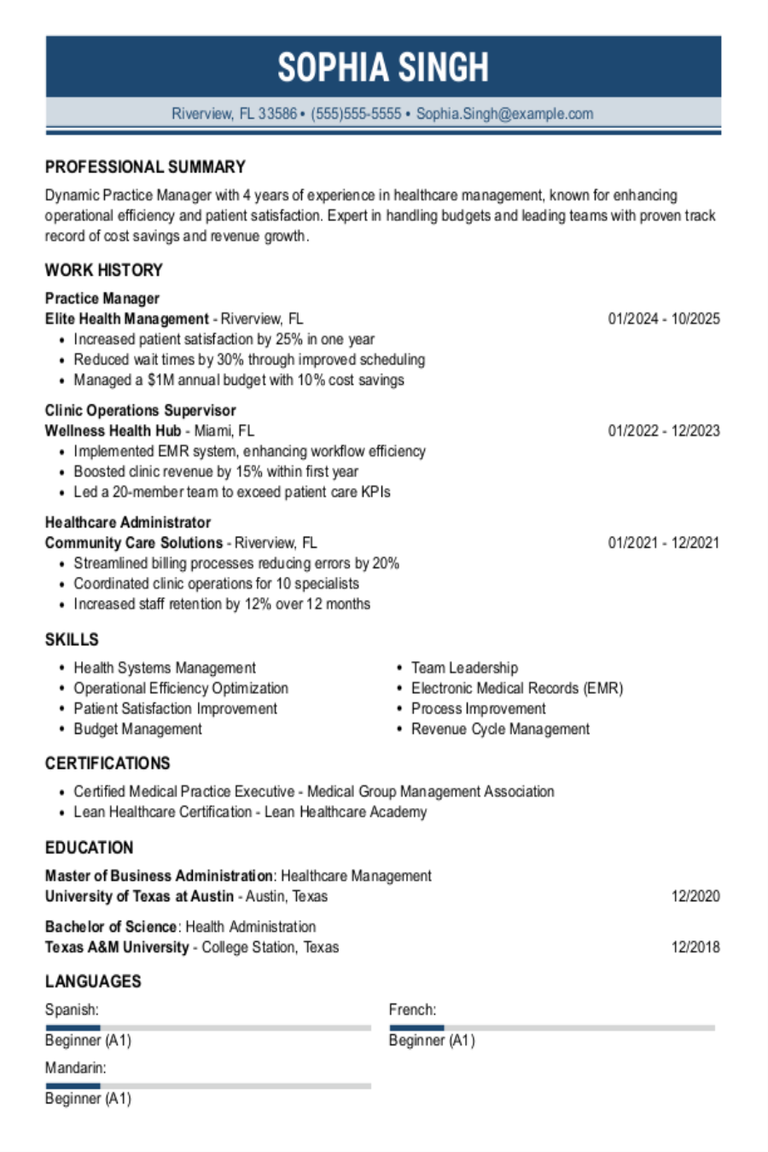

Practice Manager Resume Examples & Templates

Explore practice manager resume examples and tips to learn how to highlight your relevant skills and experience managing staff schedules and improving patient experiences.Build my resumeImport existing resumeCustomize this templateWhy

25 Interview Questions for Managers (With Answers & Tips)

Success in a management interview starts long before the conversation begins. Taking the time to prepare thoughtful responses to common interview questions for managers helps you clearly communicate leadership experience

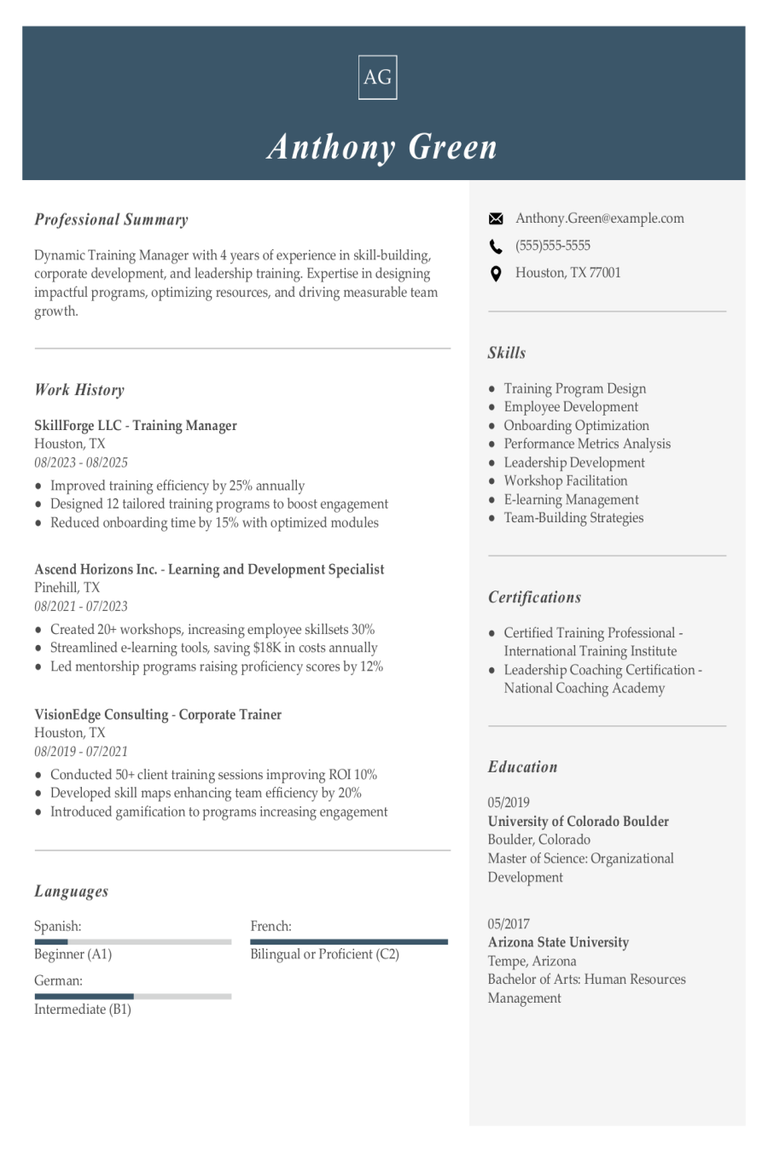

Training Manager Resume Examples & Templates

Discover how training managers showcase their skills in leading workshops and improving employee performance on their resumes. Our examples and tips will help you craft a resume that stands out

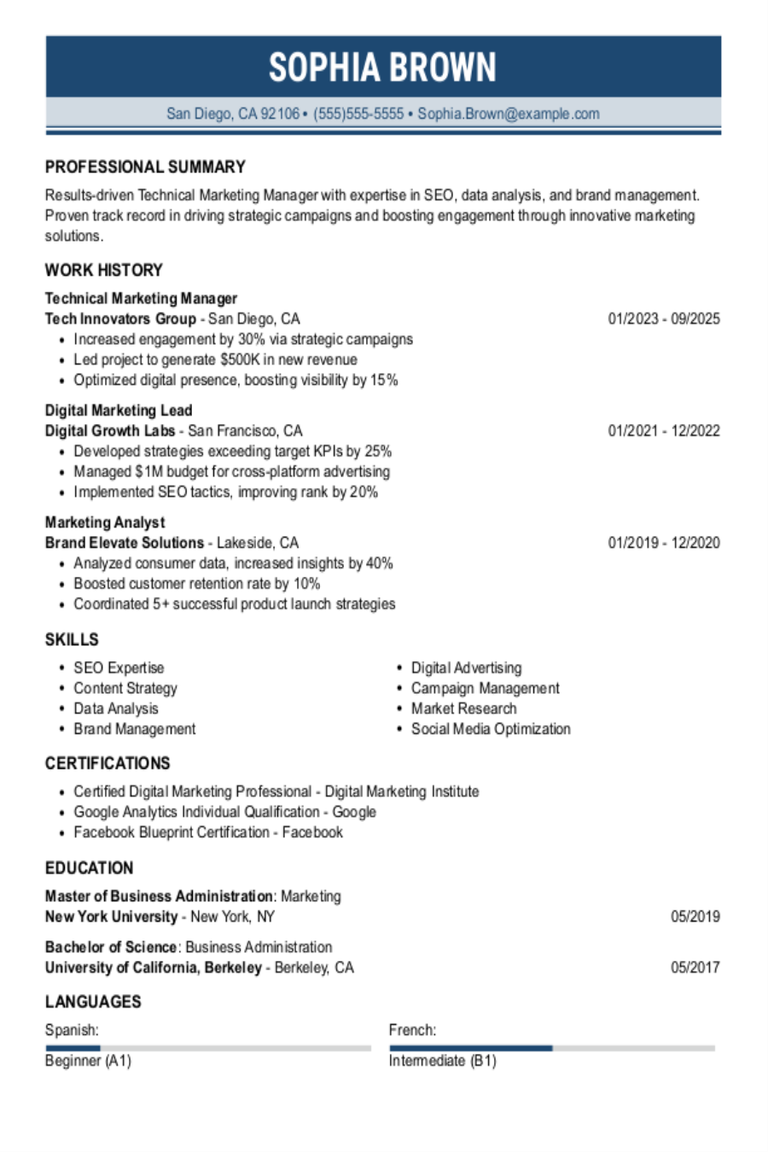

Technical Marketing Manager Resume Examples & Templates

Discover how to craft a technical marketing manager resume that shines. Learn to highlight your tech-savvy skills, marketing strategies, and project successes effectively.Build my resumeImport existing resumeCustomize this templateWhy this

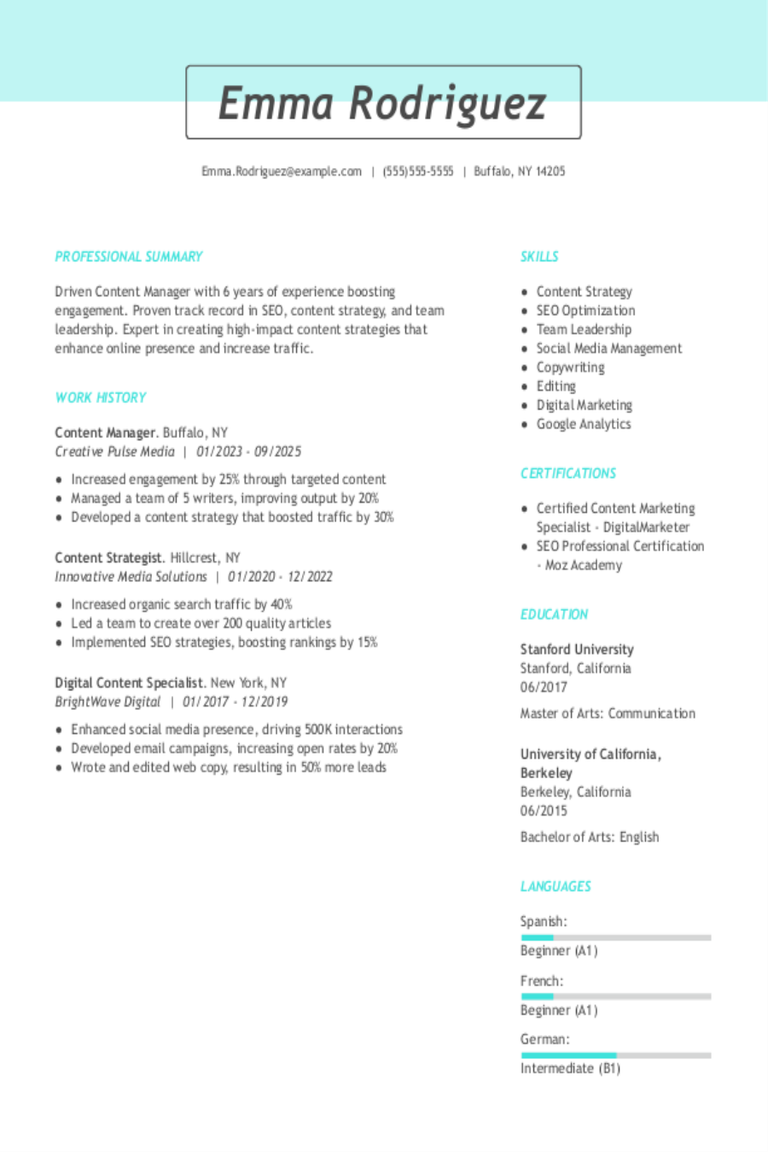

Content Manager Resume Examples & Templates

Browse content manager resume examples to see how to highlight your experience organizing, creating, and sharing engaging materials across platforms. These examples and tips help you showcase creativity, leadership, and

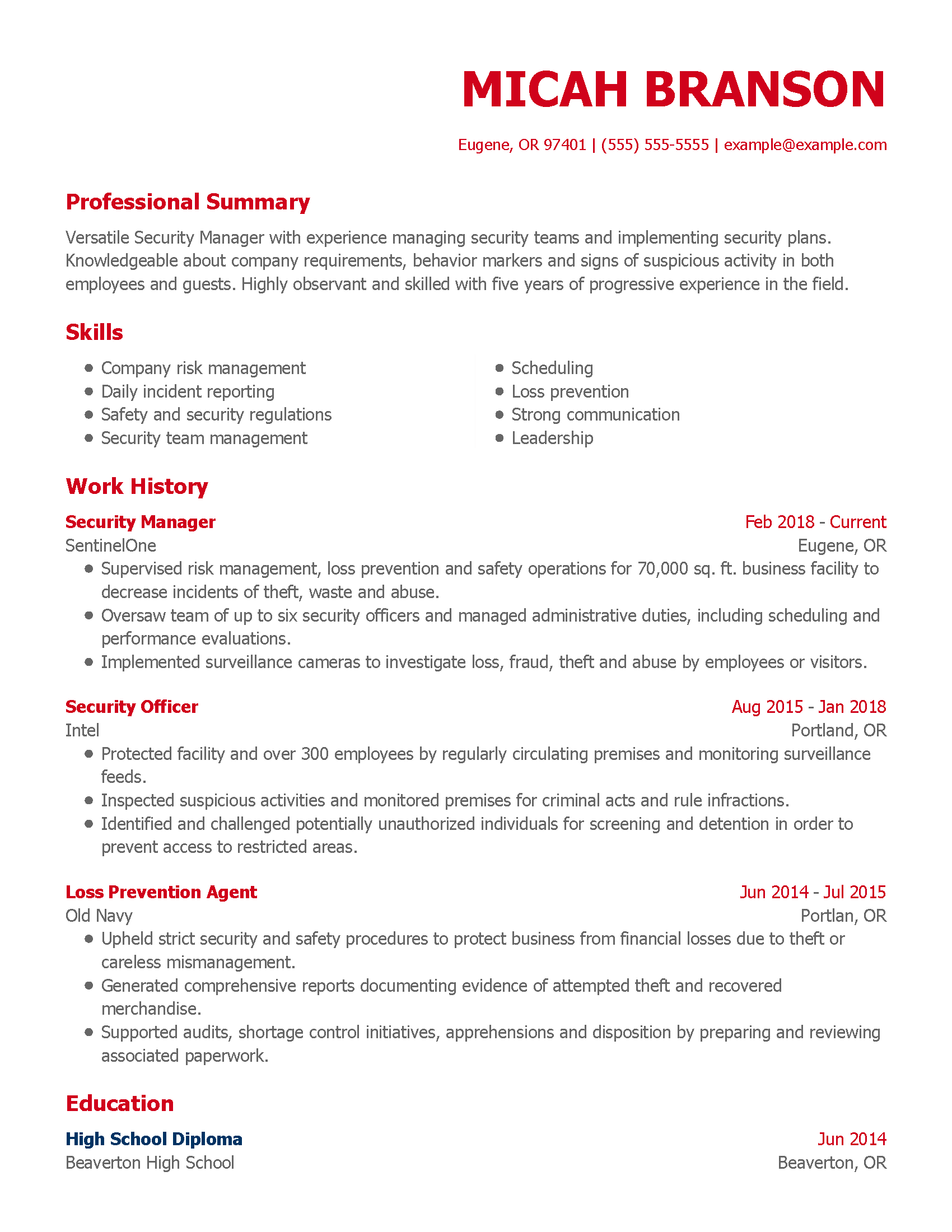

Security Manager Resume Examples & Templates

Explore security manager resume examples that showcase leadership, emergency response, and risk management. Get tips to highlight your skills and experience in keeping people and property safe.Build my resumeImport existing