Table of Contents

Get started with MyPerfectResume today!

- Build a resume on any device

- Pick an ATS-friendly template

- Tailor with AI copy suggestions

Why this resume works

- Quantifies accomplishments: Measurable accomplishments, such as the applicant’s ability to process 200+ invoices monthly and reduce late penalties by 30%, showcase impactful contributions.

- Showcases career progression: Starting as a junior bookkeeper, advancing to financial transactions analyst, and finally accounts payable clerk exemplifies the applicant’s significant career progression and expanding responsibilities.

- Illustrates problem-solving ability: Implementing solutions like reducing transaction errors by 15% demonstrates problem-solving skills and critical thinking.

More Accounts Payable Clerk Resume Examples

Browse more accounts payable clerk resume examples to discover how to highlight your organizational skills, attention to detail, and financial experience. These billing and collections resume samples will help you build a resume that effectively showcases your expertise.

Entry-Level Accounts Payable Clerk

Why this resume works

- Effective use of keywords: By weaving in essential industry keywords like “compliance audits” and “vendor account reconciliation,” the applicant optimizes their resume to pass applicant tracking systems (ATS) and stand out to hiring managers.

- Shows digital literacy: Mastery of ERP systems and Microsoft Excel highlights the applicant’s readiness for tech-driven roles, showcasing essential computer skills important for modern workplaces.

- Centers on academic background: Academic accolades, such as a master’s degree in business administration, emphasize a strong foundation early in one’s career, focusing on accounting prowess and educational achievements.

Mid-Level Accounts Payable Clerk

Why this resume works

- Points to measurable outcomes: Listing achievements like reducing payment errors by 15% showcases the applicant’s ability to drive measurable outcomes in accounts payable.

- Includes a mix of soft and hard skills: The mix of technical skills like SAP experience and interpersonal skills in vendor management highlights a strong, versatile skill set.

- Demonstrates language abilities: Language skills in Spanish, French, and German emphasize the applicant’s ability for effective cross-cultural communication.

Experienced Accounts Payable Clerk

Why this resume works

- Showcases impressive accomplishments: By optimizing workflows to save $10k annually, the applicant showcases impressive accomplishments that reflect significant business impact.

- Focuses on work history: The applicant’s focus on work history is evident through a chronological resume format, effectively emphasizing extensive career experience.

- Sections are well-organized: Using bullet points and headers strategically, the applicant ensures sections are well-organized, making the resume easy to scan and reader-friendly.

Accounts Payable Clerk Resume Template (Text Version)

John Garcia

Cedar Valley, MN 55137

(555)555-5555

John.Garcia@example.com

Professional Summary

Detail-oriented Accounts Payable Clerk with 7 years experience in finance. Expertise in invoice processing and accounts reconciliation, ensuring compliance and accuracy. Proven track record of improving efficiency and reducing errors.

Work History

Accounts Payable Clerk

FinTech Solutions Group – Cedar Valley, MN

February 2023 – June 2025

- Processed 200+ invoices monthly for payment

- Reduced late payment penalties by 30%

- Managed accounts data with 99% accuracy

Financial Transactions Analyst

Reliable Transactions Inc. – Minneapolis, MN

January 2018 – January 2023

- Audited 500+ transactions quarterly

- Improved transaction speed by 20%

- Assisted in reconciliation of accounts

Junior Bookkeeper

Pioneer Financial Services – Cedar Valley, MN

June 2016 – December 2017

- Cataloged 100+ financial records weekly

- Ensured compliance with financial laws

- Supported month-end closing processes

Skills

- Invoice Processing

- Accounts Reconciliation

- Financial Reporting

- Data Management

- Risk Analysis

- Attention to Detail

- Regulatory Compliance

- Time Management

Education

Master of Business Administration Finance

University of Illinois Urbana, Illinois

May 2016

Bachelor of Science Accounting

Illinois State University Normal, Illinois

May 2014

Certifications

- Certified Accounts Payable Professional – Institute of Finance and Management

- Financial Analysis Expert – Financial Analysts Association

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Related Resume Guides

Advice for Writing Your Accounts Payable Clerk Resume

Explore our advice on how to write a resume for an accounts payable clerk role and discover how to highlight your knack for managing invoices, payments, and vendor relationships.

Highlight your most relevant skills

Listing relevant skills when applying for a job as an accounts payable clerk is important because it shows employers you have what they need. When you tailor your skills to the job description, it makes it clear that you’re a good fit for the role. A dedicated skills section can help highlight both your technical and interpersonal abilities, giving a more complete picture of your capabilities.

Make sure to balance hard skills like managing invoices, using accounting software, and handling payments with soft skills like attention to detail and communication. This mix helps employers see that you can do the job well and work effectively with others.

To make an even stronger impact, weave key skills into your work experience section. For example, mention how you used specific accounting tools in past roles or how your organizational skills helped streamline payment processes.

A resume format that highlights attention to detail, accuracy in processing invoices, and effective communication can help accounts payable clerks make a strong impression.

Showcase your accomplishments

To effectively showcase your accomplishments as an accounts payable clerk, organize your work experience in reverse chronological order. Start with the most recent job and work backward. For each position, include your job title, the employer’s name, location, and employment dates. This format helps hiring managers see your career growth and recent experiences first.

Instead of listing job responsibilities, focus on quantifying your accomplishments to make your resume more compelling. Turn duties into achievements by highlighting measurable results like percentages, time savings, cost reductions, or efficiency improvements.

For example, instead of saying you “processed invoices,” say you “reduced invoice processing time by 20% through streamlined procedures.” Use action-oriented words that highlight both core duties and measurable achievements.

Quantified accomplishments allow hiring managers to quickly assess your impact and skills as an accounts payable clerk. They provide concrete evidence of what you can bring to a new role.

By focusing on results rather than tasks, you demonstrate not just what you’ve done but how well you’ve performed those tasks. This approach helps set you apart from other candidates who might only list their responsibilities without showing their true value.

5 accounts payable clerk work history bullet points

- Processed and verified over 1,000 invoices monthly, ensuring timely payments and reducing late fees by 15%.

- Collaborated with vendors to resolve discrepancies, resulting in a 20% decrease in unpaid invoices.

- Implemented an automated invoice scanning system, cutting processing time by 25% and improving accuracy.

- Reconciled monthly statements and maintained accurate records, contributing to a 10% improvement in audit compliance.

- Trained new hires on accounts payable procedures, improving team productivity by 18%.

Select a straightforward resume template featuring readable fonts and well-structured sections, keeping colors and graphics minimal to let your skills and experience shine without distractions.

Write a strong professional summary

A professional summary is a brief introduction on a resume that offers hiring managers a quick overview of your experience and skills. When crafting your resume, you can choose between using a summary or an objective.

A professional summary is generally used by those with some work experience. It consists of three to four sentences highlighting your past achievements and skills, showcasing your professional identity and the value you bring to the job. If you’re experienced in handling invoices and managing vendor relationships, this section is perfect for highlighting those strengths.

On the other hand, a resume objective centers more on career goals rather than past achievements. It’s best suited for people who are just starting, changing careers, or have gaps in their work history. Think of it as outlining “what I’ve accomplished” versus “what I aim to contribute.”

Now, let’s explore examples of both summaries and objectives tailored to various industries and levels of experience. See our library of resume examples for additional inspiration.

Accounts payable clerk resume summary examples

Entry-level

Recent finance graduate with a Bachelor of Science in Accounting, eager to apply strong analytical skills and academic knowledge as an accounts payable clerk. Completed internship at a mid-sized corporation where tasks included processing invoices and assisting with monthly reconciliation. Proficient in Microsoft Excel and QuickBooks, with a keen attention to detail and enthusiasm for learning industry best practices.

Mid-career

Detail-oriented accounts payable clerk with over five years of experience in managing vendor relationships and ensuring timely invoice processing. Adept at using SAP and Oracle for financial management, maintaining accurate records, and supporting month-end closing processes. Recognized for improving payment cycles by implementing streamlined procedures that reduced processing time by 20%.

Experienced

Seasoned accounts payable specialist with more than 10 years in the manufacturing industry, known for leadership in optimizing payables processes across multiple departments. Expert in leveraging ERP systems to improve accuracy and efficiency, resulting in a 30% reduction in errors over three years. Strong collaborator who mentors junior staff and drives continuous improvement initiatives to support organizational financial goals.

Accounts payable clerk resume objective examples

Recent graduate

Detail-oriented accounting graduate seeking an entry-level accounts payable clerk position to use strong numerical and organizational skills. Eager to contribute to a fast-paced finance team while developing expertise in invoice processing and vendor management.

Career changer

Organized professional transitioning from retail management to accounts payable, bringing exceptional attention to detail and problem-solving abilities. Looking forward to applying customer service experience and analytical skills in a financial setting focused on accuracy and efficiency.

Entry-level applicant with internship experience

Aspiring accounts payable clerk with hands-on experience from a recent internship, eager to support a finance department. Passionate about leveraging knowledge of accounting software and Excel to streamline processes and ensure timely payment cycles.

Use our Resume Builder to quickly create a polished resume for an accounts payable clerk job. It offers easy-to-follow templates to help you showcase your skills and experience.

Match your resume to the job description

Tailoring resumes to job descriptions is important for job seekers. It helps them stand out to employers and ensures their resume passes through applicant tracking systems (ATS). ATS software scans resumes for specific keywords and phrases from job postings, so if you customize your resume to match these terms, it’s more likely to catch the attention of hiring managers.

An ATS-friendly resume includes keywords and phrases that align your skills with what’s mentioned in the job description. For an accounts payable clerk role, this might include terms like “invoice processing,” “vendor management,” or “financial reporting.”

To find these keywords, carefully read the job posting. Look for repeated skills, qualifications, or duties such as “data entry,” “account reconciliation,” or “payment processing.”

Incorporating these terms naturally into your resume is important. For example, if a job requires “invoice processing,” you might write: “Processed over 200 invoices monthly to ensure timely payments.” This aligns closely with what employers look for without sounding forced.

Targeted resumes help make sure your application isn’t lost in the ATS shuffle. They highlight how well you fit a role and increase the likelihood of advancing in the hiring process.

Our ATS Resume Checker makes sure your resume has the right format and keywords to get noticed.

FAQ

Do I need to include a cover letter with my accounts payable clerk resume?

Yes, including an accounts payable clerk cover letter with your resume can boost your application by showcasing your strengths and enthusiasm for the role.

A cover letter gives you a chance to explain why you’re interested in working for the company and how your skills align with their needs, such as managing invoices or reconciling accounts.

For instance, if the company values accuracy and efficiency, mention how you’ve consistently met tight deadlines or reduced processing errors in previous roles. Check out our cover letter examples to see how others have effectively communicated their skills.

Consider using online tools like our Cover Letter Generator to help craft a tailored cover letter that complements your resume by emphasizing key achievements like improving payment cycles or implementing cost-saving measures.

How long should an accounts payable clerk’s resume be?

For an accounts payable clerk, a one-page resume is ideal. This length lets you highlight key skills like accounting software expertise, attention to detail, and experience managing invoices and payments.

If you’ve gathered extensive experience or hold specialized certifications relevant to the role, a two-page resume is acceptable. Ensure every piece of information ties directly to accounts payable tasks, focusing on roles that show your financial management abilities.

Consider checking out our guide on how long a resume should be for more examples and tips tailored to different career stages.

How do you write an accounts payable clerk resume with no experience?

Starting an accounts payable clerk resume without prior experience can be challenging, but you can focus on showcasing your skills, education, and training to demonstrate your potential. Here are a few tips to help you get started:

- Emphasize education: Start with your educational background. If you have taken any courses related to accounting or finance, list those first, along with the institution’s name and dates attended.

- Highlight transferable skills: Identify skills that are relevant to the role, such as attention to detail, skill in Excel or other financial software, organizational abilities, and strong communication skills.

- Include internships or volunteer work: If you’ve had internships or volunteered in roles involving financial tasks or data entry, include these experiences. Describe what you did and how it relates to accounts payable responsibilities.

- Showcase certifications or workshops: Mention any certifications, like QuickBooks certification, or workshops attended that relate to accounting practices.

Check out our guide on crafting a resume with no experience for more examples and strategic advice and examples.

Rate this article

Accounts Payable Clerk

Share this page

Additional Resources

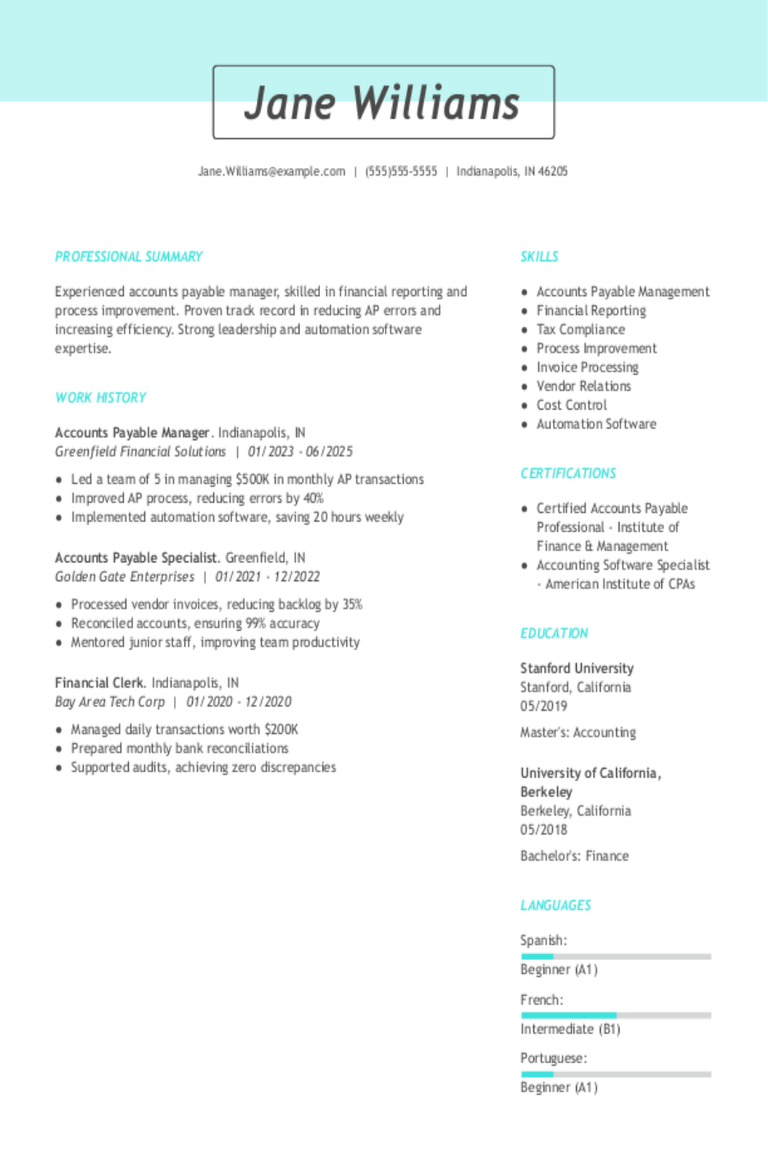

Accounts Payable Manager Resume Examples & Templates

Browse accounts payable manager resume examples to learn how to highlight your experience with invoice handling, payment processing, and vendor relations.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

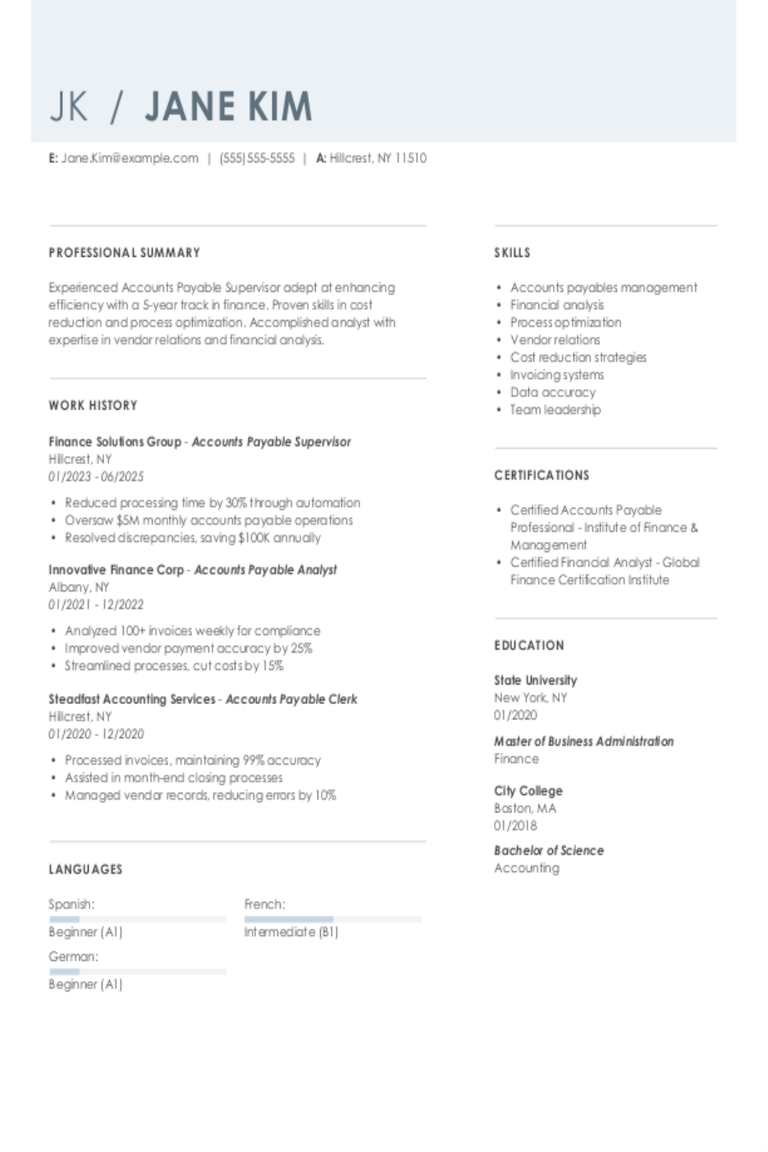

Accounts Payable Supervisor Resume Examples & Templates

Explore accounts payable supervisor resume examples and tips and see how to highlight your experience organizing invoices, tracking expenses, and managing payments.Build my resumeImport existing resumeCustomize this templateWhy this

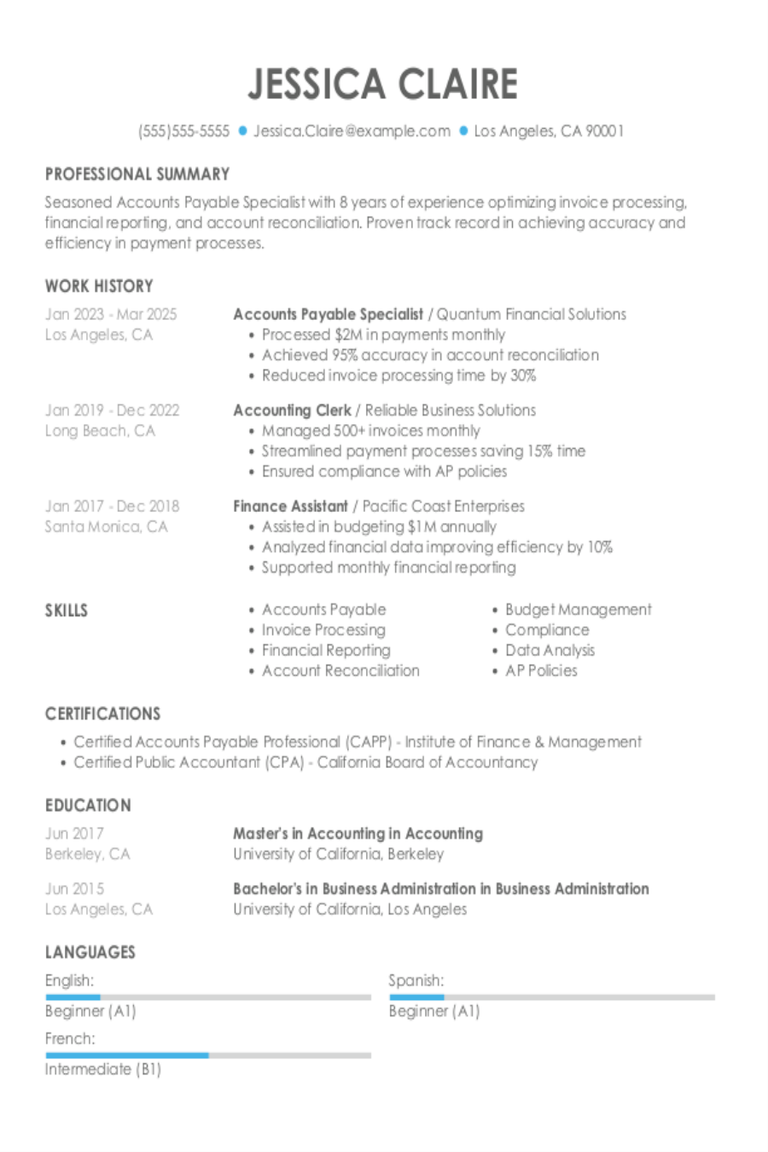

Accounts Payable Specialist Resume Examples + Expert Tips

Explore accounts payable specialist resume examples that demonstrate how to showcase essential skills like invoice processing, vendor management, and attention to detail.Build my resumeImport existing resumeCustomize this templateWhy this

Accounts Payable Cover Letter Example + Tips

Ava Taylor 1 Main Street New Cityland, CA 91010 Cell: (555) 322-7337 E-Mail: example-email@example.com Dear Ms. Flowers, I write in response to your ad seeking an Accounts Payable Clerk at Flowers Party Planning. As a highly

Accounts Receivable Clerk Cover Letter Example + Tips

Nearly all businesses, from government entities and non-profit organizations to hospitals and manufacturers, need AR clerks to handle their incoming payments. These positions take on a variety of financial tasks,

Data Entry Clerk Cover Letter Examples & Templates for 2026

Check out data entry clerk cover letter examples to learn how to make a strong first impression, emphasize relevant skills, and finish with a persuasive closing that captures attention.Build my