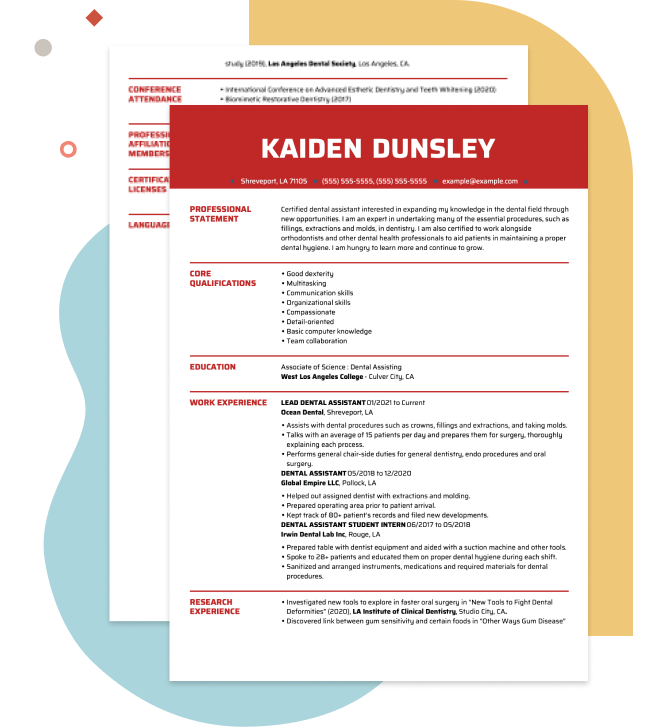

Why this resume works

- Quantifies accomplishments: By showcasing measurable accomplishments like recovering 85% of overdue accounts, the applicant illustrates their impactful contributions and quantifies success.

- Uses action-oriented language: Action verbs such as “negotiated” and “streamlined” vividly convey the applicant’s initiative, competence, and effectiveness in handling responsibilities, emphasizing their proactive approach.

- Illustrates problem-solving ability: The applicant’s ability to resolve 90% of escalated billing disputes highlights their problem-solving skills, demonstrating critical thinking and innovation.

More Collections Representative Resume Examples

Explore our collections representative resume examples to learn how to highlight your negotiation skills, customer account management, and ability to resolve payment issues. Use these billing and collections resume samples to craft a polished and impactful resume.

Entry-Level Collections Representative

Why this resume works

- Effective use of keywords: Skillfully weaving industry-specific keywords like “collections representative” and “debt recovery” aligns with industry standards and improves the applicant’s chances of passing applicant tracking systems (ATS).

- Puts skills at the forefront: The resume’s focus on showcasing skills such as negotiation and data analysis aligns with a skills-based resume format, optimizing appeal for entry-level roles.

- Shows digital literacy: By integrating tools for debtor profiling and process streamlining, the applicant displays strong computer skills and digital competence.

Mid-Level Collections Representative

Why this resume works

- Points to measurable outcomes: With impressive statistics like resolving 95% of overdue accounts monthly, the applicant effectively showcases their ability to drive measurable financial improvements in collections and cash flow.

- Includes a mix of soft and hard skills: By intertwining skills like negotiation and customer relationship management with interpersonal skills, the applicant skillfully combines technical expertise with empathy for effective problem-solving.

- Displays technical expertise: The resume’s emphasis on certifications such as Certified Credit and Collections Professional highlights their strong foundation in important industry-specific technical knowledge.

Experienced Collections Representative

Why this resume works

- Showcases impressive accomplishments: By showcasing achievements like negotiating $250,000 in payment plans annually and reducing delinquent accounts by 35%, the applicant reveals their impact-driven approach.

- Focuses on work history: Using a chronological resume format, the applicant’s extensive career in collections and finance unfolds seamlessly, emphasizing steady growth and expertise over time.

- Sections are well-organized: Clear headers and concise bullet points make the sections easily navigable, allowing readers to quickly grasp key achievements and skills without getting lost in details.

Collections Representative Resume Template (Text Version)

Emma Nguyen

Minneapolis, MN 55406

(555)555-5555

Emma.Nguyen@example.com

Professional Summary

Results-driven collections representative with 8 years of experience in debt recovery, financial analysis, and customer negotiation. Skilled in implementing strategies to reduce overdue accounts and ensure compliance, achieving a recovery rate of 85%. Committed to enhancing client relationships while improving organizational efficiency.

Work History

Collections Representative

Marble Financial Solutions – Minneapolis, MN

June 2021 – June 2025

- Recovered 85% of overdue accounts within deadlines

- Negotiated payment plans, reducing accounts by 35%

- Ensured compliance with FDCPA and company policies

Accounts Recovery Specialist

Pinnacle Credit Agency – Cedar Valley, MN

June 2016 – May 2021

- Resolved 90% of escalated billing disputes

- Streamlined recovery process improving efficiency by 20%

- Managed 0K portfolio reducing outstanding debt

Debt Recovery Agent

Integrity Collections Inc. – Cedar Valley, MN

June 2013 – May 2016

- Recovered 70% of assigned delinquent accounts

- Collaborated with legal teams on debt settlements

- Tracked payment plans to reduce late payments by 40%

Skills

- Debt recovery strategies

- Customer negotiation skills

- Financial analysis

- Compliance management

- Account reconciliation

- Payment processing systems

- Detail-oriented tracking

- Problem-solving techniques

Education

Master’s Business Administration

Georgia State University Atlanta, Georgia

May 2013

Bachelor’s Finance

University of Illinois Chicago, Illinois

May 2011

Certifications

- Certified Collections Specialist – National Association of Credit Management

- Credit Compliance Certification – Credit and Collection Education Center

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Related Resume Guides

Advice for Writing Your Collections Representative Resume

Explore our tips on how to write a resume for a collections representative role and discover how to highlight your skills in debt recovery, customer service, and financial management. Whether you’re just starting or looking to improve your existing resume, we’ve got you covered with advice tailored specifically for collections professionals.

Highlight your most relevant skills

Listing relevant skills when applying for a job as a collections representative is very important. It helps show employers that you have the abilities needed to do the job well. A dedicated skills section lets you highlight both technical skills, like data entry and account management, and soft skills, like communication and problem-solving. This balance makes your resume more appealing.

To make your resume even stronger, include key skills in your work experience section. For example, mention how your negotiation skills helped recover debts or how your attention to detail improved record accuracy. This way, employers can see how you’ve used these skills in real-life situations.

Make sure not to overlook interpersonal skills such as empathy and patience, which are important for dealing with customers who may be stressed about their financial situation. By showing you have both the hard and soft skills needed for a collections representative role, you’ll stand out as a well-rounded applicant ready to handle the challenges of the job.

Highlight your strengths—choose a resume format that organizes communication skills, negotiation tactics, and customer interactions.

Showcase your accomplishments

When you’re writing your resume as a collections representative, it’s important to organize your work experience in reverse chronological order. Start with your most recent job and work backwards. Each entry should list your job title, employer name, location, and employment dates. This helps hiring managers easily follow your career path and see how you’ve progressed over time.

To make your resume stand out, focus on turning duties into achievements by quantifying them. Instead of just listing responsibilities, show the impact of your work.

Use numbers and data whenever possible—like percentages of debt recovered or time saved through new processes—to illustrate what you’ve accomplished. For example, “Improved collection rates by 15% through implementing new strategies.” This approach offers a clearer picture of what you can bring to the team.

Using action-oriented words is key in highlighting your skills and achievements as a collections representative. Words like “increased,” “reduced,” or “implemented” help convey energy and results. Quantified accomplishments allow hiring managers to quickly assess how effective you have been in past roles and gauge the potential value you could add to their organization.

5 collections representative work history bullet points

- Negotiated payment plans with delinquent accounts, improving recovery rate by 40% within six months.

- Managed a portfolio of over 200 accounts, reducing outstanding debt by $500,000 annually through strategic outreach and follow-up.

- Collaborated with the finance team to streamline billing processes, decreasing late payments by 25%.

- Implemented an automated reminder system that increased on-time payments from customers by 30%.

- Conducted regular account audits, identifying discrepancies and recovering $100,000 in missed revenue.

Choose a resume template that’s clean and easy to follow, with simple fonts, clear sections, and bold headers. Avoid flashy graphics or busy designs that distract from your experience.

Write a strong professional summary

A professional summary is an introduction that offers hiring managers a quick snapshot of your qualifications. When writing your resume, you can choose between a professional summary and a resume objective. The goal is to make a strong first impression and set the tone for the rest of your application.

A professional summary includes three to four sentences highlighting your experience, skills, and achievements in the field. It’s especially useful for experienced applicants who want to showcase their work history and demonstrate their value. This section helps define your professional identity and shows why you’re a great fit for the role of collections representative.

In contrast, resume objectives focus more on career goals and are best suited for entry-level applicants, those changing careers, or individuals with employment gaps. While summaries emphasize “what I’ve accomplished,” objectives aim to show “what I aim to contribute” to potential employers.

Next, we will provide examples tailored to different industries and experience levels to help you craft effective summaries and objectives for any role you may be applying for. See our library of resume examples for additional inspiration.

Collections representative resume summary examples

Entry-level

Recent finance graduate with a focus on credit management and collections. Completed internships at top financial services firms, gaining foundational skills in account reconciliation and customer communication. Familiar with industry software like QuickBooks and skilled in data analysis to support debt recovery processes.

Mid-career

Collections representative with over 6 years of experience in the telecommunications industry. Proven track record in reducing delinquency rates by implementing effective negotiation techniques and personalized payment plans. Experienced in handling high-volume accounts and adept at using Salesforce for tracking client interactions and outcomes.

Experienced

Seasoned collections professional with more than 15 years of expertise in managing large portfolios across diverse sectors, including healthcare and banking. Skilled leader known for developing efficient collection strategies that have improved recovery rates by up to 30%. Expert in compliance regulations and using advanced analytics to forecast trends and improve collection efforts.

Collections representative resume objective examples

Entry-level

Detail-oriented individual with strong communication skills seeking an entry-level collections representative position. Eager to apply analytical abilities to effectively manage accounts and support the financial health of the organization while gaining valuable experience in debt recovery processes.

Career changer

Customer service professional transitioning into collections, bringing exceptional negotiation and problem-solving skills honed through years of client interaction. Aspiring to contribute to a dynamic team as a collections representative by using interpersonal skills to resolve account discrepancies and improve customer satisfaction.

Recent graduate

Ambitious recent business administration graduate eager to begin a career as a collections representative. Dedicated to leveraging educational background and internship experience in finance to assist in recovering overdue payments and maintaining positive client relationships within a fast-paced environment.

Make your resume stand out! Use our Resume Builder to create a professional resume quickly and easily with templates designed for collections representatives.

Match your resume to the job description

Tailoring your resume to the job description is key to standing out. Employers often use applicant tracking systems (ATS) to scan resumes for specific keywords from the job posting. By matching your resume to these keywords, you increase your chances of catching the employer’s attention and passing through ATS filters.

An ATS-friendly resume includes keywords and phrases that match both the job description and your skills. This alignment helps hiring managers notice you since their initial screening relies heavily on these terms. It’s about showing that your experience matches what they are looking for.

To find the right keywords in a collections representative job posting, pay attention to the skills, qualifications, and responsibilities that are mentioned repeatedly, such as “account management,” “payment negotiations,” or “delinquent account resolution.”

Use these terms naturally when describing your past work experience. For example, instead of saying “Handled late payments,” you could write “Managed delinquent accounts and negotiated payment solutions to reduce outstanding balances.” Targeted resumes boost your chances with ATS because they show you have what the employer needs.

Want to boost your resume’s chances with an ATS? Our ATS Resume Checker reviews important details and helps you improve your score right away.

FAQ

Do I need to include a cover letter with my collections representative resume?

Yes, adding a cover letter to your collections representative resume can make a difference. A cover letter allows you to emphasize your communication and negotiation skills, which are important in collections, while also showing why you’re drawn to the role.

For example, if the company prioritizes customer satisfaction or uses a specific method for collections, you can talk about how your experience matches their goals. Creating a personalized cover letter also lets you explain any unique parts of your career path that might not be obvious from just your resume.

Think about using resources like our Cover Letter Generator for step-by-step guidance or checking out cover letter examples tailored to similar roles to ensure it showcases both your skills and enthusiasm effectively.

How long should a collections representative’s resume be?

For a collections representative, aim for a one-page resume that highlights key skills like communication, negotiation, and customer service. Focus on experiences such as managing overdue accounts and resolving payment issues effectively.

If you’ve gathered extensive experience or hold specialized certifications in collections or related fields, a two-page resume is acceptable. Make sure each detail relates directly to the role, showcasing your ability to handle sensitive financial discussions and maintain client relationships.

Check out our guide on how long a resume should be for examples and tips tailored to your career stage and expertise level.

How do you write a collections representative resume with no experience?

When you don’t have direct experience as a collections representative, focus your resume on relevant skills, education, and any experiences that show your capability for the role. Here are some tips to help you write a resume with no experience:

- Emphasize transferable skills: Highlight skills such as communication, negotiation, problem-solving, and attention to detail. These are important for collections work and can be gained in various roles or educational settings.

- Include any customer service experience: If you’ve worked in retail or hospitality, emphasize how you’ve handled difficult situations or resolved customer issues. This shows your ability to manage challenging conversations effectively.

- Showcase relevant coursework or training: If you’ve taken classes in finance, accounting, or business management, include them. They demonstrate your foundational knowledge of financial principles.

- Highlight volunteer work: If you’ve volunteered in positions where you had to organize financial records or assist with community fundraising efforts, include these experiences to showcase responsibility and trustworthiness.

Consider tailoring each application by adjusting your resume’s language to match job descriptions closely. This will help show potential employers that you’re ready to step into a collections role.

Rate this article

Collections Representative

Additional Resources

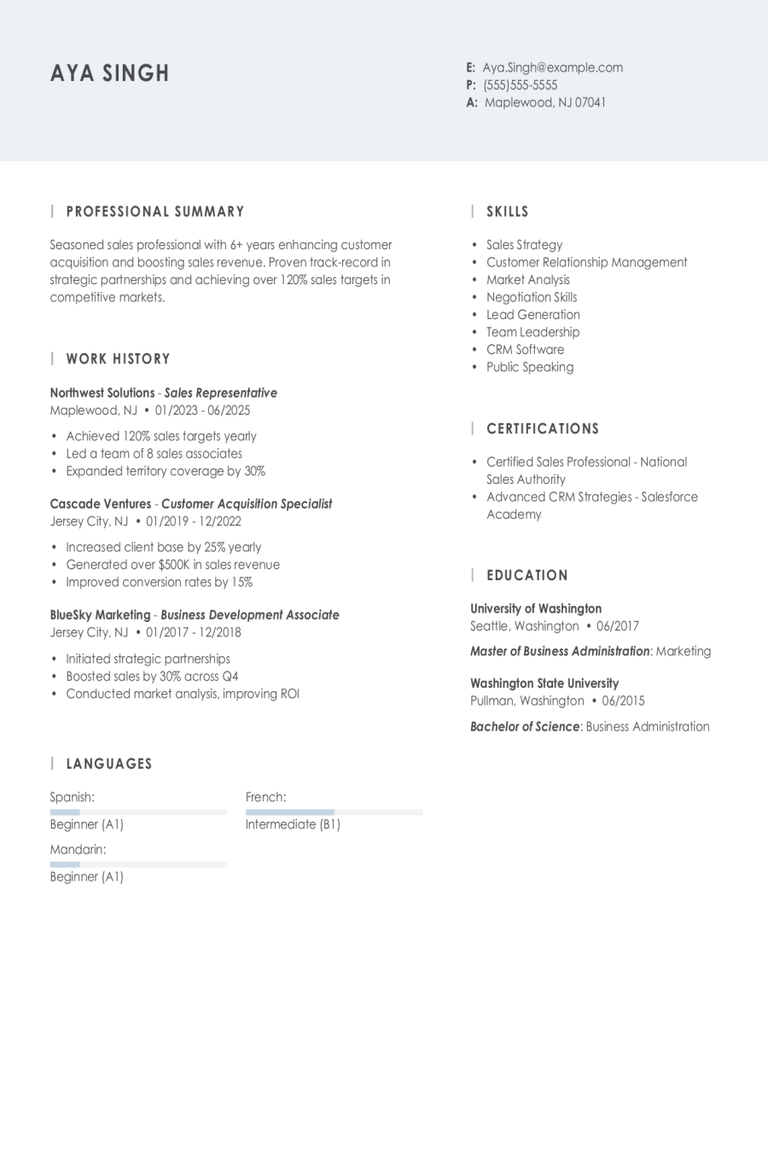

Sales Representative Resume Examples & Templates for 2025

A well-crafted sales representative resume can be the key to unlocking your dream job in the sales industry. Whether you’re just starting out or looking to make a career move,

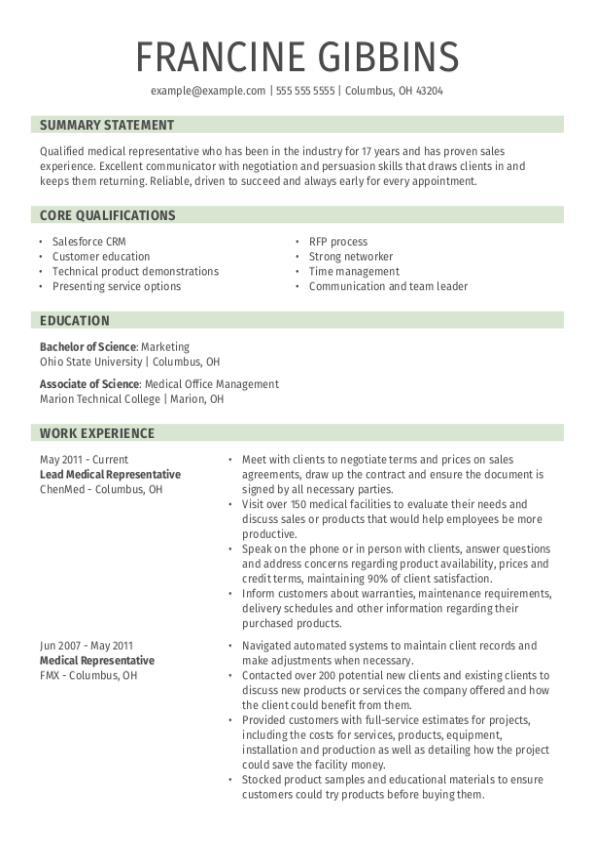

Medical Representative Resume Examples & Templates

Propel your career with an effective medical representative Resume. Use this guide with writing tips and samples to craft an excellent Resume of a medical representative that’ll showcase your sales

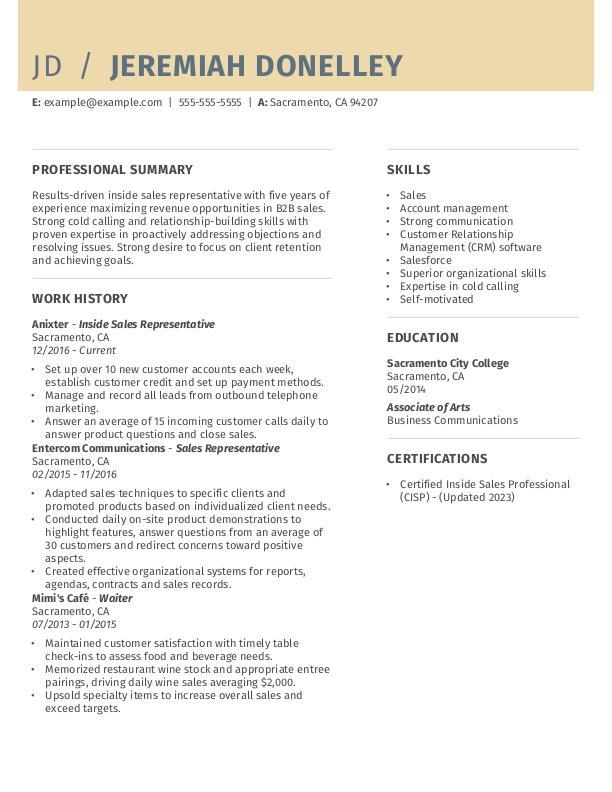

Inside Sales Representative Resume Examples & Templates

Making a resume that stands out can feel like a daunting task, especially when you need to capture all of your expertise as an inside sales rep in a page

Wine Sales Representative Resume Examples & Templates

Wine sales representatives are responsible for promoting and selling wine to customers. They must be knowledgeable, personable and strategic in their sales approach. To secure a job as a wine sales

Route Sales Representative Resume Examples & Templates

Route sales representatives are responsible for selling and delivering products to a specific set of customers on a designated route. Their primary goal is to increase sales by building and

Independent Sales Representative Resume Examples & Templates

Independent sales representatives are contractors who work on behalf of a company to sell its products or services to customers. They typically work on a commission basis, earning a percentage