Editors’ Picks

Interview Question: Setting Goals & Following Through

You’ve made it to the interview — good work! After reviewing your work history and skills, the interviewer hits you with a common behavioral question: “Tell me about a time

Top Ten Behavioral Interview Questions & Answers

Whew! You’ve made it to the interview portion of your job application process — Congratulations! Interviews can be nerve-wracking, but they don’t have to be. With some preparation and practice, you

Why Did You Choose This Career?

When an interviewer pulls out the “Why did you choose this career?” question, there are a million different answers you could provide. Similar interview questions include “What made you decide

What Two or Three Things Are Most Important to You in Your Job?

There are some interview questions that do not always seem directly related to the tasks you might take on in a new job because they are phrased like personal preference

Common Questions

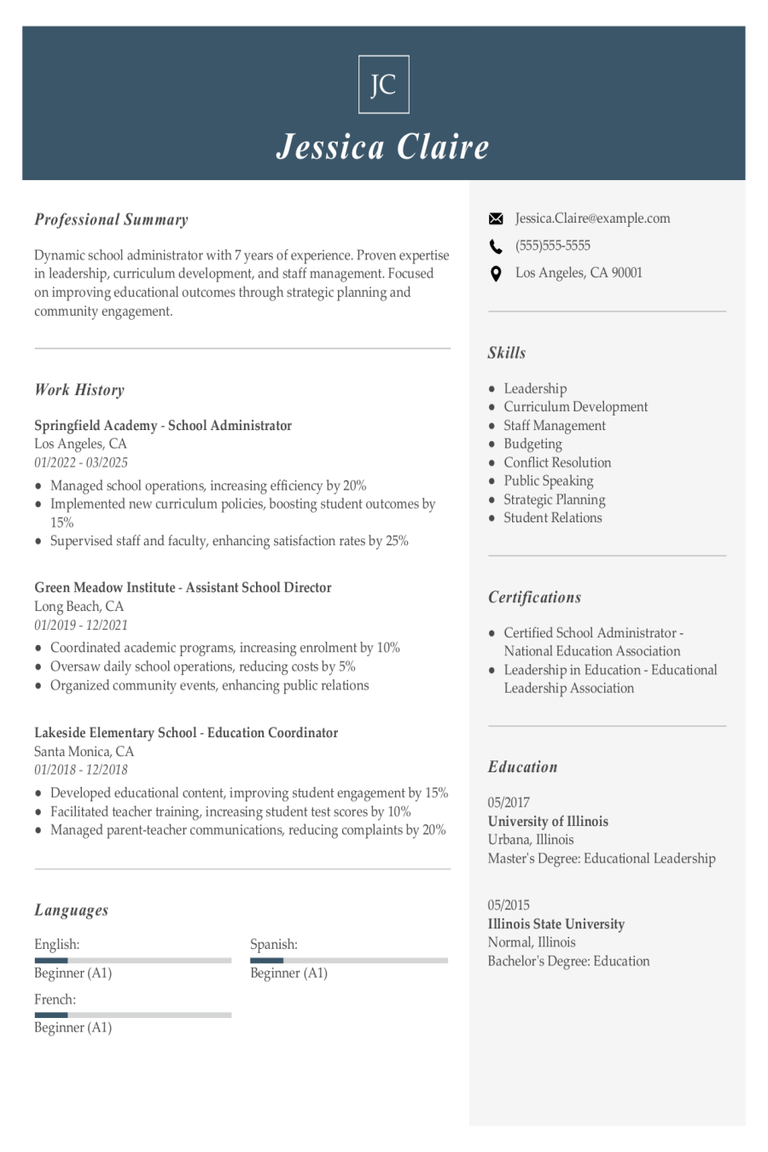

School Administrator Resume Examples & Templates

Explore school administrator resume examples to learn how to highlight your leadership skills and experience with staff supervision and school operations.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies

Dean of Students Resume Examples & Templates

A dean of students oversees administration and academic processes for students at high schools, colleges and universities. This job’s responsibilities include addressing everything from admissions, financial aid and health services

School Superintendent Resume Examples & Templates

A superintendent is a top school district executive who oversees day-to-day operations, including the management of educational programs and facilities. Superintendents supervise staff, manage educational policies, organize board meetings and

Special Education Teacher Cover Letter Examples & Templates

Special education teachers are compassionate and highly trained professionals who help students with physical, emotional or developmental needs thrive in a school environment. A strong special education teacher cover letter

Sales Executive Cover Letter Example & Templates

Start by editing this sample cover letter for a sales executive or explore our 250+ cover letter examples to find the best match for you.

Principal Cover Letter Example & Templates

As shown in the free principal cover letter sample, a cover letter should be three or four paragraphs that convince the hiring manager to contact you for an interview. The

Library Assistant Cover Letter Example & Templates

Start by editing this library assistant cover example, or explore our collection of more than 250 cover letter examples to find the best match for you.

Graduate Assistant Cover Letter Example & Templates

Start by editing this graduate assistant cover example, or explore our collection of more than 250 cover letter examples to find the best match for you.

Executive Director Cover Letter Example & Templates

When you write your version of this free executive director cover letter sample, there are some important things to keep in mind. First, keep it short and to the point.

Case Manager Cover Letter Example & Templates

The strength or weakness of your cover letter may determine whether or not you are considered for a job position. In order to receive an interview, it can be important

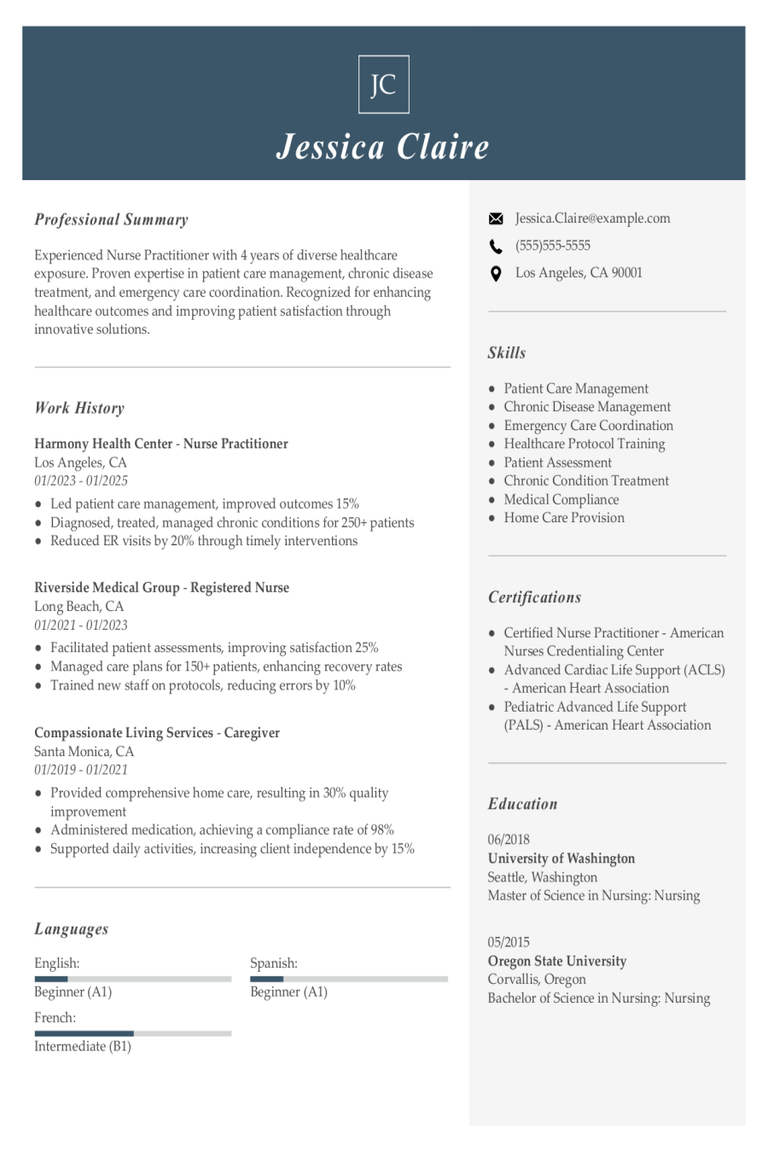

Nurse Practitioner Resume Examples & Templates

Explore nurse practitioner resume examples that showcase how to highlight your clinical experience, advanced nursing skills, and patient care expertise.Build my resumeImport existing resumeCustomize this templateWhy this resume worksQuantifies accomplishments: Includes

Engineer Resume Examples & Templates

There are many types of engineering careers, and they all have one thing in common: building and creating things, from bridges and dams to machines, textiles and prosthetic limbs. The

Medical Doctor Resume Examples & Templates

Entry-level

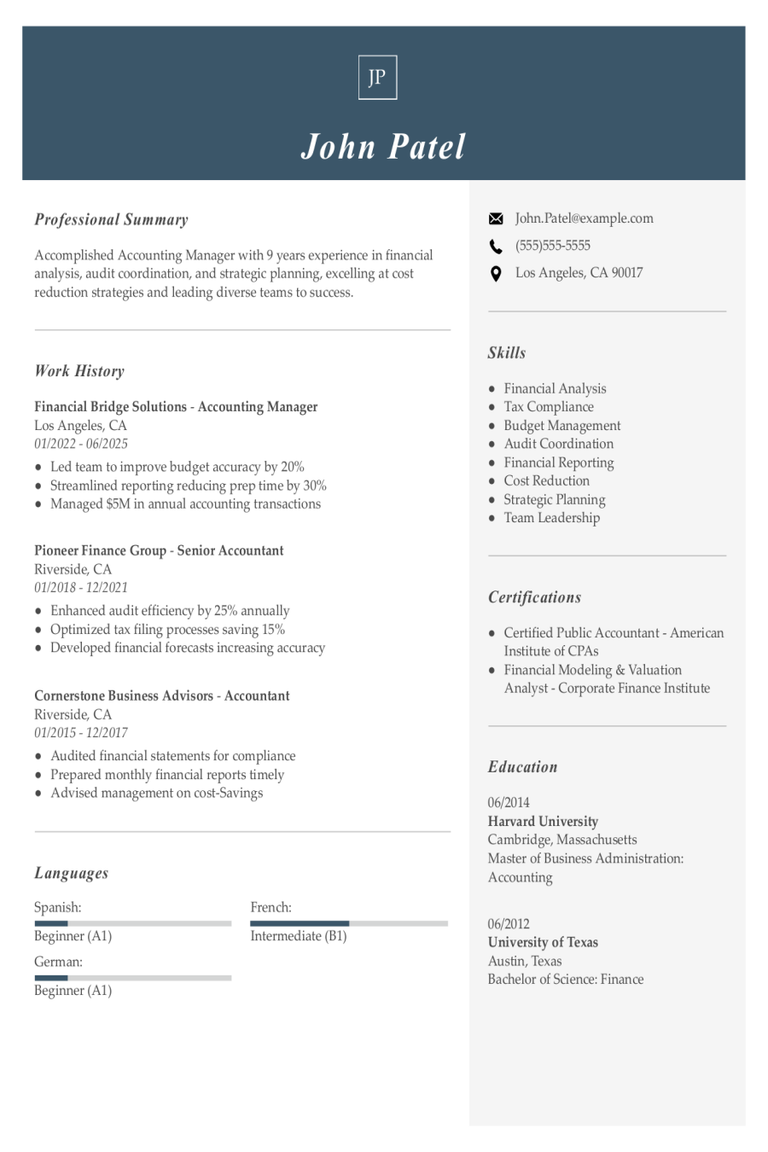

Accounting Manager Resume Examples & Templates for 2025

Accounting managers play a critical role in managing the financial operations of a company or organization. They ensure that financial records are accurate, budgets are handled efficiently, and compliance with

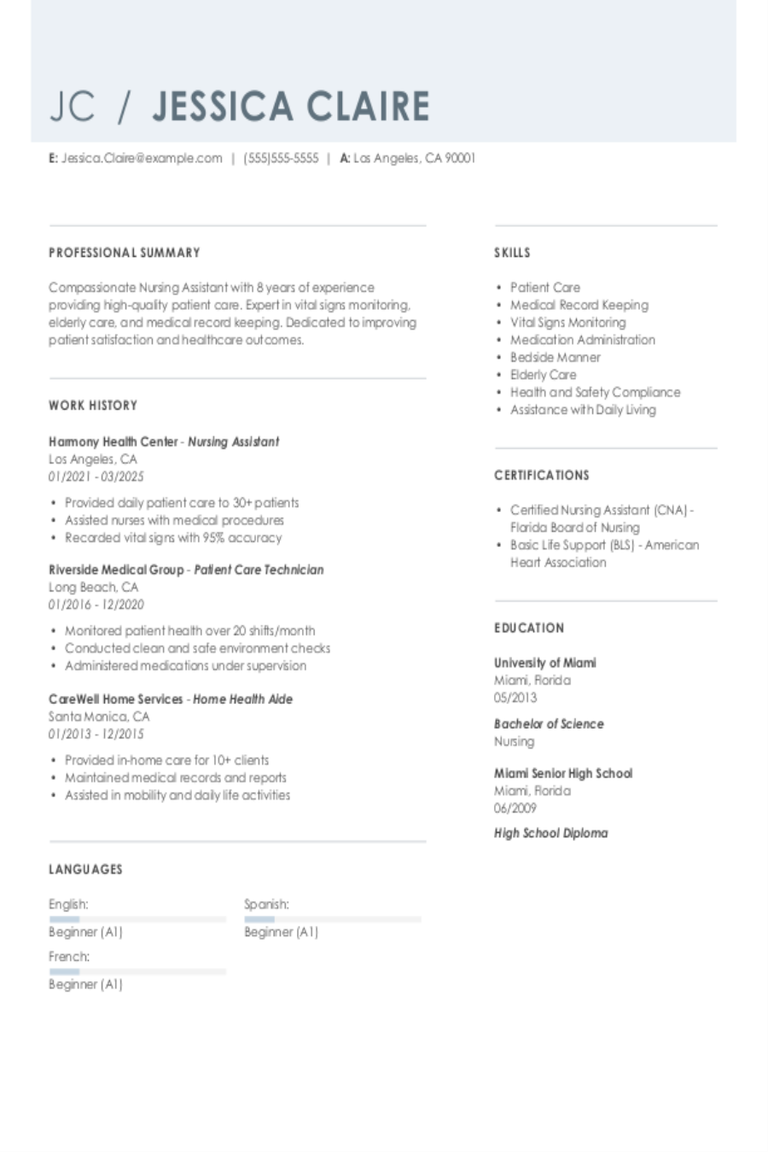

Best Nursing Assistant Resume Examples + Guide & Pro Tips

Explore nursing assistant resume examples and writing tips to learn how to highlight your hands-on experience and patient care skills effectively.Build my resumeImport existing resumeCustomize this templateWhy this resume worksHighlights

Operating Room Registered Nurse & Templates

An operating room registered nurse is one of those professions that is easy to identify thanks to its constant portrayal in movies and television shows. But there is a great

Administrative Assistant Cover Letter Examples & Templates

Administrative assistants are indispensable for the success of any organization. Whether handling documents, managing schedules, answering phones and emails or interacting with clients, their support is invaluable. When paired with

Executive Assistant Cover Letter Examples & Templates

Start by editing this sample cover letter for an executive assistant or explore our cover letter templates to find the best match for you.

Data Entry Specialist Cover Letter Examples & Templates

Start by editing this cover letter sample for a data entry specialist or explore our cover letter templates to find the best match for you.

Director Cover Letter Example & Templates

Directors lead companies and advance businesses to the next level. They are the bosses–the ones who make the important decisions. They must be able to complete the following tasks:Assigning tasks Assessing

Bartender Cover Letter Example & Templates

A well-written bartender cover letter can help you differentiate yourself from the competition. Along with a well-written resume, highlighting your exceptional interpersonal skills and problem-solving skills will give you an

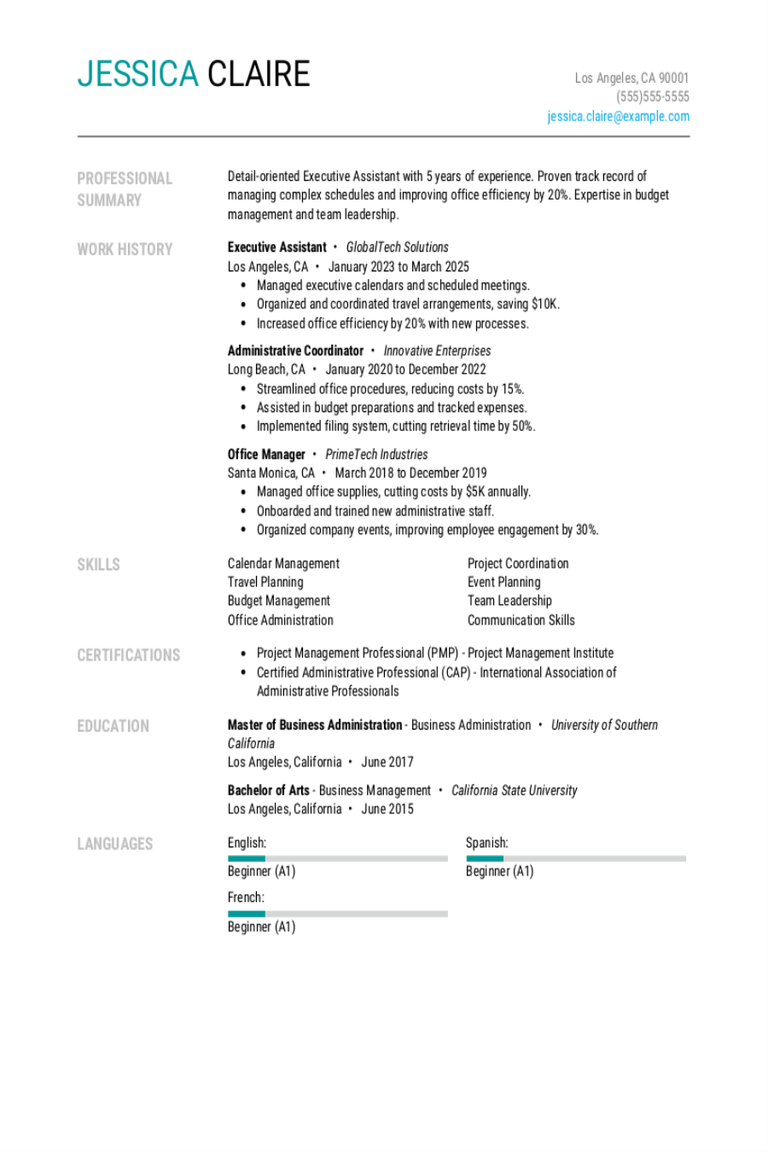

Executive Assistant Resume Examples & Templates

Browse executive assistant resume examples to see how to showcase strengths like managing schedules and coordinating meetings. Get expert writing tips to create a resume that reflects your experience and

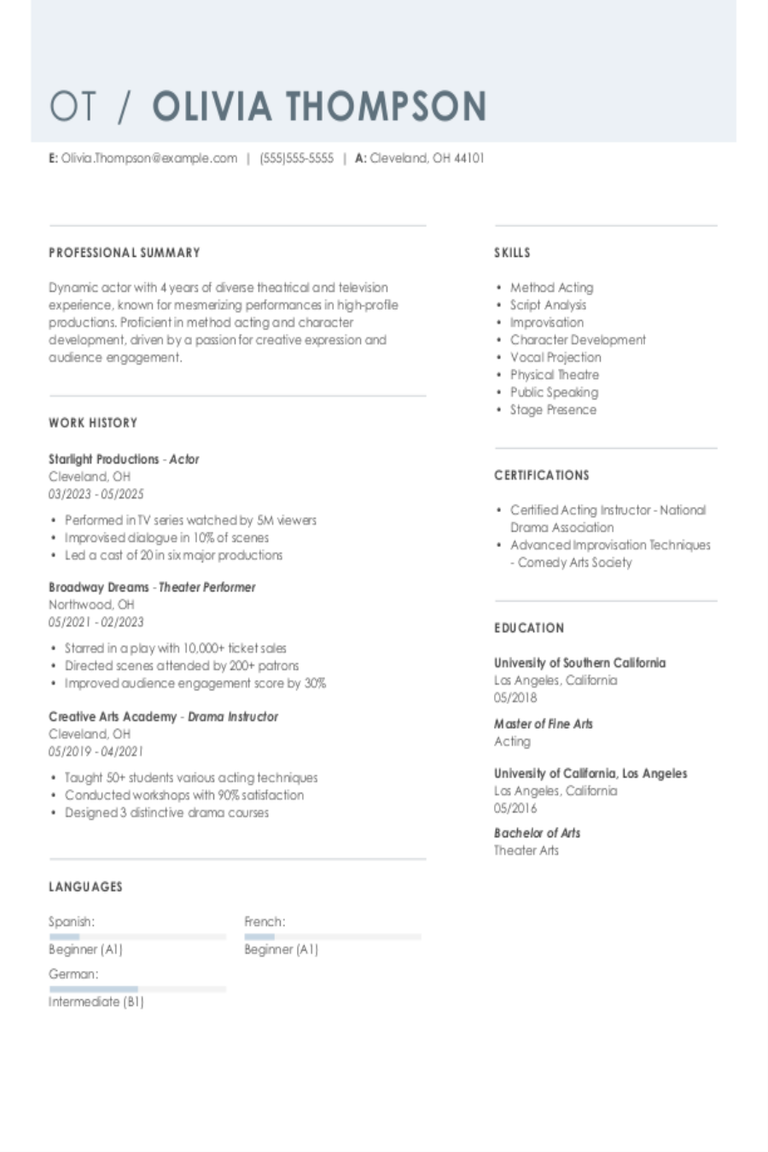

Actor Resume: Example & Tips

Discover acting resume examples that help you share your talents and experience. We’ll show you how to showcase your roles, skills, and training in a way that catches attention and

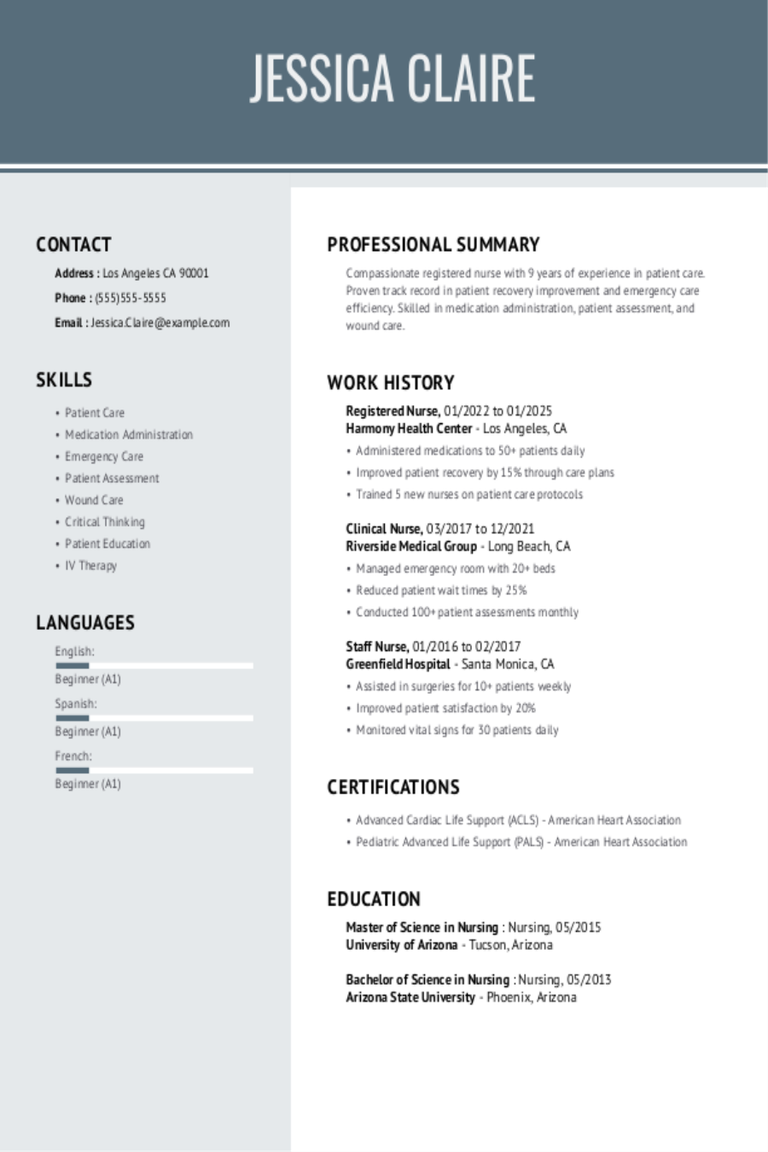

Registered Nurse Resume Examples & Templates

Explore top registered nurse resume examples that showcase your essential clinical skills. Learn how to effectively present your patient care experience and medical expertise to impress healthcare employers.Build my resumeImport

Nursing Aide Resume Examples & Templates

You need a great resume if you want a job as a nursing aide, so we’re here to help you build one. Our guide to crafting an effective resume for

Customer Service Representative Resume Examples & Templates

Explore customer service representative resume examples to learn how to highlight your communication skills, problem-solving abilities, and customer-focused experience. Browse expert tips to create a resume that stands out.Build my

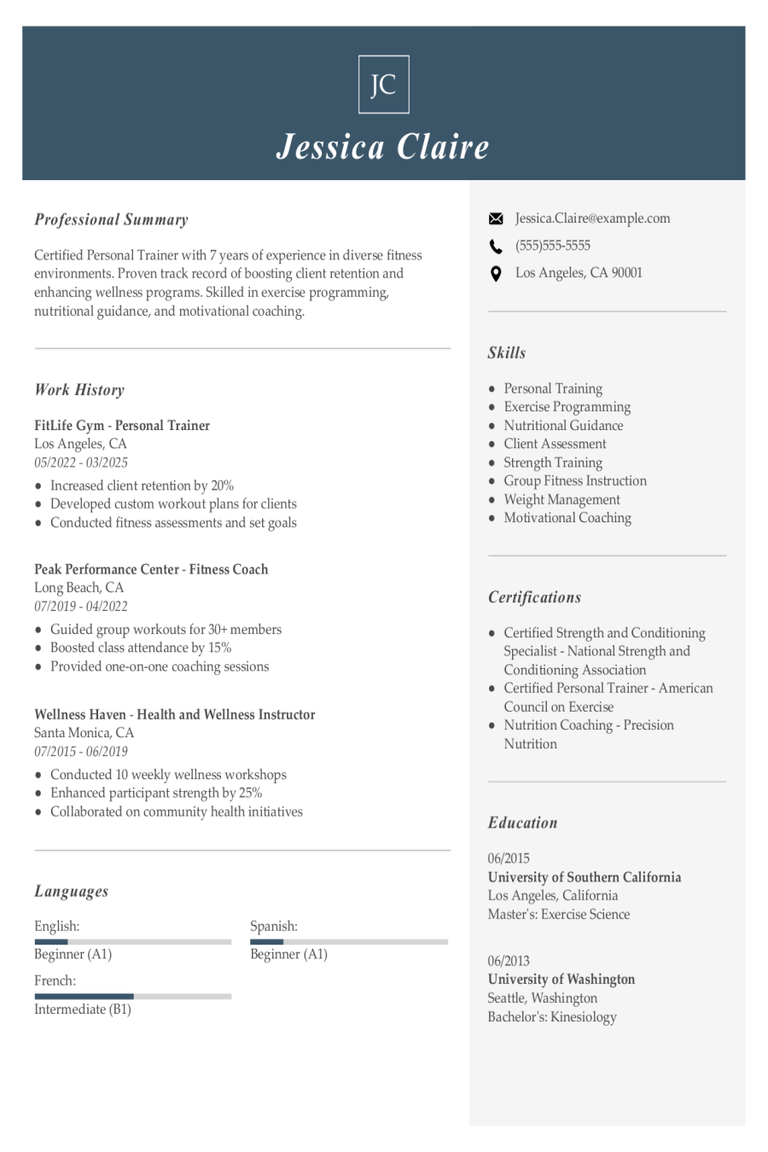

Personal Trainer Resume Examples & Templates

See how a strong personal trainer resume highlights your fitness expertise. These examples will help you showcase key skills like client programming, coaching, and motivation to stand out.Build my resumeImport

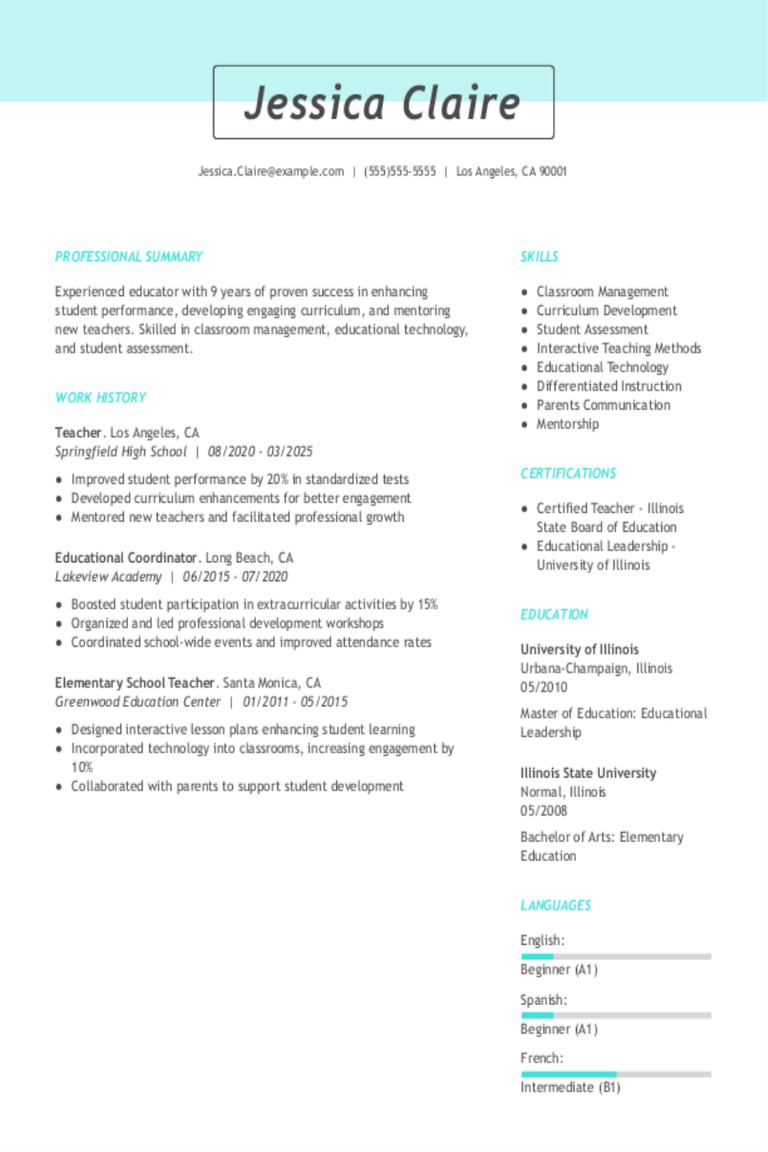

Teacher Resume Examples & Templates

Explore a variety of teacher resume examples that demonstrate how to organize your resume, highlight essential teaching skills, and showcase your classroom experience.Build my resumeImport existing resumeCustomize this templateWhy this

Information Technology Resume Examples & Templates

Information technology (IT) professionals perform a wide range of tasks related to managing and maintaining computer systems, networks and software. Get expert tips on how to write a resume that

Best Law Enforcement Resume Examples & Templates

Your community connections, law knowledge and commitment to protection can help you pursue a career in law enforcement. Time to write a resume to stand out from the applicant pool. We’re

Retail Resume Examples & Templates

Retail service professionals play a vital role in delivering excellent customer service, driving sales and maintaining a retail store’s overall operations. Discover how to write a resume that highlights your customer

Healthcare Support Cover Letter Examples & Templates

Healthcare support provides assistance to doctors and nurses while providing emotional support to patients and their families. Your role is as much technical as it is interpersonal. An efficient healthcare

Behavioral Situational

5 Common Geriatric Nurse Interview Questions & Answers

After you have finished creating a dynamite resume and cover letter, you need to prepare yourself to complete an amazing face-to-face interview. The interview is generally one of the most

Cashier Interview Questions and Answers

Securing a cashier interview means your resume and cover letter stood out in the customer service industry. Now, impress the hiring manager with your skills. Face-to-face interviews are crucial in

How to Use the PAR Method: Complete Guide (With Examples)

Acing a job interview is about providing thoughtful and concise answers showcasing precisely what makes you the right candidate for the role. How can you ensure your answers hit the

Frequently Asked Dental Assistant Interview Questions & Answers

When interviewing for a dental assistant role, it’s essential to prepare for questions that assess both your technical knowledge and your ability to provide excellent patient care. In this guide, we’ll

HR Administrative Assistant Interview Questions & Answers

Job interviews can be stressful, even for an experienced HR administrative assistant. How you tackle each answer shows an employer what type of candidate you are. We can help you create

Frequently Asked Communications Specialist Interview Questions & Answers

Preparing for a job interview for a corporate communication specialist position is crucial. With the right planning, you can ace the interview and land the job of your dreams. Preparation means

Answers: What Does Good Customer Service Mean to You?

If you are applying for a customer service position, you will likely be asked, “What does good customer service mean to you” during your job interview.In this guide, we’ll offer

Example Answers: “What is Your Educational Background?”

Interviews often give skilled recruiters the opportunity to hint at the answers they’re looking for, especially with questions about your educational background. Whether asked directly about your degrees or more

5 Common Front Desk Receptionist Interview Questions & Answers

The job search takes patience and tenacity. After crafting an eye-catching resume and a strong cover letter, you are faced with the initial interview, often including interview questions for receptionist

Top Interview Questions for Managers in 2025 (With Answers)

When interviewing for a manager position, you must demonstrate the business acumen, leadership skills, personality and subject-matter knowledge to meet the job requirements.That’s why manager interview questions and answers differ

5 Common Bilingual Customer Service Representative Interview Questions & Answers

Congratulations! You’ve written an effective resume, crafted a compelling cover letter, and now you’ve got a job interview for a bilingual customer service representative job. Well done! As you prepare for

5 Common Clinical Coordinator Interview Questions & Answers

Congratulations! You’ve written an effective resume, crafted a compelling cover letter, and now you’ve got a job interview for a clinical coordinator job. Well done! As you prepare for the big

5 Common Clinical Director Interview Questions & Answers

Congratulations! You’ve written an effective resume, crafted a compelling cover letter, and now you’ve got a job interview for a clinical director job. Well done! As you prepare for the big

5 Common Client Service Specialist Interview Questions & Answers

Congratulations! You’ve written an effective resume, crafted a compelling cover letter, and now you’ve got a job interview for a client service specialist job. Well done! As you prepare for the

5 Common Benefits Administrator Interview Questions & Answers

Congratulations! You’ve written an effective resume, crafted a compelling cover letter, and now you’ve got a job interview for a benefits administrator job. Well done! As you prepare for the big

5 Common Assistant Store Manager Interview Questions & Answers

You’ve built the perfect resume and professional cover letter to land an interview for the assistant store manager position. Now, it’s time to get ready for your first interview. Remember

5 Common HR Associate Interview Questions & Answers

Typically, the first step when applying for a job is to create a strong resume and cover letter. These pieces of information are designed to appeal to employers to earn

Tell Me About a Time When You Were Forced to Think on Your Feet

As you apply to certain positions, there are a number of job-specific questions that you can expect during an interview. These common questions, such as ‘What skill make you a

5 Common Patient Care Coordinator Interview Questions & Answers

When you’re looking for a job, a great cover letter and an impressive resume are the first prerequisites for landing a face-to-face interview. If you’ve gotten the call that a

Interview Question: Tell Me About a Time You Failed

During an interview, your potential employer wants to get to know you more than they did just by reading over your resume. They want to get to know the depth

Interview Question: Explaining Complex Information in a Clear Manner

Congrats on getting the interview! As you prepare for the big day, consider practicing common behavioral questions, like: “Could you tell me about a time you had to explain something

6 Common Senior Customer Service Interview Questions & Answers

A stellar cover letter and resume are critical for helping you to get into the door, but it takes a great interview for you to have a solid chance at

Interview Question: Good Judgement & Logic in Problem Solving

Behavioral interview questions often throw people for a loop when they first encounter them, because their goals and methods are not as clear and easy to comprehend as those of

Interview Question: Significant Contributions Made at Former Jobs

A job interview is not the time to be modest or to sell yourself short. When hiring managers ask interview questions such as “What is the most significant contribution you

5 Common Airport Customer Service Agent Interview Questions & Answers

After putting together a great resume and a compelling cover letter, your next order of business is to do great in your customer service job interview. If you’re worried about

Interview Question: How Do You Handle Difficult Clients?

You feel like your interview is going well. You’ve made a good first impression, and you’re sure you’ll land the job. But then the interviewer throws out a question like

Interview Question: Experience with Suggesting Process Improvements

During your interview, you will likely face far more behavioral interview questions than traditional questions. The unique aspect of this kind of interview question is that they are not based

Interview Question: Tell Me About a Time You Missed a Deadline

The days have passed when interviewers are only interested in your concrete skills and information such as where you went to college. Today, potential employers are focusing more on figuring

Interview Question: Using Fact-Finding Skills to Solve a Problem

During an interview, you will undoubtedly be faced with a variety of questions. A great deal of these will be behavioral interview questions such as ‘Give me an example of

7 Common Conflict Resolution Specialist Interview Questions & Answers

You are finally done writing your resume and cover letter to match the position you are pursuing, but your preparation is not quite over yet. Now you need to start

5 Common Retail Store Manager Interview Questions & Answers

When applying for any managerial position, you are going to need a strong resume and cover letter that accurately show your leadership abilities. Take plenty of time to ensure those

6 Common Coffee Shop Worker Interview Questions & Answera

Working in a coffee shop can be a great experience. After you have given the manager your resume and cover letter, you just have to wait and see if you

6 Common Perioperative Nurse Interview Questions & Answers

You’ve written a strong cover letter and resume, identified the nursing specialty where you want to work, and now you’ve been called in for an interview. Congratulations! Now it’s time

How Do You Deal With Conflict? Give Me an Example

Because interviewers want real-life examples of how you’ve applied your skills and training to specific situations, you may be faced with fewer traditional interview questions and more behavioral questions, such

Interview Question: Using Presentation Skills to Influence Opinions

Behavioral interview questions inquire about how you handled past difficult situations in the workplace. Interviewers use your answers to determine if you have the suitable skills for the job. More

5 Common Accounting Clerk Interview Questions & Answers

Writing an outstanding resume and cover letter is an important part of the job process. Once you are done with these steps, you must start getting ready for the first

5 Common Audit Manager Interview Questions & Answers

Once you are done writing your standout resume and cover letter, you should be turning your attention to finding ways to prepare for the big interview. Why is this preparation

6 Common Junior Accountant Interview Questions & Answers

After you are done writing your resume and cover letter, the next logical step is to start preparing for the actual interview process. This part of the job search can

5 Common Marketing Assistant Interview Questions & Answers

After creating an appealing resume and cover letter, you have finally landed a face-to-face interview. Congratulations. Your hard work is paying off, and you are on your way to securing

6 Common Accounting Bookkeeper Interview Questions & Answers

What do you have to do after you are done creating your outstanding resume and cover letter? It is time to get ready for the first face-to-face meeting with the

6 Common Accounts Payable Clerk Interview Questions & Answers

Writing an eye catching resume and cover letter is the first big step of landing an accounting job. After that’s accomplished, you will have to ace your first face-to-face meeting

Interview Question: How Do You Handle Complex Workplace Projects

Interviewers who employ interview questions about complexity- challenges- or new and unexpected tasks are all asking about how you react to having the bar raised. “What was the most complex

5 Common Customer Service Advisor Interview Questions & Answers

Reaching the interview stage of the hiring process is quite an accomplishment, and it takes a well-crafted resume and cover letter to get there. However, your work is not yet

5 Common Emirates Flight Attendant Interview Questions & Answers

Being a flight attendant can be an incredibly rewarding career with opportunities to travel all over the world. In addition to sending in a truly great resume and cover letter,

Interview Question: Discuss a Time You Made a Quick Workplace Decision

The reason why behavioral interview questions are becoming more common than other types is that hiring managers want to learn about real-world examples of job applicants demonstrating a desired skill.

Interview Question: Going Above the Call of Duty To Get the Job Done

When you walk into an interview you have to be prepared to answer different kinds of queries. The interview could include some behavioral interview questions such as ‘tell me about

5 Common Retail Sales Associate Interview Questions & Answers

When you get a call that you’ve been invited for an interview, you might be equally excited and nervous. You have every reason to celebrate, but you should also be

Interview Question: Following Company Policies With Which You Disagree

The most common kind of question you will like face when interviewing for a position are the behavioral interview questions. These are less concrete than traditional questions that ask about

5 Common Emergency Room Nurse Interview Questions & Answers

Your well-written cover letter and resume are a great introduction to you as a person and shed some light on your employment background. To really get to know you and

Interview Question: Persuasion & Convincing Someone to See Your Way

There are a lot of different kinds of inquiries made during an interview. Some questions, like ‘describe a situation that demanded you successfully convince someone to see things your way’

Give Me an Example of a Time When You Took Initiative

Getting ready for the big interview involves many different skills than simply preparing your resume or filling in your employment history. The interview is the opportunity for your potential employer

5 Common Insurance Agent Interview Questions & Answers

You have an impressive work history that you detailed in an exemplary resume and cover letter. It has ended up in the hands of a hiring manager who thinks that

5 Common Bank Teller Interview Questions & Answers

You’ve landed the bank teller interview! As you prepare for the big day, take time to practice common bank teller interview questions to ensure you’re including your interpersonal skills, bank

Interview Question: Using Written Communication Skills to Convince Others

Many behavioral interview questions are used by hiring managers in order to gain a more in-depth understanding of the job candidates they are interviewing. One of these questions is, “Describe

7 Common Customer Service Representative Interview Questions & Answers

If you’ve been offered an interview for a position, it means you did an excellent job presenting your qualifications in your resume and cover letter. The next step is equally

Interview Question: Miscommunications & Getting the Message Across

When going in for that all important job interview, your goal is to sell yourself as the most qualified for the job. Answering the interview questions with knowledgeable and detailed

Interview Question: Difference of Opinion on How to Reach a Shared Goal

A big part of most interviews is answering behavioral interview questions. Traditional questions typically deal with concrete facts, such as your education or previous work history, but behavioral questions inquire

Interview Question: Making Unpopular Decisions in the Workplace

Questions such as ‘Tell me about a time when you were forced to make an unpopular decision’ or ‘Have your coworkers ever disagreed with a decision you made’ are categorized

5 Common Staff Auditor Interview Questions & Answers

Once you have an outstanding resume and cover letter, it makes sense that you have to start preparing for your first face-to-face meeting. Without the right preparation, you may struggle

Interview Question: Discuss Creating an Innovative Solution to a Problem

Job interviews are designed to make candidates showcase their real-life abilities and examples of past successes. Your experience will likely include both traditional interview questions and behavioral questions such as

Interview Question: Putting Co-workers’ Needs Before Your Own

During a job interview you can expect to be asked common questions such as “Talk about yourself” or “Why do you want this job?” However, you should also be ready

Do You Have a Geographic Preference?

Many companies may ask the interview question- “do you have a geographic preference?” to potential job applicants. Interview questions may also be worded as- “are you willing to relocate?” or-

Give Me an Example of How You Juggle Multiple Deadlines

Job interviews today are full of behavioral interview questions. The questions help interviewers understand how you would react in specific situations while on the job, since past acts are a

5 Common Program Manager Interview Questions & Answers

Congratulations, you did it. Thanks to your hard work in authoring a knockout cover letter and resume, you received an invitation to interview. You’re closer than ever to getting the

Interview Question: Describe Your System for Tracking Multiple Projects

In recent years, traditional interview questions that seek to glean information about the prospective hire’s past experience and skills have begun to be supplemented by behavioral interview questions geared toward

5 Essential Underwriter Interview Tips

By now, you’ve tooled your resume to emphasize the skillsets and work experience that make you a great fit for an underwriting job. You’ve also written an appealing cover letter

6 Common Account Coordinator Interview Questions & Answers

A solid resume and a strong cover letter are absolutely essential to getting a new job. However, even if you clearly lay out all your skills on paper, you need

What Is the Biggest Mistake You Have Made?

There are numerous behavioral interview questions out there, and one of the most common and important is “What is the biggest mistake you’ve made?” This could also be asked as

Interview Question: Give Examples of Your Willingness to Work Hard

Job interviews rely on behavioral interview questions such as ‘Give two examples of things you’ve done in previous jobs or school that demonstrate your willingness to work hard.’ These questions

Tell Me About a Time When You Missed an Obvious Solution to a Problem

Interview questions come in many forms, and periodically you will be given a question regarding your behavior in a specific situation. Behavioral questions such as ‘Tell me about a time

Describe a Time When You Needed to Cope With a Stressful Scenario

During an interview you may be asked traditional and behavioral interview questions. The ‘describe a time when you needed to cope with a stressful scenario’ inquiry is behavioral. This type

Interview Question: Anticipating Problems & Developing Preventative Measures

Many jobseekers are intimidated by behavioral interview questions. Questions such as ‘Describe a time when you anticipated potential problems and developed preventative measures’ have been developed to assess your potential

Interview Question: Describe a Task that Tested Your Analytical Skills

Your job interview is an important part of the job application process, and you should know that there are different styles of questions that you could be asked. While traditional

6 Common Clinical Liaison Interview Questions & Answers

In the growing nursing and healthcare industry, the good news is that there are many choices for job opportunities for those looking for work. The best jobs, however, must be

5 Common Insurance Interview Questions & Answers

You pored over your resume to dot every “i,” so do not make the mistake of walking into your interview unprepared. Although it is true that you cannot predict exactly

5 Common Claims Adjuster Interview Questions & Answers

Landing your next job as a claims adjuster means having a competitive resume and a sharply polished cover letter, but it is important to remember that those are only the

5 Common Government Auditor Interview Questions & Answers

There is little doubt that you invested significant time into putting together your resume. Being called in for an interview is a sign that you have succeeded in the first

5 Common Government Accountant Interview Questions & Answers

You need a strong educational and professional background to achieve a position as a government accountant, but even a stellar resume highlighting your qualifications and knowledge is only half the

5 Common Forensic Accountant Interview Questions & Answers

Your resume shows prospective employers your education, professional qualifications and achievements. These factors are important for landing a job, but the interview can often be the secret sauce that can

5 Common Director of Rehabilitation Interview Questions & Answers

Now that you’ve been well-represented by a perfected resume and cover letter, it’s time to improve your personal presentation and ability to answer interview questions. This step is crucial to

5 Common Dental Interview Questions & Answers

You have made it to the interview part of the selection process, which means that you have caught your potential employer’s eye with your resume. Now you need to exceed

5 Common Claims Specialist Interview Questions & Answers

After you’ve completed an excellent resume and gotten your cover letter in order, it’s time to think about your upcoming face-to-face job interview. This meeting plays a central role in

5 Common Claims Representative Interview Questions & Answers

It’s never easy to land a face-to-face job interview. You are generally competing with several job applicants, and you need an outstanding cover letter and resume to stand out from

5 Common Chief Human Resources Officer Interview Questions & Answers

If you have made it through the first stages of applying for a job thanks to a well-crafted resume and a great cover letter, good job. The next step is

5 Common Charge Nurse Interview Questions & Answers

After taking the time to build an incredible resume and craft the perfect cover letter, you still need to ace the interview to get the position you have always wanted.

5 Common Ambulatory Nurse Interview Questions & Answers

Once you have your resume and cover letter in shape, you’ll want to devote some time to preparing for the upcoming interview. This face-to-face meeting with potential employers is an

6 Common Biomedical Technician Interview Questions & Answers

Applying for a job is a three-step process: Applicants must outline their experience in a resume, understand how to write a cover letter, and pass an interview. Spending as much

6 Common Communications Coordinator Interview Questions & Answers

There are a few hurdles that you must leap in your quest to get a job. First, you must develop a quality cover letter that summarizes your skills, character and

5 Common Endoscopy Nurse Interview Questions & Answers

Studying hard and learning how to polish a resume and cover letter into sharp, concise communication tools are both important steps in advancing your nursing career. Once you have the

4 Common Sales Associate Interview Questions & Answers

Preparing for your job interview can seem like an intimidating proposition. However, it is crucial to getting the job. Especially in a front-facing position such as sales associate, employers want

5 Common Psychiatric Nurse Interview Questions & Answers

Similar to your nursing journey thus far, getting a job as a psychiatric nurse requires you to do several things to demonstrate why you’re a candidate who deserves a close

5 Common Telephone Triage Nurse Interview Questions & Answers

Congratulations! You are experienced, highly qualified and knowledgeable. Your resume is flawless. On paper you have already impressed potential interviewers enough to receive a call back for an interview. Out

6 Common Branch Manager Interview Questions & Answers

Even though you’ve written an outstanding resume and cover letter that caught the attention of a hiring manager, you will still need to ace the in-person interview if you wish

6 Common Compensation Analyst Interview Questions & Answers

You’ve already accomplished the herculean feat of putting together an eye-catching resume and cover letter. Something about you caught the attention of the hiring department and put your application at

6 Common Sales Agent Interview Questions & Answers

If you want to get the job you’ve always dreamed of having, you will need to convince the hiring manager to look beyond your resume and cover letter and want

5 Common School Nurse Interview Questions & Answers

You have a variety of experiences in nursing, a perfect resume and an amazing cover letter. The one thing that is between you and a job offer, though, is the

5 Common Social Media Specialist Interview Questions & Answers

You live and breathe social media, and that was reflected in your amazingly well-written resume and cover letter. The next step is to ace the job interview and prove to

6 Common Transaction Coordinator Interview Questions & Answers

In most cases, you need a proper cover letter and resume in order to obtain an interview. When crafted correctly, they work together to build a firm case for you

4 Common Production Manager Interview Questions & Answers

You’ve come a long way. You’ve accumulated a significant amount of experience, and now you have a new opportunity within reach. Your cover letter and resume were well-received, and you

Common Interview Questions & Answers Glossary

Navigating the interview process can be one of the most challenging aspects of any job search. Interviews are not just about answering questions; they’re about making a connection, showcasing your

5 Common Public Affairs Specialist Interview Questions & Answers

If you find yourself in the position where you’re one of the finalists for a coveted public relations job, consider yourself lucky. Luck, however, may not be helpful when you

6 Common Network Engineer Interview Questions & Answers

In the computer technology industry, there are usually more applicants for jobs than there are available positions. For this tough field, it’s even more imperative that you do whatever you

5 Common Occupational Health Nurse Interview Questions & Answers

After completing an excellent, informational resume and a cover letter that sheds some light on your qualifications, your next step is to thoroughly prepare for the upcoming job interview. While

5 Common Postpartum Nurse Interview Questions & Answers

You wrote a strong resume and cover letter, and it paid off. You have been invited to an interview for the position of postpartum nurse. Your resume let your interviewers

5 Common Interventional Radiology Nurse Interview Questions & Answers

Since you have proven your worth on paper with your stand-out cover letter and resume, now it is time to shine in your interviews. It may take a little time,

5 Common Labor & Delivery Nurse Interview Questions & Answers

You have created a standout cover letter and exemplary resume to document your abilities and strengths, but you must still excel in the interview to land your dream job. A

5 Common Life Insurance Agent Interview Questions & Answers

After your resume and cover letter have been submitted, you might be thinking you are in the clear. However, if your materials are good enough, then you should expect to

5 Common Medical Surgery Nurse Interview Questions & Answers

Finding a job in the nursing industry can be quite the hassle, even for experienced employees. After you’ve created your outstanding resume and a cover letter geared towards making you

5 Common HR Specialist Interview Questions & Answers

Once you have put in the time necessary to craft a resume and cover letter that will stand out from the crowd, and that hard work has resulted in you

5 Common HRIS Analyst Interview Questions & Answers

Creating a strong resume and cover letter is the first step toward getting hired as an HRIS analyst, but that will only get you an interview. Once you have an

5 Common Human Resources Interview Questions & Answers

When you are seeking a career in human resources, expect to have a wide variety of job duties based on the enactment of company policy and its representation to employees.

5 Common Director of Nursing Services Interview Questions & Answers

All the hard work of perfecting your resume and cover letter have paid off with an interview, and now it’s time to prepare. Selling your talents, abilities and experience are

5 Common Communications Assistant Interview Questions & Answers

Your resume has been fine-tuned to showcase your attention to detail and infused with statements that reflect your integrity, abilities, and personality. The cover letter you submitted was updated and

6 Common Category Manager Interview Questions & Answers

The first step when seeking work is to write a winning resume and cover letter. These are designed to earn you an interview, but how can you use the interview

5 Common Health Facilities Surveyor Interview Questions & Answers

Now that you have created and shared your standout cover letter and resume, you need to prepare to ace your face-to-face interview. The interview is one of many essential moments

6 Common Benefits Specialist Interview Questions & Answers

You took the time to create a strong resume and cover letter and earned an interview. How do you ace the interview and get hired for the position? The process

5 Common Health Insurance Sales Agent Interview Questions & Answers

While you’ve worked hard on your outstanding resume and your cover letter, there’s still one more thing you need to worry about when trying to get your next job: the

5 Common Hospice Nurse Interview Questions & Answers

Landing a job as a hospice nurse requires success at several stages. First, you must submit a resume that’s free of mistakes and does a great job of conveying your

6 Common Bereavement Coordinator Interview Questions & Answers

You spent a lot of time sharpening your resume and cover letter, and it’s now time to prepare for your interview. A job interview is the best opportunity for a

6 Common HR Assistant Interview Questions & Answers

Congratulations on getting past the first few grueling levels of a job application. You’ve already got several people on your side who scoured piles of resumes and cover letters and

6 Common HR Manager Interview Questions & Answers

Because Human Resource (HR) managers are essential to the overall health and progress of a company, it is critical that the right individuals be hired for such positions. Therefore, you

5 Common Account Executive Interview Questions & Answers

After creating a strong resume and cover letter, close the deal and earn a new job by being successful when interviewing. This is the first time hiring managers will be

5 Common Airport Passenger Service Agent Interview Questions & Answers

Going through the many steps of the job search process is a stressful and frustrating time for most people. Once you’ve been able to wow an employer with your resume

6 Common Risk Manager Interview Questions & Answers

No matter how many times you do it, you’re probably just a little bit nervous before an interview. You know that even though your cover letter and resume were good

5 Common Talent Acquisition Consultant Interview Questions & Answers

Getting an interview for a position you want is hard, and getting the job based on your interview performance is even harder. Lots of people assume interviews will be easy

5 Common Talent Acquisition Coordinator Interview Questions & Answers

Your resume and cover letter both make a significant impact on your application for a job position. Nailing these will set you up for an interview. If you are at

5 Common Telemetry Nurse Interview Questions & Answers

When it’s time to go in for an in-person interview for a nursing position, don’t panic. You can help a hiring manager see your excellent qualities and experience if you

5 Common Urgent Care RN Interview Questions & Answers

Whether you just graduated or have worked in the health care field for a long time, you have been preparing for years. Your resume is spotless, and potential employers have

6 Common Public Relations Specialist Interview Questions & Answers

It took a lot of hard work to get to the interview phase of the application process. Your resume was strong and your cover letter made you stand out from

6 Common Psychiatric Nurse Practitioner Interview Questions & Answers

Your resume and cover letter stood out above the majority of the other applicants. Now you have been invited to meet your potential new coworkers and employers face-to-face. Along with

5 Common Neonatal Intensive Care Nurse Interview Questions & Answers

After completing the first steps of filling out an application and submitting an excellent resume accompanied by an equally outstanding cover letter, you’re ready to prepare for the upcoming face-to-face

5 Common Oncology Nurse Interview Questions & Answers

Getting a job in the nursing field can be a long process. You’ve made huge strides already by completing your resume and an outstanding cover letter. Next, you need to

5 Common Operating Room Nurse Interview Questions & Answers

The job search can prove to be challenging and take a good amount of time and effort. You have been diligent with making sure your resume is eye-catching and that

5 Common Marketing Data Analyst Interview Questions & Answers

For any candidate on today’s job market, the offer of an interview is also an endorsement of the resume and cover letter that took so much time and effort to

5 Common Insurance Broker Interview Questions & Answers

You’ve completed the incredibly important steps of creating an outstanding resume and a cover letter to supplement your status as the best employee for the job, and now you only

5 Common Home Health Nurse Interview Questions & Answers

You’ve perfected your resume by carefully going through it to make sure it’s up-to-date and free of errors. Besides that, you’ve written a concise but detailed cover letter that you

5 Common HR Compensation Coordinator Interview Questions & Answers

You created a strong resume and cover letter and earned a chance to interview for the HR compensation coordinator position. In order to be hired, you must give an excellent

5 Common HR Generalist Interview Questions & Answers

Once you have submitted your strong resume along with your excellent cover letter to the HR department to schedule a job as an HR generalist, you need to get ready

6 Common HR Officer Interview Questions & Answers

Your cover letter and resume couldn’t be any better, but there is still one thing standing in the way between you and your dream job– the face-to-face interview. While the

6 Common Dermatology Nurse Interview Questions & Answers

As the medical and healthcare field continues to see even more growth and increased numbers of patients, job seekers may get even more opportunities. Despite this healthy job outlook, it’s

5 Common Customer Service Associate Interview Questions & Answers

Your excellent resume and well-written cover letter have caught the attention of the hiring managers, and you’ve landed a first interview meeting. Now is the time to prepare for the

6 Common External Auditor Interview Questions & Answers

After you are done writing your resume and cover letter, the research should not end. Now you have to start preparing for the interview portion of your job search. You

5 Common Associate Product Manager Interview Questions & Answers

Landing a face-to-face interview is no easy task. It requires an amazing resume and a polished cover letter. After perfecting these documents and receiving an interview, many job applicants assume

About The Workplace

Answers: “What Can You Bring to the Team?”

Employers ask the interview question, “What can you bring to the team?” to understand your unique strengths and how you will fit into the company culture and team dynamics. We’ll dive

How Would You Describe Yourself as a Team Member?

Questions like ‘How would you describe yourself in terms of your ability to work as a team member?’ ‘Are you a team player?,’ ‘Tell me about a team you were

Interview Question: Why Do You Think You Are Qualified for This Position?

“Why do you think you are qualified for this position,” is a common interview question that hiring managers ask to determine what sets you apart from the other qualified applicants. We’ll

Answers: Why Should We Hire You?

One of the most common — and challenging — job interview questions is, “Why should I hire you?” Hiring managers ask this question to see if you’re the perfect fit

Interview Question: What Are Your Long Term Career Goals?

During the interview process interviewers tend to ask questions that may seem simple on the surface; however, they often possess a deeper meaning. It is important that you understand this

Interview Question: Qualities that Contribute to Professional Success

During an interview the hiring manager will ask you an assortment of questions in order to better understand your approach to work and life. One of the most commonly asked

What Motivates You to Do a Good Job?

When it comes to interview questions- one very common one asked by hiring managers is “what motivates you to do a good job?” This question could be presented in other

What Have You Learned From Your Work Experience So Far?

When asked “What skills have you acquired from your work experience?” it’s sometimes hard to find an answer immediately. This question is also oftentimes posed as “What have you learned

Reflecting on Past Experiences: Dislikes from Your Last Job

Some top job interview questions and answers are fairly straightforward and easy. However- a few questions can be traps and amount to something of a double-edged sword. One such question

What Has Your Experience Been Like With Public Speaking?

Some positions require you to regularly speak in front of a group of people. When you are in an interview for such a job- some interview questions are bound to

Linking College Education to Career Success: A Personal Insight

Hiring managers ask a number of interview questions- and there are some that are quite commonly asked. One that actually gets asked frequently is “how has your education prepared you

Distinguishing Yourself: Unique Qualities Among Your Peers

There are a few questions that you can often expect to be asked during an interview. “What makes you stand out among your peers?” is commonly heard in interviews for

What Do You Think This Company Could Do Better?

The “what do you think this company could do better?” question is very common during interviews. Some hiring managers may instead say “how could you improve the company?” or “what

What Kind of Supervisor Do You Work Best for?

Hiring managers often want to know how you are going to function as a part of their team if they hire you and how good you are at taking instructions.

What Do You See Yourself Doing in 10 Years?

There are few interview questions more well-known yet difficult to answer than “what do you see yourself doing in 10 years?” While this may be a tricky question, it is

How Have You Motivated Others? Give Me an Example.

During the job application process- interviewers often turn to behavioral interview questions- such as- ‘Give me an example of how you have motivated others’ to determine exactly how you will

What Interests You Most About This Position?

During an interview, you will be asked a variety of questions. One of the most commonly asked ones is “what interests you most about this position?” This question may be

Interivew Question: Provide an Example of How You Deal with Change

There is no one perfect way to answer an interview question. However- there are certain methods that can be quite helpful. It is first important to understand the type of

What Motivates You to Put Forth Your Greatest Effort?

Many interviewees make the mistake of believing that all they need to do is directly answer the interview question that is asked. Though that should be a part of your

Interview Question: In What Areas Do You Feel the Need To Improve

The “if there were one area you’ve always wanted to improve upon- what would that be?” inquiry is commonly asked by interviewers. Of course- some people give their own twist

What’s Your Proudest Accomplishment?

Interviews contain all sorts of questions- and “What’s your proudest accomplishment?” seems to be one of the most commonly interview questions used by employers across the world. As they all

How Would Your Coworkers Describe You?

When you sit down for a job interview- the hiring manager might ask you- “How would your coworkers describe you?” This is one of the most typical interview questions to

Why Should We Invest Money in Hiring & Training You?

Variations of the question “Given the investment our company will make in hiring and training you- can you give us a reason to hire you?” are commonly asked in job

Are You Goal-Driven? How to Convey Your Drive in Interviews

It’s fairly common to be asked the question ‘Would you describe yourself as goal-driven?’ during an interview. Employers want to evaluate the way you prioritize tasks and how independently you

How Would Your Boss Describe You

Most interviews will include the commonly asked “how would your boss describe you” question. Some hiring managers may ask it a little differently. You could get the “if I talked

Describing Leadership Skills: Your Approach & Impact

One of the most common interview questions is ‘how would you describe your leadership skills?’ The wording might shift a little from one employer to the next, but that particular

What’s Your Management Style

There are many common interview questions you will come across in your job search process. One example is the “what’s your management style” question. You may also hear “describe your

How Did You Hear About This Position?

How did you hear about this position? is one of those extremely common interview questions that seem innocuous and even unnecessary to those who are new to the interviewing process.

What Ways Can You Make a Contribution to This Company?

It is very common for interviewers to ask the “what ways can you make a contribution to this company” question. The question can come in a variety of forms. It

Whats The Most Difficult Decision You’ve Made

As you go on interviews you will notice a few interview questions that are commonly asked. How you address such questions can greatly affect whether you will be seriously considered

What Is Your Greatest Failure?

What’s your greatest failure’ is without a doubt one of the most common interview questions presented to job seekers- and is a question that you should give a lot of

What’s Your Availability?

For jobs that are not standard 9-to-5 positions, one of the most common interview questions to be asked is “What’s your availability?” Other variations of this question include “What hours

What Do You Do in Your Free Time?

Interviewers have many questions they can ask you, and you may be ready for many that are technical or dig into your work history. However, some interview questions are of

What Attracted You to This Company?

Among the top job interview questions and answers you will find such contenders as “Tell me about yourself” and “What are your weaknesses?” Another common question is “What attracted you

What Are Your Career Goals?

If you have been practicing for interviews at all- you likely recognize some common interview questions- such as “what are your career goals.” Even though this is a regularly asked

Ready to take the next step in your career?

Our expert advice will help you craft the perfect resume or cover letter. Showcase your unique skills and qualifications to stand out to employers and get hired faster.