Why this resume works

- Quantifies accomplishments: Measurable accomplishments, such as improving claims process efficiency by 25% and managing over 120 client accounts, reflect the applicant’s impact and value.

- Showcases career progression: Starting as a claims processor and advancing to an insurance specialist, the applicant’s career growth shows increasing levels of responsibility over time.

- Highlights industry-specific skills: With skills in risk assessment, client portfolio management, and claims processing, the applicant highlights their fit for the insurance sector.

More Insurance Resume Examples

See our insurance resume examples to learn how to highlight your risk assessment skills, policy knowledge, and customer service experience. These samples will help you craft a resume that stands out in the insurance industry.

Insurance Clerk Resume

Why this resume works

- Effective use of keywords: By incorporating industry-specific keywords, the applicant ensures their resume navigates ATS effortlessly, spotlighting insurance expertise and customer satisfaction achievements.

- Puts skills at the forefront: The emphasis on skill sets in a skills-based resume format effectively highlights the applicant’s skills in insurance policy processing and claims assessment for entry-level roles.

- Shows digital literacy: Showcasing adept use of technical tools, the applicant’s streamlined data entry techniques reflect strong computer skills essential for modern workplace efficiency.

Insurance Agent Resume

Why this resume works

- Points to measurable outcomes: By generating $250K in new policy sales yearly and raising customer satisfaction by 30%, the applicant shows a clear impact on company growth and client relations.

- Includes a mix of soft and hard skills: Combining technical skills like risk assessment with interpersonal skills, such as communication, highlights the applicant’s balanced approach to problem-solving and team collaboration.

- Demonstrates language abilities: Language skills in Spanish, French, and Mandarin facilitate cross-cultural communication and broader client engagement.

Insurance Manager Resume

Why this resume works

- Focuses on work history: Using a clear chronological resume, the applicant organizes extensive career growth, showcasing leadership roles and consistent achievements across more than a decade in insurance management.

- Showcases impressive accomplishments: By emphasizing measurable outcomes like increasing client portfolios by 25% annually, the applicant highlights powerful contributions that align with senior-level expectations.

- Lists relevant certifications: Certifications, such as Certified Risk Management Specialist, reflect an ongoing dedication to expertise, reinforce high-level insurance and risk analysis expertise.

Explore Even More Insurance Resumes

Insurance Resume Template (Text Version)

Aya Huang

Silverlake, WA 98294

(555)555-5555

Aya.Huang@example.com

Professional Summary

Seasoned insurance expert with 8 years in risk management, client portfolio optimization, and claims processing. Proficient in enhancing workflow efficiency and customer satisfaction.

Work History

Insurance Specialist

Guardian Assurance Co. – Silverlake, WA

May 2022 – May 2025

- Managed portfolio of 120+ client accounts.

- Improved claims process efficiency by 25%.

- Developed risk analysis reports monthly.

Risk Management Analyst

BlueSky Insurance Solutions – Silverlake, WA

April 2018 – April 2022

- Conducted 50+ internal audits yearly.

- Reduced operational costs by 15%.

- Provided strategic recommendations quarterly.

Claims Processor

Sunrise Coverage Inc. – Seattle, WA

May 2015 – March 2018

- Processed 100+ claims monthly.

- Achieved 95% customer satisfaction.

- Trained 5 new team members annually.

Languages

- Spanish – Beginner (A1)

- French – Intermediate (B1)

- German – Beginner (A1)

Skills

- Risk Assessment

- Claims Processing

- Client Portfolio Management

- Financial Analysis

- Customer Relationship Management

- Market Research

- Data Analytics

- Insurance Policy Development

Certifications

- Certified Insurance Consultant – National Insurance Institute

- Risk Management Specialty – Risk Management Association

Education

Master of Business Administration Finance

University of California Los Angeles, California

June 2015

Bachelor of Science Economics

University of Chicago Chicago, Illinois

June 2013

Browse Resume Examples by Industry

- Aviation

- Banking

- Billing And Collections

- Biology

- Boating

- Business Operations

- Casino

- Chemistry

- Child Care

- Civil Engineering

- Compliance

- Computer Hardware

- Computer Software

- Construction

- Copywriting

- Cosmetology

- Costco

- Culinary

- Customer Service

- Dance

- Data Systems Administration

- Deloitte

- Dentistry

- Driving

- Education

- Electrical

- Electrical Engineering

- Energy

- Engineering

- Entertainment

- Entrepreneur

- Entry Level

- Environmental

- Environmental Science

- Event Planning

- Executive

- Fashion

- Film

- Finance

- Fitness And Nutrition

- Food Service

- Freelancing

- General Laborer

- Goldman Sachs

- Government

- Graphic Design

- Healthcare Support

- Hospitality

- Human Resources

- HVAC

- Industrial Engineering

- Information Technology

- Interior Design

- Inventory Management

- Janitorial

- Landscaping

- Language Services

- Law

- Law Enforcement

- Library

- Logistics

- Maintenance

- Marketing

- McKinsey

- Mechanical Engineering

- Mechanics

- Media And Communication

- Medical

- Mental Health

- Meta

- Metal Work

- Military

- Mining

- Museum

- Music

- Netflix

- Non Profit

- Nursing

- Pharmaceutical

- Photography

- Physical Therapy

- Plumbing

- Politics

- Production

- Program Manager

- Project Manager

- Psychology

- Purchasing

- Quality Control

- Real Estate

- Religion

- Retail

- Safety And Security

- Sales

- Sciences

- Shipping

- Social Services

- Special Education

- Sports

- Statistics

- Student

- Teaching

- Team Lead

- Tesla

- Training And Development

- Transportation

- Travel

- Veterinary

- Walgreens

- Walmart

- Web Development

Advice for Writing Your Insurance Resume

Explore our guide on how to write a resume tailored for an insurance role and discover how to highlight your analytical skills, attention to detail, and client-focused approach.

Whether you’re aiming for a position as an underwriter, claims adjuster, or agent, we’ve got tips to help you stand out in the competitive world of insurance.

Highlight your most relevant skills

Listing relevant skills when applying for an insurance job is important because it helps employers quickly see that you have the abilities needed for the role.

Creating a dedicated skills section on your resume allows you to highlight both technical skills like risk assessment, claims processing, and policy analysis, as well as interpersonal skills such as communication, problem-solving, and customer service.

Balancing technical and interpersonal skills in your skills section shows you are well-rounded and can handle various aspects of the job. To make your resume even stronger, integrate key skills into your work experience section.

For example, mention how you used negotiation skills to settle a claim or how your attention to detail helped identify discrepancies in policy documents. This not only highlights your abilities but also provides concrete examples of how you’ve applied these skills in real situations.

Opt for a resume format that showcases your insurance experience, skills, and certifications clearly.

Showcase your accomplishments

When organizing your work experience for an insurance job, list each position in reverse chronological order. This means starting with your most recent job and working backwards.

For each entry, include your job title, the name of the employer, the location, and your employment dates. By showcasing your career path this way, you give employers a clear timeline of your professional growth and accomplishments.

To make your resume stand out, focus on quantifying your achievements instead of just listing duties. Use numbers to highlight results like percentage increases in sales or time savings from process improvements. For example, rather than saying “handled customer claims,” you might say “reduced claim processing time by 20%.”

Action words such as “improved,” “increased,” or “streamlined” can help convey how you made a difference. Quantified accomplishments let hiring managers see at a glance how you added value in previous roles and demonstrate skills that are relevant to their needs in the insurance industry.

5 insurance work history bullet points

- Processed 150+ insurance claims monthly, reducing average processing time by 20%.

- Implemented new underwriting guidelines, decreasing risk exposure by 15% annually.

- Conducted policy audits and identified 10 areas for compliance improvement, increasing accuracy by 25%.

- Trained a team of 8 agents on updated procedures, resulting in a 30% increase in customer satisfaction.

- Negotiated contracts with vendors to secure better rates, saving the company $50,000 annually.

Choose a clean resume template with clear sections for contact info, work history, and education. Steer clear of flashy designs that make your skills and experience harder to locate.

Write a strong professional summary

A professional summary is often the first thing hiring managers notice on your resume—and it’s your chance to make a strong impression right away. Think of it as a brief introduction that highlights your value and helps you stand out from other applicants. Before you start writing, you’ll need to decide whether a summary or a resume objective works best for your situation.

A professional summary is ideal for candidates with experience. In three to four concise sentences, it highlights your top skills, career achievements, and areas of expertise. This section demonstrates who you are as a professional and why you’re a strong asset in insurance—or any other industry.

On the other hand, a resume objective focuses on your career goals. It’s best suited for entry-level candidates, career changers, or those with employment gaps. Instead of emphasizing past accomplishments, an objective tells employers what you aim to contribute and how you plan to grow in the role.

We’ll provide examples of both summaries and objectives for different jobs and levels of experience so you can see which works best for your situation. See our library of resume examples for additional inspiration.

Insurance resume summary examples

Entry-level

Recent graduate with a Bachelor of Science in risk management and insurance, eager to apply academic knowledge in a practical setting. Completed internships focusing on claims processing and policy analysis. Certified in property and casualty insurance principles, with strong analytical skills and attention to detail. Committed to supporting the underwriting team and learning from seasoned professionals.

Mid-career

Insurance professional with over seven years of experience specializing in claims adjustment and client relations within the health insurance sector. Proven track record in reducing claim resolution times by 20% through efficient process improvements. Licensed health insurance agent known for excellent negotiation skills and a customer-focused approach, ensuring client satisfaction and retention.

Experienced

Seasoned insurance executive with 15+ years of experience leading underwriting teams in both commercial and personal lines. Expert in risk assessment, policy development, and regulatory compliance. Successfully led projects that improved profitability by streamlining underwriting processes, resulting in a 10% increase in revenue growth year-over-year. Dedicated to mentoring future leaders and fostering an innovative workplace culture.

Insurance resume objective examples

Recent graduate

Detail-oriented recent graduate with a Bachelor of Science in business administration seeking an entry-level position in the insurance industry. Eager to apply analytical skills and knowledge of risk management to support underwriting teams and contribute to client satisfaction.

Career changer

Customer service professional transitioning into the insurance field, bringing strong communication skills and experience in handling sensitive information. Looking to leverage relationship-building abilities and problem-solving skills in a fast-paced insurance environment while learning industry practices.

Entry-level applicant

Aspiring insurance analyst with a keen interest in market trends and data analysis, aiming for an opportunity to grow within a reputable insurance firm. Committed to using research skills and attention to detail to assist teams in developing effective strategies that align with company goals.

Use our Resume Builder to make your insurance resume stand out with easy-to-use templates that highlight your skills in managing policies and customer service.

Match your resume to the job description

Tailoring your resume to job descriptions is essential because it helps you stand out to employers and pass through applicant tracking systems (ATS). These systems scan resumes for specific keywords and phrases found in job postings. By matching your resume with the language used in the job description, you increase your chances of getting noticed by hiring managers.

An ATS-friendly resume includes keywords and phrases that align with your skills and experiences. This approach ensures that your resume gets picked up by the system when it’s scanning for relevant terms. By using these keywords effectively, you make it easier for hiring managers to see how well-matched you are for the role.

To identify keywords from job postings, focus on skills, qualifications, and duties mentioned repeatedly. Look for terms like “insurance policy management,” “risk assessment,” or “client communication.” It’s important to use exact phrases because ATS might not recognize variations of these terms.

Incorporate these terms naturally into your resume content. For example, instead of saying “Managed insurance policies effectively,” rewrite it as “Managed diverse insurance policies with attention to detail.” This way, you’re integrating key phrases without sounding forced.

Targeted resumes improve ATS compatibility by aligning closely with what employers seek. When you customize your resume, you’re not only increasing your chances of passing initial screenings but also showing potential employers how well-suited you are for their needs.

Want to make sure your resume gets past those tricky ATS systems? Our ATS Resume Checker checks important details and helps you boost your score right away.

FAQ

Do I need to include a cover letter with my insurance resume?

Yes, including a cover letter with your insurance resume is important and can set you apart from other applicants. A cover letter provides an opportunity to highlight your specific interest in the insurance industry and demonstrate how your skills align with the job requirements.

For instance, if the company specializes in a particular type of insurance, like health or auto, you can discuss any relevant experience or knowledge that makes you a strong match for their needs.

To create a polished document that complements your resume, consider using our Cover Letter Generator for guidance on structure and content.

Additionally, reviewing cover letter examples tailored to insurance roles can give you insights into best practices and help you write a narrative that resonates with potential employers.

How long should an insurance resume be?

For an insurance professional, a one-page resume is often sufficient to highlight key skills such as risk assessment, client management, and policy analysis. Keeping it concise ensures hiring managers immediately see your most relevant qualifications.

However, if you possess extensive experience or multiple certifications specific to the industry, a two-page resume may be appropriate. This allows room for detailing significant achievements and specialized training.

Explore our guide on how long a resume should be for examples and tips on determining the ideal length for your career stage.

How do you write an insurance resume with no experience?

If you have limited work experience, your insurance resume should highlight your skills, education, and any relevant training. Here are a few tips to help you get started:

- Focus on education and certifications: Start with your degree, include the name of your school, graduation date, and any honors. Add any insurance-related certifications or coursework you’ve completed to highlight your commitment to the field.

- Highlight transferable skills: Use any past experiences from internships, volunteer work, or part-time jobs that developed skills relevant to insurance roles like customer service, attention to detail, or analytical abilities.

- Include a strong summary statement: Craft a summary at the top of your resume that emphasizes your enthusiasm for starting a career in insurance and mentions key traits such as being organized and eager to learn.

Explore our guide on writing a resume with no experience for additional examples and actionable tips from Certified Professional Resume Writers.

Rate this article

Insurance

Additional Resources

Insurance Agent Cover Letter Example + Tips

The information you include in your cover letter should be unique to you, don’t use exactly what is in this insurance agent cover letter sample unless it truly applies to

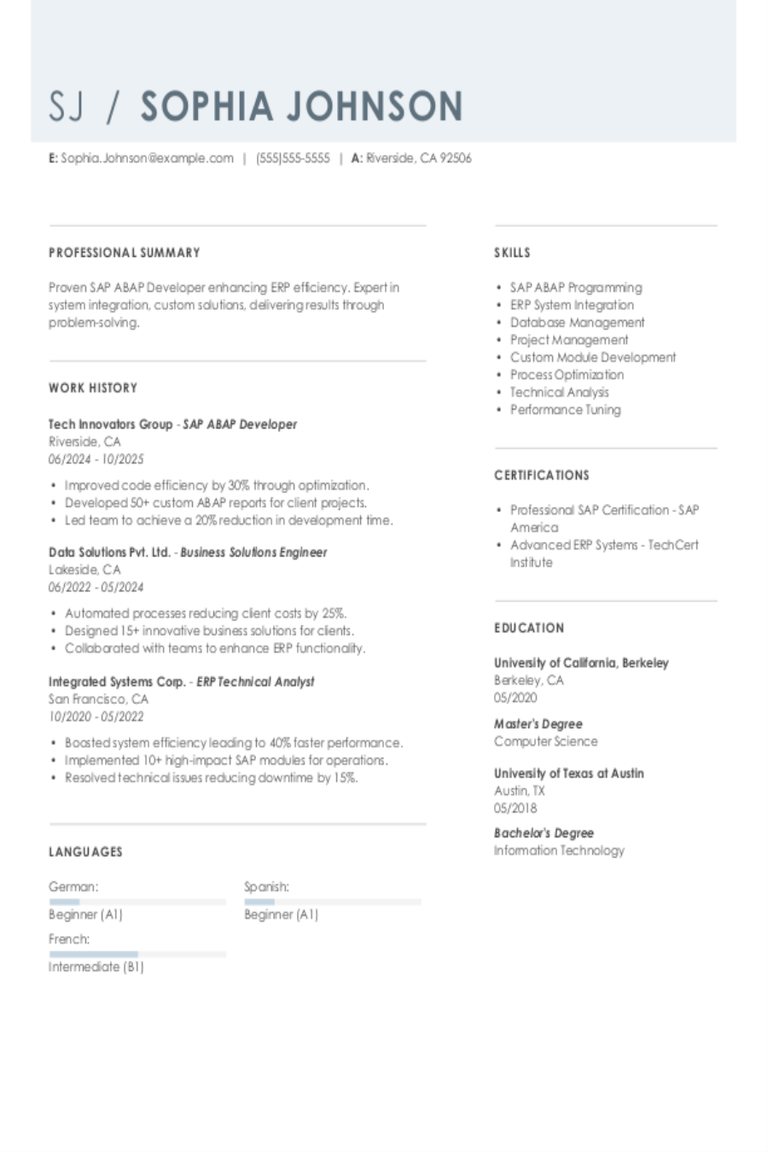

SAP ABAP Developer Resume Examples & Templates for 2025

Explore SAP ABAP developer resume examples and tips to learn how to spotlight your skills in coding, debugging, and system enhancements to stand out to hiring managers.Build my resumeImport existing

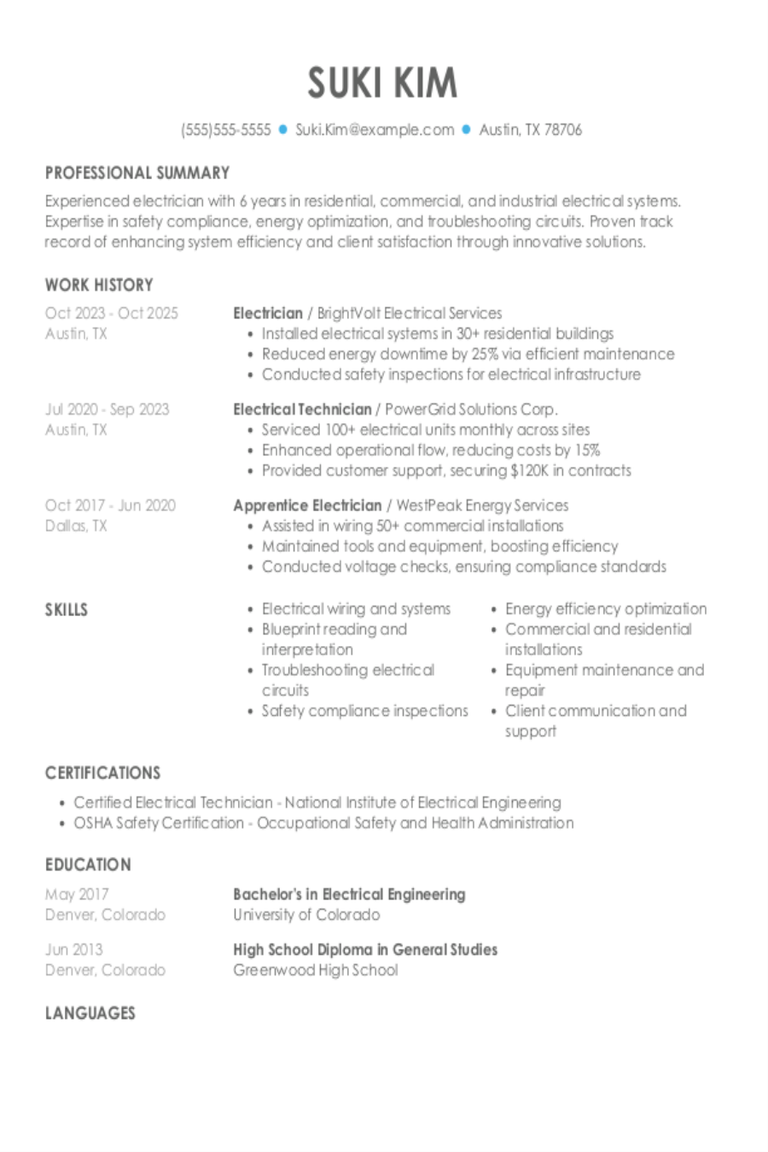

Electrician Resume Examples & Templates for 2025

Explore electrician resume examples to learn how to spotlight your wiring, troubleshooting, and safety skills. See how to emphasize your knowledge of electrical codes and highlight your experience across various

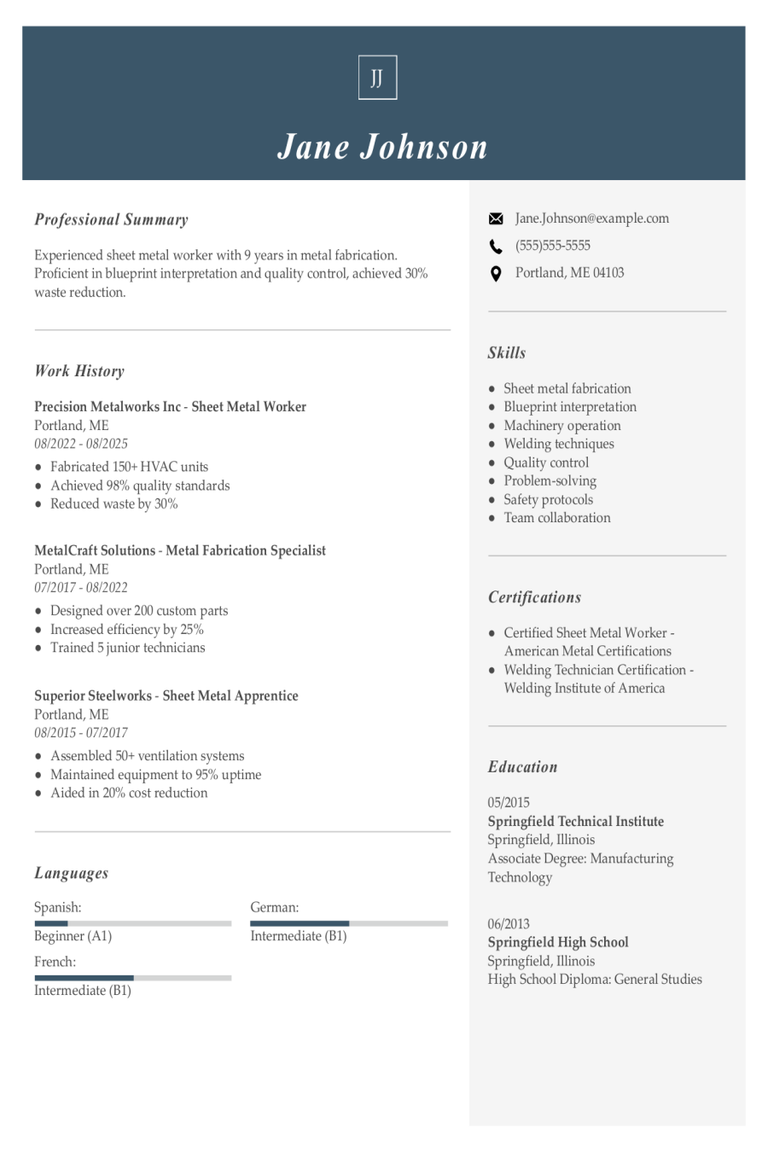

Sheet Metal Worker Resume Examples & Templates for 2025

Browse sheet metal worker resume examples and tips to learn how to highlight your hands-on experience and problem-solving abilities to stand out to recruiters and hiring managers.Build my resumeImport existing

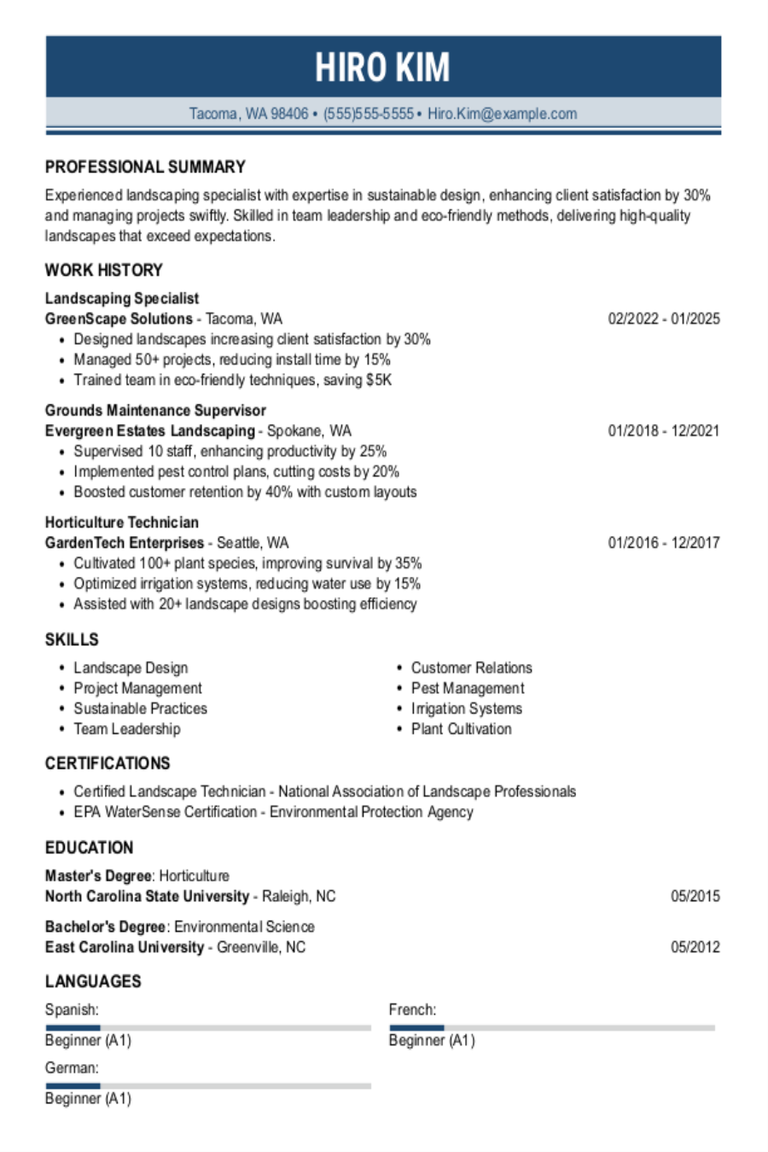

Landscaping Resume Examples & Templates for 2025

Explore landscaping resume examples to see how to showcase your gardening and design skills. Learn how to highlight your experience with plants, tools, and outdoor projects to catch the eye